Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

Spin-off thread from "HYP1 is 21" -- all the off-topic posts

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

-

MrFoolish

- Lemon Quarter

- Posts: 2339

- Joined: March 22nd, 2020, 7:27 pm

- Has thanked: 566 times

- Been thanked: 1145 times

Re: HYP1 is 21

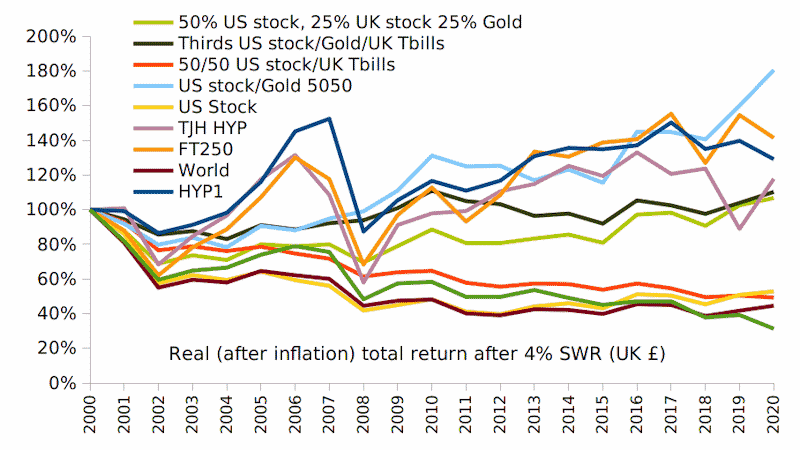

1nvest wrote:Relative (somewhat equalised) comparison indicates HYP very well placed

Are you sure this is correct, esp. re. US stock?

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

Re: HYP1 is 21

MrFoolish wrote:1nvest wrote:Relative (somewhat equalised) comparison indicates HYP very well placed

Are you sure this is correct, esp. re. US stock?

Not now.

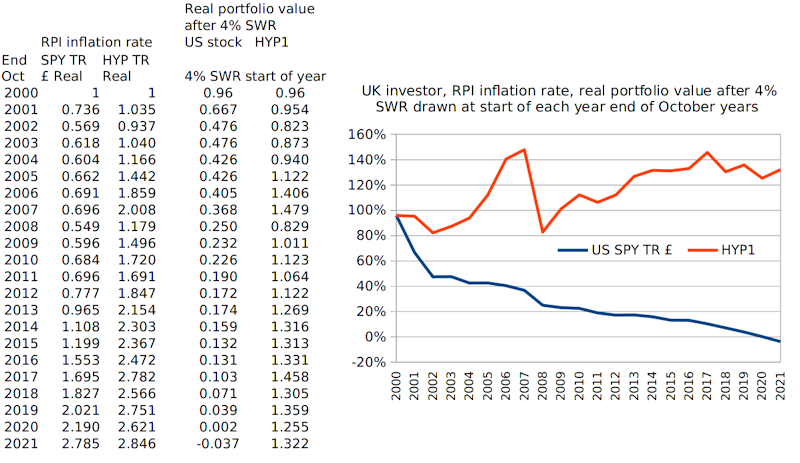

Drawing the 4% SWR at the start of each year and that exhausted capital in 2020

-

dealtn

- Lemon Half

- Posts: 6091

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 442 times

- Been thanked: 2337 times

Re: HYP1 is 21

csearle wrote:From my perspective I welcome critical discussion of HYP1, HYP, and general High-Yield strategies. As you suggest though such critical discussion is off-topic for HYP-P so, since you ask, I would prefer it if critical discussion of HYP1's performance, especially as compared to other approaches, were carried on the HYP-SS board. C.MDW1954 wrote:Let me know which course of action is preferred.

