Although this is essentially practical tinkering with my portfolio, it is adrift of the "HYP" religion, so reported here rather than the 'HYP Practical' board.

At the end of lunchtime today, I was not able to sit on my hands any longer and have done part 1 of a portfolio reshuffle.

If I can resist long enough, I will do part 2 in about a month.

Had about 5% of my total portfolio in gold etf (PHAU) in my SIPP, and about 5% in a short term bond etf (IS15) in my taxable account.

For both of these I have sold approx 40% of the holding (each trade amounts to about 2% of portfolio)

SIPP Gold->purchase CTY around 290

Taxable account: IS15 -> FCIT

Reason in both cases was to take advantage of Equity weakness to adjust asset allocation. Intent will be to reverse these trades in the longer term when equity markets recover (I assume this will take at least a year).

Also within the SIPP I top sliced Pennon which has held up rather well and was looking overweight, and moved the proceeds into LGEN, which seems to be into bargain territory. Trade was slightly less than 1% of portfolio.

Reason here is the belief that the impact of COVID on L&G is overdone. Most people who buy life insurance are middle aged, and the death rate is likely to be low. Most people who are on annuities are considerably older. Not sure that the net impact will be that negative on LGEN.

Also within SIPP had some spare cash, and topped up BT, which seems well into bargain territory. As everyone starts working from home, I don't think folks will economise on broadband or mobile. Big negative of BT is pension deficit; COVID may thin the ranks of pensioners a bit. This trade was about 0.5% of portfolio.

Next portfolio tweak will probably be another equivalent tranche of both gold and bond etfs, and possibly a top slice of NG, which is now also looking very heavy, or even HICL. Will decide what to purchase closer to the time.

This move may have been too early, but I thought I would try and split the re-balancing into 2 chunks, and this is the first shot.

I am also trying to be clear headed about what is the likely economic damage as opposed to the human cost of the pandemic. As a result some of my statements may seem a little callous.

I think the primary economic damage will come from the efforts to contain the virus. Once everyone capitulates to the fact that it is a pandemic, and infection is widespread, life for the vast majority of economically active population will return to normal surprisingly quickly. The human cost will be a tragedy, but mostly confined to economically inactive people.

There will be some wreckage of companies who are indebted, and whose defensive interval where they can cope with interrupted earnings is too short (I fear my stake in MARS is heading for the toilet). Also keeping half an eye on the short tracker - my key holdings that figure here are MARS, VF & SMDS, but all are below my arbitrary 5% bailout figure.

Would be interested to see what people here think the next month's move should be, or whether this is still too early.

Got a credit card? use our Credit Card & Finance Calculators

Thanks to Rhyd6,eyeball08,Wondergirly,bofh,johnstevens77, for Donating to support the site

Portfolio tweaking

-

TUK020

- Lemon Quarter

- Posts: 2045

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 762 times

- Been thanked: 1179 times

-

TUK020

- Lemon Quarter

- Posts: 2045

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 762 times

- Been thanked: 1179 times

Re: Portfolio tweaking

An interesting piece of reading (link courtesy of Monevator) by Wealth of Common Sense

https://awealthofcommonsense.com/2020/0 ... r-markets/

discusses the returns from the bottom of bear markets.

The bit that caught my eye was the lag between peak and trough for the top 10 US crashes in the table.

This varied between 3 months and 3 years.

We are 1 month into this? and the scale of economic dislocation is still unfolding. I am re-calibrating my sense of how much longer this has to play out. Need to sit on my hands for quite a lot longer before playing round 2 of portfolio adjustment

https://awealthofcommonsense.com/2020/0 ... r-markets/

discusses the returns from the bottom of bear markets.

The bit that caught my eye was the lag between peak and trough for the top 10 US crashes in the table.

This varied between 3 months and 3 years.

We are 1 month into this? and the scale of economic dislocation is still unfolding. I am re-calibrating my sense of how much longer this has to play out. Need to sit on my hands for quite a lot longer before playing round 2 of portfolio adjustment

-

langley59

- Lemon Slice

- Posts: 325

- Joined: November 12th, 2016, 12:12 pm

- Has thanked: 120 times

- Been thanked: 102 times

Re: Portfolio tweaking

Its the willingness/ability of companies to continue to pay dividends which worries me, as well as the potential for insolvency and therefore permanent loss of capital invested.

-

monabri

- Lemon Half

- Posts: 8426

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3443 times

Re: Portfolio tweaking

langley59 wrote:Its the willingness/ability of companies to continue to pay dividends which worries me, as well as the potential for insolvency and therefore permanent loss of capital invested.

