Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

topups or ARBIT

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

topups or ARBIT

Arb's income IT portfolio has received a dabble more capital from dividends which have been received.

Today I bought more EDIN and MYI. The four " big hitters" for income in ArbIT are CTY, EDIN,HFEL,MYI, acounting for 38% of income - broadly, equally.

The portfolio looks like this, ranged in capital weight:-

HINT was added fairly recently as the yield seemed reasonable and gives some more international flavour. I also have a small holding of VHYL, not shown, as a sort of one-stop experiment.

As many of you will know I also have a HYP, and the ArbIT to HYP ratio is about 1:1.27 though at the moment the income produced is looking roughly similar. This is, until ordinary shares restore more of their dividends, or until ITs run out of reserves!

Arb.

Arb.

Today I bought more EDIN and MYI. The four " big hitters" for income in ArbIT are CTY, EDIN,HFEL,MYI, acounting for 38% of income - broadly, equally.

The portfolio looks like this, ranged in capital weight:-

HINT was added fairly recently as the yield seemed reasonable and gives some more international flavour. I also have a small holding of VHYL, not shown, as a sort of one-stop experiment.

As many of you will know I also have a HYP, and the ArbIT to HYP ratio is about 1:1.27 though at the moment the income produced is looking roughly similar. This is, until ordinary shares restore more of their dividends, or until ITs run out of reserves!

Arb.

Arb.

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3439 times

Re: topups or ARBIT

Based on your recent graph viewtopic.php?p=335429#p335429 it would seem that ARBIT is steaming ahead. ArbHyp manager would be "in trouble" .

In terms of IT selection, did the reserve level have an influence (esp. EDIN at 1.65 years AIC definition)?

In terms of IT selection, did the reserve level have an influence (esp. EDIN at 1.65 years AIC definition)?

-

richfool

- Lemon Quarter

- Posts: 3519

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1201 times

- Been thanked: 1288 times

Re: topups or ARBIT

Arborbridge wrote:Arb's income IT portfolio has received a dabble more capital from dividends which have been received.

Today I bought more EDIN and MYI. The four " big hitters" for income in ArbIT are CTY, EDIN,HFEL,MYI, acounting for 38% of income - broadly, equally.

The portfolio looks like this, ranged in capital weight:-

HINT was added fairly recently as the yield seemed reasonable and gives some more international flavour. I also have a small holding of VHYL, not shown, as a sort of one-stop experiment.

As many of you will know I also have a HYP, and the ArbIT to HYP ratio is about 1:1.27 though at the moment the income produced is looking roughly similar. This is, until ordinary shares restore more of their dividends, or until ITs run out of reserves!

Arb.

Arb.

Thank you for posting your ARBIT portfolio. I hold several of the same IT's for similar (income focused) reasons (as listed below).

May I ask, to what extent, if any, do you give any consideration to the capital appreciation or depreciation of the trusts within that "income" portfolio? I ask, because I hold a number of the same trusts, but note that whilst their dividend yield is good, they have performed poorly in terms of capital appreciation. For example: MYI, HFEL, JETI (TMPL) & perhaps even HINT.

Disc: of your above holdings, I hold: HFEL, SOI, MRC, JETI, FGT & HINT. I sold MYI and TMPL early this year.

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: topups or ARBIT

monabri wrote:Based on your recent graph viewtopic.php?p=335429#p335429 it would seem that ARBIT is steaming ahead. ArbHyp manager would be "in trouble" .

In terms of IT selection, did the reserve level have an influence (esp. EDIN at 1.65 years AIC definition)?

I've given the ArbHYP manager a warning!!! He might lose some funds under management.

Selecting the IT top up I usually make a table of the available ITs in the account with the factors which interest me: yield, discount, cover, NAV growth or otherwise, and XD date.

I just eyeball those factors and see how it feels, and yes, the cover was an important factor. I'm taking the manager change at EDIN as being positive, too. This is the third topup to EDIN since April - though there have been topups to most other ITs along the way.

Arb.

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: topups or ARBIT

richfool wrote:Thank you for posting your ARBIT portfolio. I hold several of the same IT's for similar (income focused) reasons (as listed below).

May I ask, to what extent, if any, do you give any consideration to the capital appreciation or depreciation of the trusts within that "income" portfolio? I ask, because I hold a number of the same trusts, but note that whilst their dividend yield is good, they have performed poorly in terms of capital appreciation. For example: MYI, HFEL, JETI (TMPL) & perhaps even HINT.

Disc: of your above holdings, I hold: HFEL, SOI, MRC, JETI, FGT & HINT. I sold MYI and TMPL early this year.