From my perspective, as someone who rarely has an opportunity to respond on thie Board, I would rather it took place on Investment Strategies.

viewforum.php?f=8

Otherwise it eliminates, as off-topic, those "other approaches" that aren't on topic there, such as those that aren't considered High Yield. See Board Guidelines.

viewtopic.php?f=31&t=8652

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3640 times

- Been thanked: 5272 times

Re: HYP1 is 21

dealtn wrote:csearle wrote:From my perspective I welcome critical discussion of HYP1, HYP, and general High-Yield strategies. As you suggest though such critical discussion is off-topic for HYP-P so, since you ask, I would prefer it if critical discussion of HYP1's performance, especially as compared to other approaches, were carried on the HYP-SS board. C.MDW1954 wrote:Let me know which course of action is preferred.

From my perspective, as someone who rarely has an opportunity to respond on thie Board, I would rather it took place on Investment Strategies.

viewforum.php?f=8

Otherwise it eliminates, as off-topic, those "other approaches" that aren't on topic there, such as those that aren't considered High Yield. See Board Guidelines.

viewtopic.php?f=31&t=8652

So we just drift down the route of comparing HYP1 with the very best at the moment instruments that anyone can think of. Great

-

dealtn

- Lemon Half

- Posts: 6091

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 442 times

- Been thanked: 2337 times

Re: HYP1 is 21

Arborbridge wrote:dealtn wrote:csearle wrote:From my perspective I welcome critical discussion of HYP1, HYP, and general High-Yield strategies. As you suggest though such critical discussion is off-topic for HYP-P so, since you ask, I would prefer it if critical discussion of HYP1's performance, especially as compared to other approaches, were carried on the HYP-SS board. C.

From my perspective, as someone who rarely has an opportunity to respond on thie Board, I would rather it took place on Investment Strategies.

viewforum.php?f=8

Otherwise it eliminates, as off-topic, those "other approaches" that aren't on topic there, such as those that aren't considered High Yield. See Board Guidelines.

viewtopic.php?f=31&t=8652

So we just drift down the route of comparing HYP1 with the very best at the moment instruments that anyone can think of. GreatIt will all be quite irrelevant and feature people talking at cross purposes.

Confused, sorry.

It is agreed that "here" isn't the right place for (constructive) criticism of HYP1 and HYP and general High-Yield strategies (as postulated by csearle), should anyone choose to do so.

But if they do choose to do so, and in particular by proposing an alternative strategy you think Investment Strategy isn't the right place? Posters shouldn't be using an Investment Strategy discussion board to compare different strategies?

Personally I don't have a problem with free speech and others choosing to compare HYP1 to the very best at the moment instruments. It doesn't sound a particularly interesting choice of topic to me. But I would be willing to read it, in the same way I read others. I could always ignore it, which I think is the appropriate response for all topics that don't interest people.

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

Re: HYP1 is 21

Noteworthy is how superior HYP1 has been since Nov 2000 compared to another opting to load all into US stock (S&P500) and drawing the same amount of income (yearly 4% inflation adjusted start date portfolio value).

This is more aligned with HYP1 November years ...

After less than 21 years the US stock choice had nothing left, whilst the HYP choice has nearly 33% more than the inflation adjusted start date portfolio value.

Fundamentally a bad sequence of returns risk for the US stock choice. Over other periods things might swing the other way around. Seems like HYP1 and TJH HYP (and FT250) all weathered through the early 2000's much better than the FT100, US stock, world stock (which is around 50% US weighted). Perhaps as a consequence of less concentration risk (dot com stocks during the Big Bang, financial stocks during the financial crisis). At other times such concentration risk might pay off, heavy into tech stocks during a tech boom period for instance. The initial equal weighting of stocks/sectors as per HYP1 might be considered as a form of de-risking over concentration risk. What though when one/few HYP stock holdings rise to be heavily weighted, isn't concentration risk being introduced? Well no, as the driving factors that resulted in those stocks rising more than the other stocks = relative outperformance, good/great gains, such that even if some/most of those gains are given back it might still be other peoples money that is being returned, not your own base/original capital. In effect initial equal weightings drifts to become its own cap weighted index, where by not rebalancing you end up more heavily weighted into the stocks that gained the most.

