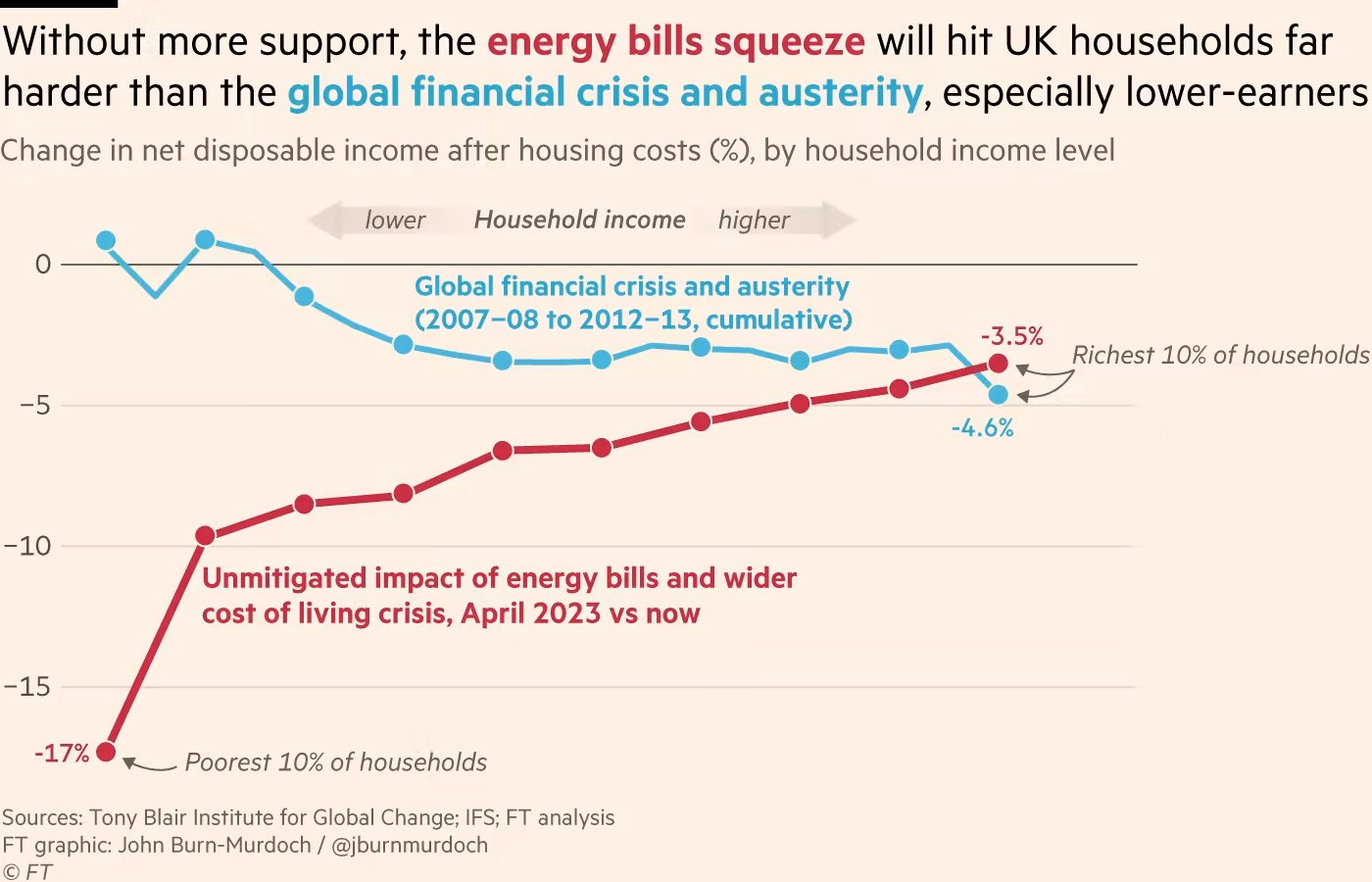

Big picture - things look pretty screwed. There are estimates that average disposable income will fall by 7% due to energy bills in the absence of any effort to ameliorate things. That's the biggest drop since records began over 60 years ago, and more than double the effect of the 2008 crisis. Although you Waitrose shoppers on an investment site will be insulated from a lot of it, but it's going to really hit the people who shop at Lidl and ASDA, the poorest 10% will lose 17% of disposable income, 5x the average hit from 2008 :

