Page 1 of 2

Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 17th, 2018, 4:29 pm

by dmukgr

Hello, I'm new to these forums from a posting point of view but have lurked around this site since the Fool closed and read the Fool for longer than I care to remember - mainly the HYP boards as that interested me and indeed a few years ago I got caught up in trying my hand at it but chased yields too much, ignored the rules and went too much into banking etc.

Anyhow, a few years ago I created a John Baron inspired dummy portfolio and that as done well, but I wasn't sure if it was a fluke or not in the timing since most things seemed to have gone up since then anyway. Last Friday I created another, this time with the view of actually putting money into it so I thought for the first time in my life I would actually ask others for advice and try and avoid the mistakes I normally make of chasing quick gains, money now etc.

I would be looking to put around £200k in within the next couple of years (I'm a bit wary at the moment and may wait for Brexit to calm down) and then adding £20k or so for hopefully no more than 6 years after that, whereupon I either have enough dividends from it to live on (plus savings, pension etc.) or need to readjust to up the dividend. I'm not entirely convinced by this thought either and may try and do dividends plus top slice - I'll see how it goes and what my needs are at the time.

Any glaring errors on my thoughts or things I should consider?

Thanks.

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 17th, 2018, 4:56 pm

by BrummieDave

That looks like a very well researched portfolio, that I'm sure you've poured over for some time. I think it's almost entirely equity based eschewing bonds, well diversified in terms of global regions, small/large cap, investment companies etc.

It looks like a well balanced, well thought through, portfolio for future regular rising income. But hey, who knows and only time will tell!

