Page 5 of 5

Re: Temple Bar

Posted: November 12th, 2020, 11:42 am

by monabri

Arborbridge wrote:ReallyVeryFoolish wrote:FWIW, Questor is cautiously positive on Temple Bar and negative on Edinburgh today. Questor isn't 100 per cent reliable but in my experience is worth weighing when making decisions this.

RVF

It woudl be interesting to compare the two portfolios - I suspect they are similar, but with different complexions.

The trouble for all of those assessing this situation is that both IT managements and portfolios are in a state of rapid flux.

Arb

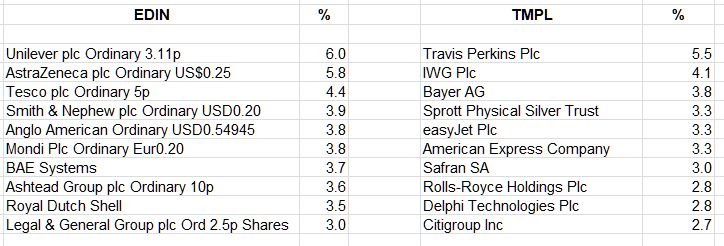

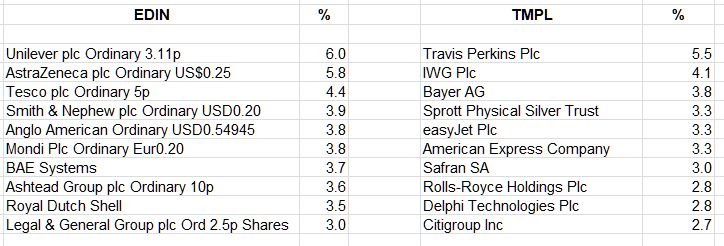

I'd say EDIN and TMPL are quite different based on their top holding (data from latest available factsheets on HL)

I was hoping to use the Morningstar "X Ray tool" but it appears to not be working (it used to work well, not that long ago!).

Re: Temple Bar

Posted: November 12th, 2020, 11:52 am

by Dod101

Thanks for that monabri.

That list and the other factors with Temple Bar suggest that it might be worth holding. At least it is a bit different whereas Edinburgh seems to be a sort of rehash of where they were. The new managers of TB are unknown to me but that does not make them no good and in fact it might be just what is needed.

Dod

Re: Temple Bar

Posted: November 12th, 2020, 7:49 pm

by ADrunkenMarcus

I don't hold directly any of TMPL's top holdings.

I do have Unilever and AstraZeneca from EDIN, though - both are in my top five directly held shares in my dividend growth portfolio.

Best wishes

Mark.

Re: Temple Bar

Posted: November 13th, 2020, 6:35 am

by torata

monabri wrote:Total Returns over the last 5 years

A comparison of "apples" ... with Vanguard's VUKE as a reference. EDIN being under recent new management..one can see why.

:- CTY's returns are approx the same as VUKE's over the last 5 years.

:- TMPL and EDIN are pretty similar. TMPL was doing "ok" (comparatively) until the start of this year.

A small point, not that it impacts on the graph or your point.

Vanguard's VUKE is the FTSE 100 ETF, not the FTSE U.K. Equity Income Index Fund - Accumulation

torata

Re: Temple Bar

Posted: November 13th, 2020, 8:08 am

by Arborbridge

monabri wrote:Arborbridge wrote:

It woudl be interesting to compare the two portfolios - I suspect they are similar, but with different complexions.

The trouble for all of those assessing this situation is that both IT managements and portfolios are in a state of rapid flux.

Arb

I'd say EDIN and TMPL are quite different based on their top holding (data from latest available factsheets on HL)

Thanks for that, not so much crossover after all. TMPL is contrarian, so that probably explains it.

I bought the IT for that very fact - that it gave an alternative approach to the usual suspects. For the first few years of ownership, I would say it showed itself to be a safe, steady if unspectacular pairs of hands. Then all hell was let loose.

Arb.

Re: Temple Bar

Posted: November 16th, 2020, 10:11 am

by ADrunkenMarcus

Another good opening, up 6 percent or so to 923p. Progress in the right direction. I think TMPL might be one of the strongest performers in my SIPP in the last month or so.

Best wishes

Mark.

Re: Temple Bar

Posted: November 18th, 2020, 11:53 am

by monabri

Looks like TMPL has already had a couple of shots from Pfizer and one from Moderna for added good measure......those new managers, eh (

)

Sentiment seems to have changed rapidly.

