Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

TwentyFour Select SMIF

-

yieldhog

- Lemon Slice

- Posts: 291

- Joined: November 25th, 2016, 7:53 pm

- Has thanked: 119 times

- Been thanked: 66 times

TwentyFour Select SMIF

SMIF 12th Interim:

1.86996p Final Dividend. Impressive, better than I thought it would be.

Yield almost 10% based on 7.37p dividends over the year.

Y

1.86996p Final Dividend. Impressive, better than I thought it would be.

Yield almost 10% based on 7.37p dividends over the year.

Y

-

moorfield

- Lemon Quarter

- Posts: 3554

- Joined: November 7th, 2016, 1:56 pm

- Has thanked: 1588 times

- Been thanked: 1417 times

Re: TwentyFour Select SMIF

yieldhog wrote:SMIF 12th Interim:

1.86996p Final Dividend. Impressive, better than I thought it would be.

Yield almost 10% based on 7.37p dividends over the year.

Y

Ssh don't tell the HYPsters.

-

BullDog

- Lemon Quarter

- Posts: 2482

- Joined: November 18th, 2021, 11:57 am

- Has thanked: 2003 times

- Been thanked: 1212 times

Re: TwentyFour Select SMIF

moorfield wrote:yieldhog wrote:SMIF 12th Interim:

1.86996p Final Dividend. Impressive, better than I thought it would be.

Yield almost 10% based on 7.37p dividends over the year.

Y

Ssh don't tell the HYPsters.

Why not?

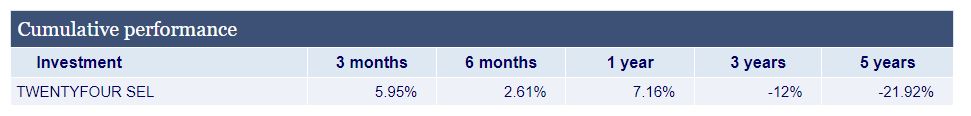

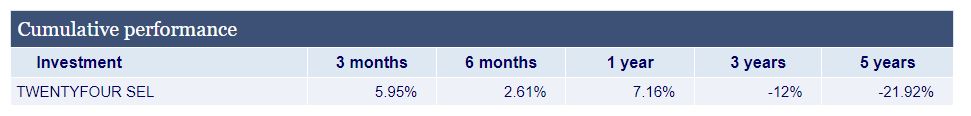

True to form, with too good to be true income stocks, you'd have lost money over 2 (-23%), 3 (-12%), or 5 years (-21%). So you might just as well keep the cash under the mattress.

-

monabri

- Lemon Half

- Posts: 8429

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: TwentyFour Select SMIF

source : https://www.hl.co.uk/funds/fund-discoun ... ion/charts

On price alone

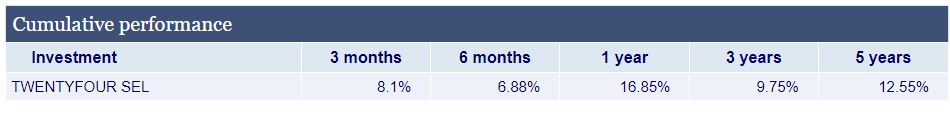

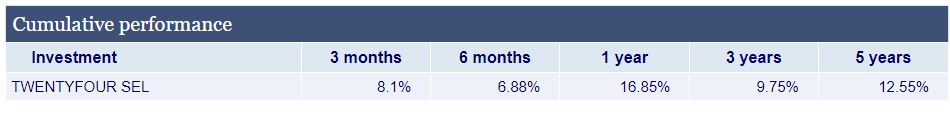

Total return

Saved, to an extent, by the dividend.

The Objective

"The Fund will actively invest in a diversified portfolio of fixed income credit securities that exhibit an illiquidity premium, and which the Portfolio Managers believe represent attractive relative value. These securities will include (but are not limited to): corporate bonds, asset-backed securities, high yield bonds, bank capital, Additional Tier 1 securities, payment-in-kind notes and leveraged loans. Uninvested cash or surplus capital or assets may be invested on a temporary basis in cash and/or a range of assets including money market instruments and government bonds. The Fund may also use derivatives. This is only a summary; details of the Fund’s investment policy, including investment restrictions, are set out more fully in the Prospectus. Typical investors for whom these Ordinary Shares are intended are professional investors or professionally advised retail investors who are principally seeking monthly income from a portfolio of credit securities."

Certainly at the riskier end!

Edit: another foreign domicile fund - GG00BJVDZ946 (Guernsey).

On price alone

Total return

Saved, to an extent, by the dividend.

The Objective

"The Fund will actively invest in a diversified portfolio of fixed income credit securities that exhibit an illiquidity premium, and which the Portfolio Managers believe represent attractive relative value. These securities will include (but are not limited to): corporate bonds, asset-backed securities, high yield bonds, bank capital, Additional Tier 1 securities, payment-in-kind notes and leveraged loans. Uninvested cash or surplus capital or assets may be invested on a temporary basis in cash and/or a range of assets including money market instruments and government bonds. The Fund may also use derivatives. This is only a summary; details of the Fund’s investment policy, including investment restrictions, are set out more fully in the Prospectus. Typical investors for whom these Ordinary Shares are intended are professional investors or professionally advised retail investors who are principally seeking monthly income from a portfolio of credit securities."

Certainly at the riskier end!

