Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

ASEI - Aberdeen Standard Equity Income

-

mike

- Lemon Slice

- Posts: 710

- Joined: November 19th, 2016, 1:35 pm

- Has thanked: 42 times

- Been thanked: 431 times

ASEI - Aberdeen Standard Equity Income

I am, like several other posters have mentioned, gradually switching away from HYP to IT, and at present have approx 70% HYP and 30% IT. These ITs are very approximately Overseas:UK in the ratio of 2:1, with the UK ITs being based on large cap, eg CTY, MRCH, SCF & DIG.

ASEI looks a diversification away from large cap as it is around 1/3 each of FTSE 100, FTSE 250 and Small Cap (inc AIM)

Figures look impressive. From the AIC website https://www.theaic.co.uk/companydata/179

- Yield - 4.8%

- 5 year dividend growth - 7.6% pa

- Income reserve - 13 months

Looking back further, the dividend increased through the financial crisis unscathed http://uk.advfn.com/p.php?pid=financials&symbol=asei, and looking forward, the half-year report states the dividend intentions for the rest of their year will give an increase of 5.2% over last year. https://www.investegate.co.uk/aberdeen-standard-eq--asei-/rns/half-year-report/201905220700017382Z/

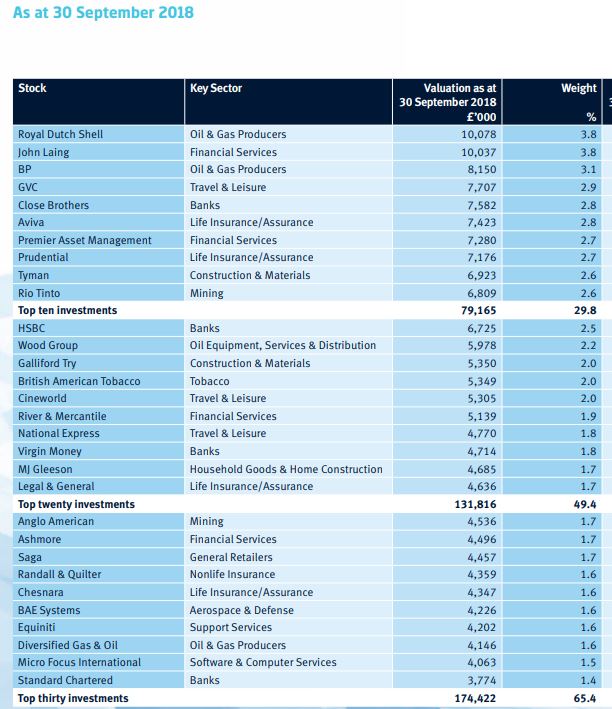

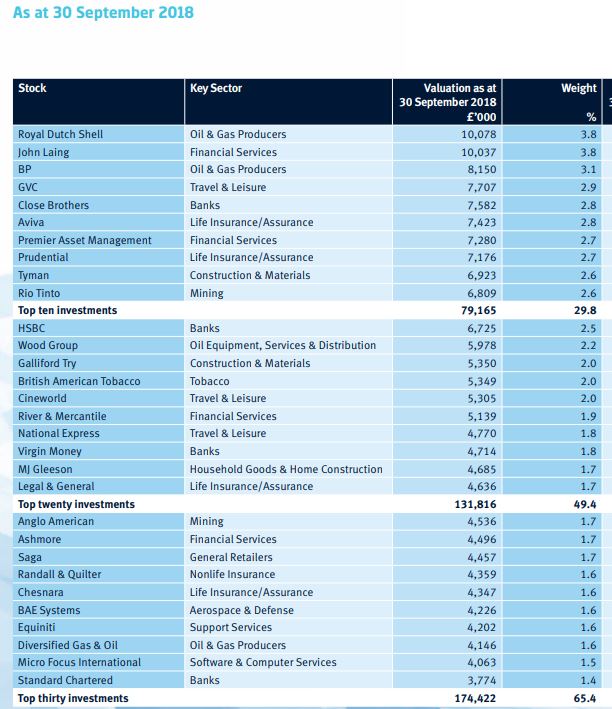

But, perhaps as I have an aversion to too much concentration in one sector, the red flag for me is their concentration in financials at 45% https://www.aberdeenstandard.com/docs?editionid=632e3c7d-b80e-479a-8000-eafa92896a5b

Searching TLF only give three brief references to ASEI, which includes a passing comment how they were impacted during the market fall late last year.

