Dod101 wrote:Howard wrote:It's an interesting phenomenon. Even for us more modest investors.

Starting investing many years ago and getting an annual total return of a modest 8% tax free, every 100k invested turns into a million after a while.

What's interesting me now is how one turns from accumulating wealth into divesting it. Even after making strenuous attempts to spend/give it away.

Or just letting IHT take 40%?

It must be even more of a puzzle if one has accumulated £8 million.

regards

Howard

I wonder how many people have managed to compound at 8% per annum, year on year? I certainly have not.

Dod

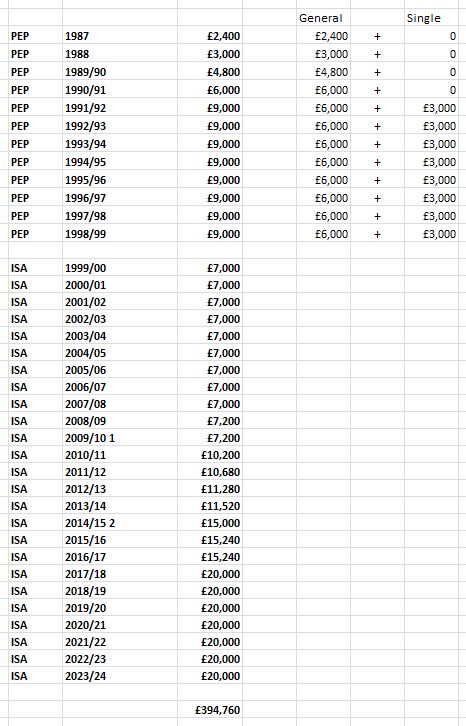

I was lucky in the 90s with a substantial initial investment, then using Mrs H and my PEP and ISA allowances and a SIPP. Two years of + 40% growth (93 and 99) and other years around + 15% (Those were the days for amateur investors often just using a couple of brilliant tip sheets!).

Of course, 2001 and 2002 were disasters then steady growth of average 17% pa up to another bad year in 2008 (down 30%). However 2009, 2010 and 2013 were kind at plus 25%, 17 % and 24%. After that I reduced small cap exposure, let Terry Smith handle a major slice of the portfolio and moved quite a bit into US orientated ETFs, including EQQQ which tracked the Nasdaq.

So average growth from early 90s to the end of 2021 was just over 8.5% pa after tax. To be honest I’ve been lazy and haven’t updated since then - must get round to it.

The big drops in the early 2000s and 2008 made me realise that after good years it was wise to move significant parts of the portfolio to less volatile investments like ETFs and accept a lower but safer growth rate.

Of course, if only I’d moved our investments to cash before big falls, not sold Asos just before it more than 10 bagged and ……. we might be closer to holding much bigger ISAs. And even more worried about IHT.

regards

Howard

PS The best investments, of course, are substantial gifts to others. They appreciate in value and never go down.