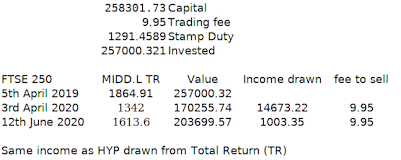

I've assumed the exact same income as HYP being drawn by selling down total return, using MIDD.L total return as the FT250 fund.

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

CryptoPlankton wrote:Wizard wrote:MDW1954 wrote:

Moorfield,

Check the HYP-P board. You may be pleasantly surprised.

MDW1954

But you may be less pleasantly surprised to see a debate has broken out as to what the upper boundary of "circa. 5%" isBut that isn't enough, it now looks like you need to answer the question "circa. 5%" of what? Current value, initial investment or some other metric yet to be suggested? The HYP-P board is priceless, there must be a comedy show in there somewhere

I really do feel for anyone asked to moderate that board, I'm surprised anyone is still willing to do the 'job'.

I'd say things have certainly improved over there since the change in guidelines - that particular issue only really required the application of a little common sense. Generally, from this reader's point of view, the discussions are definitely benefiting from less disruption.This board, however, would now seem to be the one to come to for the "amusing" comments - although I suspect it may eventually wear a little thin when people realise they don't get the same rise from the readership here that they could with a good wind up over there. Who knows, maybe then the discussions will become more focussed on wider high yield investment strategies.

Well, I can live in hope

1nvest wrote:As another benchmark, the FTSE250 is comprised of around 20% Investment Trusts, and also tends to avoid the single stocks being 10% of the total index type situations that can arise with large cap indexes (FT250 feeds both in and out of the top and bottom).

I've assumed the exact same income as HYP being drawn by selling down total return, using MIDD.L total return as the FT250 fund.

AJC5001 wrote:4. Vanguard also have a FTSE250 ETF which has a yield of 4.12% and OCF of 0.10% so may be a better choice? https://www.hl.co.uk/shares/shares-search-results/v/vanguard-funds-ftse-250-ucits-etf

5. Vanguard also do an Accumulation version - VMIG with the same OCF https://www.hl.co.uk/shares/shares-search-results/v/vanguard-ftse-250-ucits-etf-acc if you want dividens reinvested. Then selling down could be used for any income when needed. (I couldn't find an Accumulation iShares ETF)

Adrian

£258,301.73 Capital

£258,292.73 Less £9.99 trade fee to buy VMID

Value Income drawn Sell trade fee

5th April 2019 £258,292.73

3rd April 2020 £174,148.33 £14673.22 £9.99

12th June 2020 £210,542.97 £1003.25 £9.99

Return to “High Yield Shares & Strategies - General”

Users browsing this forum: No registered users and 34 guests