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 17th, 2018, 6:26 pm

by monabri

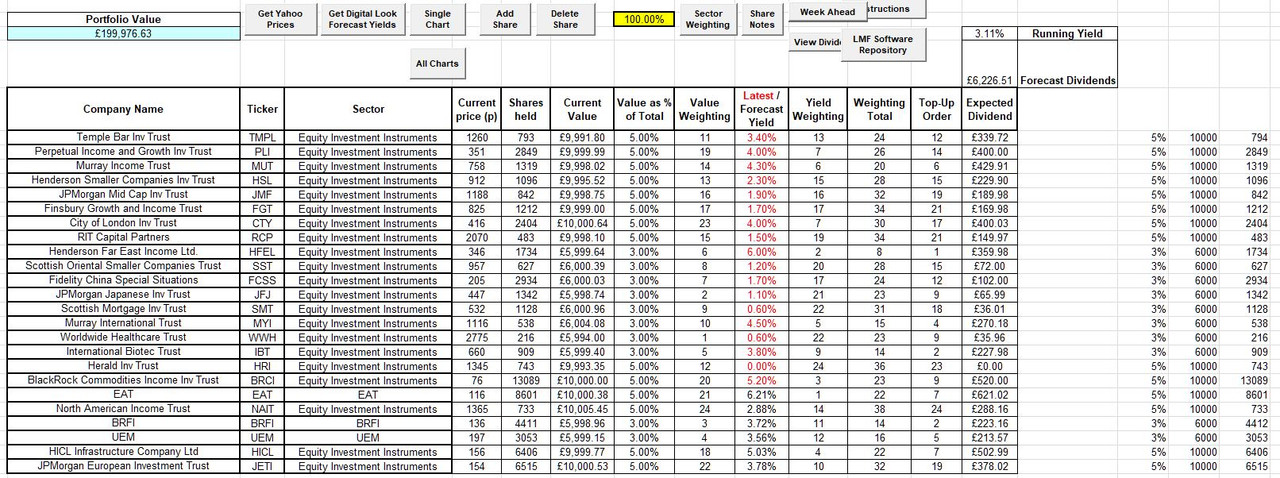

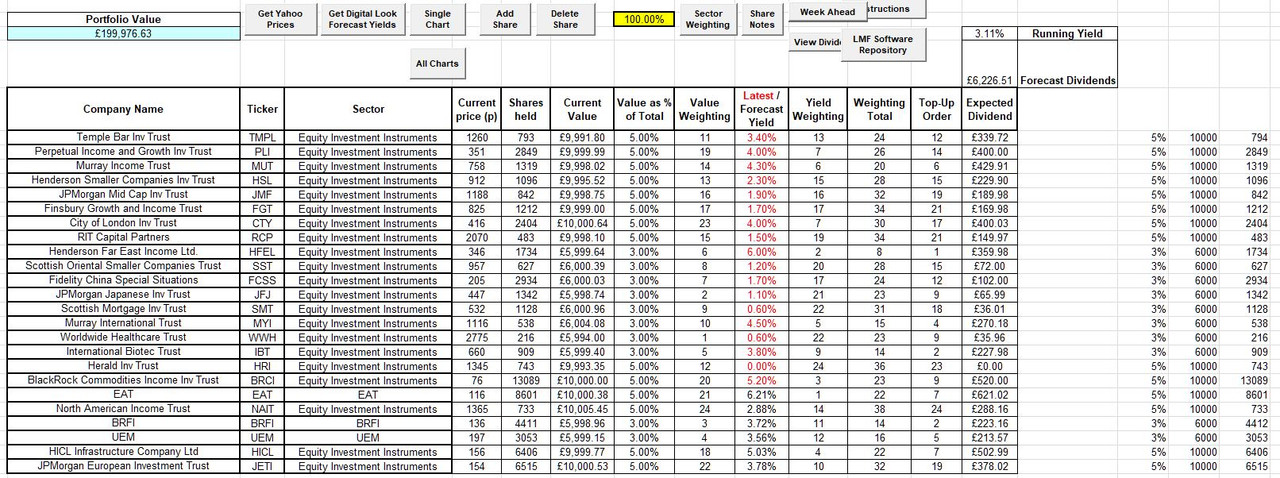

I make that a dividend of just over £6200 p.a. from a £200k investment.

Here's the HYPTUSS sheet (with a few mods)...I had to take some of the current yields from Hargreaves and type them in.

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 17th, 2018, 6:47 pm

by monabri

Just a quick comment or two:

TMPL,PLI,MUT,HSL,JMF,FGT & CTY ... I think they are very much UK focused so you'll have quite a bit of the portfolio (£70k ?) UK biased. Perhaps this is what you are after but I'd thought I'd flag it up. (and HRI is 56% UK biased I note).

At the moment RCP is at a 9% premium. & BRFI is at 4% premium ..I wonder if there are any suggestions as to possible alternatives.

Is there any scope to consider a few well chosen individual shares (LGEN, HSBA,RDSB to add a little bit more yield) or do you want to stay solely in collectives (of course, you could tweak the % of HFEL (for example) a little to gain a little more income )?

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 17th, 2018, 8:00 pm

by richfool

monabri wrote:TMPL,PLI,MUT,HSL,JMF,FGT & CTY ... I think they are very much UK focused so you'll have quite a bit of the portfolio (£70k ?) UK biased. Perhaps this is what you are after but I'd thought I'd flag it up. (and HRI is 56% UK biased I note).

Yes, that too was my main thought when looking at the portfolio. The OP has 7 trusts in the UK sector, albeit that 2 are mid-cap/small caps. That still leaves 5 trusts focussed on the UK. Noted that TMPL tends to have a focus on value stocks and FGT on conviction quality stocks.

Otherwise the portfolio looks well diversified. I didn't see any property trusts/REIT's.

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 17th, 2018, 8:42 pm

by Avantegarde

I did something similar five years ago, though I reinvested the dividends rather than spent them to fund my day-to-day living. Here are a few personal observations.

1) You have 24 trusts. Too many. 15 (max) should do.

2) Don't buy any trusts on a big premium to their net asset value (NAV).

3) Your trusts will, in general, be charging you about between 0.5% and 1% a year of your assets in overhead charges; maybe more. On £200,000 that could be easily £2,000 a year in charges. You can cut that figure drastically (by about 90% in fact) and achieve the same returns, or better, by putting a large chunk of your money in index tracker funds. To help choose, all you need to do is to compare the total return of your prospective trusts for the past five or ten years with those of comparable trackers (eg FTSE All Share, or FTSE World). The results can be very revealing and not to the credit of many trusts.

