Arborbridge wrote:ReallyVeryFoolish wrote:FWIW, Questor is cautiously positive on Temple Bar and negative on Edinburgh today. Questor isn't 100 per cent reliable but in my experience is worth weighing when making decisions this.

RVF

It woudl be interesting to compare the two portfolios - I suspect they are similar, but with different complexions.

The trouble for all of those assessing this situation is that both IT managements and portfolios are in a state of rapid flux.

Arb

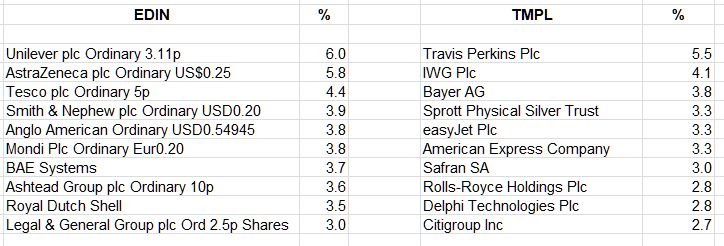

I'd say EDIN and TMPL are quite different based on their top holding (data from latest available factsheets on HL)

I was hoping to use the Morningstar "X Ray tool" but it appears to not be working (it used to work well, not that long ago!).