This is more aligned with HYP1 November years ...

After less than 21 years the US stock choice had nothing left, whilst the HYP choice has nearly 33% more than the inflation adjusted start date portfolio value.

Fundamentally a bad sequence of returns risk for the US stock choice. Over other periods things might swing the other way around. Seems like HYP1 and TJH HYP (and FT250) all weathered through the early 2000's much better than the FT100, US stock, world stock (which is around 50% US weighted). Perhaps as a consequence of less concentration risk (dot com stocks during the Big Bang, financial stocks during the financial crisis). At other times such concentration risk might pay off, heavy into tech stocks during a tech boom period for instance. The initial equal weighting of stocks/sectors as per HYP1 might be considered as a form of de-risking over concentration risk. What though when one/few HYP stock holdings rise to be heavily weighted, isn't concentration risk being introduced? Well no, as the driving factors that resulted in those stocks rising more than the other stocks = relative outperformance, good/great gains, such that even if some/most of those gains are given back it might still be other peoples money that is being returned, not your own base/original capital. In effect initial equal weightings drifts to become its own cap weighted index, where by not rebalancing you end up more heavily weighted into the stocks that gained the most.

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

Re: HYP1 is 21

Just ran the figures for US high dividend yield equal weighted stock set, £/RPI converted and for the same 4% SWR as per the earlier charts ... and that follows a similar motion to that of the HYP1.

To me that highlights the importance of starting a HYP with equal weightings and sectors diversified, to avoid what they call early year sequence of returns risk as was evident with the conventional S&P500 from November 2000. For more established portfolios that have become 'tilted' - heavier in single stocks/sectors, that is much less of a risk as more often a later bad sequence of returns risk is more a case of just giving back some of gains rather than eating ones own original capital. Indeed it may even be better not to rebalance as rebalancing has a tendency to take from the best performers (not rebalancing is inclined to have more weighting into the historic best performers compared to had you rebalanced). That is perhaps somewhat reflected in the comparison between HYP1 (non tweaked) compared to TJH HYP (tweaked/rebalanced). Again from history dating back to the mid 1930's LEXCX is a example case of buy and hold (non tweaked) original 30 stocks having performed well for a very long period of time.

Jack Bogle as I recall had investigated such initial buy in equal weights (50 shares) and left as-is for a broad range of start years and liked the outcome sufficiently to propose that as his ultimate-buy-and-hold choice. He wasn't specifically looking at income for that, so that is suggestive that HYP1 total returns should also generally be satisfactory.

To me that highlights the importance of starting a HYP with equal weightings and sectors diversified, to avoid what they call early year sequence of returns risk as was evident with the conventional S&P500 from November 2000. For more established portfolios that have become 'tilted' - heavier in single stocks/sectors, that is much less of a risk as more often a later bad sequence of returns risk is more a case of just giving back some of gains rather than eating ones own original capital. Indeed it may even be better not to rebalance as rebalancing has a tendency to take from the best performers (not rebalancing is inclined to have more weighting into the historic best performers compared to had you rebalanced). That is perhaps somewhat reflected in the comparison between HYP1 (non tweaked) compared to TJH HYP (tweaked/rebalanced). Again from history dating back to the mid 1930's LEXCX is a example case of buy and hold (non tweaked) original 30 stocks having performed well for a very long period of time.

Jack Bogle as I recall had investigated such initial buy in equal weights (50 shares) and left as-is for a broad range of start years and liked the outcome sufficiently to propose that as his ultimate-buy-and-hold choice. He wasn't specifically looking at income for that, so that is suggestive that HYP1 total returns should also generally be satisfactory.