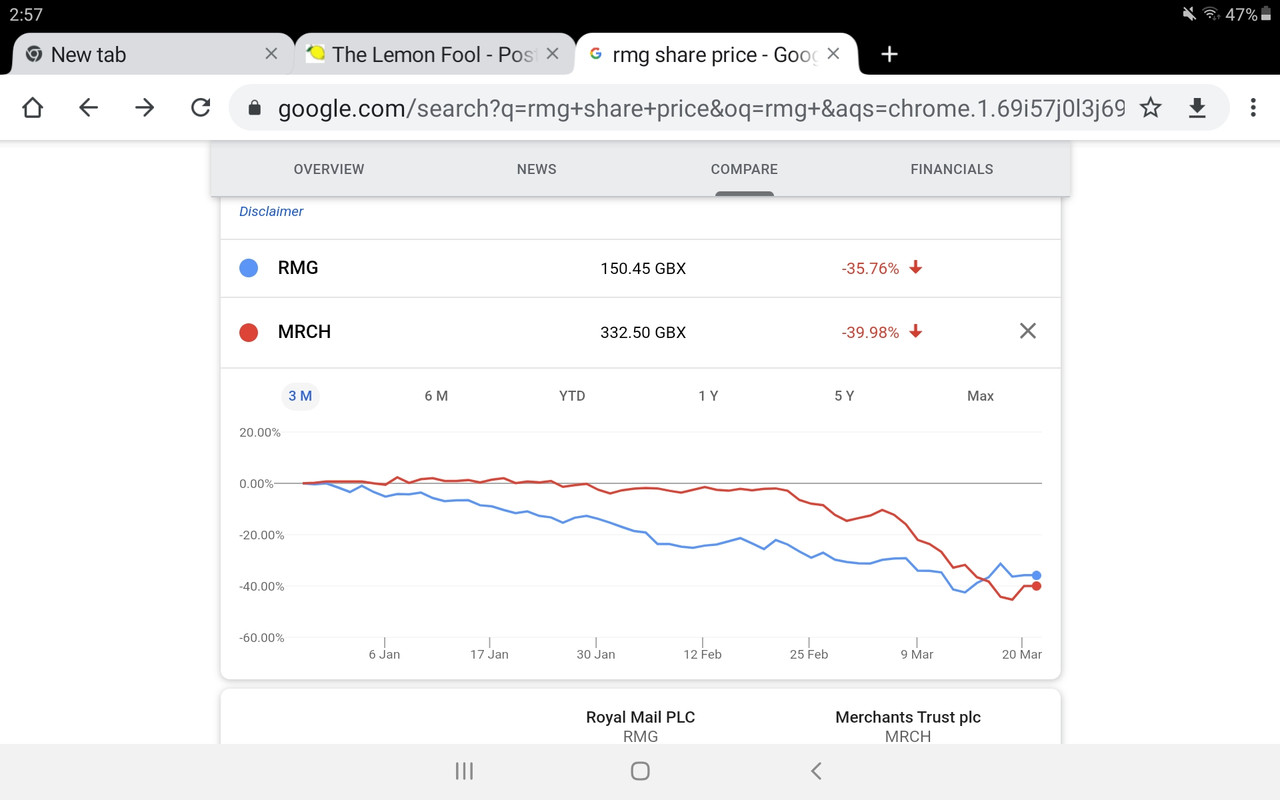

I run an income biased portfolio. It consists of individual shares and income ITs. I have noticed that some of the shares that I held which had fallen prior to C19 had remained relatively stable over the last month ( RMG for example). I then noticed the likes of CTY and Merchants share price had fallen significantly.

Cutting any losses, I sold RMG and moved the cash into ITs that have income reserves. I consider that the chances of say, CTY and MRCH continuing to pay a divi are higher than some individual companies and ..given time...their share price should recover ( compared to union ruled RMG, for example or companies with too much debt).

-

TUK020

- Lemon Quarter

- Posts: 2045

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 762 times

- Been thanked: 1179 times

Re: Portfolio tweaking

About 2 weeks ago, used some of my new tax year's ISA cash to buy a couple of more % in portfolio terms into global growth ITs

split equally between Foreign & Commonwealth (FCIT) and Alliance Trust (ATST).

Have about 3% more cash that I am sat on.

Will keep sitting tight for up to 3 months, and then review.

Fully expecting another of couple of shovelfuls to hit the rotating blades at some point in the near future and things to take another downward lurch

split equally between Foreign & Commonwealth (FCIT) and Alliance Trust (ATST).

Have about 3% more cash that I am sat on.

Will keep sitting tight for up to 3 months, and then review.

Fully expecting another of couple of shovelfuls to hit the rotating blades at some point in the near future and things to take another downward lurch

-

88V8

- Lemon Half

- Posts: 5842

- Joined: November 4th, 2016, 11:22 am

- Has thanked: 4190 times

- Been thanked: 2602 times

Re: Portfolio tweaking

TUK020 wrote:Fully expecting another of couple of shovelfuls to hit the rotating blades at some point in the near future and things to take another downward lurch

Why?

I take the opposite view.

The trajectory now is remorselessly up. Individual exceptions apply of course.

I have been buying since early March. Dividend ords, FI, ITs.

Early March was a bit too soon, but with forty-odd purchases, many of them were well timed.

I do not expect another major downturn.

The time to buy was then, and imho it will be much less so in three months.

V8

-

TUK020

- Lemon Quarter

- Posts: 2045

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 762 times

- Been thanked: 1179 times

Re: Portfolio tweaking

88V8 wrote:TUK020 wrote:Fully expecting another of couple of shovelfuls to hit the rotating blades at some point in the near future and things to take another downward lurch

Why?

I take the opposite view.

The trajectory now is remorselessly up. Individual exceptions apply of course.

I have been buying since early March. Dividend ords, FI, ITs.

Early March was a bit too soon, but with forty-odd purchases, many of them were well timed.

I do not expect another major downturn.

The time to buy was then, and imho it will be much less so in three months.

V8

V8,

I think there is plenty of opportunity for further disappointment on drug effectiveness, availability of vaccine, second wave infections, renewed lockdowns to clobber sentiment. Likewise, as some of the impact of containment measures on the economy start to become clearer (eg this morning's announcement on Shell divi cut).

Not saying that it will happen, but think there is a good chance that there will be another downward spike.

As referred to earlier in the thread, historically recessions have lasted a minimum of 3 months (usually in the range up to 3 years) from peak to trough, and it is difficult to believe that this will be much shorter.

I tried to set up my response with 1/3 late March (my timing was lucky), 1/3 mid April, and 1/3 in reserve.

Vague plan if I don't get to use the 'reserve' and the markets recover fully, is to later move this into gold - wait for the unfolding of the cost of monetary and fiscal splurge to become apparent.

tuk020

Return to “High Yield Shares & Strategies - General”

Who is online

Users browsing this forum: No registered users and 37 guests