Active Bond Funds

Posted: April 7th, 2024, 12:34 pm

Hello Folks,

Summary question: Given that it seems to be difficult to identify a comprehensive mixed bond fund, what do you think of the active "strategic" bond funds, which levy higher charges than trackers?

Detail:

Per the conventional wisdom my portfolio is too equity-heavy for my age . I've been working on identifying bond funds to start to increase the bond component with a view to preservation and also taking income over time when I do retire in the future.

Despite being simple on the surface, bonds seem to have complicated behaviours and influences over time. Some of the significant dimensions seem to be:

I haven't identified a bond fund that gives a slice of everything, in the same way that perhaps VWRP does for equities. VAGS might come close.

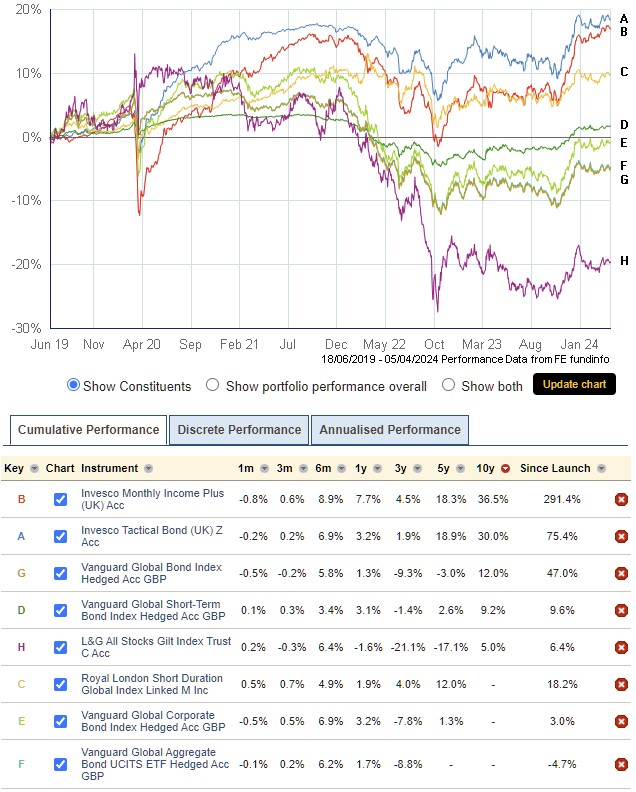

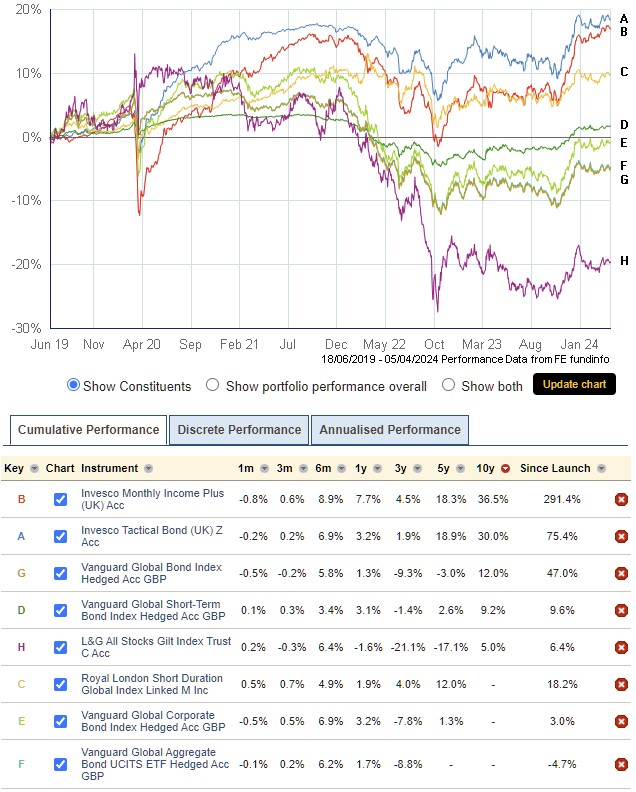

With all this in mind I have been looking at options and noticed that a couple of Invesco active "strategic" bond funds I own did seem to navigate the bond crash quite well, while giving reasonable returns at other times. The "strategic" moniker seems to indicate that the managers have a lot of freedom to move their portfolio around over time, hopefully in response to economic conditions. However, they are expensive at ~0.65% OCF. I am wondering if, in this case, the active charges are actually worth it.

Here are some charts from Trustnet. I believe the Trustnet charts do include charges, but I am not completely sure on that point.

Given that it seems to be difficult to identify a comprehensive mixed bond fund, what do you think of the active "strategic" bond funds, which levy higher charges than trackers?

Summary question: Given that it seems to be difficult to identify a comprehensive mixed bond fund, what do you think of the active "strategic" bond funds, which levy higher charges than trackers?

Detail:

Per the conventional wisdom my portfolio is too equity-heavy for my age . I've been working on identifying bond funds to start to increase the bond component with a view to preservation and also taking income over time when I do retire in the future.

Despite being simple on the surface, bonds seem to have complicated behaviours and influences over time. Some of the significant dimensions seem to be:

- Interest Rates

Duration

Government/Corporate

Global/Home

Index-Linked or not

Hedged to home currency or not

I haven't identified a bond fund that gives a slice of everything, in the same way that perhaps VWRP does for equities. VAGS might come close.

With all this in mind I have been looking at options and noticed that a couple of Invesco active "strategic" bond funds I own did seem to navigate the bond crash quite well, while giving reasonable returns at other times. The "strategic" moniker seems to indicate that the managers have a lot of freedom to move their portfolio around over time, hopefully in response to economic conditions. However, they are expensive at ~0.65% OCF. I am wondering if, in this case, the active charges are actually worth it.

Here are some charts from Trustnet. I believe the Trustnet charts do include charges, but I am not completely sure on that point.

Given that it seems to be difficult to identify a comprehensive mixed bond fund, what do you think of the active "strategic" bond funds, which levy higher charges than trackers?