4) If you want income, pay close attention to the statistics on the AIC website

https://www.theaic.co.uk/aic/find-compa ... statistics which will show you the annual growth in dividends of individual trusts. You would be amazed at how many profess to offer their investors a steady rising income, yet whose dividends fail to rise faster than RPI.

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 18th, 2018, 1:22 am

by tjh290633

I agree that there are probably too many holdings. I would look at the extent of overlaps.

TJH

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 18th, 2018, 9:06 am

by StOmer

Thanks for posting the portfolio. For me it is too many holdings but I like to keep things simple

If you are going to hold this quantity of IT's and do not wish to be monitoring them all the time, I would consider subscribing to the John Baron website for £170 a year.

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 18th, 2018, 9:29 am

by dmukgr

Thanks for the replies so far.

The 3.1% yield that monabri demonstrated agrees with my own calculations - I actually have the portfolio in a Google Sheet that I created that keeps an eye on the dividends and other data - maybe I should have shared that as well, but I do appreciate the effort mobabri went into.

I would like to get the number down as I too think it is too much, but the quantity give a level of comfort - maybe false comfort. Being heavy towards the UK wasn't really my intention, so maybe that is where I can cut things. I was thinking that most of the larger UK companies get their profits from abroad anyway so it didn't matter - but I'll think about how to trim it and repost.

What Avantegarde says is interesting - of course 1% is 2k in charges but I had sort of dismissed it without doing the calculation. I really don't know where to start with trackers though and what tickers to be looking at in order to buy them as shares in an ISA. I know about the nasdaq one - QQQ.l but what are the others?

Finally, with regards to John Baron I see he moves around a fair bit and I wanted something more long term hands off - plus I didn't want to be chasing his purchases and sales all the time.

Thanks again - I appreciate all the feedback as I want to rely on this income so need to get it right

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 18th, 2018, 10:14 am

by OZYU

OP, FWIW, here is my baker's dozen for your purpose, invest gradually, then snooze.

EQQQ Only ETF we feel we must hold, and have held since inception.

FGT

SMT

IPU

CTY

DIVI

WTAN Larger alloc

IBT

BGS

HFEL

EAT

MYI

BRFI Lowish alloc

If your platform does not charge for holding funds consider:

Replacing FGT with Lindsell Train Global Equity

If you want one more, then TRY would be my next choice.

I did not add Berkshire H. which has been massively successful for us, because I think the future might very well be not as good as the past. It is becoming much more difficult for that 'jolly pair' to invest the gigantic sums increasingly available to them.

Adjust allocs for your target yield, which I understand is not too high.

Good luck with your project

Ozyu

PS We have investments in all these, although nowadays I mostly invest in individual Cos.

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 18th, 2018, 10:20 am

by BrummieDave

Not sure I agree that there are too many Trusts in the portfolio if they are giving the investor what they seek and they take no effort whatsoever to manage especially if within an ISA. Also don't agree that you're effectively buying a global tracker, because, quite simply, you aren't.

More importantly however, this thread is not unlike others posted in the "Investment and Unit Trusts" board in as much as the OP has posted a portfolio of ITs and requests comment on them. Rather than offer comment on the selection of ITs one responder suggests buying high yielding shares, and two suggest going passive instead. Had the OP posted on "Investment Strategies" then proposing other approaches would have been appropriate.

Moderator Message:

Deleted text as adds nothing to the thread. Raptor.

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 18th, 2018, 11:05 am

by scotia

I have no wish to fall into either the Index only or Managed only camps, since I can see arguments for both. However, in my view, the USA market is so well researched that it is doubtful whether there is any benefit to be gained by using anything apart from a tracker. My choices are iShares Core S&P 500 ETF (CSP1) and iShares USA Small Cap ETF (CUS1).

For UK smaller companies, I hold several managed funds. The Henderson Smaller Cos IT (HSL) is OK, and it certainly has done well over the past year, but have a look at funds as well as ITs. There are several smaller companies funds that have a better performance over a longer time scale - e.g. Axa Framlington UK Smaller Cos, Amati UK Smaller Cos, Marlborough Special Situations etc. The chief disadvantage I see in Smaller Cos ITs is the discount which varies dramatically with investor sentiment, creating significant volatility. E.G. over the past year the discount for HSL has decreased from 15% to 6% then back to 14% before sitting around 10% at present. I suppose if it is a long term investment, and you are never likely to be forced to sell at a particular time, then volatility is not too important - but it is a nuisance in Smaller Companies ITs.

