Page 1 of 5

Temple Bar

Posted: August 18th, 2020, 11:11 am

by Dod101

The latest offering from the current managers tells us that they have been buying inter alia, Rolls Royce, Carnival, Easy jet and Weatherspoon. Nothing like looking to the future.

They also say that they have three themes namely

Construction

Travel and

General such as banks, and oil and gas.

Nothing like being contrarian and taking a long term view.

Dod

Re: Temple Bar

Posted: August 18th, 2020, 11:36 am

by G3lc

My understanding is that these managers have teams of researchers and analysis at their disposal, the same or similar to all the other manager, so how does it work that some seem to pick total losers, are they just trying to be different for the sake of it - I hold TMPL so hope they are on the level and know what they are doing - or is it like everything else to do with investing timing and luck.

Re: Temple Bar

Posted: August 19th, 2020, 3:37 pm

by Noiseboy

Do you still hold Dod? Can't say I'm that impressed with the latest investments!

Re: Temple Bar

Posted: August 30th, 2020, 10:02 pm

by ADrunkenMarcus

Noiseboy wrote:Do you still hold Dod? Can't say I'm that impressed with the latest investments!

Performance had been looking up for a brief period, in 2019.

However, I fear a dividend cut is on the way and we need to bear in mind that the share price has fallen very steeply which meant it had to basically double to get back to where it was. It was invested in what turned out to be the worst sectors and then the Board forced the manager to reduce gearing at exactly the wrong moment, selling securities on the way down. At least the share price is back above my 2001 purchase price!

Best wishes

Mark.

Re: Temple Bar

Posted: August 30th, 2020, 10:21 pm

by richfool

Dod101 wrote:The latest offering from the current managers tells us that they have been buying inter alia, Rolls Royce, Carnival, Easy jet and Weatherspoon. Nothing like looking to the future.

They also say that they have three themes namely

Construction

Travel and

General such as banks, and oil and gas.

Nothing like being contrarian and taking a long term view.

Dod

All firmly on my "avoid" list.

I can see merit in construction, but not the others.

Accepted they must be looking at the long term (and are contrarian), but I would like to see that there was definitely light at the end of those tunnels, before I would consider investing in those sectors or stocks.

Re: Temple Bar

Posted: August 31st, 2020, 8:51 am

by Dod101

Noiseboy wrote:Do you still hold Dod? Can't say I'm that impressed with the latest investments!

Sorry. I missed the question. I still hold but not for the choice of investments. The directors have said that they are looking at alternative managers and I am waiting to see what happens. It looks as if everyone is doing that as well since the share price seems stuck at around £7.30.

Surely we ought to get some sort of announcement before too long.

Dod

Re: Temple Bar

Posted: August 31st, 2020, 10:05 am

by monabri

ADrunkenMarcus wrote:

Performance had been looking up for a brief period, in 2019.

However, I fear a dividend cut is on the way

(I seem to vaguely remember that there was "chatter in the press" trying to bull up the TMPL shareprice around 2019....?)

I do not hold TMPL but do have a "reasonable" chunk of change in Merchants. Both have suffered over the last year in terms of shareprice falls. Possibly the market is pricing in the effect of Covid 19 and a future dividend cut (but not so much Brexit fear based unless that was already priced in).

I believe that a dividend cut of ~20% might be on the cards for many ITs and that the dividend increases going forward after a cut would be quite pedestrian ( a bit of simple spreadsheet modelling making some v basic assumptions). Recovery might take quite a few years ( guess....5+ years, but who knows).

