Consider that you opt for a 67/33 equity/gold asset allocation. Your home value + imputed rent might be considered as similar to stocks + dividends, so split the equity 67 into two halves, for a overall thirds each in home (land), stocks, commodity. If the stock value is held in US stocks that's £ British home, $ stocks, global commodity currency/money (gold) currency diversification. Income is sourced from imputed rent, dividends, SWR in around equal measure. Rebalanced and non-rebalanced broadly yield similar rewards, with non rebalanced you end up with more in the asset(s) that performed the best - a higher time-averaged weighting in assets that did well; In practice leaving the home value as non-rebalanced, rebalancing stock/gold is the more viable choice ... so diversification across rebalanced/non-rebalanced.

So a UK home, or maybe one UK, one elsewhere, i500.L stock, or maybe 50/50 i500 and SPXS (both track US S&P500), gold - maybe Britannia gold coins (tax exempt), along with some paper-gold (PAXG or BullionVault holdings). Two thirds of total wealth in-hand, and where the stocks can be easily/quickly liquidated if so desired.

Spend using your credit card and pay that off each month by selling some of either stocks or gold - whichever was the higher at the time, which is a form of partial rebalancing. With a ii account you pay £10/month, but get a free-trade each month, so 'withdrawals' to pay off your credit card are in effect free.

A simple to operate machine, good for heirs that may not have the insights into financial management, where beneath the hood there are some sound reasonings for the assets/currencies/styles that likely will yield a OK/satisfactory overall outcome. If a bad thing happens and you lose the entire half of one of those thirds, a 16.6% hit, then that's more of just a minor discomfort rather than a major/critical factor. Portfolio values can decline 16% or more in single years through natural market price movements.

Got a credit card? use our Credit Card & Finance Calculators

Thanks to gvonge,Shelford,GrahamPlatt,gpadsa,Steffers0, for Donating to support the site

100% equity funds

-

1nvest

- Lemon Quarter

- Posts: 4551

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 723 times

- Been thanked: 1435 times

-

vand

- Lemon Slice

- Posts: 793

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 180 times

- Been thanked: 369 times

Re: 100% equity funds

1nvest wrote:vand wrote:80/20 stock/gold is a very good mix to hold - with favourable sharpe ratio and lower start date sensitivity than stock/bond equivalent, and has historically supported higher withdrawal rates. You could try hard for a long time and not improve upon this mix for retirees.

Which is like two halves of one with all-stock, the other with 60/40 stock/gold. 4% SWR measures reflect historic bad case 30 years, more often supported SWR were higher, 6%, 8%/whatever. With two-halves of 100% stock and 60/40 stock/gold you might take a larger SWR from one - the half that was doing better, less from the other ... each year, and likely do OK/well. But there's no need for all of that management, its automatically integral within 100% allocation to 80/20.

67/33, 75/25, 80/20 ... halves of 100% and 33/67, 50/50, 60/40 respectively tend to be in the same/similar ballpark. With 67/33 its a form of Martingale, whatever might drive 67 stock value to halve down to 33, might also drive 33 gold value to double to 67. 67/33 -> 33/67 with no loss, and where rebalancing back to 67/33 has you double up on the number of shares being held after prices had halved.

Midcap for stocks is also inclined to work better, ejects its largest into the Large cap index, in exchange for faltering stocks falling down out of the large cap - that will more often work harder in order to re-establish their large cap index membership crown. It's also more inclined to have no more than a few percent weighting to any individual stock, less concentration into single sectors. Similar risk/reward as a HYP IMO via a single index fund (such as VMID outside of ISA (FTSE250), VMIG inside ISA (auto dividend reinvestment/accumulation)).

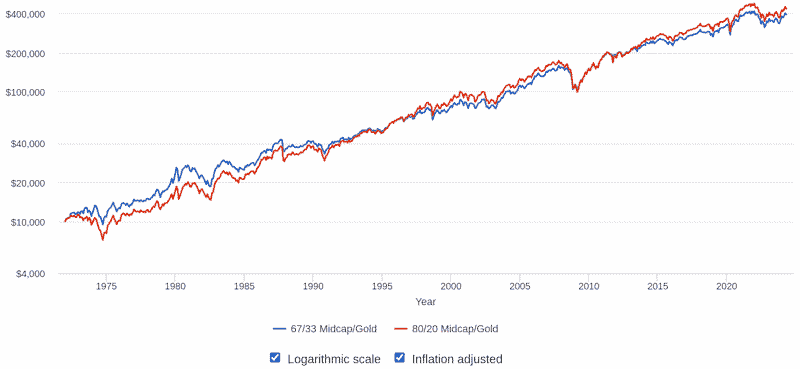

US data https://www.portfoliovisualizer.com/bac ... wUfQcq740X and 75/25 would have sat somewhere midway between those 67/33 and 80/20 lines

