Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

Forum rules

Tight HYP discussions only please - OT please discuss in strategies

Tight HYP discussions only please - OT please discuss in strategies

-

GeoffF100

- Lemon Quarter

- Posts: 4760

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1377 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

Last day of dealings in LCL: 27 March 2018

Effective Date: 28 March 2018

First dealings in New GVC Shares 29 March 2018

Do we know when we will find out the results of the mix 'n 'match? I opted for maximum shares, but reckon that many others did too, so am not expecting much over and above the basic offer. I need the figures so I can try to do a CGT forecast which will affect what other trades I do pre FY-end.

The GVC website appears to be down! {apparently it appears I am not approved to post links, but the site I tried is gvc-plc dot com}

-

GeoffF100

- Lemon Quarter

- Posts: 4760

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1377 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

The results of the Mix and Match are here:

https://gvc-plc.com/newsrelease/scheme- ... effective/

"Valid Share Elections in respect of 1,184,182,346 Ladbrokes Coral Shares, representing approximately 61.42 per cent. of the aggregate number of Scheme Shares, and valid Cash Elections in respect of 105,485,561 Ladbrokes Coral Shares, representing approximately 5.47 per cent. of the aggregate number of Scheme Shares, were made by Ladbrokes Coral Shareholders. The ability to satisfy Share Elections and Cash Elections was dependent upon other Ladbrokes Coral Shareholders making offsetting elections. As a result of all valid Mix and Match Elections, Ladbrokes Coral Shareholders making valid Cash Elections will be met in full. However, Ladbrokes Coral Shareholders making valid Share Elections will be scaled back and will be satisfied as to approximately 33.532111 per cent. of their election."

It follows that 5.47% / 0.33532111 = 16.31% elected to receive shares, and 61.42% - 16.31% = 45.11% elected for the default allocation (plus another 100% - 61.42% = 30.58% who did so by default). A surprisingly large number of what I expect were mostly professional investors elected to sell their shares at a discount. I was also surprised that so many, like me, opted for a certain outcome, rather than the chance of picking up some shares at a discount.

Here are GVCs comments on UK taxation:

https://gvc-plc.com/newsrelease/admissi ... vc-shares/

GVC's proposal is that the value of the CVRs should be calculated from the closing price of LCL on 27/03/18 and the opening price of GVC on 28/03/18, but HMRC has not approved this calculation. I believe that GVC's proposal is illogical. I believe that the closing prices of both shares on 27/03/18 should be used, because this is the latest time at which a market estimate of the value of the CVRs is available. The GVC share price may have changed overnight for reasons unconnected with the value of the CVRs. Using the opening price on 28/03/18 would make sense if we had a market value for the CVRs at the same time, but we do not, because there is no market in the CVRs. We will have to wait for HMRC's adjudication on this matter. This is the place to watch:

https://gvc-plc.com/news/

It does not make a significant difference to me, in this financial year. With GVC's calculation, my financial loss is £923.43, and with my calculation it is £923.44. It will make a significant difference to the base cost of the CVRs, but that will not affect me in this financial year. Nonetheless, I would like to get my base cost calculations finalised as soon as possible.

It is worth adding that IWeb is still showing my LCL shares, so it looks like it is going to take a while for the dust to settle here.

https://gvc-plc.com/newsrelease/scheme- ... effective/

"Valid Share Elections in respect of 1,184,182,346 Ladbrokes Coral Shares, representing approximately 61.42 per cent. of the aggregate number of Scheme Shares, and valid Cash Elections in respect of 105,485,561 Ladbrokes Coral Shares, representing approximately 5.47 per cent. of the aggregate number of Scheme Shares, were made by Ladbrokes Coral Shareholders. The ability to satisfy Share Elections and Cash Elections was dependent upon other Ladbrokes Coral Shareholders making offsetting elections. As a result of all valid Mix and Match Elections, Ladbrokes Coral Shareholders making valid Cash Elections will be met in full. However, Ladbrokes Coral Shareholders making valid Share Elections will be scaled back and will be satisfied as to approximately 33.532111 per cent. of their election."

It follows that 5.47% / 0.33532111 = 16.31% elected to receive shares, and 61.42% - 16.31% = 45.11% elected for the default allocation (plus another 100% - 61.42% = 30.58% who did so by default). A surprisingly large number of what I expect were mostly professional investors elected to sell their shares at a discount. I was also surprised that so many, like me, opted for a certain outcome, rather than the chance of picking up some shares at a discount.