That's an interesting question. In general it's a factor which buzzes away in the background - I definitely check NAV changes over 3,5,10 years but they don't take pride of place in most topup decisions. I do keep my own table of XIRR for all the ITs I own. This spread sheet records (twice yearly) in a rather crude way, whether a given trust is above, below or equal to, the median XIRR of the whole portfolio. If below, the column under the given date shows -1, if above, +1, if equal to 0. After some years, if an IT shows it has a performance consistently below the average, it will be sold.

However, beware because things change all the time. For example, I sold Murray Income after many years of noticing that its performance was sub-par only to find that since Brexit it has become relatively much better than some I retained!

No method is foolproof, and I am reluctant to make changes for the sake of it. Generally, for pooled investments, I would say a period of bum performance is probably an opportunity, though reverting to the mean can take years. As the Keynes adage goes, "Markets can stay irrational longer than you can stay solvent" - as poor Tony Dye discovered. He was eventually "right"; but lost his job, his investors lost money and died before he could know it.

Arb.

Sold in the past year or two, include BRWM, BERI, CNY, UKDV.

-

Avantegarde

- Lemon Slice

- Posts: 269

- Joined: January 29th, 2018, 10:13 pm

- Been thanked: 159 times

Re: topups or ARBIT

richfool wrote:Arborbridge wrote:Arb's income IT portfolio has received a dabble more capital from dividends which have been received.

Today I bought more EDIN and MYI. The four " big hitters" for income in ArbIT are CTY, EDIN,HFEL,MYI, acounting for 38% of income - broadly, equally.

The portfolio looks like this, ranged in capital weight:-

HINT was added fairly recently as the yield seemed reasonable and gives some more international flavour. I also have a small holding of VHYL, not shown, as a sort of one-stop experiment.

As many of you will know I also have a HYP, and the ArbIT to HYP ratio is about 1:1.27 though at the moment the income produced is looking roughly similar. This is, until ordinary shares restore more of their dividends, or until ITs run out of reserves!

Arb.

Arb.

Thank you for posting your ARBIT portfolio. I hold several of the same IT's for similar (income focused) reasons (as listed below).

May I ask, to what extent, if any, do you give any consideration to the capital appreciation or depreciation of the trusts within that "income" portfolio? I ask, because I hold a number of the same trusts, but note that whilst their dividend yield is good, they have performed poorly in terms of capital appreciation. For example: MYI, HFEL, JETI (TMPL) & perhaps even HINT.

Disc: of your above holdings, I hold: HFEL, SOI, MRC, JETI, FGT & HINT. I sold MYI and TMPL early this year.

Many of the trusts in that list have had deplorably poor capital returns in recent years. No better than, or even worse than, a relevant and much cheaper, index tracker. Does the OP actually rely on the income to live or just reinvest it in shares? If reinvestment takes place, then a portfolio with much better total returns could be constructed. I know because I used to hold some of the trusts in that list and have progressively dumped them over the years they failed to perform to my satisfaction (I don't need their income, yet). Which begs an interesting question: why, exactly, are high yielders such poor performers, as measured by total returns?

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: topups or ARBIT

Avantegarde wrote:Many of the trusts in that list have had deplorably poor capital returns in recent years. No better than, or even worse than, a relevant and much cheaper, index tracker. Does the OP actually rely on the income to live or just reinvest it in shares? If reinvestment takes place, then a portfolio with much better total returns could be constructed. I know because I used to hold some of the trusts in that list and have progressively dumped them over the years they failed to perform to my satisfaction (I don't need their income, yet). Which begs an interesting question: why, exactly, are high yielders such poor performers, as measured by total returns?

Points taken - and one can easily find ITs with better go-faster stripes, especially over a given period such as "in recent years" - but I'm not defending any of these choices, least of all on TR grounds.

They are providing me with a reasonable income which feeds my pension requirements. As I mentioned, I do "morph" the holdings over time, but slowly, so I'm always open to ideas. If I was pot building, I wouldn't go for these and would take no notice of yield.

You final question is interesting, and I don't pretend know the answer - it's above my pay grade - but I've also noticed this seems true. Look at the average return of income bearing ITs and compare with "All UK companies" and the latter is usually higher.

Arb.

-

richfool

- Lemon Quarter

- Posts: 3519

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1201 times

- Been thanked: 1288 times

Re: topups or ARBIT

Arb, Thanks for your reply and your input and also Avantgarde.

JETI is a typical case in question. My holding there is still -12%, but, it is paying a dividend yield of some 5.5% and indeed was yielding 6% until recently when its SP crawled back up to 120p. So it's a trust that I hold (onto) for income, but keep thinking I should liquidate at a suitable opportunity because of its poor capital performance. Two things pulling in opposite directions.