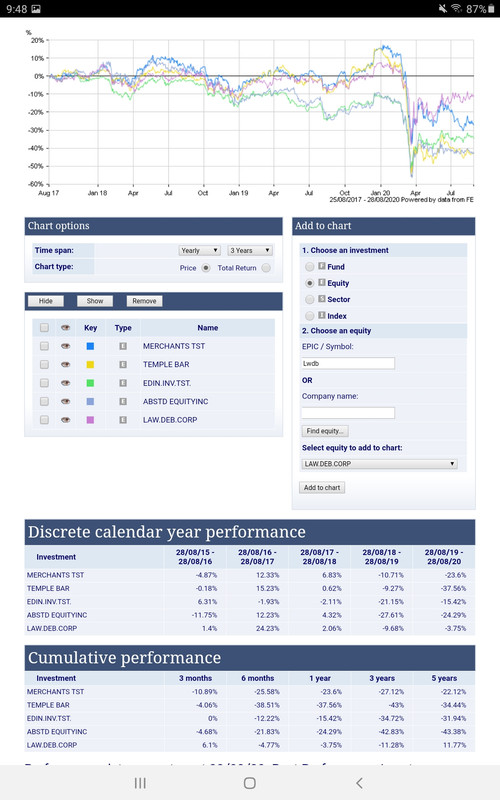

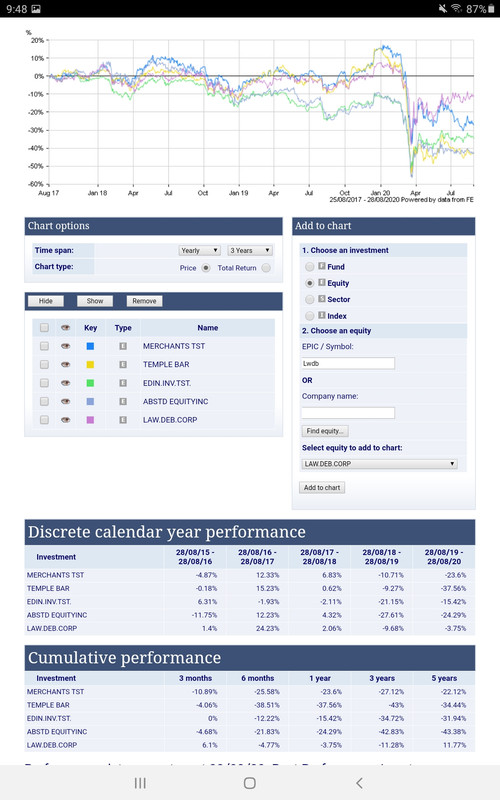

Interesting to bring in Law Debenture, LWDB, for comparison ( "reserve" as defined by the AIC of over 2)....plus Edinburgh (EDIN)and Aberdeen Standard ( ASEI).

Using the simple & free to use HL comparator tool, here's a plot of shareprice over the lsst 3 years.

https://www.hl.co.uk/funds/fund-discoun ... ion/chartsLWDB is holding up in shareprice (and total return although not shown here). TMPL and ASEI are both barking equally loudly mutt-wise. Merchants is in 2nd place ( blue curve) and EDIN ( green curve) in 3rd. A plot of total return would tell the same story (not shown).

What tools does an IT manager have in their armoury to avoid have to make divi cuts? That might be a topic of conversation...?

Re: Temple Bar

Posted: August 31st, 2020, 10:38 am

by Dod101

monabri wrote:What tools does an IT manager have in their armoury to avoid have to make divi cuts? That might be a topic of conversation...?

Well surely we know the answer to that as it has been discussed several times. After using current revenue income , there will usually be Revenue Reserves and the ability to use realised capital reserves.

Dod

Re: Temple Bar

Posted: August 31st, 2020, 1:05 pm

by monabri

Dod101 wrote:monabri wrote:What tools does an IT manager have in their armoury to avoid have to make divi cuts? That might be a topic of conversation...?

Well surely we know the answer to that as it has been discussed several times. After using current revenue income , there will usually be Revenue Reserves and the ability to use realised capital reserves.

Dod

I'd put those assumptions into the modelling ( I haven't discussed/ shared the results other than the expectation of dividend reductions of ~20%). I was thinking of increased gearing of a trust, assuming the trust allows gearing and remains within it's limits ( or could they "flex" the borrowing limits with permission? ). Of course, the return would need to be higher than the cost of borrowing.

The trust might decide to sell down existing "cutters" and stragglers and replace with an increased holding in companies paying a divi ( e.g. sell BT, buy LGEN, sell PSON, buy RIO).

Re: Temple Bar

Posted: August 31st, 2020, 1:47 pm

by ADrunkenMarcus

monabri wrote:The trust might decide to sell down existing "cutters" and stragglers and replace with an increased holding in companies paying a divi ( e.g. sell BT, buy LGEN, sell PSON, buy RIO).

I think that this might be precisely the dangers with some trusts insofar as they go yield chasing.

Best wishes

Mark.

Re: Temple Bar

Posted: August 31st, 2020, 2:37 pm

by Dod101

monabri wrote:I'd put those assumptions into the modelling ( I haven't discussed/ shared the results other than the expectation of dividend reductions of ~20%). I was thinking of increased gearing of a trust, assuming the trust allows gearing and remains within it's limits ( or could they "flex" the borrowing limits with permission? ). Of course, the return would need to be higher than the cost of borrowing.

The trust might decide to sell down existing "cutters" and stragglers and replace with an increased holding in companies paying a divi ( e.g. sell BT, buy LGEN, sell PSON, buy RIO).

Who knows? But the sort of thing that you are suggesting in general will increase the risk parameters within the trust and I think most IT Boards are more likely to cut the dividend than do that, especially in the current circumstances. Frankly I would hope so.

Dod

Re: Temple Bar

Posted: September 2nd, 2020, 5:44 pm

by Parky

Stock exchange announcement from Temple Bar today. Let's hope that "in due course" is soon.

