Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

HSBA

-

bluedonkey

- Lemon Quarter

- Posts: 1809

- Joined: November 13th, 2016, 3:41 pm

- Has thanked: 1417 times

- Been thanked: 652 times

HSBA

The share price of HSBA is at a three year high. It seems to be stuck long term in a range. Yield is now down to about 3.2%. Is this a good time to trade out?

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: HSBA

bluedonkey wrote:The share price of HSBA is at a three year high. It seems to be stuck long term in a range. Yield is now down to about 3.2%. Is this a good time to trade out?

I have no idea and neither does anyone else. You cannot time the market.

Their 2022 results will be announced on 21 February so at the very least I would wait until then. They ought to be good. I expect an increase in the dividend and I would imagine that the shares may do well for the rest of this year, with higher interest rates and the effects of all the cost savings and so on over the last few years. Around £6 is not historically high. There are of course geo political issues which are unlikely to go away so if you are really concerned about these then you should not be holding them anyway.

Like my other holdings, I will be keeping an eye on the share price and may well take some profits, but not at this moment. I have held them for a long time because I like the fact that they are highly capitalised and quite conservative, but that does not make the geo politics disappear.

I know no more than anyone else anyway.

Dod

-

bluedonkey

- Lemon Quarter

- Posts: 1809

- Joined: November 13th, 2016, 3:41 pm

- Has thanked: 1417 times

- Been thanked: 652 times

Re: HSBA

Dod,

Thank you for your reply which I appreciate. Yes, it's difficult to predict. However looking in the rear view mirror, I see that the share price has rarely been over 700p during the last 10 years. I might hang on for another 10% increase, then sell.

BD

Thank you for your reply which I appreciate. Yes, it's difficult to predict. However looking in the rear view mirror, I see that the share price has rarely been over 700p during the last 10 years. I might hang on for another 10% increase, then sell.

BD

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: HSBA

bluedonkey wrote:Dod,

Thank you for your reply which I appreciate. Yes, it's difficult to predict. However looking in the rear view mirror, I see that the share price has rarely been over 700p during the last 10 years. I might hang on for another 10% increase, then sell.

BD

Well it is now just over £6. It is not difficult to predict; it is impossible. I used to say that sort of thing. 'I'll just hang on for another £x' That can be highly dangerous. If you have misgivings, such that you will just 'hang on' for another 10%, you should I think sell now. Better to have 90% than lose 10% or more from now. You have mentally written them out and you should just follow up on that.

I am no soothsayer, but I am decisive when I need to be. Sentiment and indecision are enemies to the investor.

Sorry about all this, but that is what I feel after a number of inevitable disasters.

Dod

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: HSBA

Reading that last post again, if you do sell and the price rises by another 10% afterwards (which it may well do), 1) Please do not blame me!

and 2) Have no regrets; just move on. You will have resolved one issue.

Dod

and 2) Have no regrets; just move on. You will have resolved one issue.

Dod

-

Gerry557

- Lemon Quarter

- Posts: 2057

- Joined: September 2nd, 2019, 10:23 am

- Has thanked: 173 times

- Been thanked: 568 times

Re: HSBA

Well with rising interest rates and less pressure to reduce dividends, payments to shareholders might increase. So there is potential for the dividend yield to rise, followed by the SP

The case against is a recession meaning lots of bad debts or China messing with Taiwan.

The case against is a recession meaning lots of bad debts or China messing with Taiwan.

-

bluedonkey

- Lemon Quarter

- Posts: 1809

- Joined: November 13th, 2016, 3:41 pm

- Has thanked: 1417 times

- Been thanked: 652 times

Re: HSBA

Dod101 wrote:Reading that last post again, if you do sell and the price rises by another 10% afterwards (which it may well do), 1) Please do not blame me!

and 2) Have no regrets; just move on. You will have resolved one issue.

Dod

Absolutely, we're all grown ups.

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10032 times

Re: HSBA

bluedonkey wrote:

The share price of HSBA is at a three year high. It seems to be stuck long term in a range. Yield is now down to about 3.2%.

Is this a good time to trade out?

bluedonkey wrote:

Yes, it's difficult to predict. However looking in the rear view mirror, I see that the share price has rarely been over 700p during the last 10 years.

I might hang on for another 10% increase, then sell.

Just as a thought experiment, have you tried to think about this from a slightly different angle given what you've said above?

Imagine that the capital you're talking about wasn't invested in HSBA, and you were hoping to find an investment that might lead to a 10% rise over time.

If you were investigating options for that capital, how strongly do you think you'd favour a share that's 'stuck in a long term range', is 'at a three year high', and 'has rarely been over 700p during the last 10 years'?

If you had the capital in your pocket now, and you'd perhaps not favourably consider HSBA to achieve that 10% rise given your above quoted thought processes, then does that help you decide what you might do given that you currently are invested, but still looking for that favourable outcome for the capital?

