Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

Foreign Dividends (tax return)

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Foreign Dividends (tax return)

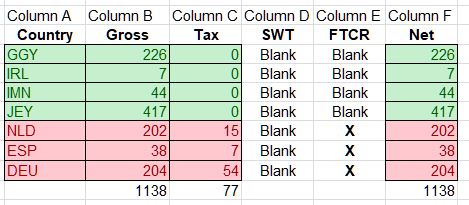

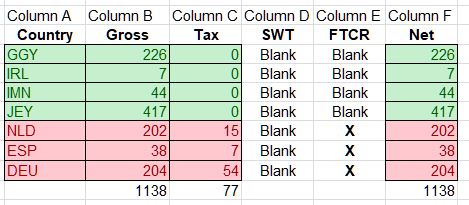

I'm preparing to submit the tax return for my wife's non-ISAed dividends - table below. As this is the first time we have had "foreign" dividends totalling over £300, do I simply list them on page F3/F4 of the Foreign pages?

(On Page TR2 of SA100, the main tax return form, box 5 will be ticked to flag up that there are Foreign dividends over £300 to be declared) - initiating the requirement to fill in a section of form SA106 - Foreign Income

On page F3/F4 of form SA106 it lists 5 columns. I assumed that

Column A = code (example JEY for Jersey)

Column B = Gross dividend

Column C = Foreign tax paid

Column D = Special withholding tax

Column E = check box to claim Foreign tax credit

Column F = taxable amount

I was planning on leaving columns D & E blank.

(SWT = Special Withholding Tax : FTCR = Foreign Tax Credit Relief)

(UK dividends outside of an ISA I know how to submit their details).

Does this look correct or does it need a correction?

(On Page TR2 of SA100, the main tax return form, box 5 will be ticked to flag up that there are Foreign dividends over £300 to be declared) - initiating the requirement to fill in a section of form SA106 - Foreign Income

On page F3/F4 of form SA106 it lists 5 columns. I assumed that

Column A = code (example JEY for Jersey)

Column B = Gross dividend

Column C = Foreign tax paid

Column D = Special withholding tax

Column E = check box to claim Foreign tax credit

Column F = taxable amount

I was planning on leaving columns D & E blank.

(SWT = Special Withholding Tax : FTCR = Foreign Tax Credit Relief)

(UK dividends outside of an ISA I know how to submit their details).

Does this look correct or does it need a correction?

-

PinkDalek

- Lemon Half

- Posts: 6139

- Joined: November 4th, 2016, 1:12 pm

- Has thanked: 1589 times

- Been thanked: 1801 times

Re: Foreign Dividends (tax return)

Brief reply but looks wrong. B & F should usually match. Column B should be restricted to the ‘Treaty Rate’ (usually 15%) despite what was deducted. Thus Spain and Germany overstated. Are you sure only 10% re Netherlands?

Also tick boxes X where relevant to claim FTCR.

Reply tomorrow if needs be. It can be more complicated depending on Wife’s tax position.

Also tick boxes X where relevant to claim FTCR.

Reply tomorrow if needs be. It can be more complicated depending on Wife’s tax position.

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Re: Foreign Dividends (tax return)

PinkDalek wrote:Brief reply but looks wrong. B & F should usually match. Column B should be restricted to the ‘Treaty Rate’ (usually 15%) despite what was deducted. Thus Spain and Germany overstated. Are you sure only 10% re Netherlands?

Also tick boxes X where relevant to claim FTCR.

Reply tomorrow if needs be. It can be more complicated depending on Wife’s tax position.

Thanks for the reply PD. It's the first time I've filled in the "foreign" section on a tax return form so it is a bit of a puzzle - not helped by the fact that one of the accounts was held with SVS who have gone to the wall and their website is not accessible.

Dutch (NLD)

With regards to dividends from the Netherlands (i.e. European Assets Trust) - I have looked at their annual report and it indicates a rate of 13.04% Dutch withholding tax to one dividend (31/1/19) and 2.38% to another dividend (15/3/19). I have simply taken each dividend and the appropriate withholding tax and totted the values up. The annual report specifies the divi in euros and then the withholding tax, in euros.

I mentioned SVS brokers having been closed but my wife holds EAT with them and with iWeb. It was the iWeb tax statement printout that highlighted the 2.38% foreign withholding tax paid.

Spain (ESP)

My wife briefly held shares with International Airlines Group (IAG). These were held only with iWeb. The tax statement from iWeb indicates a gross amount of £38.49, the Spanish withholding tax of 19% (£7.30) and a net £31.19. (figures then rounded down).