During the last year I offloaded (sold) MYI completely, as whilst it provided a good dividend yield, the capital value continued to remain under water (over periods as far back as 5 years). My holding of JGGI, in contrast, is up 26% (and still yields c 3.5-4.0% albeit supported from capital).

JETI is a typical case in question. My holding there is still -12%, but, it is paying a dividend yield of some 5.5% and indeed was yielding 6% until recently when its SP crawled back up to 120p. So it's a trust that I hold (onto) for income, but keep thinking I should liquidate at a suitable opportunity because of its poor capital performance. Two things pulling in opposite directions.

During the last year I offloaded (sold) MYI completely, as whilst it provided a good dividend yield, the capital value continued to remain under water (over periods as far back as 5 years). My holding of JGGI, in contrast, is up 26% (and still yields c 3.5-4.0% albeit supported from capital).

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: topups or ARBIT

richfool wrote:Arb, Thanks for your reply and your input and also Avantgarde.

JETI is a typical case in question. My holding there is still -12%, but, it is paying a dividend yield of some 5.5% and indeed was yielding 6% until recently when its SP crawled back up to 120p. So it's a trust that I hold (onto) for income, but keep thinking I should liquidate at a suitable opportunity because of its poor capital performance. Two things pulling in opposite directions.

During the last year I offloaded (sold) MYI completely, as whilst it provided a good dividend yield, the capital value continued to remain under water (over periods as far back as 5 years). My holding of JGGI, in contrast, is up 26% (and still yields c 3.5-4.0% albeit supported from capital).

JETI et al: these decisions are always very difficult. For example, JETI is now showing an XIRR of 5.93% (since 2012) whereas a year ago that was 11.1%. Who is to say that position won't reverse in future?

My feeling is that like the saying "hard cases make bad law" we should bear in mind that now isn't the best time to make long-term decisions. Who can say where the pieces will fall after the pandemic, and during a time of poor share price performance is not the best time to judge.

-

JohnW

- Lemon Slice

- Posts: 517

- Joined: June 1st, 2019, 7:00 am

- Has thanked: 5 times

- Been thanked: 185 times

Re: topups or ARBIT

Avantegarde wrote:Which begs an interesting question: why, exactly, are high yielders such poor performers, as measured by total returns?

Is it because they're being promoted as, and chosen for, their high yield, and thus other qualities are hardly relevant and so not given sufficient consideration in choosing?

And secondly, picking winners from all the 'horses' in the field is done very rarely over long periods of time.

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: topups or ARBIT

JohnW wrote:Avantegarde wrote:Which begs an interesting question: why, exactly, are high yielders such poor performers, as measured by total returns?

Is it because they're being promoted as, and chosen for, their high yield, and thus other qualities are hardly relevant and so not given sufficient consideration in choosing?

And secondly, picking winners from all the 'horses' in the field is done very rarely over long periods of time.

My feeling is that it's simply that the higher yielders tend to be associated with higher risk.

I'm not sure I understand your second point. Whatever it means, doesn't that apply to both high yield and low yield choices?

Arb.