I should caveat the above with the acknowledgement that I have some of my own capital invested in HSBA, and am happy to stay invested for the long term, but I just thought I'd offer up the above alternative thought-process to see if you'd perhaps consider things differently if you were to look at this situation from a slightly different angle...

Cheers,

Itsallaguess

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: HSBA

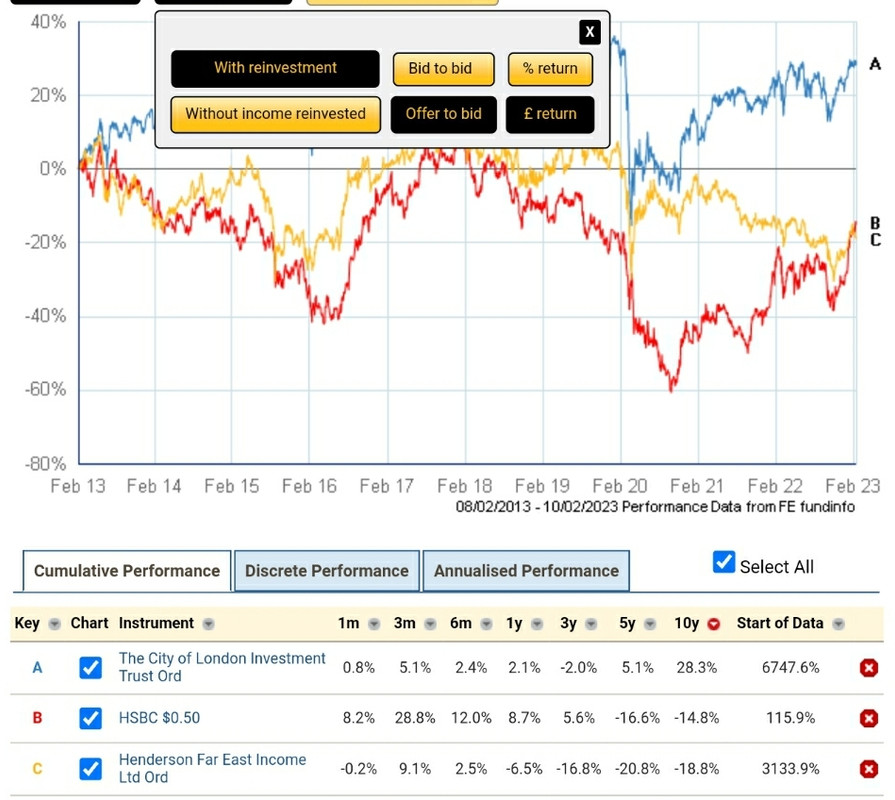

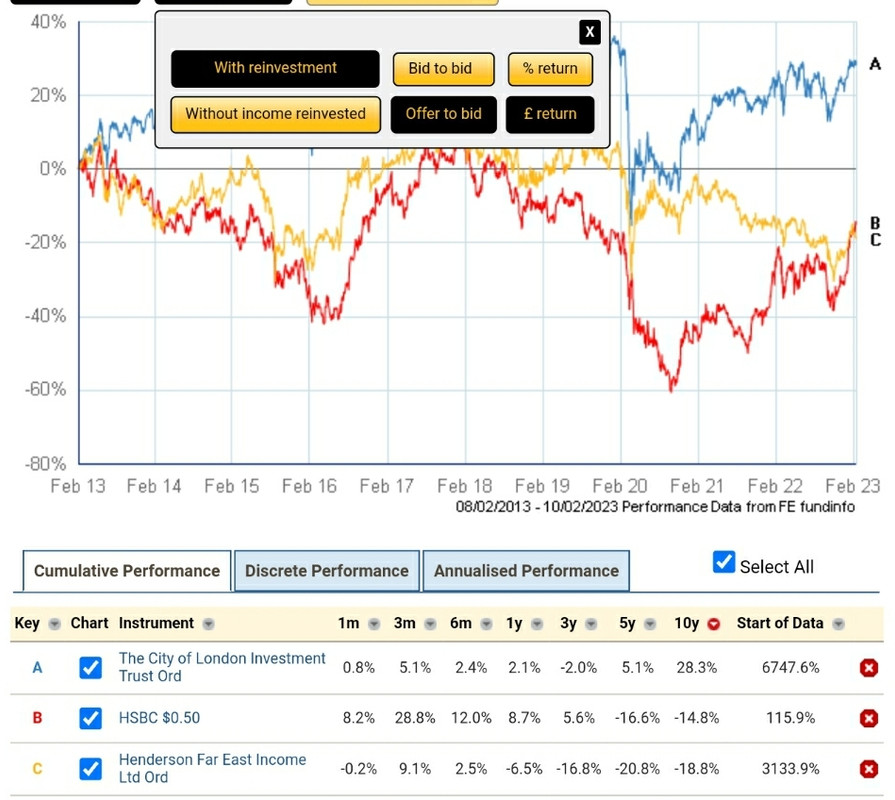

I hold shares in HSBA...bought originally as part of a HYP. My views on "investment " have developed (ie changed) over the last 5 years and I realise that HSBA has been very lacklustre....I would have been better investing in plain vanilla CTY ( better = a higher total return)...