Here are GVCs comments on UK taxation:

https://gvc-plc.com/newsrelease/admissi ... vc-shares/

GVC's proposal is that the value of the CVRs should be calculated from the closing price of LCL on 27/03/18 and the opening price of GVC on 28/03/18, but HMRC has not approved this calculation. I believe that GVC's proposal is illogical. I believe that the closing prices of both shares on 27/03/18 should be used, because this is the latest time at which a market estimate of the value of the CVRs is available. The GVC share price may have changed overnight for reasons unconnected with the value of the CVRs. Using the opening price on 28/03/18 would make sense if we had a market value for the CVRs at the same time, but we do not, because there is no market in the CVRs. We will have to wait for HMRC's adjudication on this matter. This is the place to watch:

https://gvc-plc.com/news/

It does not make a significant difference to me, in this financial year. With GVC's calculation, my financial loss is £923.43, and with my calculation it is £923.44. It will make a significant difference to the base cost of the CVRs, but that will not affect me in this financial year. Nonetheless, I would like to get my base cost calculations finalised as soon as possible.

It is worth adding that IWeb is still showing my LCL shares, so it looks like it is going to take a while for the dust to settle here.

-

GeoffF100

- Lemon Quarter

- Posts: 4760

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1377 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

Correction. 100% - 16.31% - 5.47% = 78.22% opted for the default allocation, either by election or by default, so we have:

Default 78.42%

Shares 16.31%

Cash 5.47%

Default 78.42%

Shares 16.31%

Cash 5.47%

-

Gengulphus

- Lemon Quarter

- Posts: 4255

- Joined: November 4th, 2016, 1:17 am

- Been thanked: 2628 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

GeoffF100 wrote:Correction. 100% - 16.31% - 5.47% = 78.22% opted for the default allocation, either by election or by default, so we have:

Default 78.42%

Shares 16.31%

Cash 5.47%

I don't think either of your calculations is correct, because IMHO the passage you quote says clearly that the percentages choosing to elect for shares and for cash under the Mix & Match facility are 61.42% and 5.47% respectively. That leaves 100%-61.42%-5.47% = 33.11% who didn't choose either Mix & Match option.

A rough reconciliation of this with elections for shares being scaled back to 33.532111% of what was asked for:

There are a total of about 1,928.0m shares that the scheme applies to. Of those, 1,928.0m * 61.42% = 1,184.2m elected for shares, 1,928.0m * 5.47% = 105.5m elected for cash, and 1,928.0m * 33.11% = 638.4m didn't elect for either.

The total shares & cash consideration applied for was, using the figures in the Scheme document that an election for shares was for 32.7p/873p = 0.037457... extra shares in place of the cash and one for cash was for 123.093p extra cash in place of the shares:

Enough cash was available from elections for shares to make all elections for cash satisfiable, but satisfying all the elections for cash would only make 14.9m shares available of the 44.4m wanted by elections for cash. So elections for shares were scaled back by a factor of about 14.9m/44.4m = 0.3356, and satisfying that proportion of the elections for shares would make about 0.3356 * £387.2m = £129.9m available to satisfy the elections for cash.

That isn't the exact proportion of elections for shares satisfied that was announced, but it's close, and the difference is easily explained by the fact that all my figures are rounded (as is the fact that some of my figures are 0.1m out from adding up precisely). Do it with the full-accuracy share counts and one would doubtless get something more precise - but getting the full-accuracy count of the shares that didn't elect for either Mix & Match option might take a bit of research, if the exact figure is publicly available at all, and the precise calculation probably has to take the exact distribution of individual registered shareholdings into account because of fractional-share roundings. So I'm somewhat doubtful that absolutely accurate reproduction of the company's Mix & Match calculation is feasible - and in any case, getting 0.3356 is easily close enough to the announced proportion to reassure me that I've understood the announcement correctly.

Gengulphus

-

GeoffF100

- Lemon Quarter

- Posts: 4760

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1377 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

You are absolutely right Gengulphus. I did not notice the second word (Share) in the first sentence. I was tired at the time, but I should have looked more closely.

-

GeoffF100

- Lemon Quarter

- Posts: 4760

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1377 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

The default option is:

0.141 New GVC Shares + 32.7 pence in cash + contingent entitlement of up to 42.8 pence, plus an upward adjustment for the time value of money.

According to the offer document, Mix and Match Elections are satisfied on the basis:

for every 32.7 pence in cash: 0.0374570446735395 New GVC Shares

or

for each 0.141 New GVC Shares: 123.093 pence in cash.

5.47% opted for cash, whereas 61.42% opted for shares.

Each LCL share that was opted for shares gets 5.47 * 0.141 / 61.42 = 0.01255731 New GVC shares.