-

MrFoolish

- Lemon Quarter

- Posts: 2339

- Joined: March 22nd, 2020, 7:27 pm

- Has thanked: 566 times

- Been thanked: 1145 times

Re: HYP1 is 21

1nvest wrote:To me that highlights the importance of starting a HYP with equal weightings and sectors diversified, to avoid what they call early year sequence of returns risk as was evident with the conventional S&P500 from November 2000.

I think if you relying on the 4% rule for your retirement, you have to be prepared to be flexible in the early years. So if you are unlucky enough to hit an immediate crash, you will have to cut your cloth accordingly for a year or three. There's no such thing as a free lunch (unless you are an MP, one supposes).

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3640 times

- Been thanked: 5272 times

Re: HYP1 is 21

1nvest wrote:Just ran the figures for US high dividend yield equal weighted stock set, £/RPI converted and for the same 4% SWR as per the earlier charts ... and that follows a similar motion to that of the HYP1.

To me that highlights the importance of starting a HYP with equal weightings and sectors diversified, to avoid what they call early year sequence of returns risk as was evident with the conventional S&P500 from November 2000. For more established portfolios that have become 'tilted' - heavier in single stocks/sectors, that is much less of a risk as more often a later bad sequence of returns risk is more a case of just giving back some of gains rather than eating ones own original capital. Indeed it may even be better not to rebalance as rebalancing has a tendency to take from the best performers (not rebalancing is inclined to have more weighting into the historic best performers compared to had you rebalanced). That is perhaps somewhat reflected in the comparison between HYP1 (non tweaked) compared to TJH HYP (tweaked/rebalanced). Again from history dating back to the mid 1930's LEXCX is a example case of buy and hold (non tweaked) original 30 stocks having performed well for a very long period of time.

Jack Bogle as I recall had investigated such initial buy in equal weights (50 shares) and left as-is for a broad range of start years and liked the outcome sufficiently to propose that as his ultimate-buy-and-hold choice. He wasn't specifically looking at income for that, so that is suggestive that HYP1 total returns should also generally be satisfactory.

I've mentioned this several times, and it is a point about that HYP method which slightly bothers me. We are, in effect, trimming winners and adding to shares which at present are losers, in the hope they will turn around and not cut their dividends. As I've said: HYP is a high risk strategy, but we mitigate the risks with safety measures. One of which, interestingly, is that we never intend to sell, which gives time for self-healing. It's a Zen approach which takes some mental re-adjustment and goes against the grain of normal investment advice such as we see folk here adopt. It needs patience and a detachment which few can muster outside the experimental HYP1.Indeed it may even be better not to rebalance as rebalancing has a tendency to take from the best performers

Arb.

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

Re: HYP1 is 21

Jeremy Siegel of the Wharton School calculated a hypothetical return (before transaction costs) if someone bought the 50 largest S&P 500 stocks on Dec. 31, 1950 and held on. Average annual return: 12.6%, a fraction of a point better than the market (which Siegel defines as all listed stocks). He then created separate buy and hold portfolios for every year since until 1996. Result: the buy-and-hold approach beat the market three-quarters of the time and it never underperformed by more than 0.6% a year.

-

MDW1954

- Lemon Quarter

- Posts: 2361

- Joined: November 4th, 2016, 8:46 pm

- Has thanked: 527 times

- Been thanked: 1011 times

Re: HYP1 is 21

1nvest wrote:Jeremy Siegel of the Wharton School calculated a hypothetical return (before transaction costs) if someone bought the 50 largest S&P 500 stocks on Dec. 31, 1950 and held on. Average annual return: 12.6%, a fraction of a point better than the market (which Siegel defines as all listed stocks). He then created separate buy and hold portfolios for every year since until 1996. Result: the buy-and-hold approach beat the market three-quarters of the time and it never underperformed by more than 0.6% a year.

Hi 1nvest,

I sent you a PM earlier today. Did you receive it?

MDW1954

(Message will be deleted if reply received from 1nvest.)

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

Re: HYP1 is 21

MrFoolish wrote:I definitely would not advise it to a novice investor as a one-stop approach... would you?

