Page 2 of 2

Re: ARK Invest

Posted: December 15th, 2021, 1:18 pm

by BullDog

Adamski wrote:Went back into Ark funds this month, just with some play money. Tried to buy the dip. Got lucky up 7.5% in 10 days. Wish I had invested more now

although next time try this might not be so lucky.

In arkf fintech innovation, looks less volatile than other 3. In transaction innovations and blockchain technology.

Top holdings include Square, Coinbase, Zillow, Shopify.

Looks a bit like you should have sold out again around two weeks after buying (ARKK)? Heading towards ~$90 at the moment? Hope you made a successful trade here!

Re: ARK Invest

Posted: December 15th, 2021, 1:23 pm

by Lootman

BullDog wrote:Adamski wrote:Went back into Ark funds this month, just with some play money. Tried to buy the dip. Got lucky up 7.5% in 10 days. Wish I had invested more now

although next time try this might not be so lucky.

In arkf fintech innovation, looks less volatile than other 3. In transaction innovations and blockchain technology.

Top holdings include Square, Coinbase, Zillow, Shopify.

Looks a bit like you should have sold out again around two weeks after buying (ARKK)? Heading towards ~$90 at the moment? Hope you made a successful trade here!

I found it interesting that there is now an ETF (ticker SARK) that is purely a short version of ARKK. I believe this is the first time that an ETF exists for the sole purpose of being short another ETF.

It uses swaps rather than actually shorting ARKK.

You can also buy options in ARKK if the fund itself is not volatile enough for you.

Re: ARK Invest

Posted: December 29th, 2021, 11:32 am

by vagrantbrain

Total return of -23% so far for 2021. Ouch.

Re: ARK Invest

Posted: December 29th, 2021, 11:35 am

by BullDog

vagrantbrain wrote:Total return of -23% so far for 2021. Ouch.

Oh dear. All the best for 2022!

Re: ARK Invest

Posted: December 30th, 2021, 1:14 am

by Lootman

BullDog wrote:vagrantbrain wrote:Total return of -23% so far for 2021. Ouch.

Oh dear. All the best for 2022!

Well if Lemons loved it at $153 then why would they hate it at $93?

Re: ARK Invest

Posted: December 30th, 2021, 2:51 pm

by vagrantbrain

BullDog wrote:vagrantbrain wrote:Total return of -23% so far for 2021. Ouch.

Oh dear. All the best for 2022!

Fortunately I avoided it like the plague for the reasons posted earlier!

Re: ARK Invest

Posted: December 30th, 2021, 7:38 pm

by BT63

Lootman wrote:BullDog wrote:vagrantbrain wrote:Total return of -23% so far for 2021. Ouch.

Oh dear. All the best for 2022!

Well if Lemons loved it at $153 then why would they hate it at $93?

It's difficult to achieve growth without taking on additional risk. If you want the highs you also have to be prepared for the lows.

I notice that ARKK has quite a correlation with GDX* over the last several months. The charts of both look very beaten down and due at least a bounce, if not a multi-month uptrend.

*I recently added gold mining positions to my portfolio (relevant to GDX) but have no strong opinions either way regarding ARKK.

However, since ARKK has exposure to alternative currencies, it may behave similarly to the original alternate currency (gold and its miners in GDX). Perhaps both ARKK and GDX will be reacting to a possible inflation problem.

I should stress that I don't hold ARKK, have never held ARKK and have no plans to buy into ARKK.

Re: ARK Invest

Posted: December 31st, 2021, 11:20 am

by TheMotorcycleBoy

I don't have any holdings in ARK. Whilst I believe that Cathie Wood has some smart thoughts, I believe that her Innovative funds are a fairly poor investment theory. My thesis revolves around the fact that she perceives various potentially revolutionary things e.g.

* Blockchain, fintech etc.

* Genome sequencing

* Energy storage

* AI, etc.

to all take off into these incredible S-curves. However in the past the market has priced the ETFs as if all of the above areas will starting growing very fast now. I don't find it at all likely that this will happen. All of the above have been around for sometime, and adoption rates are slow, furthermore it's quite possible that some of Cathie's "revolutionary sectors" (e.g. genomic sequencing) will grow very slowly unless high return delivery areas suddenly appear. Or that some areas will grow fast, but their growth will be diluted in the ETF, by the stumbles which occur in the other areas.

