Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

Middle of the road income yielders

Middle of the road income yielders

Would appreciate some suggestions of things to research to diversify a part of my SIPP in what I coin the middle of the road section (in terms of yield), current incumbents being INPP, BBGI, HICL which are yielding around the 5.5-6% range. Criteria would be:

- some prospect of dividend growth

- prefer generalist sector focus

I already have a fair amount of lower and higher yielding stuff, but feels like there’s a gap in the middle in terms of yield in terms of options.

Thanks in advance.

- some prospect of dividend growth

- prefer generalist sector focus

I already have a fair amount of lower and higher yielding stuff, but feels like there’s a gap in the middle in terms of yield in terms of options.

Thanks in advance.

-

DrFfybes

- Lemon Quarter

- Posts: 3792

- Joined: November 6th, 2016, 10:25 pm

- Has thanked: 1198 times

- Been thanked: 1987 times

Re: Middle of the road income yielders

These 3 seem rather focussed in one sector

Is there a reason you want a diverse range of yields, rather than a diverse range of sectors? It does seem an unusual strategy requiring a lot of management. There are a lot of cases of yesterdays high yielder to become tomorrows low/zero zero yielder, and vice Versa. DLG and Legal and General spring to mind.

Paul

[Edited for spelling, and I've probably still missed some]

Is there a reason you want a diverse range of yields, rather than a diverse range of sectors? It does seem an unusual strategy requiring a lot of management. There are a lot of cases of yesterdays high yielder to become tomorrows low/zero zero yielder, and vice Versa. DLG and Legal and General spring to mind.

Paul

[Edited for spelling, and I've probably still missed some]

Re: Middle of the road income yielders

Thanks for replying. I agree they are focused on the same sector (although perhaps more generalist than some of renewable infrastructure funds) hence I suppose why I’m keen to find some other things. I like the fact they have asset backing/contractual cash flows and the idea of investing in infrastructure is something I feel I understand. I’m definitely not trying to chase yield here. I want a fully covered dividend that can hopefully grow, probably in a fund/IT/ETF rather than a single stock.

-

88V8

- Lemon Half

- Posts: 5844

- Joined: November 4th, 2016, 11:22 am

- Has thanked: 4199 times

- Been thanked: 2603 times

Re: Middle of the road income yielders

mesb48 wrote: I’m definitely not trying to chase yield here. I want a fully covered dividend that can hopefully grow, probably in a fund/IT/ETF rather than a single stock.

The obvious ITs would be Merchants MRCH and City of London CTY.

If you want territorial variety, then Middlefield MCT for Canadian exposure although as has been pointed out it's not really an IT.

Foreign & Colonial FCIT has a few on here fans but the yield is <2% and the TR seems to me a bit meh.

V8

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: Middle of the road income yielders

Hmm that looks more interesting than I thought. Haven't checked it for a while. As ever, the problem is that you get 38% in Lindsell Train, the company, rather than a bigger spread of companies.

And lets face it, the performance hasn't been great.

-

richfool

- Lemon Quarter

- Posts: 3530

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1208 times

- Been thanked: 1294 times

Re: Middle of the road income yielders

mesb48 wrote:Would appreciate some suggestions of things to research to diversify a part of my SIPP in what I coin the middle of the road section (in terms of yield), current incumbents being INPP, BBGI, HICL which are yielding around the 5.5-6% range. Criteria would be:

- some prospect of dividend growth

- prefer generalist sector focus

I already have a fair amount of lower and higher yielding stuff, but feels like there’s a gap in the middle in terms of yield in terms of options.

Thanks in advance.

If you're looking for generalist trusts with some dividend yield, I would have a look at Brunner (BUT) and Alliance (ATST), from the Global Growth sector. Or if you want a bit more dividend yield: JP Morgan Global Growth & Income (JGGI), or Scottish American (SAIN), from the Global Growth & income sector.

The first 2 normally yield just over 2.00%, though the yield on BUT is currently just under 2.00% because its SP has risen significantly over the last few months.