I've compared the lack of political understanding of how regressive energy bills are, to the poll tax, and I think without major political action we're well into rioting in Trafalgar Square territory. Truss looks utterly unequiped to handle something as big as this, she could well manage to be a worse PM than Johnson. I guess the only thing is that she will be so desperate to make back some of the Tories' 12-point deficit in the polls that she'll do popular stuff to kick the can down the road, particularly in the fact of popular unrest. But it will be misdirected and won't be enough to save the economy - too little, too late.

https://upload.wikimedia.org/wikipedia/commons/8/81/Poll_Tax_Riot_31st_Mar_1990_Trafalger_Square_-_Horse_Charge.jpg

And then you've got the effect of higher interest rates on mortgages as a separate thing. So a lack of disposable income is going to really hit consumer-facing businesses, which are already being hit by their own (uncapped) energy crisis. It will be brutal for retail and hospitality - so shorting them seems easy money, there's going to be a lot of bankruptcies there and eg voids in commercial property. Doesn't look great for residential property either TBH.

Anyway, amongst all this misery, energy looks a potential bright spot for investors. Yes it's catastrophe investing, but that's for the individual to decide how they feel about it. Whatever government may do in the short term, this crisis is only going to be resolved in the long term by serious investment by corporates and it's not unreasonable to be involved in deploying capital towards that end, and expecting a return on that investment. OTOH, the nature of these things means that we could see governments acting unpredictably to take some of those profits away from investors, and part of the skill in investment is managing risks such as that.

One thing though - this is a bit different. In the noughties we were used to the idea of price pressure coming from additional demand as eg China industrialised, but some of the big threats now are due to lack of supply, and the reponses are different. Examples specific to the UK are the supply shock in the labour market due to the withdrawal of freedom of movement with Europe, and the supply shocks in raw materials in all sorts of markets due to the new problems in trading with our near neighbours. They are both factors that increase costs and hence inflation, but that doesn't mean that

increasing taxes/interest rates is the correct response from the authorities, as it would be if the inflation came from excess demand.

And so it is on the energy side. The futures markets are obssessing over a lack of demand for oil - from a potentially severe recession in the short term to more general worries about the impact of eg electric vehicles (EVs) - BNEF reckon we've already lost 1.5 million barrels (mmbbl)/day of demand due to electric vehicles (mostly two wheels so far but cars are catching up) and they reckon petrol demand will peak in 2026 and road fuels as a whole will peak in 2027. On the flip side, Russia has given a dramatic example of the withdrawal of supply, which in turn has second-order effects on long-term demand. The European response to that is REPowerEU, to make Europe independent of Russian gas. And that mostly means using less gas in general - either through energy efficiency or more renewables - although in the short-term there is a huge dash for liquefied natural gas (LNG) which is forcing up gas prices around the globe. So how to take advantage of this?

Obviously the market for liquids is relatively divorced from gas at the moment, although there will be some interplay - anything that can take dual fuels will obviously be using liquids at the moment, and eg diesel generators may be looking quite attractive for some right now. It's also worth noting that refining margins are through the roof at the moment, whereas "normally" refining profits are negatively correlated with oil prices, as cheap oil means cheap inputs for the refineries. So refining might be one thing to look at.

Russia exported around 7.5 mmbbl/d (million barrels per day) of oil/products in 2021, of which 55% went to the US/EU and so might be thought to be sanctioned :

The European countries that were most dependent on Russian oil/products are in this chart from Reuters and absolute quantities of liquid imports by region are in this one and by country in this table from the IEA.

However it's not clear how much effect sanctions are having on Russian exports given the healthy trade in "Latvian" and "Turkmenistan" blends which can be up to 49.9% Russian oil even before you get to alternate routes to China/India etc so there's a lot of uncertainty about the real supply balance of the liquids market. But the latest IEA (International Energy Agency) report suggests that sanctions are having essentially no effect on Russian oil reaching the market.

It looks like the spot market got really tight last month, with storage at Cushing at multi-year lows and Brent front spreads going crazy, but in the last few weeks it's eased a lot due to recession fears and more Russian supply than expected. But the big news for the medium-term seems to have been missed, which is Saudi saying a few weeks ago that they are one expansion away (1mmbpd offshore, in 2027) from their all time peak capacity. Certainly it feels like Saudi are close to capacity regardless of what nameplate they claim - currently producing 10.83mmbpd from a claimed 12mmbpd capacity, with about half of OPEC's claimed spare capacity of 2.73mmbpd (per IEA). I don't really like to get into the game of predicting oil prices - it involves small differences between big numbers - but the short term could be a bit weak due to recession but saved by gas-replacement demand whereas medium-term looks pretty strong. Most companies are hedging around $70-75 and I reckon if the numbers look OK at that level then you should do OK - after all that's where it was at Christmas.

