I think we can all spot the remarkable increase in OEIC income, with ITs coming second and HYP a reasonable third. In terms of total accumulated income for a £100 in each in 2011, the OEICs come out on top with the other two very close to one another.

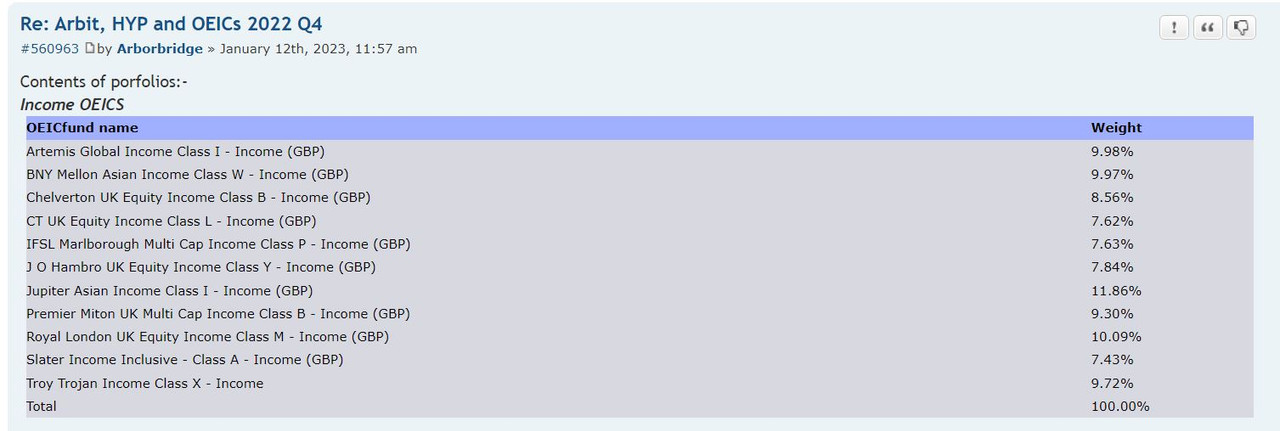

The composition of each portfolio is largely unchanged from that report in the 22 Q4 thread, here viewtopic.php?f=31&t=37369

My HYP income is down slightly compared with 2022 (around 3%) and that is roughly true of the total income of the three streams. My actual income this 6 months is 3-4% down on the same period in 2022 - but sadly, my expenditure has increased, and my reinvestments have almost ground to a halt. Some of you may have noticed that, as I haven't posted about portfolio changes on the HYP practical board for some time. Proportionally more investment has been funnelled into ITs than HYP.

Arb.