Each LCL share that was opted for shares wanted 0.037457045 New GVC shares.

gets / wanted = 0.01255731 / 0.037457045 = 0.335245624.

This is as near as we can expect to 0.3353211.

0.141 New GVC Shares + 32.7 pence in cash + contingent entitlement of up to 42.8 pence, plus an upward adjustment for the time value of money.

According to the offer document, Mix and Match Elections are satisfied on the basis:

for every 32.7 pence in cash: 0.0374570446735395 New GVC Shares

or

for each 0.141 New GVC Shares: 123.093 pence in cash.

5.47% opted for cash, whereas 61.42% opted for shares.

Each LCL share that was opted for shares gets 5.47 * 0.141 / 61.42 = 0.01255731 New GVC shares.

Each LCL share that was opted for shares wanted 0.037457045 New GVC shares.

gets / wanted = 0.01255731 / 0.037457045 = 0.335245624.

This is as near as we can expect to 0.3353211.

-

Gengulphus

- Lemon Quarter

- Posts: 4255

- Joined: November 4th, 2016, 1:17 am

- Been thanked: 2628 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

GeoffF100 wrote:...

5.47% opted for cash, whereas 61.42% opted for shares.

Each LCL share that was opted for shares gets 5.47 * 0.141 / 61.42 = 0.01255731 New GVC shares.

Each LCL share that was opted for shares wanted 0.037457045 New GVC shares.

gets / wanted = 0.01255731 / 0.037457045 = 0.335245624.

This is as near as we can expect to 0.3353211.

Yes, I agree that's the right way to calculate it, stripped of some rather irrelevant extra calculations I included in my previous reply (I was exploring the route to the correct calculation, and managed to unnecessarily wander into a few dead ends in the process...).

I will observe that rounding errors in the input figures can easily account for the remaining discrepancy. In particular, the percentages 5.47% and 61.42% have clearly been rounded to 2 decimal places; the underlying unrounded figures could be anywhere in the ranges 5.465% to 5.475% and 61.415% to 61.425% respectively. That means that the number of shares each LCL share that opted for shares gets could be anywhere from 5.465 * 0.141 / 61.425 = 0.01254481 to 5.475 * 0.141 / 61.415 = 0.01256981, and so 'gets/wanted' could be anywhere from 0.01254481 / 0.037457045 = 0.334911920 to 0.01256981 / 0.037457045 = 0.335579383. The announced figure of 0.3353211 is a bit above the midpoint of that range, but well within it.

We can actually get rid of that rounding error by using the precise figures announced of 1,184,182,346 LCL shares opting for shares and 105,485,561 opting for cash. Each of the latter makes 0.141 shares available to the former, so each LCL share that opted for shares got 105,485,561 * 0.141 / 1,184,182,346 = 0.01260113 New GVC shares, and 'gets/wanted' is 0.01260113 / 0.037457045 = 0.335320448.

Still not an exact match to the announced figure of 0.3353211, but very close! And my guess is that fractional share effects account for the remaining difference. In particular, the number of New GVC shares received by each registered LCL shareholding that opted for shares will not have been precisely its number of shares times 0.141 + 0.01260113, but that number rounded down to a whole number. That results in a statistically-expected average of 0.5 New GVC shares per registered LCL shareholding that were available for distribution not actually being distributed. And one way of dealing with that failure to make the books balance is to very slightly increase the allocation of New GVC shares per LCL share that opted for shares.

Gengulphus

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

Thanks GeoffF100 and Gengulphus, this is really helpful. So, I am now working out how much cash I'll receive, to allow me to do end-of-year trades to use up but not exceed my CGT allowance. I opted for maximum GVC shares, but now I know that only 33.5% of that can be satisfied and I will get some cash.

My understanding is that the basic offer is the starting point and if you specified a certain number of your shares to be used for 'extra' GVC shares then these would contribute to your new share count, over and above the basic offer but converted at a different rate. That number of LCL shares would be removed from the cash part of the calculation so that fewer LCL shares would contribute to the 32.7p calculation.