It is reliable income I am after, and historically, ASEI ticks the boxes. But their concentration in financials is concerning.

Has anyone any thoughts ?

ASEI looks a diversification away from large cap as it is around 1/3 each of FTSE 100, FTSE 250 and Small Cap (inc AIM)

Figures look impressive. From the AIC website https://www.theaic.co.uk/companydata/179

- Yield - 4.8%

- 5 year dividend growth - 7.6% pa

- Income reserve - 13 months

Looking back further, the dividend increased through the financial crisis unscathed http://uk.advfn.com/p.php?pid=financials&symbol=asei, and looking forward, the half-year report states the dividend intentions for the rest of their year will give an increase of 5.2% over last year. https://www.investegate.co.uk/aberdeen-standard-eq--asei-/rns/half-year-report/201905220700017382Z/

But, perhaps as I have an aversion to too much concentration in one sector, the red flag for me is their concentration in financials at 45% https://www.aberdeenstandard.com/docs?editionid=632e3c7d-b80e-479a-8000-eafa92896a5b

Searching TLF only give three brief references to ASEI, which includes a passing comment how they were impacted during the market fall late last year.

It is reliable income I am after, and historically, ASEI ticks the boxes. But their concentration in financials is concerning.

Has anyone any thoughts ?

-

MDW1954

- Lemon Quarter

- Posts: 2361

- Joined: November 4th, 2016, 8:46 pm

- Has thanked: 527 times

- Been thanked: 1011 times

Re: ASEI - Aberdeen Standard Equity Income

Several points. First, the ticker ASEI will not give many hits on TLF, as the ticker is new following the recent name change, which took place around last Christmas, from memory.

SLET, the previous ticker, will give you more hits, I would imagine.

I don't hold ASEI at the moment, but will probably do so quite soon, as I pursue a similar strategy of adding to my ITs at the expense of funds and shares.

The 45% in financials is of course concerning, which is why my ITs are well-diversified. On that basis, I'll take the risk.

MDW1954

SLET, the previous ticker, will give you more hits, I would imagine.

I don't hold ASEI at the moment, but will probably do so quite soon, as I pursue a similar strategy of adding to my ITs at the expense of funds and shares.

The 45% in financials is of course concerning, which is why my ITs are well-diversified. On that basis, I'll take the risk.

MDW1954

-

mike

- Lemon Slice

- Posts: 710

- Joined: November 19th, 2016, 1:35 pm

- Has thanked: 42 times

- Been thanked: 431 times

Re: ASEI - Aberdeen Standard Equity Income

MDW1954 wrote:Several points. First, the ticker ASEI will not give many hits on TLF, as the ticker is new following the recent name change, which took place around last Christmas, from memory.

SLET, the previous ticker, will give you more hits, I would imagine.

MDW1954

Thanks for the referral to SLET, and yes, plenty of TLF hits. Not quite sure why the old grey matter didn't think of that; I even own shares in Standard Life so was fully aware that SL morphed into Standard Life Aberdeen last year.

I am also happy to go ahead, but will make sure I sell down some of my directrly held financial shares to keep my overall financial sector exposure (directly held and within ITs) to a reasonable limit. I have set my spreadsheet up to keep an eye on the combined Direct+IT sector totals.

-

MDW1954

- Lemon Quarter

- Posts: 2361

- Joined: November 4th, 2016, 8:46 pm

- Has thanked: 527 times

- Been thanked: 1011 times

Re: ASEI - Aberdeen Standard Equity Income

mike wrote:Thanks for the referral to SLET, and yes, plenty of TLF hits. Not quite sure why the old grey matter didn't think of that; I even own shares in Standard Life so was fully aware that SL morphed into Standard Life Aberdeen last year.

Easily done, although the fact sheet that you linked to provided a clue.

It has a solid enough reputation, and the move now means that it can be bought within the popular Aberdeen share plan wrapper, which is free of dealing commission or account holding fees.

MDW1954

-

richfool

- Lemon Quarter

- Posts: 3515

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1200 times

- Been thanked: 1283 times

Re: ASEI - Aberdeen Standard Equity Income

MDW1954 wrote:mike wrote:Thanks for the referral to SLET, and yes, plenty of TLF hits. Not quite sure why the old grey matter didn't think of that; I even own shares in Standard Life so was fully aware that SL morphed into Standard Life Aberdeen last year.

Easily done, although the fact sheet that you linked to provided a clue.

