Let’s have a closer look at this possible High Yield Portfolio (HYP) candidate.

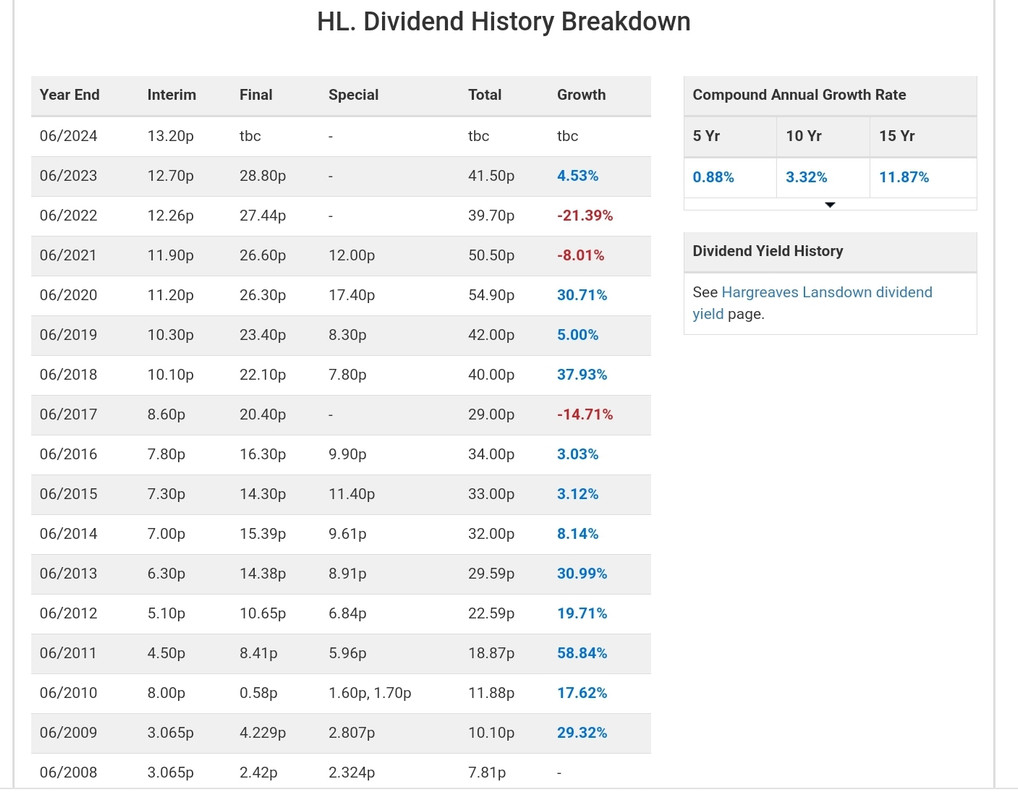

First all the history.

The dividends, including specials, have been much discussed, as has the drop in Market Price over the past 5 or so years. Here I have calculated the returns that might have been achieved from purchases made at various dates in the past:

| Date | Price | Yield ORD | Yield +SPE | 16-May-24 | Dividends | Tot Rtn

01 Year | 16-May-23 | 802.0000 | 5.00% | 5.00% | 896.2000 | 42.0000 | 16.54%

02 Years | 16-May-22 | 877.6000 | 4.43% | 5.80% | 896.2000 | 82.1400 | 5.48%

03 Years | 16-May-21 | 1,713.5000 | 2.23% | 3.24% | 896.2000 | 133.0000 | -16.64%

05 Years | 16-May-19 | 2,392.0000 | 1.35% | 1.68% | 896.2000 | 231.5000 | -15.24%

10 Years | 16-May-14 | 1,180.3750 | 1.81% | 2.57% | 896.2000 | 402.8000 | 1.07%

15 Years | 18-May-09 | 205.5000 | 2.67% | 3.65% | 896.2000 | 502.8310 | 18.80%

At a current yield of 5%, this share is indeed within HYP range although, with a number of other holdings offering 9-10% I would suggest that Hargreaves Lansdown is somewhat bringing up the rear. Still, in a full HYP being built now, it may well figure.

Now to what we should expect going forward.

HL has rather crept up on me and so far, I have made no detailed investigation. Today I have read through what some others are saying and, given time, I shall review the latest accounts.