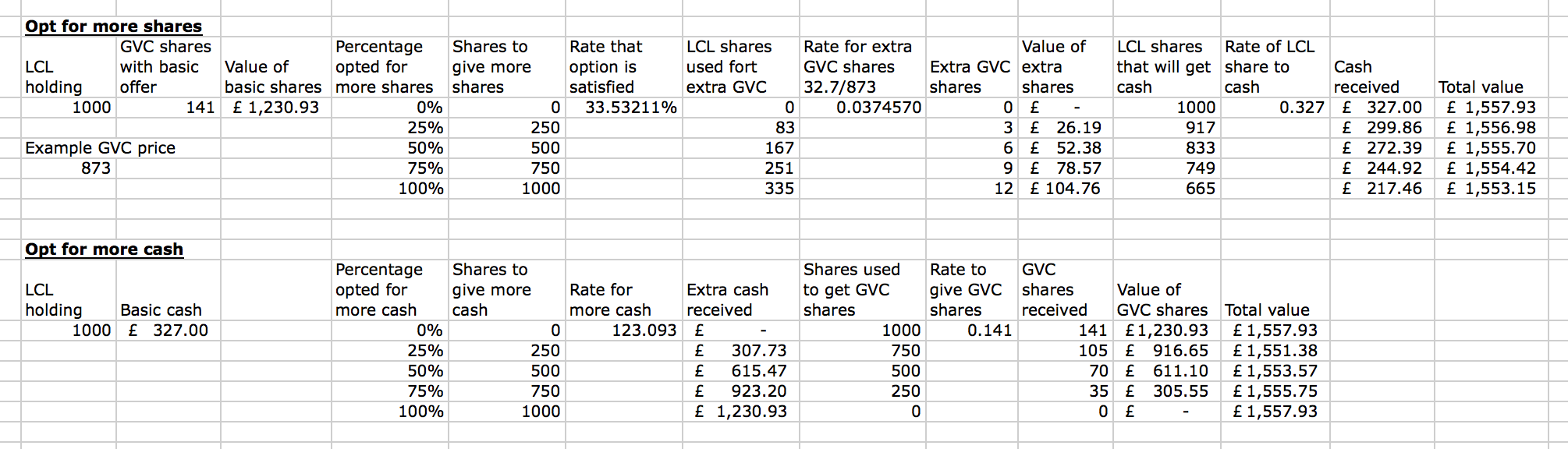

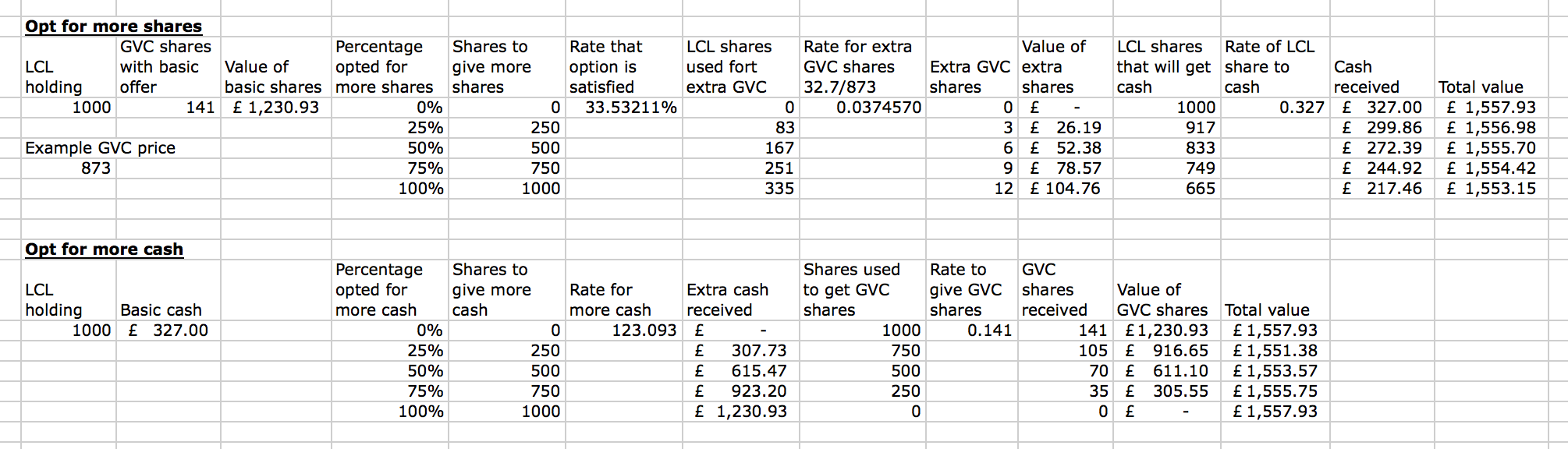

Here is an image of a sheet I've produced

For a holding of 1,000 shares where the holder opted for maximum new GVC shares, I think they will get 141 shares from the basic offer plus 1000 x 33.55% x 32.7/873 = 12 extra, making 153 GVC shares and (1000 - 335) x 0.327 = £217.46 cash.

The image above also shows the calculations for opting for more cash, just for completeness and comparison.