Having said that, oil looks like it will be pedestrian compared to gas markets around the world. TTF, the main European gas benchmark is around €300/MWh, which corresponds to about $500 per barrel of oil equivalent (boe), and the UK benchmark NBP is around $375/boe. Think about that....

This chart from a few days ago gives an idea of just how far TTF is from the long-term "norm", it's up more than 10x :

https://pbs.twimg.com/media/Fax0s6kX0AEbtOw?format=png&name=small

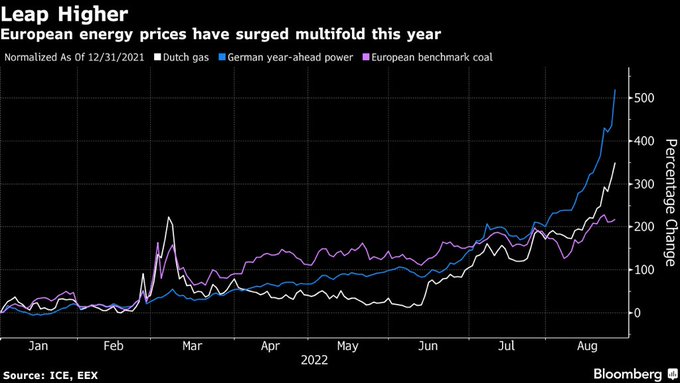

And this has "bled through" into related markets like electricity and coal, all up up 2x-5x YTD :

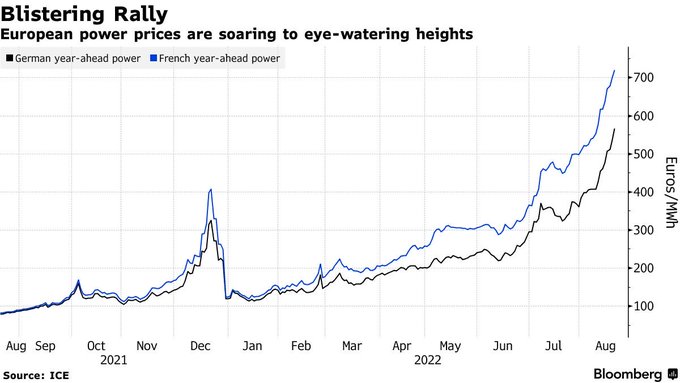

France should be feeling even more smug than usual with >80% of their electricity generated by nuclear and <10% gas, but a combination of corrosion problems and drought leaving them short of cooling water has led them to dial production right back so their electricity prices are currently among the highest in Europe. nuclear-monitor.fr normally gives the current status of the French nuclear fleet but seems to be having problems just at the moment.

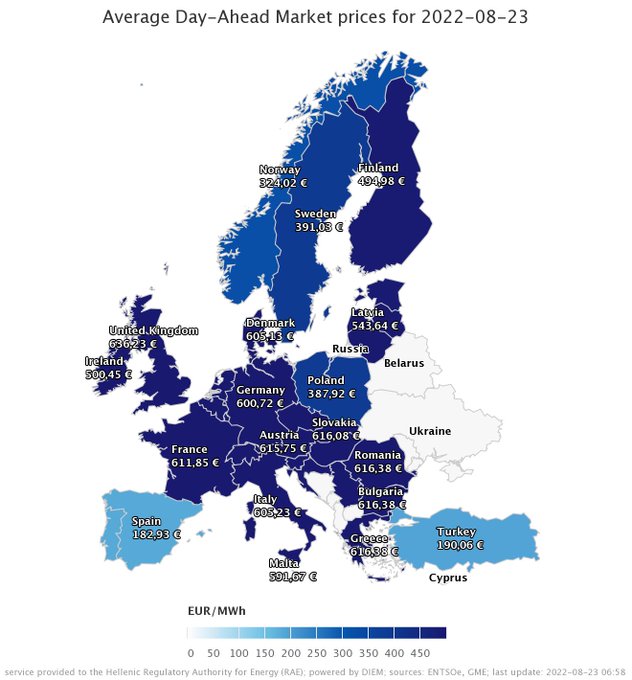

You'll notice that Iberia is an "island" in the European electricity market - it's physically separate, relying mostly on North African gas and they've implemented a separate €243.57/MWh supplement for gas generators to cover the extra cost of gas, leaving the "pool" cost for non-gas electricity much lower. The vibes coming out of Brussels at the moment suggest that something similar will be implemented at an EU-wide level in the next few days.