Edit: another foreign domicile fund - GG00BJVDZ946 (Guernsey).

-

stevensfo

- Lemon Quarter

- Posts: 3497

- Joined: November 5th, 2016, 8:43 am

- Has thanked: 3879 times

- Been thanked: 1422 times

Re: TwentyFour Select SMIF

BullDog wrote:moorfield wrote:

Ssh don't tell the HYPsters.

Why not?

True to form, with too good to be true income stocks, you'd have lost money over 2 (-23%), 3 (-12%), or 5 years (-21%). So you might just as well keep the cash under the mattress.

True to form, with too good to be true income stocks, you'd have lost money over 2 (-23%), 3 (-12%), or 5 years (-21%).

You can say this about most shares at certain moments in their history. But you lose money only if you sell.

Meanwhile you're getting a certain income from it. It's all a balance.

Steve

-

moorfield

- Lemon Quarter

- Posts: 3554

- Joined: November 7th, 2016, 1:56 pm

- Has thanked: 1588 times

- Been thanked: 1417 times

Re: TwentyFour Select SMIF

stevensfo wrote:BullDog wrote:Why not?

True to form, with too good to be true income stocks, you'd have lost money over 2 (-23%), 3 (-12%), or 5 years (-21%). So you might just as well keep the cash under the mattress.

True to form, with too good to be true income stocks, you'd have lost money over 2 (-23%), 3 (-12%), or 5 years (-21%).

You can say this about most shares at certain moments in their history. But you lose money only if you sell.

Meanwhile you're getting a certain income from it. It's all a balance.

Steve

What I meant of course was:

- it has a yield greater than the FTSE100 index

- it can be reasonably expected to sustain and possibly grow its dividends in the future (and note it paid through the covid years)

- it suits those who want a LTBH income strategy and take the view that capital growth is secondary

That's decent enough to consider including into a 15 holding HYP PHY. Overall income, the sum of the parts, is what matters from one of those of course.

-

stevensfo

- Lemon Quarter

- Posts: 3497

- Joined: November 5th, 2016, 8:43 am

- Has thanked: 3879 times

- Been thanked: 1422 times

Re: TwentyFour Select SMIF

moorfield wrote:stevensfo wrote:

True to form, with too good to be true income stocks, you'd have lost money over 2 (-23%), 3 (-12%), or 5 years (-21%).

You can say this about most shares at certain moments in their history. But you lose money only if you sell.

Meanwhile you're getting a certain income from it. It's all a balance.

Steve

What I meant of course was:

- it has a yield greater than the FTSE100 index

- it can be reasonably expected to sustain and possibly grow its dividends in the future (and note it paid through the covid years)

- it suits those who want a LTBH income strategy and take the view that capital growth is secondary

That's decent enough to consider including into a 15 holding HYP PHY. Overall income, the sum of the parts, is what matters from one of those of course.

Agree. But only 15 holdings? I guess that back in the TMF days, I approached investing a bit like a stamp collector. Over the years I have collected so many holdings that I'm embarrassed to say how many. But they seem to be be working well. I hope!

Steve

-

88V8

- Lemon Half

- Posts: 5847

- Joined: November 4th, 2016, 11:22 am

- Has thanked: 4205 times

- Been thanked: 2603 times

Re: TwentyFour Select SMIF

monabri wrote:"The Fund will actively invest in a diversified portfolio of fixed income credit securities ....

Certainly at the riskier end!

Edit: another foreign domicile fund - GG00BJVDZ946 (Guernsey).

Yeah, was struck when completing my tax form how much 'foreign' stuff I've accumulated. Gen would not have approved.

Regards the SP, it's been OK since I've held, but over 5 years you'd expect some drop as the price of FI has drifted downward.

BIPS, NCYF, SHRS, pretty much the same.

I reckon we're at the bottom now in price terms, and the divi should be safe with the chunky yields on new issues.

V8

-

monabri

- Lemon Half

- Posts: 8429

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: TwentyFour Select SMIF

I bought some small tranches of TFIF, NCYF & BIPS ('CMHY' as was) in April 18. The returns (XIRR) have been 2.8%, 7.2% and 2.8% respectively. Pretty poor with the exception of NCYF. Whether this is a good entry point, I don't know?

I've been investing (periodically when funds allow) mainly in FI via Prefs since Q4 2022. Recently 'distracted' by short term Gilts having filled ISAs and exceeded the £1k savings allowance.

(There's too much "on offer" and not enough funds...).

I've been investing (periodically when funds allow) mainly in FI via Prefs since Q4 2022. Recently 'distracted' by short term Gilts having filled ISAs and exceeded the £1k savings allowance.

(There's too much "on offer" and not enough funds...).

-

kempiejon

- Lemon Quarter

- Posts: 3586

- Joined: November 5th, 2016, 10:30 am

- Has thanked: 1 time

- Been thanked: 1197 times

Re: TwentyFour Select SMIF

monabri wrote:(There's too much "on offer" and not enough funds...).

Isn't it always such. I have 3 accounts in which I generally buy something in every month with either pension contributions, accumulated dividends or savings and I always have a watch list of more picks than funds. SMIF isn't the sort of thing I buy (nor TFIF, NCYF or BIPS all new to me) so I've not really looked, I too have some FI prefs and scored some gilts to dodge the cash interest tax.

Return to “High Yield Shares & Strategies - General”

Who is online

Users browsing this forum: No registered users and 37 guests