nmdhqbc wrote:monabri wrote:Your ISA is earning 2%...? ( small error but might as well mod it in your sheet)

not sure who you're talking to here. but I don't see any other spreadsheets posted so is it me? If so, no I don't have returns assigned for ISA in the spreadsheet above. L3 and L4 have 2% in but that's nothing to do with an ISA. It's the assumed rate of increase in the state pension and spending.

Yes, the comment was to nmdhqbc.

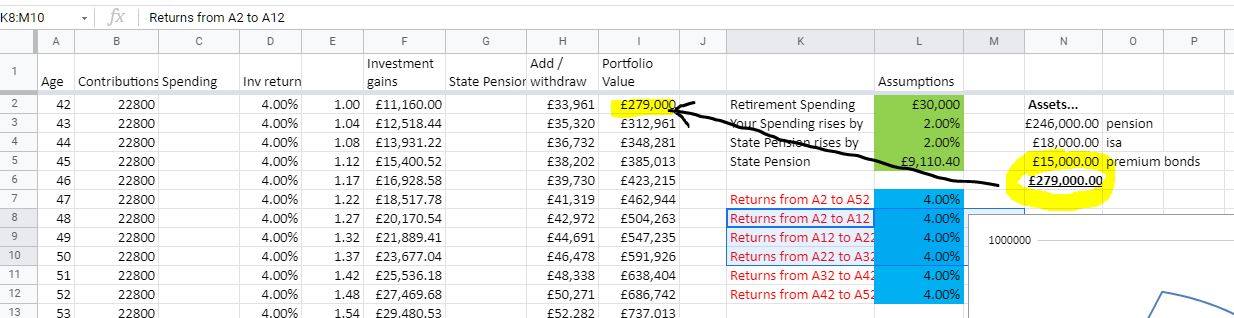

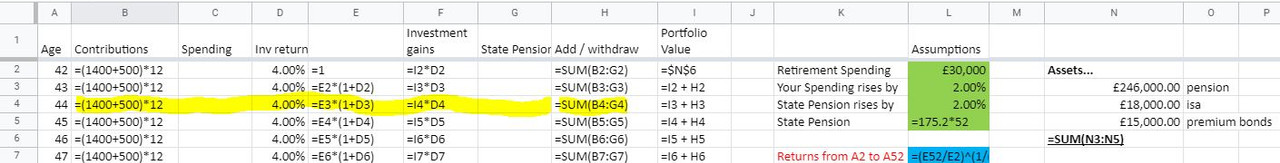

Cell I2 forms the starting point for the calculations - and that comprises the sum of values under "Assets" (£279k). These assets are then assumed to grow at 4% and there is also the additional contributions of column B (£22.8k). Column F is growing the Assets at 4%.

Of course, "ISA" might refer to "share ISA". If it is indeed a share ISA then you might well get 4%. As for a consistent return of 4% on £15k premium bonds I think that this would be very (very) lucky. I would thus suggest that the "Assets" figure certainly removes the premium bond value and possibly the "ISA" (and certainly if it is a Cash ISA).

I note that in column H you are doing a sum (example =sum(B3:G3)) - this would then add in the contents of column D3 (4%) and hidden column E3 which is not what you want to do - you could simply define the contents of H3 to be = B3+D3+F3+G3 (and copy down the formula into lower cells)

I know you mentioned that there was no Tax Calcs (at the moment ?) but looking at some of those withdrawal amounts shown in red font (and with a State Pension on top) you will likely be in the 40% tax range.