Dod101 wrote:So does this mean Arb that you have withdrawn your order for buying PHP? Are you not confusing yield with dividend in quoting the numbers you have? Using the same argument why do you hold any individual shares; why not just convert them all to ITs?

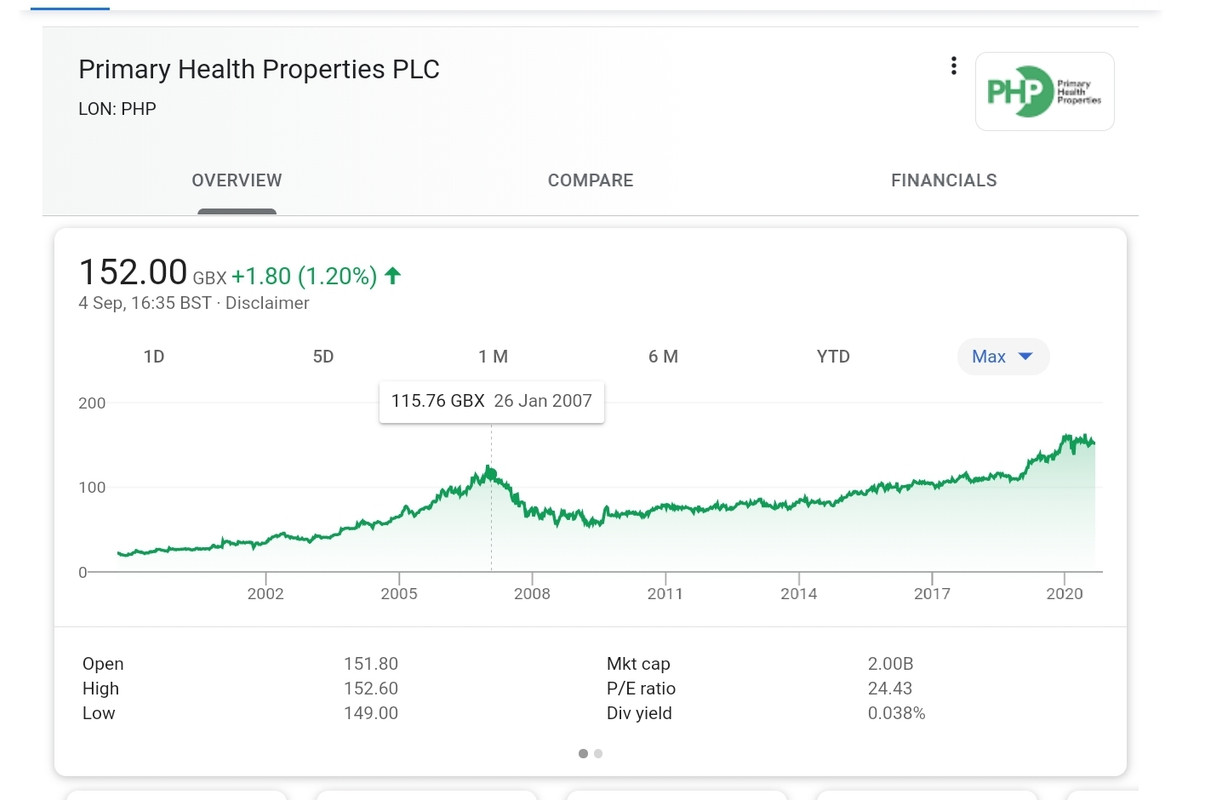

PHP is a share that has grown its dividend consistently over the last several years, even through the Covid pandemic and it continues to do so. A much better income share than say Shell for instance!

Dod

I haven't withdrawn the buy order - I have until Wednesday night to make up my mind. If I do nothing, the buy will go ahead on Thursday.

I've mentioned both yield and dividend growth. The yield on ITs is potentially hgher, and the dividend growth also higher. If the dividenddata site is correct, PHP's

dividend growth is as I quoted, and lower than several of the ITs I mentioned.

Using the same argument why do you hold any individual shares; why not just convert them all to ITs?

Yes, that's true, and it's a point I have made along with other posters. The only counter-argument would be if my HYP income was growing

faster than my IT basket income over the long term. There is considerable doubt about that in my case - even pre-Covid. Maybe you don't keep detailed records of income per unit for your shares and ITs, but because I keep them separate, I can compare.

Here's a chart showing the point well. Even before the disastrous drop of due to Covid, one can see that the IT income is firmly moving away from the HYP income per unit. There seems, at present, little hope that the HYP will stage a "catch up" - but I'm willing to be patient and keep the HYP experiment running indefinitely -until I'm too old to manage it, most likely.

Arb.