Whilst, I don't think the above areas are doomed, I don't believe their earnings growth will be as marked as some may dream.

Matt

Re: ARK Invest

Posted: December 31st, 2021, 11:38 am

by dealtn

Growth Strategies is a two word phrase. Reliance on Growth alone isn't sufficient to be successful. The concept of price (to pay for that growth) is at least as important, if not more so.

Re: ARK Invest

Posted: December 31st, 2021, 12:26 pm

by BT63

dealtn wrote:Growth Strategies is a two word phrase. Reliance on Growth alone isn't sufficient to be successful. The concept of price (to pay for that growth) is at least as important, if not more so.

It is often the case that by the time the average investor joins the bandwagon a lot of growth is already priced in, to the extent where long term shareholder returns will be mediocre at best even though the underlying companies do well.

Share prices don't necessarily follow company profits if the shares were very overvalued (or undervalued) to begin with.

Re: ARK Invest

Posted: January 7th, 2022, 11:09 am

by vand

Well, I've watched the ARK with interest for the last year. We all know that markets have tendency to mean revert, and that often top performing funds in one periods are the worst in the next, and vice versa. Any fund that quadruples in the space of year can easily go back down just as fast unless they have the good sense to recognise that themselves and take advantage to spread their money around, yet Cathie Wood seems to double up on her strategy.

Nothing wrong with that, of course, as its a thematic fund. As a value investor with a contrarian streak, I wouldn't touch it with a barge pole myself just based on avoiding doing what is the most popular thing.

However what makes me think that Cathie Wood is actually bordering on being charlatan are her own predictions to return "30-40%pa over the next 5 years". IMO a good money manager accepts the vagaries of the market and would never make such projections of their own return. Buffett & Munger for example only ever promise to try to do what is in their power which is to buy good companies with an acceptable margin of safety given best estimates about its future cashflows.

ARKx funds are also very different to SMT imo. SMT have a long proven record of outperforming even over multiple market cycles. Everything about ARKx makes them look more like a tulip fund.

Re: ARK Invest

Posted: January 7th, 2022, 11:32 am

by BullDog

vand wrote:Well, I've watched the ARK with interest for the last year. We all know that markets have tendency to mean revert, and that often top performing funds in one periods are the worst in the next, and vice versa. Any fund that quadruples in the space of year can easily go back down just as fast unless they have the good sense to recognise that themselves and take advantage to spread their money around, yet Cathie Wood seems to double up on her strategy.

Nothing wrong with that, of course, as its a thematic fund. As a value investor with a contrarian streak, I wouldn't touch it with a barge pole myself just based on avoiding doing what is the most popular thing.

However what makes me think that Cathie Wood is actually bordering on being charlatan are her own predictions to return "30-40%pa over the next 5 years". IMO a good money manager accepts the vagaries of the market and would never make such projections of their own return. Buffett & Munger for example only ever promise to try to do what is in their power which is to buy good companies with an acceptable margin of safety given best estimates about its future cashflows.

ARKx funds are also very different to SMT imo. SMT have a long proven record of outperforming even over multiple market cycles. Everything about ARKx makes them look more like a tulip fund.

Don't disagree at all. Bear in mind, there's always a cohort who are ready to listen to someone saying what they want to hear. That's how people like Madoff and others operated.

Recently, Elizabeth Holmes was convicted of fraud. She told rich potential investors what they wanted to hear. So they invested millions into the snake oil company she was running (Theranos). Not for the first time, folks wanting to get rich quick fall for sweet talk and fear of missing out.

I am not saying ARK is in the Madoff or Holmes category at all. But it pays to not fall for the sweet talk without proper due diligence.

Re: ARK Invest

Posted: January 8th, 2022, 12:13 pm

by TheMotorcycleBoy

BullDog wrote:Recently, Elizabeth Holmes was convicted of fraud. She told rich potential investors what they wanted to hear. So they invested millions into the snake oil company she was running (Theranos). Not for the first time, folks wanting to get rich quick fall for sweet talk and fear of missing out.