Germany (DEU)

The divi relates to a brief holding in TUI , the shares being held only with iWeb - their tax printout indicates the Gross dividend, the German withholding tax sum of 26.38% and the net amount.

You mentioned

"Column B should be restricted to the ‘Treaty Rate’ (usually 15%) despite what was deducted. Thus Spain and Germany overstated. Are you sure only 10% re Netherlands?"

Is this a case of despite the 26.38% Germany withholding tax ( inc special solidarity tax) one can only claim 15%? I was thinking that HMRC's software would deduce the appropriate tax?

(I'll be glad when these foreign shares are ISA'ed!

-

PinkDalek

- Lemon Half

- Posts: 6139

- Joined: November 4th, 2016, 1:12 pm

- Has thanked: 1589 times

- Been thanked: 1801 times

Re: Foreign Dividends (tax return)

monabri wrote:Thanks for the reply PD. It's the first time I've filled in the "foreign" section on a tax return form so it is a bit of a puzzle - not helped by the fact that one of the accounts was held with SVS who have gone to the wall and their website is not accessible. ...

You mentioned

"Column B should be restricted to the ‘Treaty Rate’ (usually 15%) despite what was deducted. Thus Spain and Germany overstated. Are you sure only 10% re Netherlands?"

Is this a case of despite the 26.38% Germany withholding tax ( inc special solidarity tax) one can only claim 15%? I was thinking that HMRC's software would deduce the appropriate tax?

The forms are confusing and I only use hard copy versions. HMRC often process them incorrectly and they refer queries to a Technician who amends correctly. I don't therefore know what happens online but I too would suspect they correct any overclaim and presumably the calculations can be looked at prior to submission.

To complicate matters, your wife will only obtain FTCR up to the maximum UK Income Tax charged on those dividends.

The form does say C Foreign tax taken off or paid but that is incorrect and one should only include the treaty rate amount.

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/787469/SA106_2019.pdf includes check the relevant Double Taxation Treaty for any limits to the relief you can claim.

If you then look at the notes https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/787470/SA106_notes_2019.pdf re Column C they state:

If you had any foreign tax taken off your income in column B, put the amount of tax (in UK pounds) in column C. Foreign tax is the lower of the foreign tax actually withheld and the amount of tax credit allowed under the terms of a DTA.

I can't help re The Netherlands but generally, depending on the amounts involved, you aren't forced to mention the Foreign Tax Credit Relief at all.

Spain and Germany maximum relief 15% from memory (I certainly haven't checked the treaties), despite what was taken at source.

There is an alternative basis, whereby you can expense the allowable withholding tax (restricted to the 15%s or lower) if that suits the taxpayer's position. Mentioned briefly in the notes where they say If you’re not claiming FTCR, the figure will be the amount in column B, minus any amount in column C.

Hope that helps but I do find it hard to put in writing, especially when time is short.

(I'll be glad when these foreign shares are ISA'ed!)

Yes but she'll lose any chance of relief for the withholding tax.

Edit: Spain may only be 10%. https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/507409/spain-dtc_-_in_force.pdf

Haven't checked Germany

-

PinkDalek

- Lemon Half

- Posts: 6139

- Joined: November 4th, 2016, 1:12 pm

- Has thanked: 1589 times

- Been thanked: 1801 times

Re: Foreign Dividends (tax return)

Germany (Article 10) appears to be maximum 15% relief:

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/734388/2010_Germany-UK_Double_Taxation_Convention_as_amended_by_the_2014_Protocol_-_in_force.pdf

Others may be able to clarify on Spain. The wording in the DTC Article 10 is above my pay grade (I may not even have managed to pick up the most recent treaty/convention):

2 a)

(i) 10 per cent of the gross amount of the dividends, except as provided in subparagraph a) (ii);

(ii) 15 per cent of the gross amount of the dividends where those dividends are paid out of income (including gains) derived directly or indirectly from immovable property within the meaning of Article 6 by an investment vehicle which distributes most of this income annually and whose income from such immovable property is exempted from tax;

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/734388/2010_Germany-UK_Double_Taxation_Convention_as_amended_by_the_2014_Protocol_-_in_force.pdf

Others may be able to clarify on Spain. The wording in the DTC Article 10 is above my pay grade (I may not even have managed to pick up the most recent treaty/convention):

2 a)

(i) 10 per cent of the gross amount of the dividends, except as provided in subparagraph a) (ii);

