Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

British Aerospace

Forum rules

Tight HYP discussions only please - OT please discuss in strategies

Tight HYP discussions only please - OT please discuss in strategies

-

invest2019

- Posts: 11

- Joined: March 24th, 2019, 10:14 am

- Has thanked: 13 times

British Aerospace

I am considering purchase of BA. for HYP

BA - Morningstar 4 star rated

Data from HL site

Dividend yield 4% plus

Dividend cover 1.93

BA. would add a new sector for diversification.

Share price drop - is there any significant reason not to purchase if it meets diversification, yield, div cover ?

Balance sheet seems ok (am an amateur here) Debt seems no worse than some HYP shares, possibly better.

The only thing I can find is a concern about BA future contracts with Saudi Arabia?

Any input appreciated,

Thank you.

BA - Morningstar 4 star rated

Data from HL site

Dividend yield 4% plus

Dividend cover 1.93

BA. would add a new sector for diversification.

Share price drop - is there any significant reason not to purchase if it meets diversification, yield, div cover ?

Balance sheet seems ok (am an amateur here) Debt seems no worse than some HYP shares, possibly better.

The only thing I can find is a concern about BA future contracts with Saudi Arabia?

Any input appreciated,

Thank you.

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: British Aerospace

Note the pension issues too - they have quite a defined benefit pension liability (£4.3billion).

a question for consideration : with the demise of Carillion (and others) and it's big pension hole, will the next government take a dimmer view on pension deficits and direct companies to ensure that the deficit is "closed".

The current yield is 4.7% but their 5 year compound annual growth rate in divis is only 2.01% (source: dividenddata).

https://www.dividenddata.co.uk/dividend ... &order=#AV.

Data from Morningstar would indicate why the divi growth rate has slowed - there are periods when the free cash flow per share didn;t suppport the dividends paid.

I assume you mean BAE Systems though...they've only been around just under 20 years under that name.. (30th Nov 1999).

(30th Nov 1999).

a question for consideration : with the demise of Carillion (and others) and it's big pension hole, will the next government take a dimmer view on pension deficits and direct companies to ensure that the deficit is "closed".

The current yield is 4.7% but their 5 year compound annual growth rate in divis is only 2.01% (source: dividenddata).

https://www.dividenddata.co.uk/dividend ... &order=#AV.

Data from Morningstar would indicate why the divi growth rate has slowed - there are periods when the free cash flow per share didn;t suppport the dividends paid.

I assume you mean BAE Systems though...they've only been around just under 20 years under that name..

-

jackdaww

- Lemon Quarter

- Posts: 2081

- Joined: November 4th, 2016, 11:53 am

- Has thanked: 3203 times

- Been thanked: 417 times

Re: British Aerospace

the financial metrics are quite good - except the substantial pension deficit .

otherwise its about having to stomach the business dealings - saudi etc , and politics.

i hold for long term yield .

otherwise its about having to stomach the business dealings - saudi etc , and politics.

i hold for long term yield .

-

Walrus

- Lemon Slice

- Posts: 255

- Joined: March 21st, 2018, 12:32 pm

- Has thanked: 52 times

- Been thanked: 93 times

Re: British Aerospace

Personally too much accounting risk for me. Long term contracting, imagine difficult to audit and lots of valuation judgement. I try and steer away from these type of investments. Admittedly different to the support services sector but for me a similar accounting risk.

-

invest2019

- Posts: 11

- Joined: March 24th, 2019, 10:14 am

- Has thanked: 13 times

Re: British Aerospace - meant BAE Systems!

Point taken re pension deficit, accounting and politics.

Had my doubts which is why I posted here.

Views appreciated and there are other candidate shares anyway.

Had my doubts which is why I posted here.

Views appreciated and there are other candidate shares anyway.

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: British Aerospace

Walrus wrote:Personally too much accounting risk for me. Long term contracting, imagine difficult to audit and lots of valuation judgement. I try and steer away from these type of investments. Admittedly different to the support services sector but for me a similar accounting risk.

BAE programme management disciplines will be quite strict and would certainly involve the use of Earned Value Management ( along with other PM tools).

-

mattman74

- Lemon Pip

- Posts: 61

- Joined: November 11th, 2016, 12:42 am

- Has thanked: 17 times

- Been thanked: 34 times

Re: British Aerospace

I used to have BAe Systems in my HYP

I sold after viewing a BBC documentary about their Saudi contract.