Others aren't so definitive.

Bogle recommends the ultimate in buy-and-hold investing: a completely static portfolio. He would buy the 50 largest companies in the S&P 500 and then never buy another. The portfolio would ignore the constant small adjustments that Standard & Poor's makes in the index.

.

.

Jeremy Siegel of the Wharton School calculated a hypothetical return (before transaction costs) if someone bought the 50 largest S&P 500 stocks on Dec. 31, 1950 and held on. Average annual return: 12.6%, a fraction of a point better than the market (which Siegel defines as all listed stocks). He then created separate buy and hold portfolios for every year since until 1996. Result: the buy-and-hold approach beat the market three-quarters of the time and it never underperformed by more than 0.6% a year.

https://www.forbes.com/forbes/1999/0614 ... 61b9668747

Jeremy Siegel looked at how investors would have done had they simply bought and held the original list of S&P500 stocks. From March 1957 through to the end of 2003, 341 of the original 500 stocks survived (including spinoffs) and only 170 were still in the S&P500.

.

.

Siegel reports that if you had bought and held an equal amount of each of the original S&P500 stocks, you would have gained an average of 12.14% annually. That's a 1.29 percentage point annual advantage over the index's return

http://www.ndir.com/SI/articles/1007.shtml

The next-to-the-top line is the original Dow 30, using a price-weighted index, just like the current Dow 30 uses. The only changes in the next 80 years are companies getting bought or dying.

.

.And there is an even bigger differential if you simply equal-weight the components

https://mikesmoneytalks.ca/john-mauldin ... cks-banks/

It seems to me that initial equal weighting a broadly diversified stocks reduces early years sequence of returns risk, a major risk for retirees. But that then drifts over time to find its own cap weighting like balance, where winners are left to run and maximise exposure/weighting in those stocks.

In that last link above Mauldin also noted

But equal weighting or, better yet, weighting and indexing according to valuation fundamentals like price to earnings, price to sales, price to book, etc. is even better.

Using a 'sampled' index rather than full replication can work as equally as well, and using Dividend/Price as a valuation fundamental is a reasonable yet simple choice of relative valuation metric.

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

Re: HYP1 is 21

MrFoolish wrote:1nvest wrote:Bogle recommends the ultimate in buy-and-hold investing: a completely static portfolio. He would buy the 50 largest companies in the S&P 500 and then never buy another. The portfolio would ignore the constant small adjustments that Standard & Poor's makes in the index.

The 50 largest companies in the S&P is a very different beast to the typical HYP though.

Lots of established tech (e.g. Microsoft, Apple), Amazon, Berkshire Hathaway (mostly non-tech), Home Dept, J&J, Coca-Cola, McDonalds, to name a few.

https://www.slickcharts.com/sp500

I remember reading recently that the market cap of Apple was bigger than the entire FTSE 100.

Is it such a different beast, or are the general characteristics similar?

1988 and the Dow Industrial Average (30 stocks) included McDonalds. Let's take that as a start year and equal weight all 30 stocks with $10K and accumulate/reinvest dividends. As of the end of 2020 that single holding had risen to $320 in real (after inflation) terms, matched (exceeded) the total original amount invested in all 30 stocks (30 x $10K). So even if all of the other 29 had gone broke you broke-even in real terms. Not all of them however did go broke, American Express for instance where in real terms $10K grew to $166K. So those two alone resulted in a 1.5% annualised real portfolio total return.

That is part of a common natural fractal pattern, take a bunch of stocks and calculate their total returns, sort and plot those and at the left edge there will a small number that did very poorly or failed, at the right edge there will be a small number that did very well, and a large middle set that tends to average around zero. Where collectively the broad average is positive, limited by the worst losing -100% whereas the right tail can be +200%, +1000% ... unbounded.

If you sold some of MCD along the way, to add to a central (or maybe left tail) case, then you're levelling down the right tail, likely wont do as well as if you'd just left MCD as-is.