It has a solid enough reputation, and the move now means that it can be bought within the popular Aberdeen share plan wrapper, which is free of dealing commission or account holding fees.

MDW1954

As a holder of ASEI, I can't say I am over-impressed by its capital performance. It was amongst the bigger fallers in my portfolio in Dec 2018 and still hasn't fully recovered, and it's towards the bottom part of the UK G&I performance tables, (on page 2).

https://citywire.co.uk/funds_insider/in ... ePeriod=12

MUT has performed best amongst my UK G&I holdings.

-

midgesgalore

- Lemon Slice

- Posts: 257

- Joined: November 5th, 2016, 12:02 am

- Has thanked: 273 times

- Been thanked: 72 times

Re: ASEI - Aberdeen Standard Equity Income

mike wrote:...

But, perhaps as I have an aversion to too much concentration in one sector, the red flag for me is their concentration in financials at 45% https://www.aberdeenstandard.com/docs?editionid=632e3c7d-b80e-479a-8000-eafa92896a5b

...

I don't have a position in ASEI however I don't think it alone in ramping up exposure to financials.

A common inclusion in posters IT portfolio is HFEL, Henderson Far East Income Ltd.

Their financials exposure is 39.5% and their exposure to China is 24.5% - as per their 2018 annual report.

These are pretty big commitments too yet seems to be very popular hereabouts.

I hold HFEL but certainly not large dollops of it for these reasons - despite the high yield.

midgesgalore

-

ffacoffipawb64

- Lemon Pip

- Posts: 71

- Joined: May 26th, 2019, 11:54 am

- Has thanked: 10 times

- Been thanked: 17 times

Re: ASEI - Aberdeen Standard Equity Income

ASEI is the worst performer in my SIPP.

Currently down about 14% ignoring dividends, mostly in the last month or so. Not sure why, is there something bad under the bonnet here?

Down about 5% including dividends as have held for about 2 years. Not a disaster, just expected better. Paid nearly £5 a share early last year for the last tranche to bring me up to my full holding of 8,500 shares

Currently down about 14% ignoring dividends, mostly in the last month or so. Not sure why, is there something bad under the bonnet here?

Down about 5% including dividends as have held for about 2 years. Not a disaster, just expected better. Paid nearly £5 a share early last year for the last tranche to bring me up to my full holding of 8,500 shares

-

richfool

- Lemon Quarter

- Posts: 3515

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1200 times

- Been thanked: 1283 times

Re: ASEI - Aberdeen Standard Equity Income

ffacoffipawb64 wrote:ASEI is the worst performer in my SIPP.

Currently down about 14% ignoring dividends, mostly in the last month or so. Not sure why, is there something bad under the bonnet here?

Down about 5% including dividends as have held for about 2 years. Not a disaster, just expected better. Paid nearly £5 a share early last year for the last tranche to bring me up to my full holding of 8,500 shares

Yep, ASEI is my worst performer too, down c 12%. Its largest holding is John Laing, followed by Shell and BP, some financials, and a couple miners in the 20 holdings. I wonder if its poor performance is down to its holdings of smaller and mid cap stocks.

-

monabri

- Lemon Half

- Posts: 8415

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1544 times

- Been thanked: 3439 times

Re: ASEI - Aberdeen Standard Equity Income

midgesgalore wrote:A common inclusion in posters IT portfolio is HFEL, Henderson Far East Income Ltd.

Their financials exposure is 39.5% and their exposure to China is 24.5% - as per their 2018 annual report.

These are pretty big commitments too yet seems to be very popular hereabouts.

I hold HFEL but certainly not large dollops of it for these reasons - despite the high yield.

midgesgalore

The HFEL annual report (2018) shows a pie chart on page 9 where it states "financials 39.6%" - this is based on "income".

However, when ones looks at the actual holdings as shown on pages 10 & 11, the percentage of financials by "valuation" seems to be 28.4% (rounded up a little).

-

midgesgalore

- Lemon Slice

- Posts: 257

- Joined: November 5th, 2016, 12:02 am

- Has thanked: 273 times

- Been thanked: 72 times

Re: ASEI - Aberdeen Standard Equity Income

monabri wrote:midgesgalore wrote:A common inclusion in posters IT portfolio is HFEL, Henderson Far East Income Ltd.

Their financials exposure is 39.5% and their exposure to China is 24.5% - as per their 2018 annual report.

These are pretty big commitments too yet seems to be very popular hereabouts.