I'm somewhat skeptical of relying on "mid cap" or any particular subsector of equities (small cap value was particularly popular option designed to improve returns), as there is no real working theory to why that sector has outperformed, or even if there is then the market will probably arbitrage it away in the future - just see their relative underperformance in the last 10 years compared to large cap as a case in point.

-

vand

- Lemon Slice

- Posts: 793

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 180 times

- Been thanked: 369 times

Re: 100% equity funds

100% equity

vs 80/20 stock/bond

vs 80/20 stock/gold

4% initial Withdrawal Rate

When your stocks were about to go through a tough time and you really needed a lifeboat, it is GOLD that has fulfilled that role, not bonds:

This is particularly true if you are retired and making withdrawals from the portfolio

From 1972

From 2000

It gets even more interesting if you increase the intial WR to 5%, although I haven't shown that here

vs 80/20 stock/bond

vs 80/20 stock/gold

4% initial Withdrawal Rate

When your stocks were about to go through a tough time and you really needed a lifeboat, it is GOLD that has fulfilled that role, not bonds:

This is particularly true if you are retired and making withdrawals from the portfolio

From 1972

From 2000

It gets even more interesting if you increase the intial WR to 5%, although I haven't shown that here

-

1nvest

- Lemon Quarter

- Posts: 4551

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 723 times

- Been thanked: 1435 times

Re: 100% equity funds

vand wrote:1nvest wrote:Which is like two halves of one with all-stock, the other with 60/40 stock/gold. 4% SWR measures reflect historic bad case 30 years, more often supported SWR were higher, 6%, 8%/whatever. With two-halves of 100% stock and 60/40 stock/gold you might take a larger SWR from one - the half that was doing better, less from the other ... each year, and likely do OK/well. But there's no need for all of that management, its automatically integral within 100% allocation to 80/20.

67/33, 75/25, 80/20 ... halves of 100% and 33/67, 50/50, 60/40 respectively tend to be in the same/similar ballpark. With 67/33 its a form of Martingale, whatever might drive 67 stock value to halve down to 33, might also drive 33 gold value to double to 67. 67/33 -> 33/67 with no loss, and where rebalancing back to 67/33 has you double up on the number of shares being held after prices had halved.

Midcap for stocks is also inclined to work better, ejects its largest into the Large cap index, in exchange for faltering stocks falling down out of the large cap - that will more often work harder in order to re-establish their large cap index membership crown. It's also more inclined to have no more than a few percent weighting to any individual stock, less concentration into single sectors. Similar risk/reward as a HYP IMO via a single index fund (such as VMID outside of ISA (FTSE250), VMIG inside ISA (auto dividend reinvestment/accumulation)).

US data https://www.portfoliovisualizer.com/bac ... wUfQcq740X and 75/25 would have sat somewhere midway between those 67/33 and 80/20 lines

I'm somewhat skeptical of relying on "mid cap" or any particular subsector of equities (small cap value was particularly popular option designed to improve returns), as there is no real working theory to why that sector has outperformed, or even if there is then the market will probably arbitrage it away in the future - just see their relative underperformance in the last 10 years compared to large cap as a case in point.

S&P500 has been relatively pulled ahead by the Magnificent 7, FANGS .. whatever name you prefer. At other times the 'giants' cause pain .... relatively lag. Japan 1990 peak for instance, where the giants halved and more, but still remain large/dominant of the index, held it down for decades. Mid and small avoid that, their largest are ejected into the next level up index. Tend to be more like a equal weighted index.