I am not saying ARK is in the Madoff or Holmes category at all. But it pays to not fall for the sweet talk without proper due diligence.

Slightly OT. I read "Bad Blood" recently, an analysis of Holmes and Theranos. Whilst I don't condone exactly what she did, she wasn't a outright fraudster IMHO. Just totally obsessed with miniaturization, and overly broad functionality. The miniaturisation meant the initial prototypes were v buggy, and that's why they ended up fixing their results with ones from existing equipment, "till they got their's working properly". Then events with Sunny and Walgreens, carried her away, mixed with her viciously driven (unfortunately resulting in her being quite mean to employees) work ethic+ambition, seem to cascade, as more and more outsiders flocked in for a slice of the pie (they'd imagined was there). Additionally IIRC her parents were very successful, and pressured her. Dad was even VP at Enron! A really sad story TBH.

Matt

Re: ARK Invest

Posted: January 8th, 2022, 12:33 pm

by monabri

From the B.Gifford stable, Edinburgh Worldwide fund (EWI)....that is down 30% this year (ok, ARKK is -40%). I was surprised that EWI had come off the boil so much. Not a big holding for me.

Re: ARK Invest

Posted: January 28th, 2022, 10:06 am

by vand

What is it Warren Buffett's famous quote: "It's only when the tide goes out that you see who's been swimming naked."

And it seems the good ship Ark has crashed on the rocks and the tide is now going out.

The question to pose now is: did Cathie Wood ever really have any investment skills, or was her previous outperformance all just a the result of randomness and a good yarn?

If you want to beat the market then it's not that hard - just take on more risk. However that cuts both ways, as when the rubber band snaps the other way the losses can be huge.

