crazypanda wrote:monabri wrote:BullDog wrote:For those who follow Fundsmith, the May report says they have sold out of their holding in Starbucks. No new holdings are reported this month.

Reviewing the previous factsheets there appears to me to be a fair amount of selling for a fund with a mantra of " do nothing " after finding good companies and not overpaying.

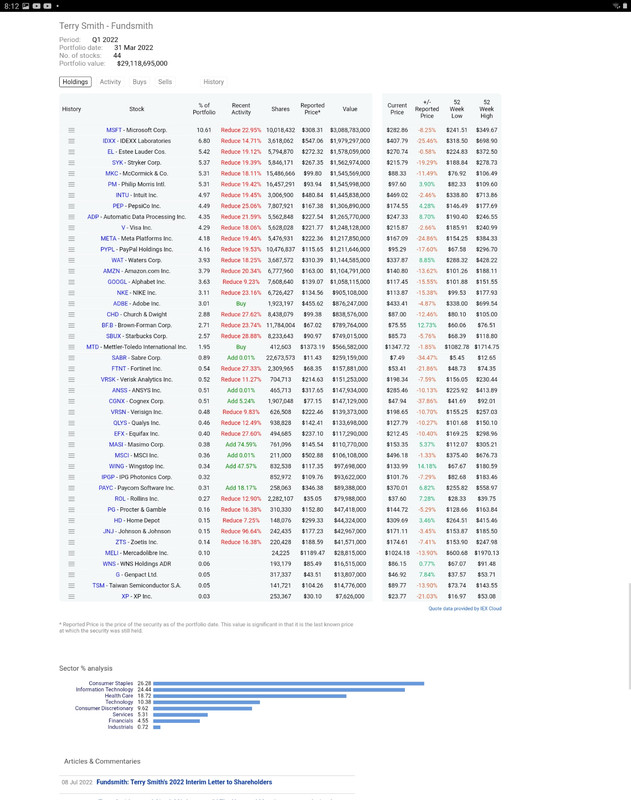

https://www.fundsmith.co.uk/factsheet/

I’m surprised with this sale at what are close to lows, despite some of the headwinds they are seeing

Actually, I just checked and I suspect that when Smith bought the shares back in March 2020 it was in the $60's and he's sold recently in the $70's. Admittedly, he could have sold a while back for more. But that's 100% hindsight that not even Smith has.

Kind of interesting-ish is that when he bought Starbucks, Smith also bought Nike. While Nike is also well below recent highs, it's still maybe close to 2x what Smith bought the stock for in March 2020.