Iberia is a good example of how gas/electricity markets used to work, as individual "islands" relying on fixed pipelines that fed a single market. In turn that meant that each market had a different gas price that moved independently of others depending on weather etc. But now that it is possible to move gas between markets via LNG, gas markets are starting to link up and this is shown well in this chart - although European gas is up 8-10x on where it's been the last few years, US gas is up nearly 3x as producers there rush to stuff gas into LNG tankers for Europe :

https://pbs.twimg.com/media/FaIHxhSXkAMCqOK?format=jpg&name=small

Remember that chart, we'll come back to it later - US gas companies could be a good way to play this crisis as the less extreme movements in price are less likely to attract government interference whilst the high cost of shale gas means high operational gearing effects in response to higher prices.

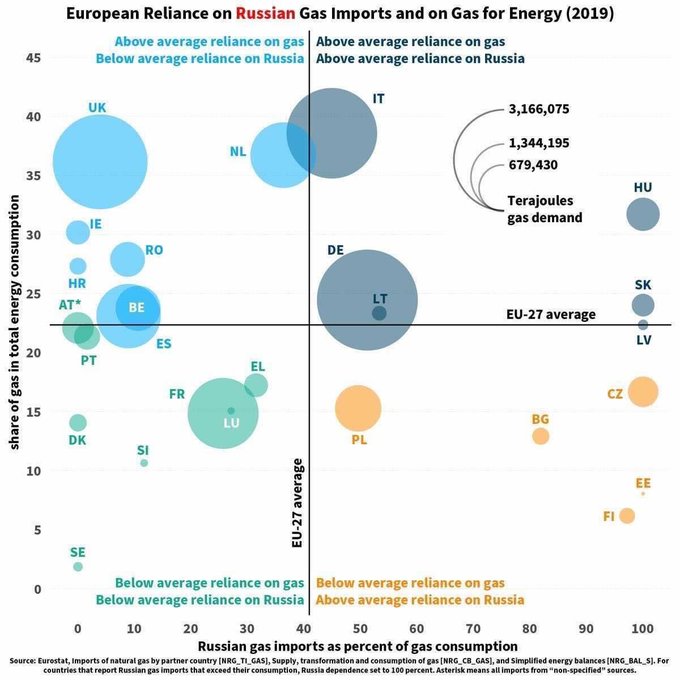

But going back to European markets, this chart shows how much different countries depend on gas, and how much they get from Russia so might be a good starting point of where one might want to invest. Czechia, Slovakia, Estonia, Latvia, Finland and Bulgaria are super-dependent on Russia, but are relatively small markets; Germany and Italy are less dependent on Russia but are huge markets that use a lot of gas and who have traditionally taken a majority of their gas from Russia, France is somewhat less dependent thanks to all their nuclear power stations, Poland and NL are also significant markets. Lithuania is an interesting case that has consciously moved away from dependency on Russia with eg a new LNG terminal.

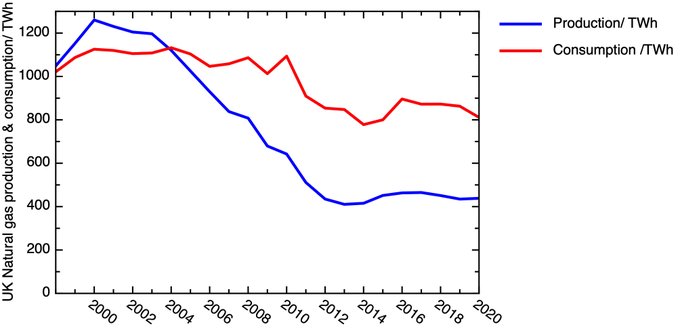

The basic problem for the UK is that it has had the mindset of a country that's self-sufficient in oil and gas, but that's not been true for nearly two decades due to declines in the North Sea eg for gas :

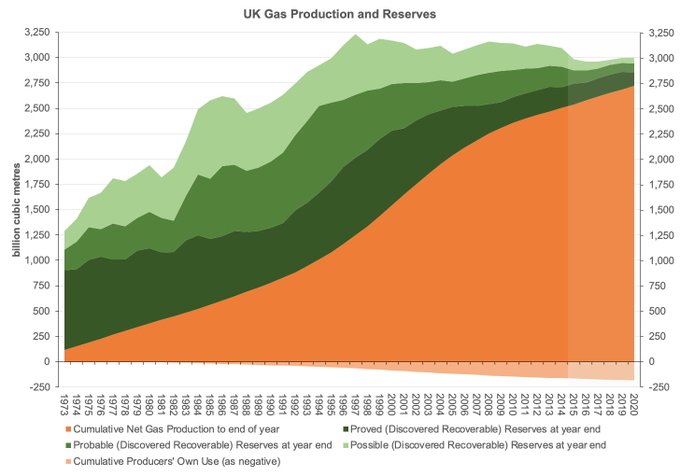

That's driven by the fact that we're not discovering any more, we pretty much knew where in the North Sea all the gas was by the late 1990s, and we've now consumed most of it :