-

1nvest

- Lemon Quarter

- Posts: 4551

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 723 times

- Been thanked: 1435 times

Re: 100% equity funds

vand wrote:100% equity

vs 80/20 stock/bond

vs 80/20 stock/gold

4% initial Withdrawal Rate

When your stocks were about to go through a tough time and you really needed a lifeboat, it is GOLD that has fulfilled that role, not bonds:

This is particularly true if you are retired and making withdrawals from the portfolio

From 1972

From 2000

It gets even more interesting if you increase the intial WR to 5%, although I haven't shown that here

67/33 https://www.portfoliovisualizer.com/mon ... dTWHds7U6U 92% success rate at 5% SWR

80/20 https://www.portfoliovisualizer.com/mon ... war6UAzqTO 91% success rate

Median case (50th percentile) real (end of 30 years residual) 3.16 versus 3.55 times (respectively) the inflation adjusted start date portfolio value, a 3.55 / 3.16 = 1.12 difference - after 30 years.

For me a good, or a slightly better than that median case outcome is worth less than the improvement from 91% to a 92% chance of success (9% failure reduction to 8%).

Whatever might drive 67 stock value to halve to 33 might see 33 gold value double to 67. No loss, rebalancing has you back at 67/33 again, where you hold twice as many shares as before. 80/20 and stocks halve/gold doubles = 40/40, you're down 20%, need a +25% gain to get back to the 67/33'er (but where by then they'd also have moved on/up).

-

1nvest

- Lemon Quarter

- Posts: 4551

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 723 times

- Been thanked: 1435 times

Re: 100% equity funds

A variant of 67/33 stock/gold is to consider home/house value + imputed to be similarly rewarding as stock + dividends. 67/33 'Equity'/gold if each of home, stocks and gold is a third each weighted.

A paid-off house covers needs and wants in three potential ways. It produces a stream of housing consumption (even better than a stream of inflation-adjusted income because the "inflation adjustments" are matched perfectly to personal needs for housing). It replaces the need to pay a mortgage or rent, the cost of your shelter is liability matched.

Second, a home could be sold in old age to support long-term care expenses if investment returns are poor or even if all other assets/income streams were lost you might get by with just our home + pensions and later the house being sold to fund late life care/nursing home costs.

Finally, a home could be sold, and move to a less valuable home if future investment returns happen to be particularly bad.

Historically imputed rent and dividends have both averaged around 4.5%. Where that is sourced via a third imputed rent, a third stock dividends, a third SWR (1.5% SWR), then that's more diversified income streams. Supplemented with pensions - that might be considered as being a form of bond ladder that is totally exhausted/spent the day you die. Whilst stocks might not pay a 4.5% dividend you might take that amount as a SWR out of stock total returns, DIY dividends to the amount and times you prefer/require.

Land/stock/gold asset diversify, £/$/global currency diversification if US stocks are held. Three sources of income diversity.

Rebalancing and non rebalanced tend to yield similar rewards, unpredictable as to which will have been the better between two points in time. So diversify across both, non-rebalanced home value, rebalance stock/gold.

Two thirds of assets in-hand (land and gold). There are distinct benefits from that, and as stocks can be liquidated in T+2 time that's additional counter-party risk reduction comfort.

A paid-off house covers needs and wants in three potential ways. It produces a stream of housing consumption (even better than a stream of inflation-adjusted income because the "inflation adjustments" are matched perfectly to personal needs for housing). It replaces the need to pay a mortgage or rent, the cost of your shelter is liability matched.

Second, a home could be sold in old age to support long-term care expenses if investment returns are poor or even if all other assets/income streams were lost you might get by with just our home + pensions and later the house being sold to fund late life care/nursing home costs.

Finally, a home could be sold, and move to a less valuable home if future investment returns happen to be particularly bad.

Historically imputed rent and dividends have both averaged around 4.5%. Where that is sourced via a third imputed rent, a third stock dividends, a third SWR (1.5% SWR), then that's more diversified income streams. Supplemented with pensions - that might be considered as being a form of bond ladder that is totally exhausted/spent the day you die. Whilst stocks might not pay a 4.5% dividend you might take that amount as a SWR out of stock total returns, DIY dividends to the amount and times you prefer/require.

Land/stock/gold asset diversify, £/$/global currency diversification if US stocks are held. Three sources of income diversity.

Rebalancing and non rebalanced tend to yield similar rewards, unpredictable as to which will have been the better between two points in time. So diversify across both, non-rebalanced home value, rebalance stock/gold.

Two thirds of assets in-hand (land and gold). There are distinct benefits from that, and as stocks can be liquidated in T+2 time that's additional counter-party risk reduction comfort.

Return to “Investment Strategies”

Who is online

Users browsing this forum: No registered users and 3 guests