The best cases can change. For instance compare AXP and MCD over time and at times AXP was around 2x ahead of MCD, Then fell to be a quarter of MCD, then rebounded to match MCD ... type motions.

In HYP1 case consider PSN with all of dividends reinvested has grown 27x since November 2000. £5K original investment with dividends reinvested = £135K present day nominal value. Since 2000 RPI has seen a 1.8x increase, £75K rising to £135K. So PSN has been the MCD in the HYP1 case. Dump PSN, get all of your original inflation adjusted capital back and with a divisor of zero the remainder provide a infinite dividend yield

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3640 times

- Been thanked: 5272 times

Re: HYP1 is 21

1nvest wrote:MrFoolish wrote:The 50 largest companies in the S&P is a very different beast to the typical HYP though.

From a set of 15 you need one to total return (dividends reinvested) 14.5% annualised real, or two to 10.6% real, or three to 8.4% real, or four to 6.8% real ... over 20 years, in which case all of the others could go broke and you'd break-even in real terms. Those are pretty good odds of being achieved on the growth side even if you threw darts to select the candidate stocks, whilst all of the remainder going broke is a remote probability. Above average yield as a selection criteria is picking riskier stocks, distressed situations where the stock could collapse, could recover/rebound (above average upside potential). The probabilities of say 4 out of 15 achieving 6.8% annualised real are pretty good odds IMO.

And Mr Foolish perhaps forgets that the original HYP chose from the biggest companies, and whilst the FTSE hasn't "flown" as well as the US market, I'd said the comparison is closer than he suggests.

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

Re: HYP1 is 21

1nvest wrote:MrFoolish wrote:The 50 largest companies in the S&P is a very different beast to the typical HYP though.

From a set of 15 you need one to total return (dividends reinvested) 14.5% annualised real, or two to 10.6% real, or three to 8.4% real, or four to 6.8% real ... over 20 years, in which case all of the others could go broke and you'd break-even in real terms. Those are pretty good odds of being achieved on the growth side even if you threw darts to select the candidate stocks, whilst all of the remainder going broke is a remote probability. Above average yield as a selection criteria is picking riskier stocks, distressed situations where the stock could collapse, could recover/rebound (above average upside potential). The probabilities of say 4 out of 15 achieving 6.8% annualised real are pretty good odds IMO.

As a quick test I thought of 4 US large-cap stocks, not obvious outperformers, PG, CAT, IBM, JNJ, started in 2000, the peak of the market. If three fail, one rises 4-fold over 21 years, 6.8% annualised real total return, you end up at break-even in real terms. Knowing what subsequently occurred my initial guess was that JNJ with Covid likely was the best, suspected CAT or IBM as likely the worst. Actual outcome to the end of 2020 was that CAT was the winner, providing a 10.9% annualised real, IBM was the worst with 0.8%. PV data here. Looking at the four as a equal initial weighted portfolio and non rebalanced provided a 7% annualised real (see here), which comfortably bettered the S&P500's 4.3%. In those links hover the mouse over the (i) next to the nominal CAGR value in the Portfolio Value section to see the inflation adjusted values. You can also click the Allocation Drift tab to see how the weightings of the individuals varied over time.

Not suggesting you followed just four stocks, maybe two from each of 8 sectors might be sufficient diversification, perhaps selecting candidates based on some Value type measure, such as dividend yield. As a concept that seems sound. HYP1 and others (LEXCX ..etc.) also indicate it can work well in practice.

-

tjh290633

- Lemon Half

- Posts: 8266

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 918 times

- Been thanked: 4130 times

Re: HYP1 is 21

Arborbridge wrote: I've mentioned this several times, and it is a point about that HYP method which slightly bothers me. We are, in effect, trimming winners and adding to shares which at present are losers, in the hope they will turn around and not cut their dividends. As I've said: HYP is a high risk strategy, but we mitigate the risks with safety measures. One of which, interestingly, is that we never intend to sell, which gives time for self-healing. It's a Zen approach which takes some mental re-adjustment and goes against the grain of normal investment advice such as we see folk here adopt. It needs patience and a detachment which few can muster outside the experimental HYP1.