My understanding is that the basic offer is the starting point and if you specified a certain number of your shares to be used for 'extra' GVC shares then these would contribute to your new share count, over and above the basic offer but converted at a different rate. That number of LCL shares would be removed from the cash part of the calculation so that fewer LCL shares would contribute to the 32.7p calculation.

Here is an image of a sheet I've produced

For a holding of 1,000 shares where the holder opted for maximum new GVC shares, I think they will get 141 shares from the basic offer plus 1000 x 33.55% x 32.7/873 = 12 extra, making 153 GVC shares and (1000 - 335) x 0.327 = £217.46 cash.

The image above also shows the calculations for opting for more cash, just for completeness and comparison.

-

GeoffF100

- Lemon Quarter

- Posts: 4760

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1377 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

Suppose you have 1,000 LCL shares.

The basic offer is 141 New GVC shares + £327 in cash + interest later on.

If you opted for shares, you were asking for 37.457 New GVC shares in place of your £327 cash.

Your allocation is 37.4570 * 0.3353211 = 12.5597 shares, which will be rounded down to 12 shares.

Your 12 shares have a notional cash value of 12 * £8.73 = £104.76.

You should receive £327 - £104.76 = £222.24 in cash.

You appear to have got the number of shares right, but the cash value wrong. It is only the cash element of the offer that incurs a CGT liability in this tax year.

The basic offer is 141 New GVC shares + £327 in cash + interest later on.

If you opted for shares, you were asking for 37.457 New GVC shares in place of your £327 cash.

Your allocation is 37.4570 * 0.3353211 = 12.5597 shares, which will be rounded down to 12 shares.

Your 12 shares have a notional cash value of 12 * £8.73 = £104.76.

You should receive £327 - £104.76 = £222.24 in cash.

You appear to have got the number of shares right, but the cash value wrong. It is only the cash element of the offer that incurs a CGT liability in this tax year.

-

GeoffF100

- Lemon Quarter

- Posts: 4760

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1377 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

On second thoughts, if GVC rounds down all the share allocations, they will be left with an excess of shares, so you may get 13 shares. If you hold your shares in a pooled nominee account, it is also possible that your broker will apply his own rounding to your allocation. It is these sort of issues that promoted me to go for the default option. It does not greatly surprise me that my New GVC shares are not showing on my account. I did not want to be scrambling to complete my CGT sales this week, with incomplete information. It would have been nice to receive a few extra shares at a small discount, and preserve a little more of my tax loss, but it did not seem worth the trouble.

Last edited by GeoffF100 on April 2nd, 2018, 8:13 am, edited 1 time in total.

-

Gengulphus

- Lemon Quarter

- Posts: 4255

- Joined: November 4th, 2016, 1:17 am

- Been thanked: 2628 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

MrSplosh wrote:My understanding is that the basic offer is the starting point and if you specified a certain number of your shares to be used for 'extra' GVC shares then these would contribute to your new share count, over and above the basic offer but converted at a different rate. That number of LCL shares would be removed from the cash part of the calculation so that fewer LCL shares would contribute to the 32.7p calculation.

I don't really understand what you mean by "converted at a different rate". But basically, if you chose to get more shares with respect to N of your LCL shares, it will apply to M = 0.3353211 * N of your shares. For those M shares, you won't get any cash, so on the assumption that you didn't also choose to receive more cash with respect to other shares in your holding (*), the cash you end up receiving is (N-M)*32.7p. But you will get extra shares equal to the number the amount of cash foregone (i.e. M*32.7p) would have bought at a share price of 873p, so the number of GVC shares you get will be 0.141*N + (M*32.7p)/873p, which is 0.141*N + 0.0374570446735395*M. That formula is fixed - it does not vary according to the market price of the shares (**).

I should possibly add that those formulae don't take account of rounding. I suspect e.g. that the entire formula for the number of shares you get is calculated to the full computer accuracy and then rounded down to a whole number of shares once at the end, so that you end up with RoundDown(0.141*N + 0.0374570446735395*M) shares. But it's conceivable that the rounding is done separately for the basic and extra share counts, so that you instead end up with RoundDown(0.141*N) + RoundDown(0.0374570446735395*M) shares. Doubtless a detailed check of the scheme terms would reveal the answer, but I'll leave doing that to anyone who actually cares - it makes a maximum difference of 1 GVC share...

(*) This was possible, at least as far as the company was concerned. There wouldn't really be any point for individual shareholders in choosing more shares with respect to some of their shares and more cash with respect to others, so nominee brokers might well have simplified the options they passed on to their clients. The shareholders the option of doing that is really there for are the nominee brokers and anyone else who is the legal owner of a registered shareholding which is the 'pooled' holdings of multiple beneficial owners: it enables them to reflect different choices made by the different beneficial owners in the instructions they pass on to the company.