For "income takers" ( dividends not reinvested), HSBA is currently performing similar to the much maligned HFEL ( interesting...main market area of both? ).

Source : https://www2.trustnet.com/Tools/Chartin ... O:GLBLGRTH

I tilted my investment Eastwards with both HSBA & HFEL...my timing was clearly wrong...the problem is, will the situation improve? I'm not so sure it will if politics interferes which I suspect it will.

I'm tempted to reduce my percentage holding.

For "income takers" ( dividends not reinvested), HSBA is currently performing similar to the much maligned HFEL ( interesting...main market area of both? ).

Source : https://www2.trustnet.com/Tools/Chartin ... O:GLBLGRTH

I tilted my investment Eastwards with both HSBA & HFEL...my timing was clearly wrong...the problem is, will the situation improve? I'm not so sure it will if politics interferes which I suspect it will.

I'm tempted to reduce my percentage holding.

-

GoSeigen

- Lemon Quarter

- Posts: 4439

- Joined: November 8th, 2016, 11:14 pm

- Has thanked: 1614 times

- Been thanked: 1607 times

Re: HSBA

For the past three years HSBA has been close to multi-decade lows. This has given me the opportunity to buy tranches of shares at 408p, 308p and 412p. HSBC is profitable but net interest margins still very low, I can see profits doubling at least. Will use future dips to buy more.

GS

GS

-

BobGe

- Lemon Slice

- Posts: 554

- Joined: November 5th, 2016, 12:49 am

- Has thanked: 176 times

- Been thanked: 125 times

Re: HSBA

Although a small part of their business they are closing UK branches at a rate and stiffing small business customers with fee increases like there is no tomorrow, despite offering little in the way of service other than access to their on-line platform so clients (for whom they don't give a toss) do all the work themselves, so they should be increasing revenue and profitability in this sector. It was muted some time back that they may sell off HSBC UK.

-

bluedonkey

- Lemon Quarter

- Posts: 1809

- Joined: November 13th, 2016, 3:41 pm

- Has thanked: 1417 times

- Been thanked: 652 times

Re: HSBA

bluedonkey wrote:The share price of HSBA is at a three year high. It seems to be stuck long term in a range. Yield is now down to about 3.2%. Is this a good time to trade out?

Set myself to sell at 640p. As the share price ticked up with the results today, sold out the holding at that price just now. The proceeds will probably go into Vanguard World Tracker (VWRL) to continue my move over the last several years from single share holdings to collectives; also I don't need to chase yield anymore. Just as well, as VWRL yields c.2%!

-

kempiejon

- Lemon Quarter

- Posts: 3585

- Joined: November 5th, 2016, 10:30 am

- Has thanked: 1 time

- Been thanked: 1196 times

Re: HSBA

bluedonkey wrote:bluedonkey wrote:The share price of HSBA is at a three year high. It seems to be stuck long term in a range. Yield is now down to about 3.2%. Is this a good time to trade out?

Set myself to sell at 640p. As the share price ticked up with the results today, sold out the holding at that price just now. The proceeds will probably go into Vanguard World Tracker (VWRL) to continue my move over the last several years from single share holdings to collectives; also I don't need to chase yield anymore. Just as well, as VWRL yields c.2%!

If your shares are sheltered switch for VWRP the zero yielding accumulation version and no need to pay trading to re-invest dividends.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: HSBA

bluedonkey wrote:bluedonkey wrote:The share price of HSBA is at a three year high. It seems to be stuck long term in a range. Yield is now down to about 3.2%. Is this a good time to trade out?

Set myself to sell at 640p. As the share price ticked up with the results today, sold out the holding at that price just now. The proceeds will probably go into Vanguard World Tracker (VWRL) to continue my move over the last several years from single share holdings to collectives; also I don't need to chase yield anymore. Just as well, as VWRL yields c.2%!

If you are intent on getting out of single shares that is not a bad exit point I think, although I expect them to continue moving higher. I would not call holding HSBC, chasing yield mind you. I think it is now breaking out of the long term price range since it has not been over £6 for very long. Anyway the market seems to like their results as the last price I saw was 648p

Dod

Return to “Stocks and Share Dealing Discussions”

Who is online

Users browsing this forum: No registered users and 47 guests