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3439 times

Re: topups or ARBIT

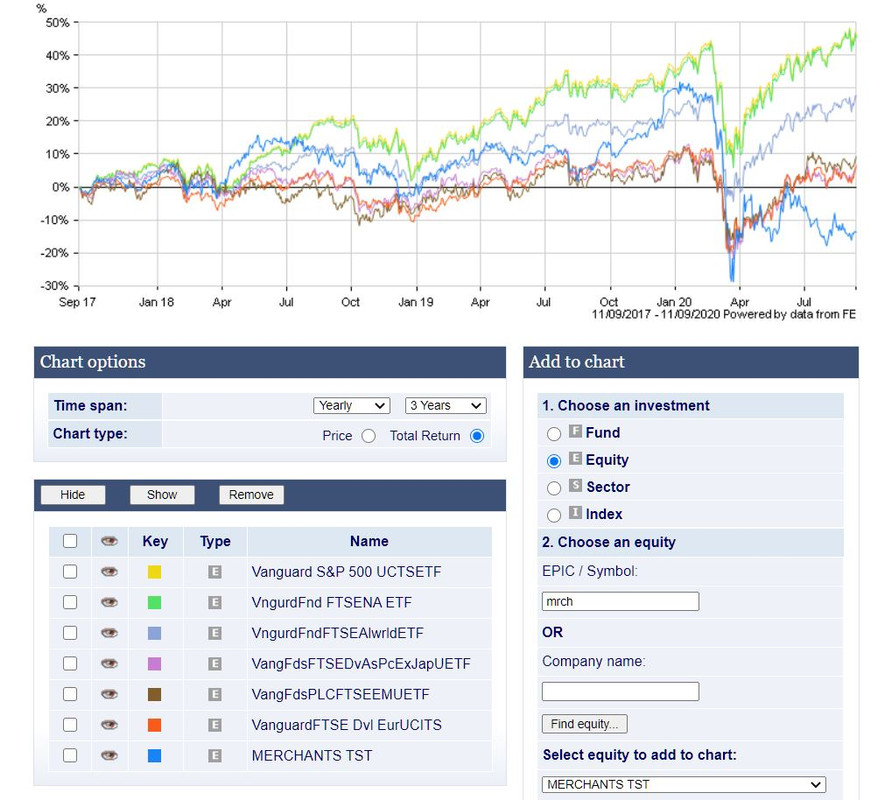

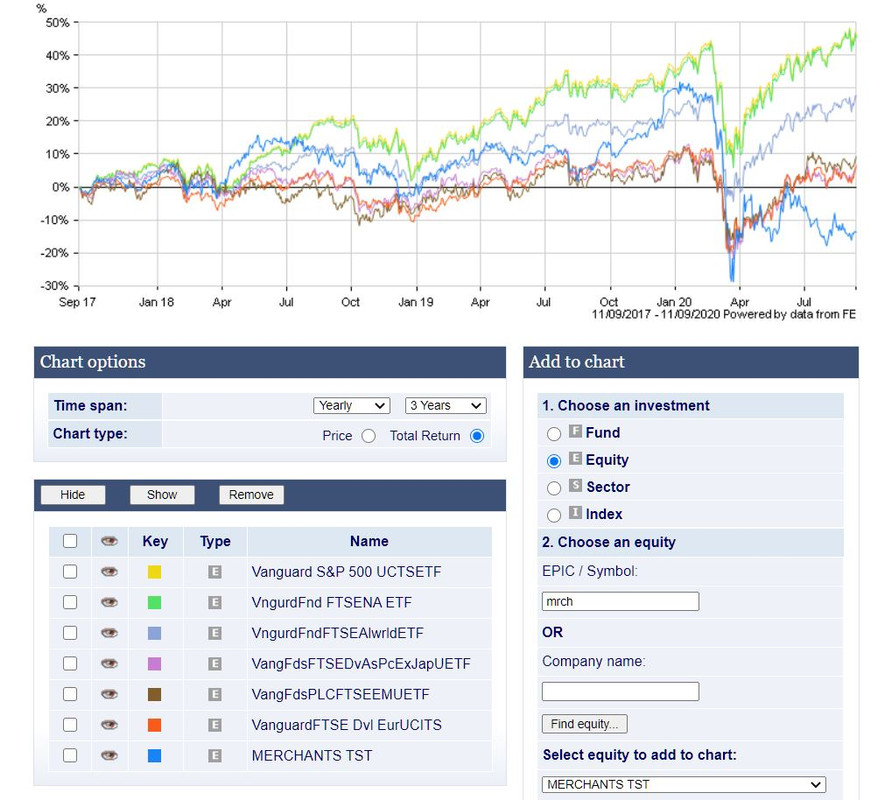

Here's a comparison of TR for several Vanguard Trackers over the last 5 years - compared to Merchants.

What has hit Merchants hard is Covid...the patient is struggling for breath, limping along now in last place. Until this year, Merchants was doing a reasonable job in terms of TR, keeping up with Vanguard's All-World tracker but some way behind the "purer" US focused investments. This year, the wheels fell off from a TR point of view. Some will argue that as long as the income stream comes in, that's what I bought it for. Just goes to show how things can go off kilter so rapidly (from memory, other UK IT income funds are even worse...TMPL for example).

Will the US funds continue to defy Covid (and a forthcoming election)...? dunno, but I bet there is scope for a reversal of recent (5 years) performance.

Yellow = VUSA https://www.hl.co.uk/shares/shares-sear ... etf-usdgbp

Green =VNRT, https://www.hl.co.uk/shares/shares-sear ... th-america

Lighter blue = VWRL, https://www.hl.co.uk/shares/shares-sear ... f-usd-dist

Purple =VAPX , https://www.hl.co.uk/shares/shares-sear ... ia-pacific

brown = VFEM, https://www.hl.co.uk/shares/shares-sear ... arkets-etf

Orange = VEUR, https://www.hl.co.uk/shares/shares-sear ... ped-europe

Darker blue = Merchants). https://www.hl.co.uk/shares/shares-sear ... dinary-25p

What has hit Merchants hard is Covid...the patient is struggling for breath, limping along now in last place. Until this year, Merchants was doing a reasonable job in terms of TR, keeping up with Vanguard's All-World tracker but some way behind the "purer" US focused investments. This year, the wheels fell off from a TR point of view. Some will argue that as long as the income stream comes in, that's what I bought it for. Just goes to show how things can go off kilter so rapidly (from memory, other UK IT income funds are even worse...TMPL for example).