Re: Temple Bar

Posted: November 18th, 2020, 3:15 pm

by ADrunkenMarcus

monabri wrote:Sentiment seems to have changed rapidly.

The net asset value is currently at c. 951-964p per share (depending on which permutation we use) so it appears TMPL has benefited both from a degree of improvement in the trust's assets but also a narrowing of the discount. It's nice when that happens but, conversely, it did such damage on the way down when we had asset declines and a widening discount!

Best wishes

Mark.

Re: Temple Bar

Posted: November 20th, 2020, 11:24 am

by Parky

"The Daily Telegraph (Questor share tips): BUY Temple Bar; BUY Murray International."

Quote from Citywire Friday Papers today. I don't have access to the article.

Re: Temple Bar

Posted: November 20th, 2020, 11:29 am

by Laughton

Re: Temple Bar

Posted: November 20th, 2020, 12:15 pm

by Dod101

There seems to be some optimism about value investing very recently. On that basis the bombed out Edinburgh IT should do well too.

Dod

Re: Temple Bar

Posted: November 20th, 2020, 12:39 pm

by seagles

Subscription needed to read article.

Re: Temple Bar

Posted: November 20th, 2020, 12:58 pm

by OllyDrod

Dod101 wrote:There seems to be some optimism about value investing very recently. On that basis the bombed out Edinburgh IT should do well too.

Dod

There is, and I think some of it is slightly misplaced: the vaccines should certainly give cyclical businesses a shot in the arm ('scuse the pun) but whilst there's a lot of value in cyclicals at the moment, not every holding in a value trust will be a cyclical business. Edinburgh IT's top 3 holdings are Unilever, AstraZeneca and Tesco, for example.

- OllyDrod

Re: Temple Bar

Posted: November 20th, 2020, 3:34 pm

by Dod101

OllyDrod wrote:Dod101 wrote:There seems to be some optimism about value investing very recently. On that basis the bombed out Edinburgh IT should do well too.

Dod

There is, and I think some of it is slightly misplaced: the vaccines should certainly give cyclical businesses a shot in the arm ('scuse the pun) but whilst there's a lot of value in cyclicals at the moment, not every holding in a value trust will be a cyclical business. Edinburgh IT's top 3 holdings are Unilever, AstraZeneca and Tesco, for example.

- OllyDrod

But it us not simply cyclicals that are value businesses and I think that the attraction of value shares (if any) does not have a lot to do with Covid or the vaccine. Value shares have been bombed out for some years, certainly long before Covid, hence trusts like Temple Bar and Edinburgh and a slew of others have been doing very poorly.

Dod

Re: Temple Bar

Posted: November 20th, 2020, 4:26 pm

by OllyDrod

Dod101 wrote:OllyDrod wrote:Dod101 wrote:There seems to be some optimism about value investing very recently. On that basis the bombed out Edinburgh IT should do well too.

Dod

There is, and I think some of it is slightly misplaced: the vaccines should certainly give cyclical businesses a shot in the arm ('scuse the pun) but whilst there's a lot of value in cyclicals at the moment, not every holding in a value trust will be a cyclical business. Edinburgh IT's top 3 holdings are Unilever, AstraZeneca and Tesco, for example.

- OllyDrod

But it us not simply cyclicals that are value businesses and I think that the attraction of value shares (if any) does not have a lot to do with Covid or the vaccine. Value shares have been bombed out for some years, certainly long before Covid, hence trusts like Temple Bar and Edinburgh and a slew of others have been doing very poorly.

Dod

Agreed re: value investing's under-performance pre-dating Covid, but Edinburgh and Temple Bar's share prices fell off a cliff in response to the pandemic! What's fuelling the recent optimism around value, if not the hope that a vaccine will revive the fortunes of cyclical holdings?

- OllyDrod

Re: Temple Bar

Posted: November 20th, 2020, 4:33 pm

by Dod101

OllyDrod wrote:Dod101 wrote:

Agreed re: value investing's under-performance pre-dating Covid, but Edinburgh and Temple Bar's share prices fell off a cliff in response to the pandemic! What's fuelling the recent optimism around value, if not the hope that a vaccine will revive the fortunes of cyclical holdings?

- OllyDrod

Your guess is as good as mine but I think the huge rise in many of the tech stocks has sent investors looking for better value (to coin a phrase) and there is thus a realisation that many of these value stocks are under priced. I think that Covid is a sideshow as far as that is concerned although it may have provided some stimulus. I don't know, but if value shares start to rise a bit I will not be unhappy.

Dod