(ii) 15 per cent of the gross amount of the dividends where those dividends are paid out of income (including gains) derived directly or indirectly from immovable property within the meaning of Article 6 by an investment vehicle which distributes most of this income annually and whose income from such immovable property is exempted from tax;

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Re: Foreign Dividends (tax return)

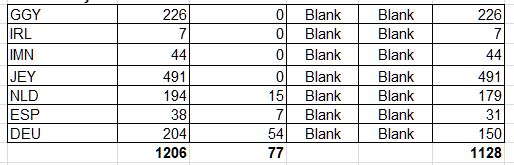

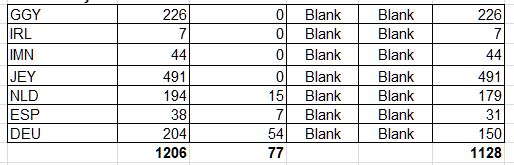

I decided to contact HMRC helpline. The advice they gave was to fill the F2/F3 section thus:

(maybe I will phone them again tomorrow to see if they say the same )

)

(maybe I will phone them again tomorrow to see if they say the same

-

PinkDalek

- Lemon Half

- Posts: 6139

- Joined: November 4th, 2016, 1:12 pm

- Has thanked: 1589 times

- Been thanked: 1801 times

Re: Foreign Dividends (tax return)

Sorry I effectively wasted my time but showing £54 on £204 for DEU (same applies to ESP) is not really correct, if one follows their own instructions***, but, as you say, their software may correct down to the relevant %.

*** As before column C. Foreign tax is the lower of the foreign tax actually withheld and the amount of tax credit allowed under the terms of a DTA.

Btw I think that is your cleverly created table but F is not "Net", not that it matters.

If you speak to a "Technician" then, yes, you may receive a different answer. Those general enquiries type individuals I have spoken to over the years do not always understand and, as I said, pass the query over to a Technician, who sometimes calls me back and/or amends what HMRC did incorrectly in the first place.

The WHT numbers are on the low side not to worry any further.

I may have this all wrong anyway, as I'm beginning to doubt my own knowledge.

*** As before column C. Foreign tax is the lower of the foreign tax actually withheld and the amount of tax credit allowed under the terms of a DTA.

Btw I think that is your cleverly created table but F is not "Net", not that it matters.

(maybe I will phone them again tomorrow to see if they say the same)

If you speak to a "Technician" then, yes, you may receive a different answer. Those general enquiries type individuals I have spoken to over the years do not always understand and, as I said, pass the query over to a Technician, who sometimes calls me back and/or amends what HMRC did incorrectly in the first place.

The WHT numbers are on the low side not to worry any further.

I may have this all wrong anyway, as I'm beginning to doubt my own knowledge.

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Re: Foreign Dividends (tax return)

Tax return submitted ....finally! (there are mitigating circumstances on my part  )

)

As it was submitted online, the fact that there were seven "foreigner" countries was not a problem as one simply clicked on an "add" button to enter a new line.

The online form asked for the gross sum for the dividend and also any tax paid. There was an option regarding tax relief (a pull down menu where one could select an appropriate rate - wrongly or rightly I decided not to enter any information)

I noted that despite being "online", the printed pdf file which one can view prior to submission listed 6 of the 7 entries in one section of the return and the final seventh entry (DEU) was to be found a few pages further down the pdf file. The dividend from country DEU was added to the total and calculated and displayed correctly in the pdf file (£1128).

A minor note -

I noted on the tax return form (in pdf) that the country codes I entered for Jersey (JEY) and Isle on Man (IMN) following their guide had been changed automatically to JSY and IOM.

As it was submitted online, the fact that there were seven "foreigner" countries was not a problem as one simply clicked on an "add" button to enter a new line.

The online form asked for the gross sum for the dividend and also any tax paid. There was an option regarding tax relief (a pull down menu where one could select an appropriate rate - wrongly or rightly I decided not to enter any information)

I noted that despite being "online", the printed pdf file which one can view prior to submission listed 6 of the 7 entries in one section of the return and the final seventh entry (DEU) was to be found a few pages further down the pdf file. The dividend from country DEU was added to the total and calculated and displayed correctly in the pdf file (£1128).

A minor note -

I noted on the tax return form (in pdf) that the country codes I entered for Jersey (JEY) and Isle on Man (IMN) following their guide had been changed automatically to JSY and IOM.