I hold HFEL but certainly not large dollops of it for these reasons - despite the high yield.

midgesgalore

The HFEL annual report (2018) shows a pie chart on page 9 where it states "financials 39.6%" - this is based on "income".

However, when ones looks at the actual holdings as shown on pages 10 & 11, the percentage of financials by "valuation" seems to be 28.4% (rounded up a little).

Yes, thanks monabri, I see that now and exposure up from 21.6% on the previous year. It will not be encouraging me to top up though.

midgesgalore

-

ffacoffipawb64

- Lemon Pip

- Posts: 71

- Joined: May 26th, 2019, 11:54 am

- Has thanked: 10 times

- Been thanked: 17 times

Re: ASEI - Aberdeen Standard Equity Income

There seems to be something wrong with this IT. Poor performance but its investments look OK. Very odd.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: ASEI - Aberdeen Standard Equity Income

Surely you can say the same about all the UK equity income ITs. It has the usual selection of UK income shares, quite like say Edinburgh IT, another which has had a very poor capital performance. If you run an equity portfolio, you will understand the problem.

Dod

Dod

-

richfool

- Lemon Quarter

- Posts: 3515

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1200 times

- Been thanked: 1283 times

Re: ASEI - Aberdeen Standard Equity Income

ffacoffipawb64 wrote:There seems to be something wrong with this IT. Poor performance but its investments look OK. Very odd.

It does seem to live in a kennel (become a dog). I sold out of my holding a few months back. The yield was good, but not the capital appreciation. On the latest Citywire tables it is 26 out of 28 on the 1 year performance tables and similar positions over 3 and 5 years..

https://citywire.co.uk/funds_insider/in ... ePeriod=12

-

monabri

- Lemon Half

- Posts: 8415

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1544 times

- Been thanked: 3439 times

Re: ASEI - Aberdeen Standard Equity Income

If one casts one's eye over the holdings we see Aviva, Pru, Close Bros, GFRD, Wood Group,SAGA & others. Others, such as RIO & LGEN, are coming off recent share price highs. Individually they have under performed versus the FTSE as a whole. I think it is just "a sum of the parts". As Dod says, the same is true for other UK funds (e.g. EDIN - nice income reserve though according to the AIC).

-

Alaric

- Lemon Half

- Posts: 6059

- Joined: November 5th, 2016, 9:05 am

- Has thanked: 20 times

- Been thanked: 1413 times

Re: ASEI - Aberdeen Standard Equity Income

monabri wrote: Individually they have under performed versus the FTSE as a whole. I think it is just "a sum of the parts". As Dod says, the same is true for other UK funds (e.g. EDIN - nice income reserve though according to the AIC).

The Lindsell Train fund leading that sector for returns has a much more concentrated portfolio including stalwarts such as Unilever and Diageo, both absent from the top 30 in ASEI.

Being dependent on fewer stocks increases the risk of an individual failure but also increases the chance of major success. Unilever and Diageo both have income yields below that of the FTSE 100, so funds orientated to towards income may not consider them.

-

ffacoffipawb64

- Lemon Pip

- Posts: 71

- Joined: May 26th, 2019, 11:54 am

- Has thanked: 10 times

- Been thanked: 17 times

Re: ASEI - Aberdeen Standard Equity Income

ASEI is down 20% in a couple of years, FTSE nowhere near that. Discount has widened a bit but I dont think that explains it.

It is 1/15 of my SIPP and 1/32 of my ISA.

EDIN is 1/32 of my ISA.

Half my gains in both portfolios gone in just over a week.

Makes me wary of pressing the RE button of FIRE much as I'd love to.

DB pension kicking in next month of £7k pa. Bit early but break even age is 85 so worth taking. Early retirement factor was only 3% per annum simple, pro rata. NRA 62 taking at just over 55 factor is approx 20%. Salary sacrifice into my DC pension has been increased. Probably not great as I am over LTA but the bigger pension pot I get the better. PCLS of £48k is going on deposit awaiting ISA investment next tax year.

It is 1/15 of my SIPP and 1/32 of my ISA.

EDIN is 1/32 of my ISA.

Half my gains in both portfolios gone in just over a week.

Makes me wary of pressing the RE button of FIRE much as I'd love to.

DB pension kicking in next month of £7k pa. Bit early but break even age is 85 so worth taking. Early retirement factor was only 3% per annum simple, pro rata. NRA 62 taking at just over 55 factor is approx 20%. Salary sacrifice into my DC pension has been increased. Probably not great as I am over LTA but the bigger pension pot I get the better. PCLS of £48k is going on deposit awaiting ISA investment next tax year.

