Page 1 of 1

VHYL: UK Tax Status?

Posted: May 7th, 2022, 3:57 pm

by Newroad

Hi All.

A while back, I recall reading something which, if accurate, I hadn't really appreciated - that in addition to income, dividend and/or capital gains tax (which I'm happy to accept outside a SIPP or ISA) - that some Irish domiciled ETF's may be subject to further tax. Here is some source material discussing this

https://www.justetf.com/uk/news/passive-investing/how-etfs-are-taxed-in-the-uk.htmland here is the detail for VHYL specifically

https://www.vanguardinvestor.co.uk/investments/vanguard-ftse-all-world-high-dividend-yield-ucits-etf-usd-distributing/overviewwhich amongst other things, states VYHL is "UK Reporting".

So, if I invest in this, outside a SIPP or ISA wrapper, am I subject to any taxes other than (it seems) dividend or capital gains tax (or are there complications from its structure in determining the dividend or capital gains tax to pay)? For example, is Excess Reportable Income (ERI) likely to be a factor - it's not clear to me?

Regards, Newroad

Re: VHYL: UK Tax Status?

Posted: May 7th, 2022, 5:18 pm

by monabri

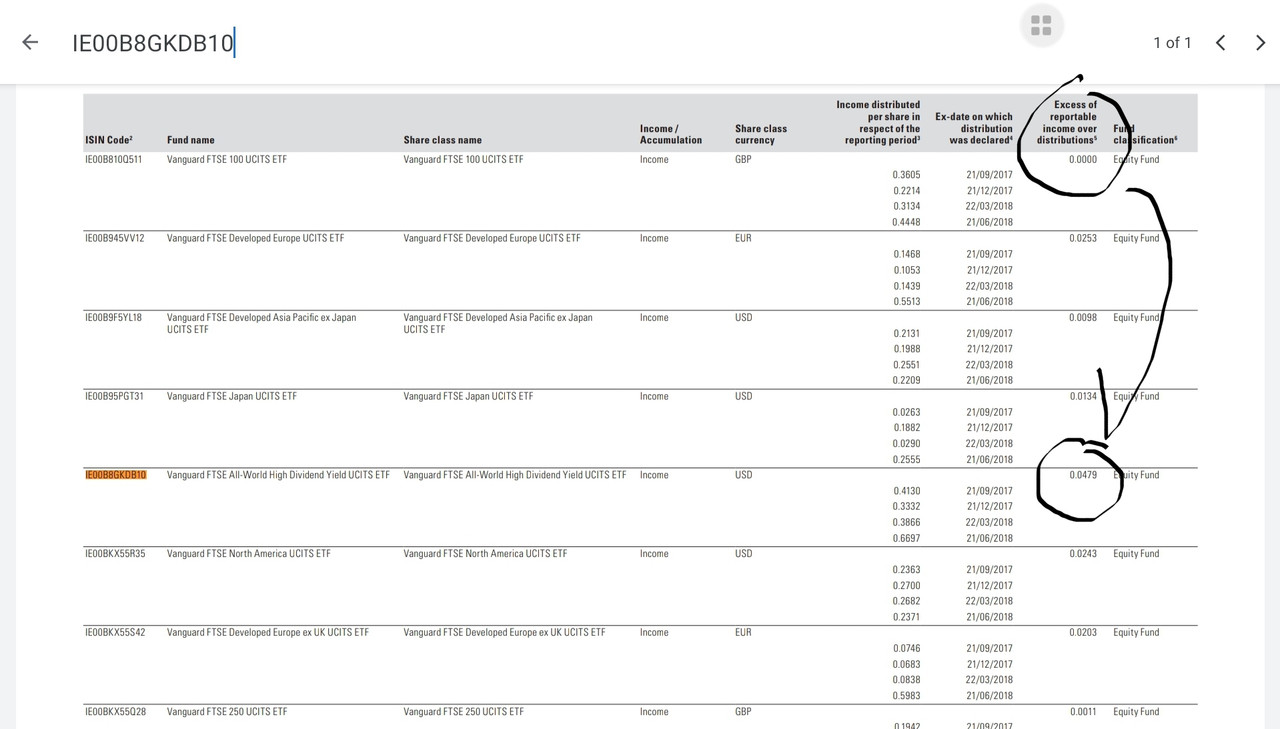

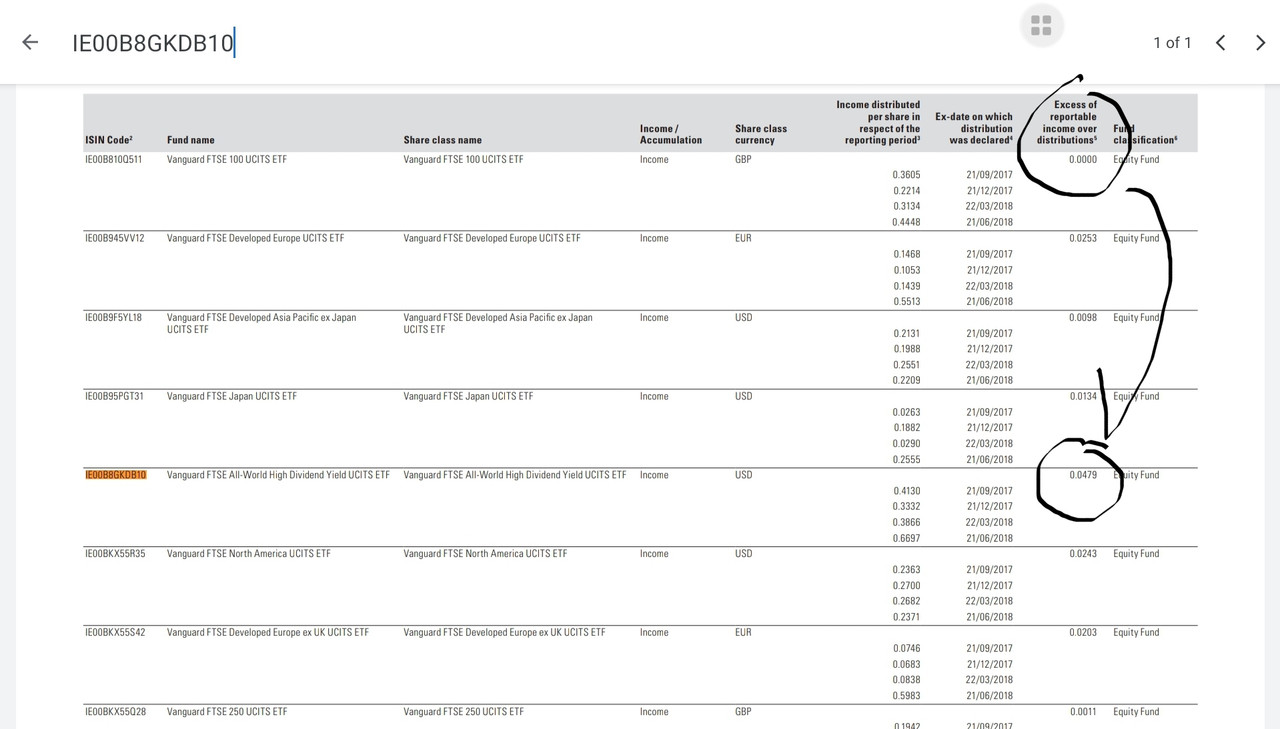

I believe VHYL has the ISIN: IE00B8GKDB10.

Vanguard publish tables which state ERI. I had a look at one report ( 30 June 2020 - see link below) and they quoted an ERI value for VHYL which leads me to the conclusion that one needs to include it in one's tax report outside of a tax free wrapper.

https://www.vanguardinvestor.co.uk/inve ... nformation

https://www.vanguardinvestor.co.uk/inve ... nformation

Re: VHYL: UK Tax Status?

Posted: May 7th, 2022, 6:59 pm

by Newroad

Thanks, Monabri.

Do you (or does anyone else) have any clue how one would report that on a tax return as a practical matter?

However, my gut instinct (as it was when I first heard about this) was to avoid it - which is a shame, as there are a number of circumstances where I think this would otherwise be a good option

Regards, Newroad

Re: VHYL: UK Tax Status?

