“2019 has been a challenging year with results below our expectations due to tough trading in Next Generation

Products (NGP). We are implementing actions to drive a stronger performance in the coming year.

“Our resilient tobacco value creation model continues to produce high margin sales growth and is well-placed to

deliver sustained profitable growth in the years ahead.

“Although we grew NGP revenues by around 50 per cent, this was below the level we expected to deliver. Our delivery

was also impacted by an increasingly competitive environment and regulatory uncertainty in the USA. Growth in

Europe was also slower, despite achieving leading retail shares in several markets. We have taken the learnings from

this year to reset our NGP investment plans for 2020, prioritising the markets and categories with the highest

potential for sustainable, profitable growth. We will scale up investment as the visibility on returns and regulatory

uncertainties improves.

“Our priority going forward is to optimise the profit and cash generation from our tobacco assets, while improving

growth in NGP with greater discipline and a more tightly focused business model that will create long-term value for

shareholders.”

Alison Cooper

Chief Executive

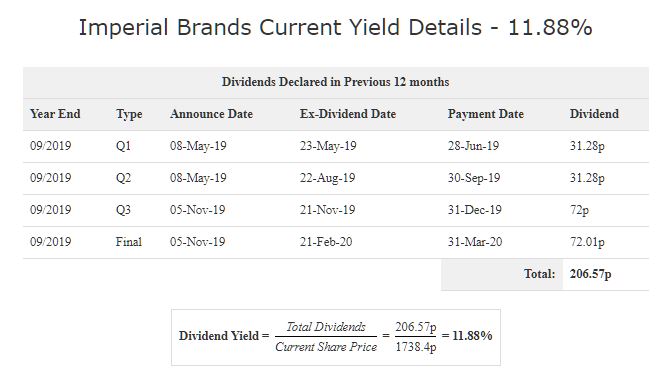

later; • Annual dividend of 206.58p up +10%; revised capital allocation and shareholder distribution policy in place

And; Dividend Growth

The Group has paid two interim dividends totalling 62.56 pence per share in June 2019 and September 2019, in line with our quarterly dividend payment policy to give shareholders a more regular cash return.

The Board approved a further interim dividend of 72.00 pence per share and will propose a final dividend of 72.01 pence per share, bringing the total dividend for the year to 206.57 pence per share. The third interim dividend will be paid on 31 December 2019 with an ex-dividend date of 22 November 2019. Subject to AGM approval, the proposed final dividend will be paid on 31 March 2020, with an ex-dividend date of 21 February 2020.

https://www.imperialbrandsplc.com/conte ... dasset.pdf