Of the second two, SAIN yields around the mid 2.0%'s and JGGI around the high 3.00%'s, the latter targets a yield of 4%.

In the UK (G&I) sector you could look at: Law Debenture (LWDB), Edinburgh (EDIN) and Dunedin (DIG), with dividend yields ranging from 3.00 - 4.00%.

I hold all of the above.

Re: Middle of the road income yielders

Thanks for the replies.

I've considered a basket of some of the 'dividend hero' type investment trusts, JGGI etc. Although, for those that yield 4% or below, frankly I'd rather the safety of a longer dated government bond because I'm not chasing capital appreciation.

Also considered investment grade corporate bonds but since they are harder to buy direct for retail investors, by the time you take account of the fees that risk premium on the return gets eaten into quite a lot.

There's loads of options in the higher yield space (at the bottom end of which some of the cumulative preference shares are interesting I think).

I guess I'm trying to create an annuity with a natural and growing yield from a modest risk profile portfolio - without actually buying the annuity.

The markets make it easy to buy quite a lot of risk or relatively little. The middle bit seems tricky.

I've considered a basket of some of the 'dividend hero' type investment trusts, JGGI etc. Although, for those that yield 4% or below, frankly I'd rather the safety of a longer dated government bond because I'm not chasing capital appreciation.

Also considered investment grade corporate bonds but since they are harder to buy direct for retail investors, by the time you take account of the fees that risk premium on the return gets eaten into quite a lot.

There's loads of options in the higher yield space (at the bottom end of which some of the cumulative preference shares are interesting I think).

I guess I'm trying to create an annuity with a natural and growing yield from a modest risk profile portfolio - without actually buying the annuity.

The markets make it easy to buy quite a lot of risk or relatively little. The middle bit seems tricky.

-

DrFfybes

- Lemon Quarter

- Posts: 3792

- Joined: November 6th, 2016, 10:25 pm

- Has thanked: 1198 times

- Been thanked: 1987 times

Re: Middle of the road income yielders

88V8 wrote:mesb48 wrote: I’m definitely not trying to chase yield here. I want a fully covered dividend that can hopefully grow, probably in a fund/IT/ETF rather than a single stock.

The obvious ITs would be Merchants MRCH and City of London CTY.

If you want territorial variety, then Middlefield MCT for Canadian exposure although as has been pointed out it's not really an IT.

Foreign & Colonial FCIT has a few on here fans but the yield is <2% and the TR seems to me a bit meh.

V8

FCIT seems to be a slightly leverage global tracker, or very much acts like one.