I took the view that their profitability depended on quite a dodgy (though long term) relationship with the Saudi's.

Sold post Trump election when they were riding high so made a decent profit

I really don't regret my decision.

I avoid gambling/tobacco/low cost lenders (eg provident financial) for similar ethical reasons. At the moment this "semi ethical" stance does not seem to be unprofitable.

I do realise that other people have different views and that is fine. It is purely a personal decision.

Matt

I sold after viewing a BBC documentary about their Saudi contract.

I took the view that their profitability depended on quite a dodgy (though long term) relationship with the Saudi's.

Sold post Trump election when they were riding high so made a decent profit

I really don't regret my decision.

I avoid gambling/tobacco/low cost lenders (eg provident financial) for similar ethical reasons. At the moment this "semi ethical" stance does not seem to be unprofitable.

I do realise that other people have different views and that is fine. It is purely a personal decision.

Matt

-

tjh290633

- Lemon Half

- Posts: 8289

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 919 times

- Been thanked: 4138 times

Re: British Aerospace

Stan wrote:I’m thinking of buying some here, a good time or not in your opinion?

How do you define a good time? The dividend has been increased every year except in 2003 and 2004, when it was held, since I got them spun out of GEC in 1999. The yield is 4.2%, not unreasonable.

Who knows what the market will do in the next year or so?

You have to do your own research and make your own decisions.

TJH

-

idpickering

- The full Lemon

- Posts: 11383

- Joined: November 4th, 2016, 5:04 pm

- Has thanked: 2476 times

- Been thanked: 5801 times

Re: British Aerospace

Stan wrote:I’m thinking of buying some here, a good time or not in your opinion?

As Terry says above, no-one knows for sure, or words to that effect,

I’ve held BA. continually since 12 Sep 2011, and regard them as a mainstay in my HYP.

I topped up a year ago. They’ve done well of late, being up 18% in the last six months. According to HL the yield on offer currently is a tad over 4%, so if you’re happy with that go for it. But there are higher yields on offer elsewhere. I do like the diversification they bring to my HYP though and have no intention of selling my holdings any time soon, if ever.

Ian.

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: British Aerospace

What are these new pension rules being touted? Companies with pension deficits forced to top up their pension schemes rather than pay dividends? ( pension scheme act 2021). The pension scheme act 2021 seems to have come about due to the collapse of the likes of Carillion whuch had a big pension hole. BAE Systems has a large pension deficit.

(Thus , with BAE, I'd say to hold off for the moment! )

(Thus , with BAE, I'd say to hold off for the moment! )

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10032 times

Re: British Aerospace

monabri wrote:

What are these new pension rules being touted?

Companies with pension deficits forced to top up their pension schemes rather than pay dividends? ( pension scheme act 2021). The pension scheme act 2021 seems to have come about due to the collapse of the likes of Carillion which had a big pension hole.

BAE Systems has a large pension deficit.

(Thus, with BAE, I'd say to hold off for the moment!)

I'll agree that they've got a large pension deficit, but I'm not sure if you're aware that it's certainly not as large as it recently used to be..

From their 29th July half-year report -

Post-employment benefits deficit -

The Group's share of the pre-tax accounting post-employment benefits deficit decreased to £2.4bn (31 December 2020 £4.5bn).

https://www.investegate.co.uk/bae-systems-plc--ba.-/rns/half-year-report/202107290700078281G/

They paid a £1bn lump sum into the schemes at the end of last year, and it looks like they've also had some accounting benefits too, going from this additional snippet from the above report -

Post-employment benefits schemes -

The Group's share of the pre-tax accounting net post-employment benefits deficit decreased to £2.4bn (31 December 2020 £4.5bn). The decrease was mainly driven by an increase in discount rates during the first half of the year. The Group's deficit funding programme has completed with the next triennial valuation exercise due to take place in 2022.

So whilst you're quite right to be wary of large pension deficits with regards to these new pension rules (as highlighted elsewhere earlier this morning - https://www.lemonfool.co.uk/viewtopic.php?f=31&t=30996) I think BAE Systems look to be quite aware of the issue, and seem to be keen to address it, and given that they've managed to raise their half-year dividend this year as well (9.9p vs 9.4p), following that lump-sum payment, then on the face of it they seem to be steering a course through these twin requirements with some level of resilience...