Having now read BrummieDave's riposte to other posters, I apologise to the original poster for drifting away from the title. I own ITs, ETFs, Funds and Shares, and can see advantages and disadvantages in all. Hence my above contribution.

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 18th, 2018, 11:51 am

by Avantegarde

dmukgr wrote:

Any glaring errors on my thoughts or things I should consider?

Thanks.

Here are the changes I would suggest to trim your portfolio.

1) Drop Temple Bar, PIGIT, Murray Income, JP Morgan Mid Cap and City of London. Replace with a much cheaper FTSE All-share tracker.

2) Drop North American Income and Murray International. Replace with a much cheaper FTSE World ex-UK tracker.

3) Drop RIT Capital Partners altogether.

4) Drop Fidelity China Special Situations (Henderson Far East is big in China anyway).

That is 9 out and 2 in, cutting your portfolio to 17.

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 18th, 2018, 12:25 pm

by dmukgr

Avantegarde wrote:dmukgr wrote:

1) Drop Temple Bar, PIGIT, Murray Income, JP Morgan Mid Cap and City of London. Replace with a much cheaper FTSE All-share tracker.

2) Drop North American Income and Murray International. Replace with a much cheaper FTSE World ex-UK tracker.

3) Drop RIT Capital Partners altogether.

4) Drop Fidelity China Special Situations (Henderson Far East is big in China anyway).

In order to respect the board I'll post elsewhere about the trackers as I think it is worth some investigation.

RIT is a funny one - I like it but no idea why. For that reason alone I think dropping it is a good idea.

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 18th, 2018, 12:28 pm

by dmukgr

Ozyu - I typed up your suggested portfolio and it does look good to me and has a slightly higher yield (around 3.4% I calculated). I'll investigate those choices, especially BGS which stood out but seems to be on a huge premium.

I'm not sure how to go with premiums and discounts to NAV as it feels like trying to time the market which is a bad idea, but it also seems ridiculous to contemplate buying something that you know isn't worth the price being asked

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 18th, 2018, 12:33 pm

by SalvorHardin

Moderator Message:

Text deleted and reference post also edited. Raptor.

I should add that a major reason for investing in multiple investment trusts (as opposed to, say, a single tracker fund) is to reduce the risk to your assets in the event of fraud and/or severe mismanagement at a management company / custodian / registrar. Sure, these are very low-probability events but why take the chance by putting all your eggs in the one basket?

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 18th, 2018, 1:00 pm

by richfool

The key was in the topic title, and the board on which the OP posted. (Investment and Unit Trusts).

I would suggest if he or whoever wanted a discussion about alternative investment products or strategies then he would have posted on Investment Strategies board and used a more open topic title.

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 18th, 2018, 2:08 pm

by Raptor

Moderator Message:

Have edited and removed posts as they add nothing to the discussion and are irrelevant to this thread. Please keep to the OPs topic and posts. Thanks in advance. Raptor.

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 18th, 2018, 2:29 pm

by tjh290633

There is no need to stay away from HYP Practical if you want to talk about an HYP portfolio. If you have a mixture of investments, just keep them separate. If you want to discuss everything, there are places you can do that without problems.

As far as switching to ITs in old age, mentioning that you may be or are making that move is a logical way of saying farewell to that board and picking up the discussion on a more relevant board. The definition of old age is another question, and for some it might be 60, for others 90 or anything in between. I haven't got to the stage of wanting or needing to make the transition, although for some it could be the right medium in youth.

TJH

Re: Having a crack at an Investment Trust Portfolio to live on in old age

Posted: September 18th, 2018, 4:05 pm

by StOmer

dmukgr wrote:RIT is a funny one - I like it but no idea why. For that reason alone I think dropping it is a good idea.

My wife holds RIT which both serves to dampen portfolio performance whilst adding a different element. I would like to add some to my own portfolio but the current premium is too high, we last bought it a few months ago at around -3% discount so perhaps an opportunity will arise again.