-

monabri

- Lemon Half

- Posts: 8415

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1544 times

- Been thanked: 3439 times

Re: ASEI - Aberdeen Standard Equity Income

[quote="monabri"]If one casts one's eye over the holdings we see Aviva, Pru, Close Bros, GFRD, Wood Group,SAGA & others. Others, such as RIO & LGEN, are coming off recent share price highs. Individually they have under performed versus the FTSE as a whole. I think it is just "a sum of the parts". As Dod says, the same is true for other UK funds (e.g. EDIN - nice income reserve though according to the AIC).

[quote/]

Er, I suppose it doesn't explain the discount to NAV if it's the sum of its parts!...?

[quote/]

Er, I suppose it doesn't explain the discount to NAV if it's the sum of its parts!...?

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: ASEI - Aberdeen Standard Equity Income

On this subject, these UK oriented income funds have just the same problem as the average HYP, the difference being that the HYP (per the HYP - Practical guidance) encourages us to ignore or at least play down capital changes. ITs cannot afford to do that and so we get the reaction of the OP, which I totally agree with. I have written to the Chairman of Edinburgh IT to suggest that his Board considers paying at least part of the dividend from realised capital gains as is now permitted. That would give the manager more scope to move way from simply high yield shares to something more like a Total Shareholder Return. There is no reason why they could not do that, and the same logic applies to ASEI I would imagine.

Dod

Dod

-

richfool

- Lemon Quarter

- Posts: 3515

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1200 times

- Been thanked: 1283 times

Re: ASEI - Aberdeen Standard Equity Income

Dod101 wrote:On this subject, these UK oriented income funds have just the same problem as the average HYP, the difference being that the HYP (per the HYP - Practical guidance) encourages us to ignore or at least play down capital changes. ITs cannot afford to do that and so we get the reaction of the OP, which I totally agree with. I have written to the Chairman of Edinburgh IT to suggest that his Board considers paying at least part of the dividend from realised capital gains as is now permitted. That would give the manager more scope to move way from simply high yield shares to something more like a Total Shareholder Return. There is no reason why they could not do that, and the same logic applies to ASEI I would imagine.

Dod

Yes, Dod makes a good point. Because these types of trusts target income, it restricts them to certain types of stocks, (stocks which may not be benefiting from capital appreciation during certain periods). I have deliberately opted for some IT's which pay a dividend yield partly from capital specifically because they target a broader range of stocks, including growth stocks. Whilst not in the UK sector, JPGI (JP Morgan Grth & Inc trust) is one such trust in the Global G & I sector. Whilst I am not aware of any that do so in the UK G&I sector, I believe EAT [European Assets trust] and JAI [JP Morgan Asian Income trus] also do similarly.

-

BrummieDave

- Lemon Slice

- Posts: 818

- Joined: November 6th, 2016, 7:29 pm

- Has thanked: 200 times

- Been thanked: 378 times

Re: ASEI - Aberdeen Standard Equity Income

richfool wrote:Dod101 wrote:On this subject, these UK oriented income funds have just the same problem as the average HYP, the difference being that the HYP (per the HYP - Practical guidance) encourages us to ignore or at least play down capital changes. ITs cannot afford to do that and so we get the reaction of the OP, which I totally agree with. I have written to the Chairman of Edinburgh IT to suggest that his Board considers paying at least part of the dividend from realised capital gains as is now permitted. That would give the manager more scope to move way from simply high yield shares to something more like a Total Shareholder Return. There is no reason why they could not do that, and the same logic applies to ASEI I would imagine.

Dod

Yes, Dod makes a good point. Because these types of trusts target income, it restricts them to certain types of stocks, (stocks which may not be benefiting from capital appreciation during certain periods). I have deliberately opted for some IT's which pay a dividend yield partly from capital specifically because they target a broader range of stocks, including growth stocks. Whilst not in the UK sector, JPGI (JP Morgan Grth & Inc trust) is one such trust in the Global G & I sector. Whilst I am not aware of any that do so in the UK G&I sector, I believe EAT [European Assets trust] and JAI [JP Morgan Asian Income trus] also do similarly.

This, with its table at the bottom of the article, will help: https://www.investorschronicle.co.uk/fu ... m-capital/

Return to “Investment Trusts and Unit Trusts”

Who is online

Users browsing this forum: No registered users and 79 guests