For example, if client A chooses more shares and client B chooses more cash, each with respect to their own entire holding of 1000 LCL shares, and no other clients had holdings of LCL shares, then client A is expecting to receive 0.141*1000+0.0374570446735395*335.3211 = 153.560137... shares (which becomes 153 shares plus a fractional entitlement payment for the remaining fraction) and (1000-335.3211)*32.7p = £217.35 cash, and client B is expecting to receive no shares and 1000*(32.7p+123.093p) = £1,557.93 cash. The broker can receive the required totals of 153.560137... shares and £1,775.28 cash for the 'pooled' registered shareholding of 2000 LCL shares by choosing shares for 1000 LCL shares and cash for the other 1000. Note that they could not do the same by simply netting the clients' choices off against each other and so choosing the basic 0.141 shares and 32.7p cash for all 2000 shares: that would have produced 282 shares and £654.00 cash, very different from the required totals.

I should possibly add that that doesn't necessarily work out exactly where fractional-entitlement payments are concerned. E.g. in the same example, if both clients had chosen to receive more shares, each of them would expect to receive 153 shares, a fractional entitlement payment for the remaining 0.560137... shares and £217.35 cash. But when the broker asks for more shares on the entire 'pooled' holding of 2000 shares, they get 307 shares, a fractional entitlement payment for 0.120274... shares and £434.70 cash, which is 1 share more and a fractional entitlement payment that is less than the total fractional entitlement payments expected by the clients by about the value of 1 share than the clients are expecting. Just how the broker deals with that sort of situation will be up to their terms & conditions - it's usually covered by a clause about receipts from corporate actions that cannot be equitably distributed between clients or some similar wording. (One particular point to note about that is that for a broker with a large number of clients who held LCL shares, rather than my toy example with just two such clients, it's quite likely that neither the extra shares nor the fractional entitlement payment they receive can be equitably distributed between their clients.)

(**) Though to be extremely pedantic, it's actually the figure 0.0374570446735395 that is written into the scheme terms, so the number of extra shares that you get is actually calculated at a share price of 32.7p/0.0374570446735395 = approximately 873.0000000000004405p!

Gengulphus

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

Thank you both.

GeoffF100 said

I think the way you have worked out the cash is incorrect. It is not done by taking the value of the extra shares away from the basic cash value, it is calculated by using a reduced number of shares multiplied by 32.7p. Taking the example above where all 1000 shares were opted to give extra GVC shares the reduced number is 1000 - (1000 x 33.5321%) = 664.67895. So the cash element will be 664.67895 x 32.7p = £217.35. This is a tiny bit lower than my earlier calcs as I am now not rounding until the very end of the process [which is what I believe to be the way the registrars do it]

Gengulphus said

To use your example "the number of GVC shares you get will be ... 0.141*N + 0.0374570446735395*M" I meant that the numbers in front of N and M are different, that's all. Your two formulas agree with my calculations, so I am reasonably happy that I know how much cash I will be getting.

But of course I cannot work out the exact base cost of this cash until the value of the CVRs is known, because that will impact the three-way aportionment of the base cost of my LCL shares. So I guess this will be the first time I will have to give an estimated figure for CGT (always seen that on the submission form but never used it yet). Then make an adjustment in a later tax return. It just shows that even those who opted for the basic offer to get a known amount of cash will still not be able to make fully-informed accurate end-of-year trades to maximise CGT allowance (and that's a pain). I've chosen to max out my CGT utilisation for this year, ignoring the CVR value, then pay the tax on that gain if and when it happens.

Jonathan

GeoffF100 said

You should receive £327 - £104.76 = £222.24 in cash. You appear to have got the number of shares right, but the cash value wrong.

I think the way you have worked out the cash is incorrect. It is not done by taking the value of the extra shares away from the basic cash value, it is calculated by using a reduced number of shares multiplied by 32.7p. Taking the example above where all 1000 shares were opted to give extra GVC shares the reduced number is 1000 - (1000 x 33.5321%) = 664.67895. So the cash element will be 664.67895 x 32.7p = £217.35. This is a tiny bit lower than my earlier calcs as I am now not rounding until the very end of the process [which is what I believe to be the way the registrars do it]

Gengulphus said

I don't really understand what you mean by "converted at a different rate"

To use your example "the number of GVC shares you get will be ... 0.141*N + 0.0374570446735395*M" I meant that the numbers in front of N and M are different, that's all. Your two formulas agree with my calculations, so I am reasonably happy that I know how much cash I will be getting.