-

PinkDalek

- Lemon Half

- Posts: 6139

- Joined: November 4th, 2016, 1:12 pm

- Has thanked: 1589 times

- Been thanked: 1801 times

Re: Foreign Dividends (tax return)

Thanks for getting back to us, as you said you would.

From a quick glance at your table, you appear to have expensed (all) the withholding taxes, thus showing £1,2046 - £767 = £1,128 (minor amendments re rounding). Thus you may not have claimed FTCR after all. As before, expensing the WHT may conceivably have been beneficial anyway but we hold insufficient info. You've probably covered the lack of a claim for FTCR by your There was an option regarding tax relief (a pull down menu where one could select an appropriate rate - wrongly or rightly I decided not to enter any information), whereas previously you showed 3 Xs when you intended to claim!

I'll also repeat myself that the withholding taxes deducted and shown are not necessarily at the allowable treaty rates and may have been overclaimed/expensed, despite what you were told by the Technician and you have recorded. It may be that the online calculation itself is correctly calculated though.

Did you get that far to see what precisely was taxed - was it the net £1,128 or something else?

monabri wrote:Tax return submitted ....finally! (there are mitigating circumstances on my part) ...

From a quick glance at your table, you appear to have expensed (all) the withholding taxes, thus showing £1,2046 - £767 = £1,128 (minor amendments re rounding). Thus you may not have claimed FTCR after all. As before, expensing the WHT may conceivably have been beneficial anyway but we hold insufficient info. You've probably covered the lack of a claim for FTCR by your There was an option regarding tax relief (a pull down menu where one could select an appropriate rate - wrongly or rightly I decided not to enter any information), whereas previously you showed 3 Xs when you intended to claim!

I'll also repeat myself that the withholding taxes deducted and shown are not necessarily at the allowable treaty rates and may have been overclaimed/expensed, despite what you were told by the Technician and you have recorded. It may be that the online calculation itself is correctly calculated though.

Did you get that far to see what precisely was taxed - was it the net £1,128 or something else?

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Re: Foreign Dividends (tax return)

PinkDalek wrote:Did you get that far to see what precisely was taxed - was it the net £1,128 or something else?

Looking at the pdf file (in the Tax Calculation sections) there is unfortunately no info as to what had been taxed.

During the submission of the tax form, I did (briefly) tick the FTCR box and that then lead to the option of a pull down menu to select the tax level. I wasn't sure (I was looking for a 15% Tax rate) but ..in the end..decided not to tick the boxes.

-

PinkDalek

- Lemon Half

- Posts: 6139

- Joined: November 4th, 2016, 1:12 pm

- Has thanked: 1589 times

- Been thanked: 1801 times

Re: Foreign Dividends (tax return)

monabri wrote:Looking at the pdf file (in the Tax Calculation sections) there is unfortunately no info as to what had been taxed.

I was initially surprised when you said there's no breakdown of what's been taxed in the Tax Calculations section but it may depend on where you looked. A printed version of an online submitted Tax Return here, entitled "Tax calculation summary" (page TC 1), does not, as you say, provide anything much other than "Tax due". Earlier on in the process though, there was a "View your calculation" part (where it stated Your Tax return is 90% complete). We printed that and it shows a separate heading for Dividends from foreign companies and another for Dividends from UK companies.

During the submission of the tax form, I did (briefly) tick the FTCR box and that then lead to the option of a pull down menu to select the tax level. I wasn't sure (I was looking for a 15% Tax rate) but ..in the end..decided not to tick the boxes.

Thanks for the feedback. When I next have a look at the online return for someone I assist, I must remember to take a look at that section and play around with some sample numbers. Perhaps one day I may even sign up myself.

Come what may, I doubt your Wife will hear anything further.

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Re: Foreign Dividends (tax return)

I logged into the account again and there is an option to view the tax calculation...which I did.

The printout indicates that tax was based on £1128 as one part of her overall income.

The printout indicates that tax was based on £1128 as one part of her overall income.

-

fca2019

- 2 Lemon pips

- Posts: 220

- Joined: July 18th, 2019, 8:37 am

- Has thanked: 166 times

- Been thanked: 65 times

Re: Foreign Dividends (tax return)

Hi there, surely not worth the hassle. I would sell now before new tax year. And invest proceeds in uk investments

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Re: Foreign Dividends (tax return)

fca2019 wrote:Hi there, surely not worth the hassle. I would sell now before new tax year. And invest proceeds in uk investments

Problem is that the shares are tied up in SVS Securities and I have no access.

Who is online

Users browsing this forum: No registered users and 27 guests