From the above half-year report -

The Group recognises the importance to investors of a clear and consistent capital allocation policy. The Group's balance sheet is managed conservatively in line with its policy to retain its investment grade credit rating and to ensure operating flexibility.

The Group expects to continue to meet its pension obligations, invest in research and technology and other organic investment opportunities, and plans to pay dividends in line with its policy of long-term sustainable cover of around two times underlying earnings.

Cheers,

Itsallaguess

-

MDW1954

- Lemon Quarter

- Posts: 2365

- Joined: November 4th, 2016, 8:46 pm

- Has thanked: 527 times

- Been thanked: 1013 times

Re: British Aerospace

monabri wrote:What are these new pension rules being touted? Companies with pension deficits forced to top up their pension schemes rather than pay dividends? ( pension scheme act 2021). The pension scheme act 2021 seems to have come about due to the collapse of the likes of Carillion which had a big pension hole. BAE Systems has a large pension deficit.

(Thus, with BAE, I'd say to hold off for the moment! )

I'm always slightly dubious about pension deficits and surpluses, which simply reflect what is happening with gilt yields, most of the time.

MDW1954

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: British Aerospace

I note also that the pension deficit can be arrived at using several methods - and obtain several different deficit values. Five methods are given in the link below and (page 6 of 7) the deficits can vary widely.

https://www.thepensionsregulator.gov.uk ... nding.ashx

https://www.thepensionsregulator.gov.uk ... nding.ashx

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: British Aerospace

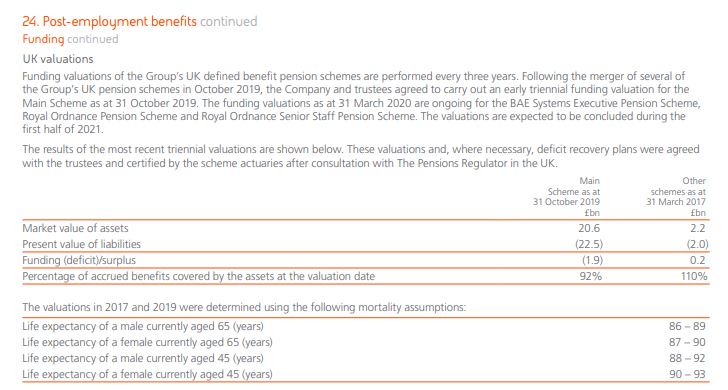

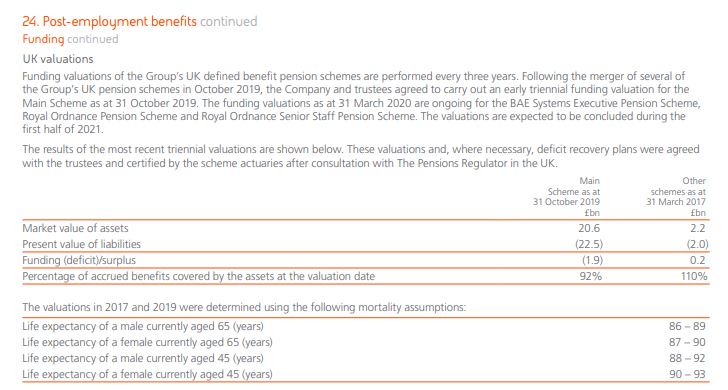

I had a look at the last BAE annual report.

https://investors.baesystems.com/~/medi ... e-2020.pdf

"In October 2019 the assets and liabilities of six of the Group’s pension schemes were consolidated into a single scheme. This was carried out to drive long-term efficiencies. Following the merger, the Company and Trustees agreed to carry out an early triennial funding valuation as at 31 October 2019. In February 2020 that valuation and deficit recovery plan were agreed with the Trustees after consultation with The Pensions Regulator in the UK. The funding deficit as at 31 October 2019 was £1.9bn. As part of the valuation agreement, the Company paid £1bn into the Scheme in April 2020, representing an advancement of £1bn of deficit contributions due between 2022 and 2026.

The UK triennial funding valuations for the other smaller UK pension schemes dated 31 March 2020 are being finalised. As at the previous valuations these schemes were in surplus."

BAE took out a £1bn bond.

"As previously reported, a $1.3bn (£1.0bn), ten-year, 3.4% bond was raised in April 2020 in order for the Group to inject £1bn into the UK pension scheme"

In conclusion, having looked at the numbers, I believe BAE Systems have been proactively managing their pension scheme deficit. In 2018, the scheme was £4.27bn in deficit.