Posted: May 9th, 2022, 7:26 am

by Genghis

Newroad wrote:Thanks, Monabri.

Do you (or does anyone else) have any clue how one would report that on a tax return as a practical matter?

However, my gut instinct (as it was when I first heard about this) was to avoid it - which is a shame, as there are a number of circumstances where I think this would otherwise be a good option

Regards, Newroad

As it’s an equity fund, calculated ERI gets added to the foreign dividend income (ie the dividends from that fund and any others) and goes in that box.

Re: VHYL: UK Tax Status?

Posted: May 9th, 2022, 8:27 am

by Lootman

monabri wrote:Vanguard publish tables which state ERI. I had a look at one report ( 30 June 2020 - see link below) and they quoted an ERI value for VHYL which leads me to the conclusion that one needs to include it in one's tax report outside of a tax free wrapper.

Genghis wrote:As it’s an equity fund, calculated ERI gets added to the foreign dividend income (ie the dividends from that fund and any others) and goes in that box.

I had an interesting conversation about this with my accountant. At the time I held 3 Irish ETFs in my taxable account. When I prepared the information for my self-assessment tax return I did not include any ERI amounts.

My accountant spotted that omission. But then he prepared my tax return without the ERI anyway. He did mention that to me, but he suggested that the amounts involved were so trivial that "the tax man won't care". He added that over a few years it is "swings and roundabouts" and any anomaly will even out.

So we did that. Even so I sold those ETFs as I didn't want the hassle, and now only hold ETFs in tax-sheltered accounts. But as it was explained to me, unless you hold accumulating ETFs, or else have millions invested in distribution ETFs, then this is not usually a huge deal anyway.

There is the additional annoyance that ETF distributions count as foreign income and so need to go in a different section of the return.

Re: VHYL: UK Tax Status?

Posted: May 9th, 2022, 9:27 am

by monabri

I went down the same route as Lootman and didn't realise at the time that Vanguard's distributions were "foreign income".

Re: VHYL: UK Tax Status?

Posted: May 9th, 2022, 9:44 am

by kempiejon

Lootman wrote: Even so I sold those ETFs as I didn't want the hassle, and now only hold ETFs in tax-sheltered accounts. But as it was explained to me, unless you hold accumulating ETFs, or else have millions invested in distribution ETFs, then this is not usually a huge deal anyway.

There is the additional annoyance that ETF distributions count as foreign income and so need to go in a different section of the return.

Yeah I missed that too when I first held ETFs, for 2 years my foreign income and ERI was not reported, I was selling down my unsheltered holdings to get below the dividend income limit and harvest capital gains and unsheltered ETFs went.

Re: VHYL: UK Tax Status?

Posted: May 9th, 2022, 12:31 pm

by Newroad

Hi Lootman et al.

Are you sure it's the whole distribution that is regarded as foreign income, or only the ERI part?

The way I read it (in fairness, not as an expert) the "normal" distribution paid quarterly is counted as "UK Dividend Income" for tax purposes, but the ERI (which may fluctuate, and sometimes be zero) would be the "Foreign Dividend Income".

Regards, Newroad

Re: VHYL: UK Tax Status?

Posted: May 9th, 2022, 12:46 pm

by kempiejon

Newroad wrote:Are you sure it's the whole distribution

Hey Newroad, I'm not sure but on my tax cetrtificate from Halifax all my Vanguard dividends are collected in the section listed as Non-UK Equities.

Re: VHYL: UK Tax Status?

Posted: May 9th, 2022, 1:21 pm

by Alaric

kempiejon wrote:Hey Newroad, I'm not sure but on my tax cetrtificate from Halifax all my Vanguard dividends are collected in the section listed as Non-UK Equities.

Did Halifax report the ERI as well, or leave it to you to resaerch it?

That' can be the headache with ETFs, the amount of research needed to establish what is usually a trivial amount of potentially taxable income.

Re: VHYL: UK Tax Status?

Posted: May 9th, 2022, 1:47 pm

by Newroad

Hi KempieJon and Alaric.