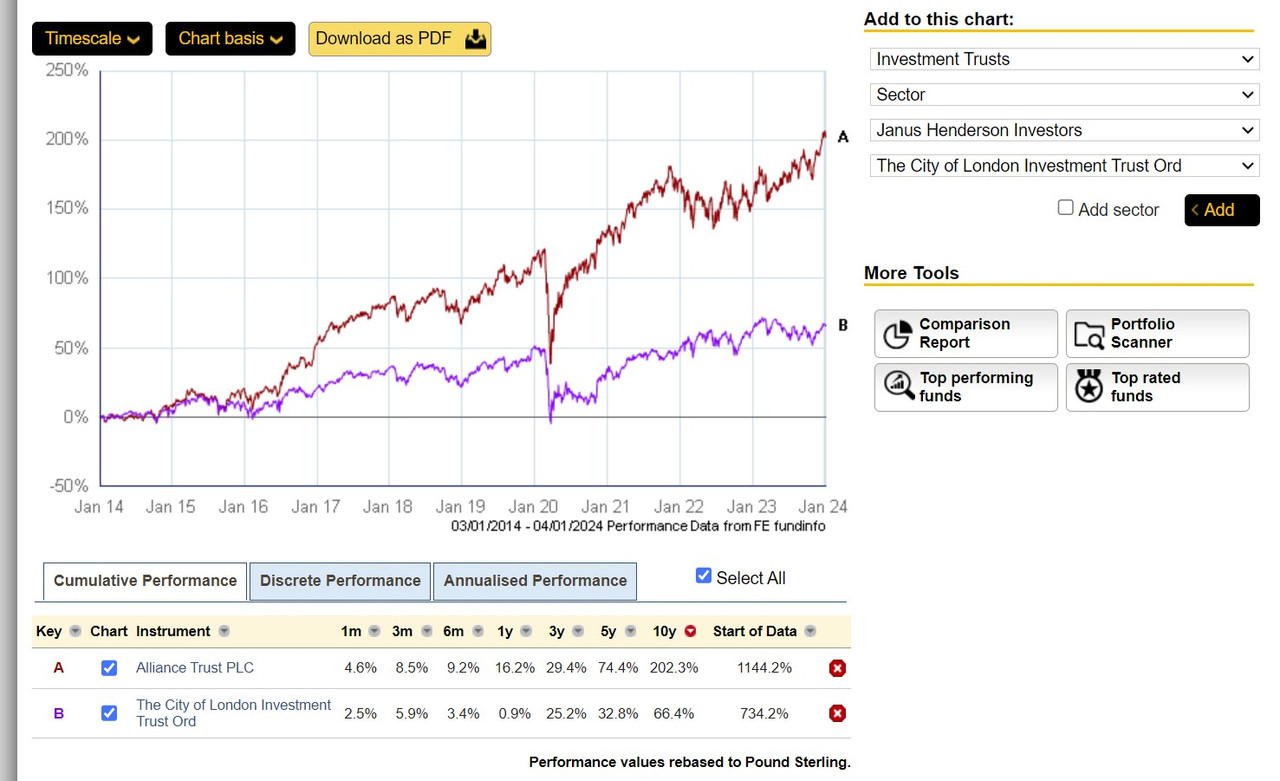

One thing I have observed but not tested is that the ITs I've looked at with returns over 4.5% tend to have poor long term performance. CTY is the obvious one, up 10% in a decade whilst chucking out a nice Divi, ATST at the opposite end with a low Divi but 150% increase in price in a decade.

One day I'll work out TR for a few of them and plot it against yield to prove myself wrong

Paul

-

kempiejon

- Lemon Quarter

- Posts: 3586

- Joined: November 5th, 2016, 10:30 am

- Has thanked: 1 time

- Been thanked: 1196 times

Re: Middle of the road income yielders

DrFfybes wrote:CTY is the obvious one, up 10% in a decade whilst chucking out a nice Divi, ATST at the opposite end with a low Divi but 150% increase in price in a decade.

Just on this specific choice ASTS is more global and CTY FTSE100, comparing the UK to the global market over that period shows how UK has lagged.

mesb48 wrote:- some prospect of dividend growth

- prefer generalist sector focus

There's a Vanguard Global income ETF VHYL yielding about 3.5% pretty generalist though 40% US, dividend has been growing since Covid reduction but fell back in the most recent 12 months. It'll cost you 0.29%.

https://www.vanguardinvestor.co.uk/inve ... tributions

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: Middle of the road income yielders

DrFfybes wrote:88V8 wrote:The obvious ITs would be Merchants MRCH and City of London CTY.

If you want territorial variety, then Middlefield MCT for Canadian exposure although as has been pointed out it's not really an IT.

Foreign & Colonial FCIT has a few on here fans but the yield is <2% and the TR seems to me a bit meh.

V8

FCIT seems to be a slightly leverage global tracker, or very much acts like one.

One thing I have observed but not tested is that the ITs I've looked at with returns over 4.5% tend to have poor long term performance. CTY is the obvious one, up 10% in a decade whilst chucking out a nice Divi, ATST at the opposite end with a low Divi but 150% increase in price in a decade.

One day I'll work out TR for a few of them and plot it against yield to prove myself wrong

Paul

Total Return over the last 10 years.....

source: https://www2.trustnet.com/Tools/Chartin ... O:GLBLGRTH

Return to “Retirement Investing (inc FIRE)”

Who is online

Users browsing this forum: No registered users and 28 guests