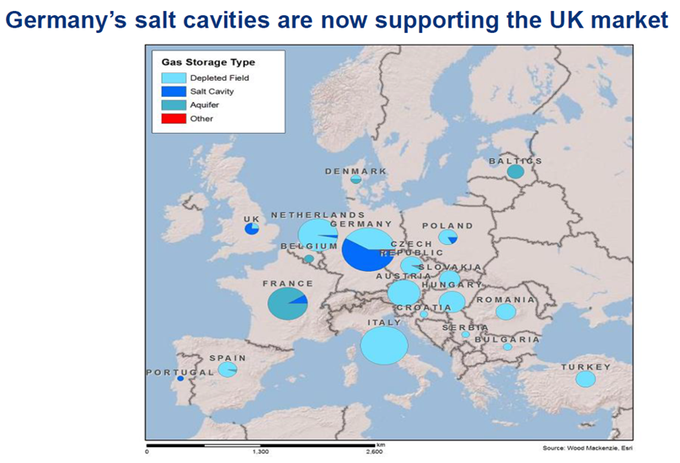

But we used the fact that we were a producer to gain exemptions from the EU rules on gas storage, and then once we became a net importer we argued that gas storage was no longer necessary as we could always rely on the world market that had recently developed in LNG. We do have a bit of storage - you'll have heard about how our biggest long-term store at Rough has been shut down ([url]Kathryn Parker has done a great piece[/url] on the detail of the Rough closure), our biggest one is now the Stublach salt caverns in Cheshire run by ENGIE (aka GdF Suez). So now our plan for winter is to effectively scrounge the use of some of what's stored in Germany and NL :

You can get details of each storage unit in Europe from Gas Infrastructure Europe - perhaps the most important one is that Germany have made good progress in filling up their storage despite everything, currently at 82.74% capacity; NL are not doing quite so well at 74.9%.

Anyway, we have markets where there have been massive increases in selling prices, but far less in costs, so that most of the companies involved are awash with cash flow. In principle this should be an attractive area to invest in. There will be longer-term plays on this theme like uranium, but getting through this winter means looking at existing production of gas, coal and electricity.

On the flip side is the prospect of government intervention, at least in Western Europe, so one might want to spread things around a bit rather than being too exposed to any one government (with the UK having quite a lot of political risk at the moment). Based on that chart of Russian supply, Italy is probably of particular interest (from a macro perspective and also as they froze all development as a green thing which really hit shares), along with Germany and to a lesser extent NL and France.

I think US gas production/midstream may be quite a good way to play this as it should have a lot less risk of government interference whilst still benefiting from prices that are maybe 3x higher than they were not long ago. HYP types might want to look at North American royalty trusts, which are sort of the oily equivalent of REITs. It's also worth looking for things like unused tax losses as a protection against higher corporation tax, and big investment programmes that can be offset against windfall taxes. One can also assume that service companies will also have good prospects, with no danger of government interference albeit less gearing to the price of commodities. In particular one might think that any companies that can help producers increase production in the short term will benefit more than exploration services like seismic - so drilling, casing, that kind of thing. And the tanker/LNG companies - we've had cargoes of LNG coming from Australia to the UK recently, the market is that dislocated.

It's also worth saying that even at a time of massive cash flows, oily shares are not immune from wider market misery, as we saw earlier this summer. On the flip side potential predators have more cash than they know what to do with and will be looking to "go drilling on Wall Street", and electricity companies, perhaps with government financial assistance, may look to buy companies with gas in the ground as a way to ensure supplies. In many cases they've spent H1 paying off the debt they accumulated during Covid etc and are now feeling confident enough to expand. We've already seen deals and attempted deals starting to happen, and there will be many more in the next 6-12 months. But governments will be looking particularly closely at any deals, and it will be very hard to complete any deal involving a "national champion".

There's not many companies in London operating in those areas in the EU and I assume regulars here will be well aware of them so I had a wade through a few 1000 companies to see if I could find possible investments in other markets. Short version is that there's not many as EU energy markets have so much involvement from governments and national champions, I'll start a parallel thread for what I found. In the meantime, I'd be interested in how others see the big picture.

Alternatively you could just follow momentum, which seemed to work quite well earlier in the year....