Arb.

One point about that point, is that experience has shown that often last year's losers are this year's winners. It's a form of contrarian investing to top-up depressed shares. Some may be in terminal decline, or destined for failure, but usually the signs are visible some time before, Carillion notwithstanding.

I have posted my year-on-year records of share price changes a few times now. I will probably do the same at the end of this calendar year.

TJH

-

moorfield

- Lemon Quarter

- Posts: 3547

- Joined: November 7th, 2016, 1:56 pm

- Has thanked: 1579 times

- Been thanked: 1414 times

Re: HYP1 is 21

Arborbridge wrote: I've mentioned this several times, and it is a point about that HYP method which slightly bothers me. We are, in effect, trimming winners and adding to shares which at present are losers, in the hope they will turn around and not cut their dividends. As I've said: HYP is a high risk strategy, but we mitigate the risks with safety measures. One of which, interestingly, is that we never intend to sell, which gives time for self-healing. It's a Zen approach which takes some mental re-adjustment and goes against the grain of normal investment advice such as we see folk here adopt. It needs patience and a detachment which few can muster outside the experimental HYP1.

Turn the experiment around for a change. If pyad today presented you an income plan paying £3451 next year, £3474 the second year, and so on, £11338 in the twenty first year, with an option to return your capital at market value at any time -

Would you sign over your £75000 to him?

And if not, why not?

-

BullDog

- Lemon Quarter

- Posts: 2471

- Joined: November 18th, 2021, 11:57 am

- Has thanked: 1995 times

- Been thanked: 1208 times

Re: HYP1 is 21

moorfield wrote:Arborbridge wrote: I've mentioned this several times, and it is a point about that HYP method which slightly bothers me. We are, in effect, trimming winners and adding to shares which at present are losers, in the hope they will turn around and not cut their dividends. As I've said: HYP is a high risk strategy, but we mitigate the risks with safety measures. One of which, interestingly, is that we never intend to sell, which gives time for self-healing. It's a Zen approach which takes some mental re-adjustment and goes against the grain of normal investment advice such as we see folk here adopt. It needs patience and a detachment which few can muster outside the experimental HYP1.

Turn the experiment around for a change. If pyad today presented you an income plan paying £3451 next year, £3474 the second year, and so on, £11338 in the twenty first year, with an option to return your capital at market value at any time -

Would you sign over your £75000 to him?

And if not, why not?

That's an interesting thought. And one that a few income focussed investment trusts kind of offer you. Possibly at lower risk.

-

dealtn

- Lemon Half

- Posts: 6091

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 442 times

- Been thanked: 2337 times

Re: HYP1 is 21

moorfield wrote:Arborbridge wrote: I've mentioned this several times, and it is a point about that HYP method which slightly bothers me. We are, in effect, trimming winners and adding to shares which at present are losers, in the hope they will turn around and not cut their dividends. As I've said: HYP is a high risk strategy, but we mitigate the risks with safety measures. One of which, interestingly, is that we never intend to sell, which gives time for self-healing. It's a Zen approach which takes some mental re-adjustment and goes against the grain of normal investment advice such as we see folk here adopt. It needs patience and a detachment which few can muster outside the experimental HYP1.

Turn the experiment around for a change. If pyad today presented you an income plan paying £3451 next year, £3474 the second year, and so on, £11338 in the twenty first year, with an option to return your capital at market value at any time -

Would you sign over your £75000 to him?

And if not, why not?

No.

I am more than confident in doing the job myself, (and don't use income as a metric).

The big concern is the lack of visibility on risk, and concentration risk. I wouldn't delegate that to someone else.

Return to “High Yield Shares & Strategies - General”

Who is online

Users browsing this forum: No registered users and 36 guests