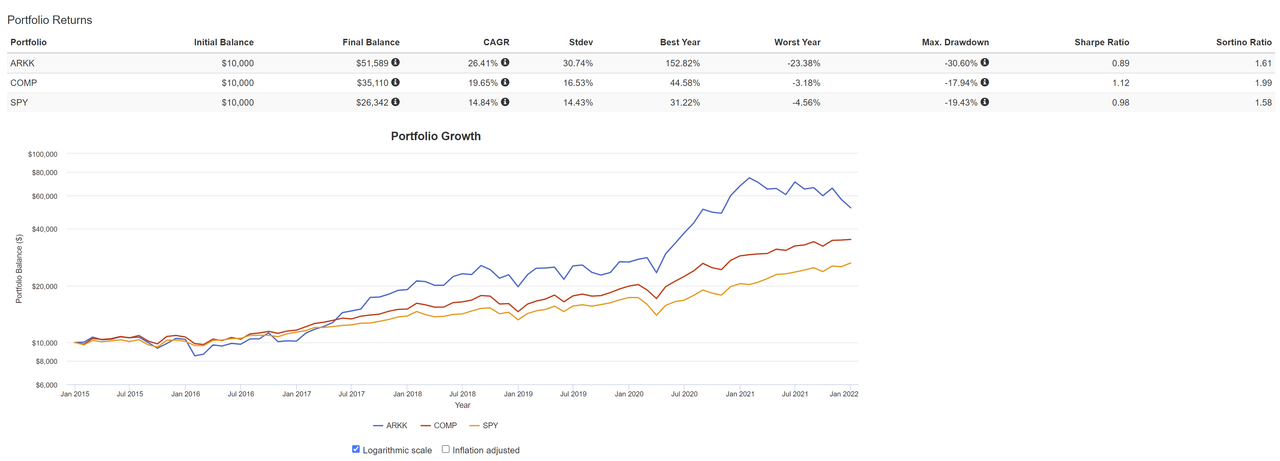

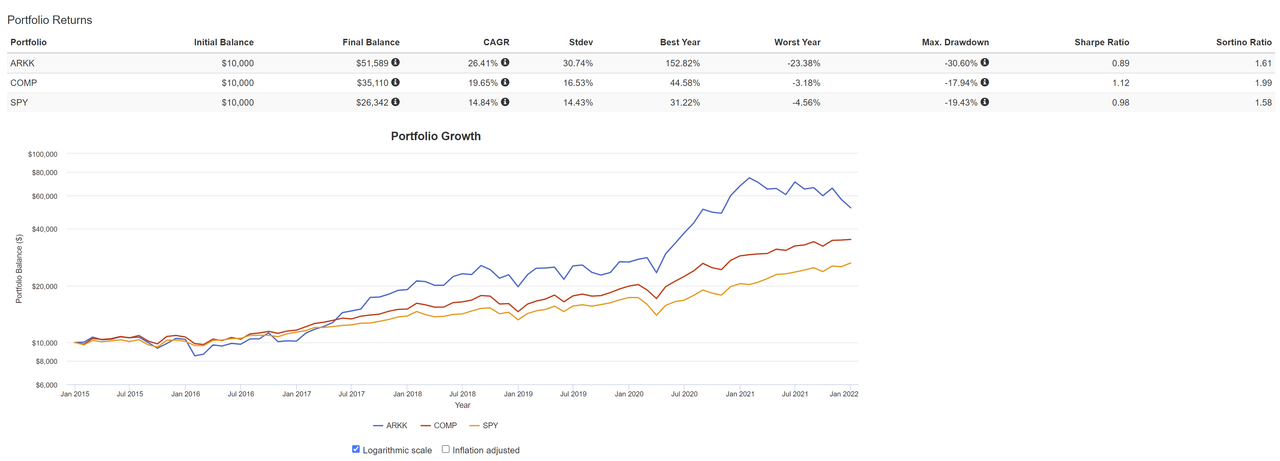

Looking at her risk adjusted metrics, the evidence seems to point to the latter. Since 2015 her fund's Sharpe/Sortino ratios have been lower than both the S&P and the Nasdaq. Therefore, one is not wrong to conclude that there is no evidence of her having any real investment skill, and her outperformance has simply been the result of holding much more risk.

Whether you subscribe to Buffett's definition of risk as permanent loss of capital, or the orthodox investment management definition of risk as portfolio volatility (I personally don't think they are mutually exclusive), the Ark funds carry a hell of a lot of risk that its investors are now bearing.

Re: ARK Invest

Posted: January 28th, 2022, 1:05 pm

by Lootman

vand wrote:What is it Warren Buffett's famous quote: "It's only when the tide goes out that you see who's been swimming naked."

And it seems the good ship Ark has crashed on the rocks and the tide is now going out.

The question to pose now is: did Cathie Wood ever really have any investment skills, or was her previous outperformance all just a the result of randomness and a good yarn?

Go back a year on this site and you can read posts from some people here sounding almost desperate to invest in the ARK complex, but of course not being able to do so in most cases.

Perhaps with hindsight that was a sell signal. Certainly looks like it now that ARKK is down more than 50%.

But then perhaps all this criticism of Woods now is similarly a buy signal?

Re: ARK Invest

Posted: January 28th, 2022, 1:29 pm

by BullDog

Lootman wrote:vand wrote:What is it Warren Buffett's famous quote: "It's only when the tide goes out that you see who's been swimming naked."

And it seems the good ship Ark has crashed on the rocks and the tide is now going out.

The question to pose now is: did Cathie Wood ever really have any investment skills, or was her previous outperformance all just a the result of randomness and a good yarn?

Go back a year on this site and you can read posts from some people here sounding almost desperate to invest in the ARK complex, but of course not being able to do so in most cases.

Perhaps with hindsight that was a sell signal. Certainly looks like it now that ARKK is down more than 50%.

But then perhaps all this criticism of Woods now is similarly a buy signal?

That would be typical, yes

However, I will keep my bargepole to hand here.

Re: ARK Invest

Posted: January 28th, 2022, 2:05 pm

by vand

Yes, there will definitely be a technical bounce, perhaps very soon, which can easily see it regain 50%.

However I don't sense investors have reached capitulation point just yet - in the last 2 weeks the ARKK fund has actually seen half a billion of net inflows. I'd look for mass selling washout before the long term bottom is in.

Re: ARK Invest

Posted: January 28th, 2022, 5:30 pm

by NotSure

vand wrote:Yes, there will definitely be a technical bounce, perhaps very soon, which can easily see it regain 50%.

ARKK holds lots of listed companies, so not sure about a technical bounce?

https://cathiesark.com/ark-funds-combined/complete-holdings

although next time try this might not be so lucky.