If you look at the screenshot kindly provided by Monabri above, you will see

Four quarterly distributions

One "Excess of reportable income over distributions"

The wording of the latter looks clear to me - as it refers to

all the distributions, it looks like an annual figure. Further, as can be seen from the example above (the FTSE 100 ETF) it can be zero.

So my educated guess would be

Distributions = (UK) Dividend Income

ERI = Foreign Income

But that could easily be wrong.

Regards, Newroad

Re: VHYL: UK Tax Status?

Posted: May 9th, 2022, 2:46 pm

by Lootman

Newroad wrote:Hi Lootman et al.

Are you sure it's the whole distribution that is regarded as foreign income, or only the ERI part?

No all of it is "foreign" because all of it comes from Ireland. The fact that it is listed in London doesn't matter; it is the domicile of the fund that matters.

It is the same with some London-listed ITs like Ruffer (RICA) and some LSE-listed shares (XP energy). Income is deemed 100% foreign.

Re: VHYL: UK Tax Status?

Posted: May 9th, 2022, 2:52 pm

by Newroad

Thanks, Lootman.

On related note then, what does "UK Reporting Status" confer when approved (by a foreign domiciled ETF, trust etc) - noting that it is something that needs to be applied for from HMRC?

Regards, Newroad

Re: VHYL: UK Tax Status?

Posted: May 9th, 2022, 3:25 pm

by ursaminortaur

Newroad wrote:Thanks, Lootman.

On related note then, what does "UK Reporting Status" confer when approved (by a foreign domiciled ETF, trust etc) - noting that it is something that needs to be applied for from HMRC?

Regards, Newroad

For UK reporting funds capital gains are taxed as such whereas for non UK reporting funds they are taxed as income meaning you pay more tax.

https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/emeia-financial-services/ey-uk-reporting-fund-status.pdf?downloadA UK investor in a non-reporting fund must pay income tax on their realised gain at rates of up to 45%. The purpose of imposing income tax rates is to prevent UK investors accumulating income free of tax in an offshore fund, and then claiming capital gains tax treatment on a realisation.

However, in the case of a reporting fund, the gain on realisation is respected as a capital gain, taxable at a maximum rate of 20%.

Unlike some other jurisdictions this favourable rate is available regardless of how long the investor held their shares in the fund or how long the fund typically holds its investments.

Re: VHYL: UK Tax Status?

Posted: May 9th, 2022, 3:28 pm

by monabri

Newroad wrote:Hi Lootman et al.

Are you sure it's the whole distribution that is regarded as foreign income, or only the ERI part?

The way I read it (in fairness, not as an expert) the "normal" distribution paid quarterly is counted as "UK Dividend Income" for tax purposes, but the ERI (which may fluctuate, and sometimes be zero) would be the "Foreign Dividend Income".

Regards, Newroad

One call tell by looking at the International Securities Identification Number (ISIN).

Example

VWRL ...... IE00B3RBWM25 = Foreign Income (Ireland)

WPP .....JE00B8KF9B49 = Foreign income (Jersey) (you might think it is "GB" as it is FTSE100)

Re: VHYL: UK Tax Status?

Posted: May 9th, 2022, 4:28 pm

by Lootman

ursaminortaur wrote:Newroad wrote:Thanks, Lootman.

On related note then, what does "UK Reporting Status" confer when approved (by a foreign domiciled ETF, trust etc) - noting that it is something that needs to be applied for from HMRC?

Regards, Newroad

For UK reporting funds capital gains are taxed as such whereas for non UK reporting funds they are taxed as income meaning you pay more tax.

I would have written that as "probably pays more tax".

I could come up with some scenarios where holding a non-reporting fund would save you tax, and in fact they were marketed that way for a long time. One example might be if, at some point in the future, you will no longer be UK resident. The non-reporting fund could then be sold without any UK tax liability.

Non-reporting funds can also choose to "roll up" their dividends, so there is no tax event until you sell when, again, you may be non-resident or be in a lower tax bracket.

Note also that if you have a realised capital loss from a non-reporting fund, then you may not offset that against gains elsewhere. There is no tax to pay then but the loss is in fact "wasted".

Re: VHYL: UK Tax Status?

Posted: May 9th, 2022, 6:11 pm

by Newroad

Thanks all for your clarifications.

Regards, Newroad