What does HL do?HL is what used to be called a stockbroker. Of course that has rather morphed into an Investment Platform provider, giving clients the ability to directly purchase investments – Shares, ETFs, Gilts and Bonds, Investment Trusts - without having to go through a Financial Adviser. They can provide various Account Types – Dealing, ISA’s (Regular, Junior, Lifetime), SIPP’s – and of course provide certificates and documentation that may be needed for official purposes – Tax!

I cannot find out if they offer an Investment Manager service. Does anyone know?

How does HL make money?HL has more than 1.7 Million clients from which fees are earned, I believe in two distinct ways.

1. Custody services

2. Transaction processing

Someone on this thread mentioned Interest being earned on Clients’ cash balances. This appears somewhat odd to me as my broker, A J Bell (AJB), pays interest on my cash to me. They may make a margin for themselves, probably do, but I believe the bulk comes to me.

Incidentally, when I was selecting an Investment Platform provider, back in 2012, I turned down HL as being too expensive. I believe they are still more expensive than some other platforms - AJB and Interactive Investor (II) – to name but two. There are those who believe that HL may be forced to review those fees, possibly reducing earnings in the process.

However, there are others who say that HL clients generally are content. HL does not lose any more client than other brokers.

https://finance.yahoo.com/news/hargreav ... 00878.htmlBut is Hargreaves Lansdown worth it?

Despite the higher cost, Hargreaves Lansdown remains a top choice among investors and is particularly popular among its own customers.

Its retention rate was 92.1pc last quarter. Part of the pull is its broad range of investment options. It offers Isas, junior Isas, Sipps, lifetime Isas, international shares from the US, Canada and Europe, as well as its own multi-manager and ready-made funds and a dedicated cash-saving platform and cash Isa.

It also has top notch customer service, according to Platforum, which rated it a 5/5 for content and investment choice, a 4/5 for user experience and a 4/5 for its mobile app service. It found that customers could easily get in touch and received a quick response.

Boring Money found the same. It regularly surveys more than 3,000 platform investors and Hargreaves Lansdown has the top score of all the traditional platforms — 40pc of its customers give them a 9 or 10/10 when asked if they would recommend the service.

“Hargreaves Lansdown is undoubtedly a class act, but costs are falling across the sector so it has become relatively more expensive. If you have time to spend on investments and like getting the best price, then it’s not for you,” said Holly Mackay, founder of Boring Money.

“But if you want something which works and is a reliable FTSE 100 company which will stay the course, it might be. At the end of the day, customers like Hargreaves. They think it does a good job and would recommend it – but they know it’s pricey.”

Also, while the Share Price has been diminishing – tanking? – over the past few years, Earnings per Share (EPS) has been rising. Clearly not all Retail Investors agree with me with regard to HL fees.

As an aside, here is some analysis concerning the effect of fees on an Investment Portfolio.

https://finance.yahoo.com/news/hargreav ... 00878.htmlTrue cost of fees

While it can be easy to brush off the cost of a company you like, especially when the money is taken automatically from your investment account, the impact of higher charges can be substantial in the long run.

Analysis from the Lang Cat, a consultancy firm, shows that a pot worth £100,000 would be worth £162,890 after 10 years of 6pc investment growth, if the fees were 1pc. If the fees were 2pc, the pot would be worth just £148,000.

After 30 years, the pot paying 1pc would be worth £432,200, while the pot paying 2pc would be worth £324,340.

To put it another way, after 10 years the investment portfolio being charged 2pc has lost about 9pc of what it could have made had it been paying half the fees. After 30 years, it had lost 25pc.

Maybe I was right to pass on HL’s fees!

Does HL make it into an HYP?I guess I am still worried about HL being forced into a fees war with its competitors. All those short sellers may just be right!

For me, IG Group (IGG) offers a better alternative. Sure, IGG is not exactly the same kind of beast as HL. IGG are more widespread and of course are heavily into Traded Options – Over the Counter and Exchange Traded. Only 3% of their revenue comes from boring old share trades. I guess their clients are more Professional Traders than the more amateur ISA or SIPP holders. IGG offers a higher yield and a rising dividend over the last 3 years, after being unchanged for the prior 3 years, strongly rising in spurts before that.

As I said, I shall review the accounts when time allows, but for now HL is a no go from me!

Enjoy!

Ian