JoyofBrex8889 wrote:I would suggest that compounding at 18% is way more than a smidgen better than the FTSE index.

Such a calculation does of course entirely depend on when the purchase was made, which date as far as I am aware, you have not given.

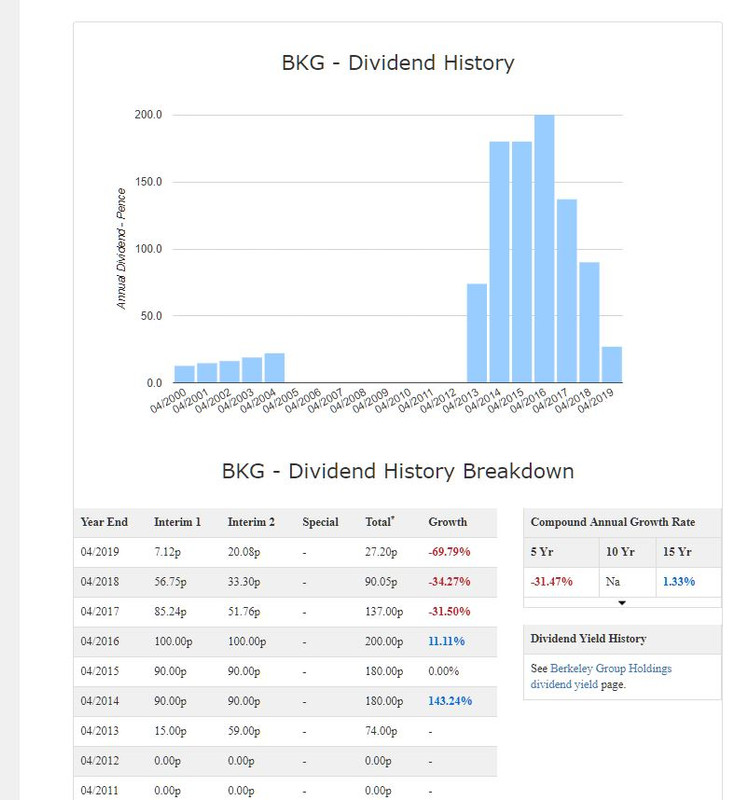

From my records I can see that Berkeley Group Holdings (BKG) became a high yield for HYP purposes on or around January 2014, using the most generous price that I have for that month - 2,611p - I calculate the annual return to date to be a shade over 12%, certainly nowhere near the 18% you have managed. Of course you may be using different inputs - date and price - which, if you will advise them, I shall gladly do my calculation again. Until such, I must assume my calculation is correct.

JoyofBrex8889 wrote:As for preaching: Your post was entirely off topic as it said zero about the share, Berkeley, actually under discussion. I posted a comparative graph, pointed out the founders involvement and the long positive track record in property that the founders have every right to be proud of.

Yes you did and thank you so much for your sermon - sorry lecture - on the capital gains being enjoyed by the founders, most illuminating.

JoyofBrex8889 wrote:All you did was bluster about your love of income. Zero input about the share.

Please do not be offended, but this is the HYP - Practical board so Income is … well …. rather important. Would you not agree?

JoyofBrex8889 wrote:So I ask you: who is preaching, and who is trying to help further the discussion on Berkeley? House builders are thought in some quarters to be making excessive profits currently, hence my surprise at Fools selling.

Well, right now, you are. Preaching that is, but also trying to help further the discussion on Berkeley, thank you so much for that. But do you not think such a discussion would be better on a board not dedicated to an Income Strategy? Just a thought.

Ian