Will the US funds continue to defy Covid (and a forthcoming election)...? dunno, but I bet there is scope for a reversal of recent (5 years) performance.

Yellow = VUSA https://www.hl.co.uk/shares/shares-sear ... etf-usdgbp

Green =VNRT, https://www.hl.co.uk/shares/shares-sear ... th-america

Lighter blue = VWRL, https://www.hl.co.uk/shares/shares-sear ... f-usd-dist

Purple =VAPX , https://www.hl.co.uk/shares/shares-sear ... ia-pacific

brown = VFEM, https://www.hl.co.uk/shares/shares-sear ... arkets-etf

Orange = VEUR, https://www.hl.co.uk/shares/shares-sear ... ped-europe

Darker blue = Merchants). https://www.hl.co.uk/shares/shares-sear ... dinary-25p

-

JohnW

- Lemon Slice

- Posts: 517

- Joined: June 1st, 2019, 7:00 am

- Has thanked: 5 times

- Been thanked: 185 times

Re: topups or ARBIT

Arborbridge wrote:JohnW wrote:And secondly, picking winners from all the 'horses' in the field is done very rarely over long periods of time.

My feeling is that it's simply that the higher yielders tend to be associated with higher risk.

I'm not sure I understand your second point. Whatever it means, doesn't that apply to both high yield and low yield choices?

Arb.

If you hold to the view that total return is the most valid measure of performance, and if we're saying that the high yielders are commonly not providing the best total return (sorry if I picked that up in another thread), then I don't think it 'computes' that the high yielders are the high risk group. Overall, long term, a higher risk product should outperform a lower risk one.

On the second point, yes indeed, it applies to stock picking for: high/low yield; early growth/late growth; 'set up' to win with climate change/bound to fail with climate change. Whatever the reason you try to pick stocks for, it ain't easy to outperform the market long term.

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: topups or ARBIT

JohnW wrote:If you hold to the view that total return is the most valid measure of performance, and if we're saying that the high yielders are commonly not providing the best total return (sorry if I picked that up in another thread), then I don't think it 'computes' that the high yielders are the high risk group. Overall, long term, a higher risk product should outperform a lower risk one.

On the second point, yes indeed, it applies to stock picking for: high/low yield; early growth/late growth; 'set up' to win with climate change/bound to fail with climate change. Whatever the reason you try to pick stocks for, it ain't easy to outperform the market long term.

Overall, long term, a higher risk product should outperform a lower risk one.

Only if you make the right choices.

High yielding companies tend to come in two types: 1) high risk of failure 2) high yield because the company has gone ex-growth.

Either way, TR could well be affected adversely.

I've no idea if this is borne out by the data, but intuitively I feel something like this may be operating. Underlying it is my feeling that it is true to say: "The higher the return, the higher the risk". And that may mean that companies edging towards failure may need to pay out more to keep attracting investors who in turn want compensation for the higher risk of failure which they are taking on. This is what was behind Luni's theory of the "danger zone" - if believe he had something, though may have been going too far for some people's taste when he assigned actual boundaries to his zones.

Arb.

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: topups or ARBIT

To anyone wondering what on earth the title of this thread means, it's one of my typos.

It should read "topups of ArbIT"

Arb.

It should read "topups of ArbIT"

Arb.

-

dealtn

- Lemon Half

- Posts: 6091

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 442 times

- Been thanked: 2338 times

Re: topups or ARBIT

Arborbridge wrote: Underlying it is my feeling that it is true to say: "The higher the return, the higher the risk". And that may mean that companies edging towards failure may need to pay out more to keep attracting investors who in turn want compensation for the higher risk of failure which they are taking on.

Arb.

Well it "may" mean that, but to be honest paying out more is increasing the risk further. In the situations you describe using a stressed cash flow to pay out to equity is increasing the stress and perhaps accelerating the bust. I would view it the other way round. The higher the risk, the higher the return (in an aggregated portfolio sense - no guarantees about individual investments). Given there are (at least) two ways that return comes about, I think the larger (potential) one is from capital gain (or loss) through revaluing the market price of the equity through recovery or bust. The income from the equity is much less relevant.

Return to “Investment Trusts and Unit Trusts”

Who is online

Users browsing this forum: No registered users and 31 guests