From page 231 of the AR.

https://investors.baesystems.com/~/medi ... e-2020.pdf

"In October 2019 the assets and liabilities of six of the Group’s pension schemes were consolidated into a single scheme. This was carried out to drive long-term efficiencies. Following the merger, the Company and Trustees agreed to carry out an early triennial funding valuation as at 31 October 2019. In February 2020 that valuation and deficit recovery plan were agreed with the Trustees after consultation with The Pensions Regulator in the UK. The funding deficit as at 31 October 2019 was £1.9bn. As part of the valuation agreement, the Company paid £1bn into the Scheme in April 2020, representing an advancement of £1bn of deficit contributions due between 2022 and 2026.

The UK triennial funding valuations for the other smaller UK pension schemes dated 31 March 2020 are being finalised. As at the previous valuations these schemes were in surplus."

BAE took out a £1bn bond.

"As previously reported, a $1.3bn (£1.0bn), ten-year, 3.4% bond was raised in April 2020 in order for the Group to inject £1bn into the UK pension scheme"

In conclusion, having looked at the numbers, I believe BAE Systems have been proactively managing their pension scheme deficit. In 2018, the scheme was £4.27bn in deficit.

From page 231 of the AR.

-

tjh290633

- Lemon Half

- Posts: 8289

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 919 times

- Been thanked: 4138 times

Re: British Aerospace

If you go back a few years you will probably find that the Company had to stop contributing to the pension fund, because it was in surplus. I get my pension from the Babcock Pension Fund, which was in that situation.

That situation could return if interest rates rise to more normal levels.

TJH

That situation could return if interest rates rise to more normal levels.

TJH

-

dealtn

- Lemon Half

- Posts: 6100

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 443 times

- Been thanked: 2344 times

Re: British Aerospace

MDW1954 wrote:

I'm always slightly dubious about pension deficits and surpluses, which simply reflect what is happening with gilt yields, most of the time.

MDW1954

No, they really don't simply reflect that. But this isn't the correct board for a better explanation.

-

torata

- Lemon Slice

- Posts: 524

- Joined: November 5th, 2016, 1:25 am

- Has thanked: 207 times

- Been thanked: 212 times

Re: British Aerospace

monabri wrote:I had a look at the last BAE annual report.

https://investors.baesystems.com/~/medi ... e-2020.pdf

".... The funding deficit as at 31 October 2019 was £1.9bn. As part of the valuation agreement, the Company paid £1bn into the Scheme in April 2020, representing an advancement of £1bn of deficit contributions due between 2022 and 2026..."

BAE took out a £1bn bond.

"As previously reported, a $1.3bn (£1.0bn), ten-year, 3.4% bond was raised in April 2020 in order for the Group to inject £1bn into the UK pension scheme"

Thanks Monabri.

To clarify my understanding, they borrowed money to upfront the over-payments they'd need to make for the next 4/5 years.

Let's hope it's a clever move, rather than just kicking the can down the road.

torata

-

miner1000

- 2 Lemon pips

- Posts: 180

- Joined: November 4th, 2016, 1:36 pm

- Has thanked: 10 times

- Been thanked: 129 times

Re: British Aerospace

I have held BA. for many years. with the state of the world, China, Taliban, etc, I cannot afford not to hold them for the future. Like it or not, military hardware is in high demand, not to mention the number of military companies currently the subject of takeovers. Private equity certainly thinks the sector is worthy of investment.

Sorry, not an ethical view. Just realistic

Sorry, not an ethical view. Just realistic

-

idpickering

- The full Lemon

- Posts: 11383

- Joined: November 4th, 2016, 5:04 pm

- Has thanked: 2476 times

- Been thanked: 5801 times

Re: British Aerospace

miner1000 wrote:I have held BA. for many years. with the state of the world, China, Taliban, etc, I cannot afford not to hold them for the future. Like it or not, military hardware is in high demand, not to mention the number of military companies currently the subject of takeovers. Private equity certainly thinks the sector is worthy of investment.

Sorry, not an ethical view. Just realistic

Well said. My sentiments exactly.

Ian.

Return to “HYP Practical (See Group Guidelines)”

Who is online

Users browsing this forum: No registered users and 40 guests