But of course I cannot work out the exact base cost of this cash until the value of the CVRs is known, because that will impact the three-way aportionment of the base cost of my LCL shares. So I guess this will be the first time I will have to give an estimated figure for CGT (always seen that on the submission form but never used it yet). Then make an adjustment in a later tax return. It just shows that even those who opted for the basic offer to get a known amount of cash will still not be able to make fully-informed accurate end-of-year trades to maximise CGT allowance (and that's a pain). I've chosen to max out my CGT utilisation for this year, ignoring the CVR value, then pay the tax on that gain if and when it happens.

Jonathan

-

GeoffF100

- Lemon Quarter

- Posts: 4760

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1377 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

MrSplosh wrote:I think the way you have worked out the cash is incorrect. It is not done by taking the value of the extra shares away from the basic cash value, it is calculated by using a reduced number of shares multiplied by 32.7p. Taking the example above where all 1000 shares were opted to give extra GVC shares the reduced number is 1000 - (1000 x 33.5321%) = 664.67895. So the cash element will be 664.67895 x 32.7p = £217.35. This is a tiny bit lower than my earlier calcs as I am now not rounding until the very end of the process [which is what I believe to be the way the registrars do it]

That does not make sense to me. It is not what the offer document says:

Mix and Match Elections are satisfied on the basis:

for every 32.7 pence in cash: 0.0374570446735395 New GVC Shares

or

for each 0.141 New GVC Shares: 123.093 pence in cash.

For each 0.141 New GVC shares you get 123.093p.

For a single New GVC share you get 123.093p / 0.141 = 873p.

For 12 New GVC shares you get 12* £8.73 = £104.76.

Or the other way around:

For £104.76 you get £104.76 * 0.0374570446735395 / £0.327 = 12 shares.

Whether you opt for shares or for cash, the conversion rate is 873p per share. This was the last GVC price that was available when the offer document was issued.

-

GeoffF100

- Lemon Quarter

- Posts: 4760

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1377 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

My iWeb account is now correctly showing my new GVC shares, and an entry for the CVRs valuing them at 1p each, which I assume is just a place holder. Nobody knows what the CVRs are worth. More curiously, the account is showing an entry for:

LADBROKES CORAL GR ORD GBP0.2833333 MAX CASH (037U)

These are valued at 175p. an investor opting for maximum cash should receive 32.7p + 123.093p = 155.793p, so the price of 175p is nuts, even for someone who opted for cash. I assume this entry is just a place holder too.

LADBROKES CORAL GR ORD GBP0.2833333 MAX CASH (037U)

These are valued at 175p. an investor opting for maximum cash should receive 32.7p + 123.093p = 155.793p, so the price of 175p is nuts, even for someone who opted for cash. I assume this entry is just a place holder too.

-

GeoffF100

- Lemon Quarter

- Posts: 4760

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1377 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

It is worth adding that in the 1,000 share example, the default option includes exactly 141 New GVC shares. There is no issue concerning a fractional number of shares in this case. That issue would be easily tackled, but there is a worse possibility. If your shares are held in a pooled nominee account, your broker may have opted for the default option. The number of shares that you would then get depends on the numbers of shares within the broker's nominee account that were opted for shares and cash, rather than the numbers within the registrar's pool. The only safe way is to wait and see how many shares and how much cash you acually get. That does not leave much time for end of financial year trading though.

-

Gengulphus

- Lemon Quarter

- Posts: 4255

- Joined: November 4th, 2016, 1:17 am

- Been thanked: 2628 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

MrSplosh wrote:But of course I cannot work out the exact base cost of this cash until the value of the CVRs is known, because that will impact the three-way aportionment of the base cost of my LCL shares. So I guess this will be the first time I will have to give an estimated figure for CGT (always seen that on the submission form but never used it yet). Then make an adjustment in a later tax return. ...

Well, you only have to submit your tax return for the 2017/2018 tax year by 31 January 2019, which is nearly 10 months away. My guess is that by then, HMRC will have agreed a CVR value with GVC that shareholders can use in the apportionment calculation and GVC will have put it up on their website. So you probably only have to use an estimated value if you're in a hurry to submit your tax return.

And you can amend that tax return up to 31 January 2020, so there's no need to make the adjustment in a later tax return until after then.

MrSplosh wrote:... It just shows that even those who opted for the basic offer to get a known amount of cash will still not be able to make fully-informed accurate end-of-year trades to maximise CGT allowance (and that's a pain). I've chosen to max out my CGT utilisation for this year, ignoring the CVR value, then pay the tax on that gain if and when it happens.

