I have diligently reinvested dividends in those holdings that paid the highest yield that were below the average value of the HYP constituents (once dividends had built up to a worthwhile figure to allow for trading costs (about £1k)).

My plan is to consider slowing down work-wise at about 62 (13 years from now) so my target income is linked to this date, although what I might do is use my auto-enrolment scheme through my employer at 62 to live off and run this down to zero over 5 years to coincide with my State Pension starting and give my HYP a little more time to grow.

Capital wise, the HYP has increased by about 3.45% helped mainly by IG Group, Sky and Tui (just if anyone's interested of course

Cumulative dividends received to Original Cost is just a figure of interest to me so I know when dividends have exceeded capital invested (it'll be a nice feeling!).

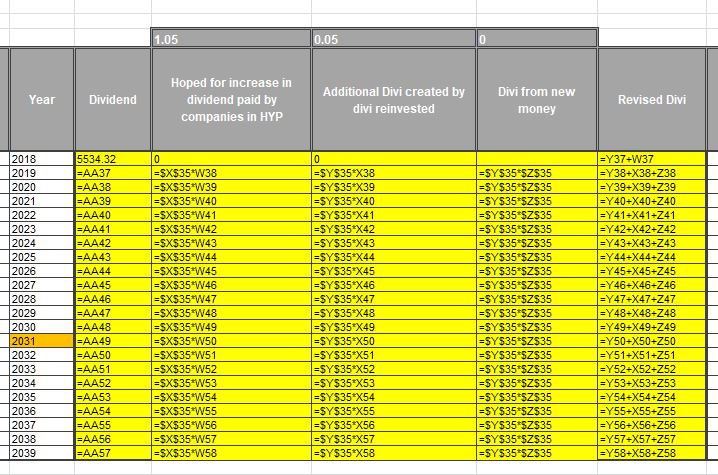

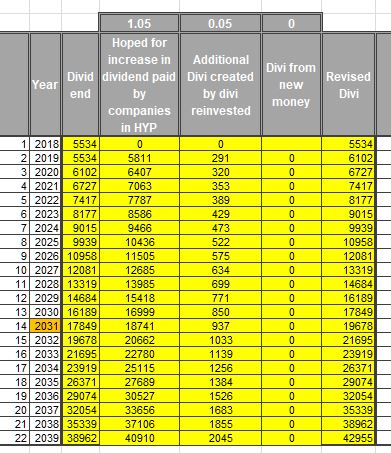

Here is my income table as mentioned above:

So, seems to be going ok and will keep re-investing dividends when I can to try and get to where I need to be.

I am also a sector short after Carillion disappeared so will be adding either Standard Life Aberdeen (SLA), or WPP as I do not have exposure in these sectors currently (fund managers or advertising).

Any comments welcome!

Cheers, OLTB.