Dod101 wrote:Unilever has managed 8% or so rises in its dividend for the last couple of years and its share price has risen more than 20% even post the attempted takeover bid. If we look further back, its share price has risen about 50% since immediate pre the bid. There is a lot to be said for what some have called a 'quality' dividend even with a much lower yield if it is protecting the share price.

Dod

HYP is not about 'protecting the share price'.

I bought Unilever in Jul. 2011, the 11th lowest yielding of 15 in my Footsie 'LuniHYP100'. Unilever then paid 3.7%, compared with 3.1% for the All-Share and a blended 4.6% for the portfolio. Since 2000 it had been occasionally available at or above market average yield: more often than Diageo, the other often-cited 'quality' payer with a low initial return. In seven years Unilever paid me £479 from a stake of £1,200; but dodgy, risky Vodafone contributed £1,176, and a profitable part return of capital to boot. (VOD was my fourth highest yielder of 15.)

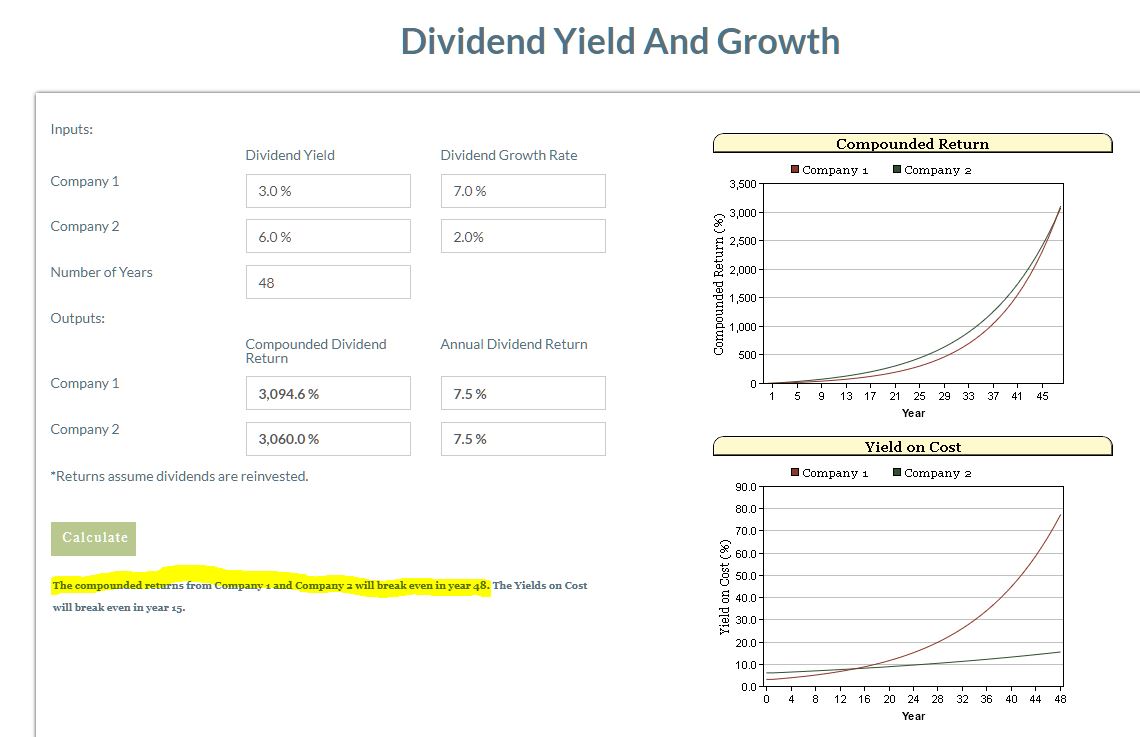

The trouble is that when a starting yield is considerably below market, say three-quarters of it or less as so many are, it can take more than a lifetime for the real purchasing power of the income to catch up with a seemingly riskier immediate yield from a HYP-able-- even if the quality stock's dividend grows much faster thereafter. A pound paid out today is worth a lot more than a 50p divi which becomes a pound after seven or eight years of successful trading.

This dilemma is seen in the tale of my two investment trust baskets. Typically the lower-yielding Basket of Seven, more focused on dividends which can grow ULVR-like, can be bought yielding just below the All-Share; whereas the 'juicier' Basket of Eight's initial yield is a quarter higher than the All-Share's. (Though both ratios have worsened in recent times, with investors pursuing income.)

After nearly 20 years since HYP1 Day in Nov. 2000, the B7's income would have grown over twice as fast as the B8's, c. 4% pa real v. less than 2%. But actual revenue to the end of 2018 would have totalled £72,280 for the B7, only £5,248 more than from the B8. And because so much of the B7's payout has been delivered later- the tortoise overtook the hare on annual payout only in 2009-- the purchasing power the juicy basket supplied would have remained, up to now, greater. Tortoises live long lives, which is just as well for them.

You might justify including lower-yielders with good form as a way of absorbing future shocks from allegedly safe higher payers such as Tesco or Centrica. But my researches suggest that such shocks are not frequent or severe enough to warrant wilfully crippling your immediate income.

Another objection to lower yielders is that a company whose dividend ticks up by 6% pa like clockwork year after year is less likely to be the object of the 'market trading' which can do so much to enhance income generation down the road: by recycling capital without tinkering. Squeaky wheels get the grease, erratic payers get the M&A lads after them. Witness my Vodafone v. Unilever experience.

As with everything in life, one must strike a balance. I have often been attacked for being too wary of Warning and Danger Zone shares, but I am as averse to the Low Zone. Quality can be too dear. Mr Market offers hidden gold mines (for him) as well as loss leaders;

caveat emptor.