What do you mean by "accurate"? If you're going for using your CGT allowance precisely - not a pound less nor a pound more - I agree. But I don't really see how you achieve that even in normal circumstances , since share sales are rarely if ever at the exact price one assumed in one's CGT planning. If on the other hand one is willing to tolerate some inaccuracy to allow for that, I would suggest running the apportionment calculation with a few varied plausible CVR values: you may well find that the gains calculated on the cash received don't vary all that much between them.

Gengulphus

-

GeoffF100

- Lemon Quarter

- Posts: 4760

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1377 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

Gengulphus wrote:MrSplosh wrote:... It just shows that even those who opted for the basic offer to get a known amount of cash will still not be able to make fully-informed accurate end-of-year trades to maximise CGT allowance (and that's a pain). I've chosen to max out my CGT utilisation for this year, ignoring the CVR value, then pay the tax on that gain if and when it happens.

What do you mean by "accurate"? If you're going for using your CGT allowance precisely - not a pound less nor a pound more - I agree. But I don't really see how you achieve that even in normal circumstances , since share sales are rarely if ever at the exact price one assumed in one's CGT planning. If on the other hand one is willing to tolerate some inaccuracy to allow for that, I would suggest running the apportionment calculation with a few varied plausible CVR values: you may well find that the gains calculated on the cash received don't vary all that much between them.

You have to include the CVR value in the base cost calculation. There is no liability for CGT on the CVRs in this tax year, because no capital gain has been realised.

I update my spreadsheet with the exact values of my trades as I go. For the last trade, I set the amount to be realised to the exact amount of allowance that I have left. iWeb rounds the trade size down, even for sales, so I am under my allowance by at most the price of one share. As stated above, I did two calculations. My original estimate was based on the LCL and GVC closing prices on the last day of trading of the LCL shares. The result was only one penny different from GVC's calculation. In reality, my capital loss on the cash element will be about £5 more than my original estimate because I expect that iWeb will give me a fractional entitlement.

-

Gengulphus

- Lemon Quarter

- Posts: 4255

- Joined: November 4th, 2016, 1:17 am

- Been thanked: 2628 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

GeoffF100 wrote:It is worth adding that in the 1,000 share example, the default option includes exactly 141 New GVC shares. There is no issue concerning a fractional number of shares in this case. That issue would be easily tackled, but there is a worse possibility. If your shares are held in a pooled nominee account, your broker may have opted for the default option. ...

I suspect that's not actually a problem in this case, because the company's Form of Election (or its CREST electronic equivalent) probably allows separate choices of how many shares out of a registered shareholding opt for the share option and how many for the cash option (with the obvious restrictions that each number is >= zero and their sum <= the total number of shares in the holding), with any left over opting for the default option. Certainly that's the way the corresponding Mix & Match form for the Melrose takeover of GKN works.

If so, a nominee broker could easily collect its clients' responses, tell the company the total numbers of shares on which they opt for shares and for cash (not netting them off against each other) and receive the right amounts to satisfy all its clients (give or take small fractional share effects).

There are types of corporate action on which nominee brokers can end up doing different scaling down than the company - an example is applications for more shares than one's basic entitlement under an open offer's excess application facility (assuming it has one - some do, some don't). But mix & match elections generally aren't one of them.

Gengulphus

-

Gengulphus

- Lemon Quarter

- Posts: 4255

- Joined: November 4th, 2016, 1:17 am

- Been thanked: 2628 times

Re: Mixed shares/cash/CVR offer for Ladbrokes Coral (LCL)

GeoffF100 wrote:I update my spreadsheet with the exact values of my trades as I go. For the last trade, I set the amount to be realised to the exact amount of allowance that I have left. iWeb rounds the trade size down, even for sales, so I am under my allowance by at most the price of one share. ...

I don't really see that, because the CGT allowance is a limit on the gains that you realise by your sales, not on the proceeds of those sales, and they're not the same unless you have some shares with zero base cost to sell (which is possible, but it's pretty rare in practice). E.g. if you're selling shares that have doubled in price, the value of the sale that you want is twice the amount of CGT allowance you have left plus the selling commission - but variations in share price will make the exact multiple of the remaining CGT allowance that you want vary as well...

But basically, what you say about being under the allowance by at most the price of one share does answer my actual question, which was essentially "How much accuracy is 'accurate' meant to require?". And yes, I think that in normal circumstances, something pretty close to that accuracy is achievable by the sort of technique you describe. But does the CVR value uncertainty's effect on the base cost apportionment detract appreciably from that level of accuracy?

Gengulphus

Return to “HYP Practical (See Group Guidelines)”

Who is online

Users browsing this forum: Google [Bot], wanderer and 41 guests