"As stated in previous announcements on 20 April and 9 June 2020, the Board of Temple Bar has instigated a review of its investment management arrangements. It is anticipated that this review will be completed shortly, and the publication of the interim results has been delayed in order to publish the results of the review and the interim results together. The interim results will therefore be published in due course."

Re: Temple Bar

Posted: September 2nd, 2020, 8:52 pm

by ADrunkenMarcus

Parky wrote:Stock exchange announcement from Temple Bar today. Let's hope that "in due course" is soon.

Yes indeed.

I worked out today that, although the share price has risen on a nominal basis since my December 2001 purchase, it would need to be 900p or so simply to have kept pace with Consumer Price Inflation! Thank goodness for dividends.

best wishes

Mark.

Re: Temple Bar

Posted: September 3rd, 2020, 12:01 pm

by mike

ADrunkenMarcus wrote:Thank goodness for dividends.

And speaking of the devil ....

The Board of Temple Bar has today declared a second interim dividend for the year ending 31 December 2020 of 11.0p per ordinary share, to be paid on 30 September 2020 to those Shareholders on the register at the close of business on 11 September 2020.

Whilst the second interim dividend has been maintained compared to the previous year, Shareholders should not assume from this that the total dividend for the year as a whole will be similarly maintained.

https://www.investegate.co.uk/temple-bar-inv-tst--tmpl-/prn/second-interim-dividend/20200903090543PE08B/I think that the

"should not assume from this that the total dividend for the year as a whole will be similarly maintained" bit is rather tongue-in-cheek ! And a great contrast from other ITs stating that their revenue reserves are to be used in the current circumstances.

Re: Temple Bar

Posted: September 3rd, 2020, 12:12 pm

by Dod101

mike wrote:ADrunkenMarcus wrote:Thank goodness for dividends.

And speaking of the devil ....

The Board of Temple Bar has today declared a second interim dividend for the year ending 31 December 2020 of 11.0p per ordinary share, to be paid on 30 September 2020 to those Shareholders on the register at the close of business on 11 September 2020.

Whilst the second interim dividend has been maintained compared to the previous year, Shareholders should not assume from this that the total dividend for the year as a whole will be similarly maintained.

https://www.investegate.co.uk/temple-bar-inv-tst--tmpl-/prn/second-interim-dividend/20200903090543PE08B/I think that the

"should not assume from this that the total dividend for the year as a whole will be similarly maintained" bit is rather tongue-in-cheek ! And a great contrast from other ITs stating that their revenue reserves are to be used in the current circumstances.

I rather think that we will probably see a complete change in the style of investing from Temple Bar if/when they appoint new managers and that that will probably include the dividend policy. This seems to be a warning. Strange though that they cannot be a bit clearer about the timing of an announcement.

Dod

Re: Temple Bar

Posted: September 3rd, 2020, 7:22 pm

by ADrunkenMarcus

Dod101 wrote:I rather think that we will probably see a complete change in the style of investing from Temple Bar if/when they appoint new managers and that that will probably include the dividend policy.

If the new style results in the share price being higher in real terms after another 19 years, then that would be an improvement.

Best wishes

Mark.

Re: Temple Bar

Posted: September 3rd, 2020, 9:37 pm

by Wizard

According to HL, almost 10% of the fund is invested in 2020 Gilts, so presumably they will be looking for some chunky new purchases pretty soon.

Re: Temple Bar

Posted: September 4th, 2020, 10:10 am

by Avantegarde

This trust appears to be in deep trouble. Actually, it IS in deep trouble. Huge share price drop this year; manager has departed; dividend warning; results delayed *whoop, whoop, whoop, warning, warning, warning, nee-naw, nee-naw, nee-naw*; "review" of "prospects" to be published. Anyone might think this was a prelude to selling out or shutting up shop.

Re: Temple Bar

Posted: September 4th, 2020, 10:24 am

by Dod101

Avantegarde wrote:This trust appears to be in deep trouble. Actually, it IS in deep trouble. Huge share price drop this year; manager has departed; dividend warning; results delayed *whoop, whoop, whoop, warning, warning, warning, nee-naw, nee-naw, nee-naw*; "review" of "prospects" to be published. Anyone might think this was a prelude to selling out or shutting up shop.

You are right unfortunately. I suppose the lack of action and the warning is whilst they sort out a new manager and probably new management company. It has been on hold for some months now.

Dod

Re: Temple Bar

Posted: September 4th, 2020, 11:50 am

by ADrunkenMarcus

Avantegarde wrote:Anyone might think this was a prelude to selling out or shutting up shop.

RIP Temple Bar 1926-2020?

Best wishes

Mark.