Page 1 of 2

IVI disappearing soon

Posted: December 11th, 2020, 1:20 pm

by TahiPanasDua

I can't find anything on the boards discussing the upcoming voluntary liquidation of Invesco Growth and Income (IVI) and the option to receive shares in Invesco Perpetual Select Trust or cash. The date has not been made public. HSBC tell me there are limits to the % cash you may be able to get but I didn't understand what they were saying.

Where should I look for discussion or has anyone got more information?

Thanks,

TP2

Re: IVI disappearing soon

Posted: December 11th, 2020, 3:33 pm

by Dod101

IVI refers to Invesco Income Growth Trust and on the Invesco website you will find the details of the proposed merger with Invesco perpetual Select Trust. There is a cash option of up to 30% for holders of IVI. All quite normal these days where there seems to be a rationalisation going on in the Invesco stable.

Dod

Re: IVI disappearing soon

Posted: December 11th, 2020, 5:13 pm

by TahiPanasDua

Dod101 wrote:IVI refers to Invesco Income Growth Trust and on the Invesco website you will find the details of the proposed merger with Invesco perpetual Select Trust. There is a cash option of up to 30% for holders of IVI. All quite normal these days where there seems to be a rationalisation going on in the Invesco stable.

Dod

Thanks for that, DOD. I'm not keeping up with the action these days.

TP2

Re: IVI disappearing soon

Posted: December 11th, 2020, 8:29 pm

by 88V8

This is one of the negatives of collectives.

They sometimes cook the books by merging and name changing so it's hard to follow their performance.

Or perhaps I'm being cynical.

V8

Re: IVI disappearing soon

Posted: December 11th, 2020, 8:50 pm

by Dod101

88V8 wrote:This is one of the negatives of collectives.

They sometimes cook the books by merging and name changing so it's hard to follow their performance.

Or perhaps I'm being cynical.

V8

Perhaps, but there are just too many not very good ITs and probably other collectives as well. I welcome the mergers, takeovers and occasional winding up that is taking place. Few I think are actually cooking the books although if we do not look into what is actually happening it can look like that.

Dod

Re: IVI disappearing soon

Posted: December 18th, 2020, 6:39 pm

by Arborbridge

For some reason, I've only today noticed this upcoming event in my Bell account. Since I check my account weekly, I can't help thinking the message (dated 5th Dec) may have been delayed.

Anyhow, I'm really not sure what to make of this, and advice would be welcome. As a holder of IVI, I'm being merged into IP Select UK equity, IVPU, which seem to have a complex four fold structure which allows switching between - the sort of tangential complexity I could do without.

I notice that the 5 year growth rate for IVPU dividends is pretty bad and the yield less than IVI.

On the plus side, the discount is lower - apparently .

I hate such changes, and my first instinct is to just see how it settles down. My second thoughts are, perhaps I should sell in the market now and take advantage of the reasonable rise there has been in the shares.

I'd welcome advice from any brains out there who might understand what the mathematical implications are of selling now as opposed to hanging on, or perhaps taking their offer to sell 30% for cash and hanging on to the rump. (I suspect that whatever route one takes, there's no way to arbitrage anything useful)

Arb.

Re: IVI disappearing soon

Posted: December 18th, 2020, 7:12 pm

by monabri

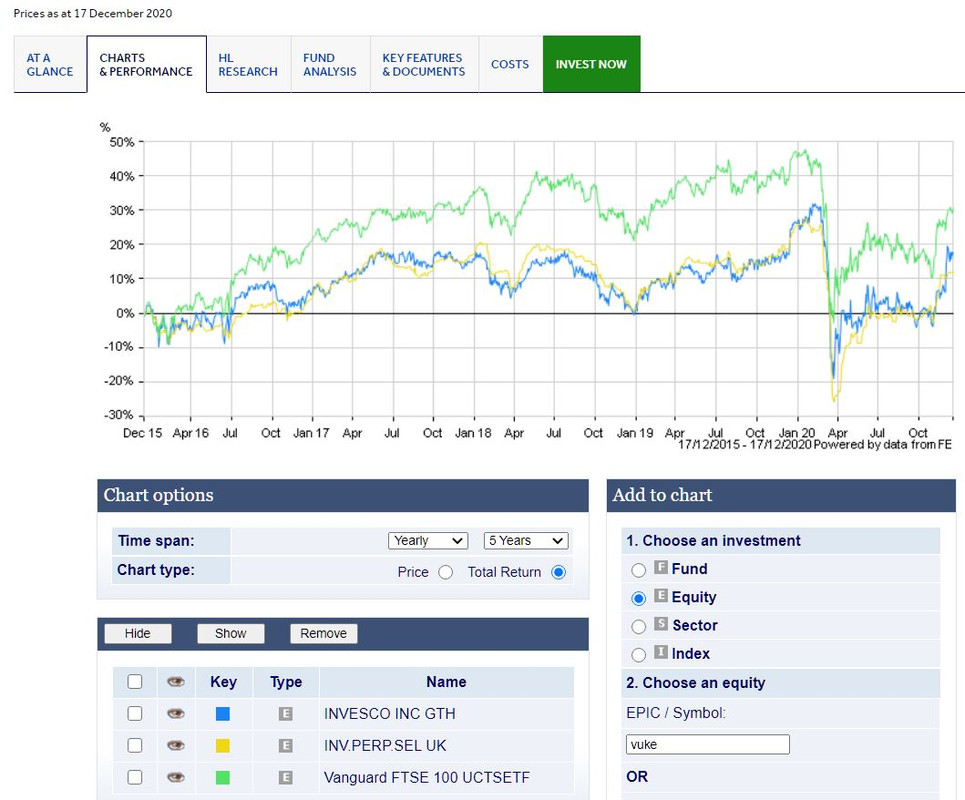

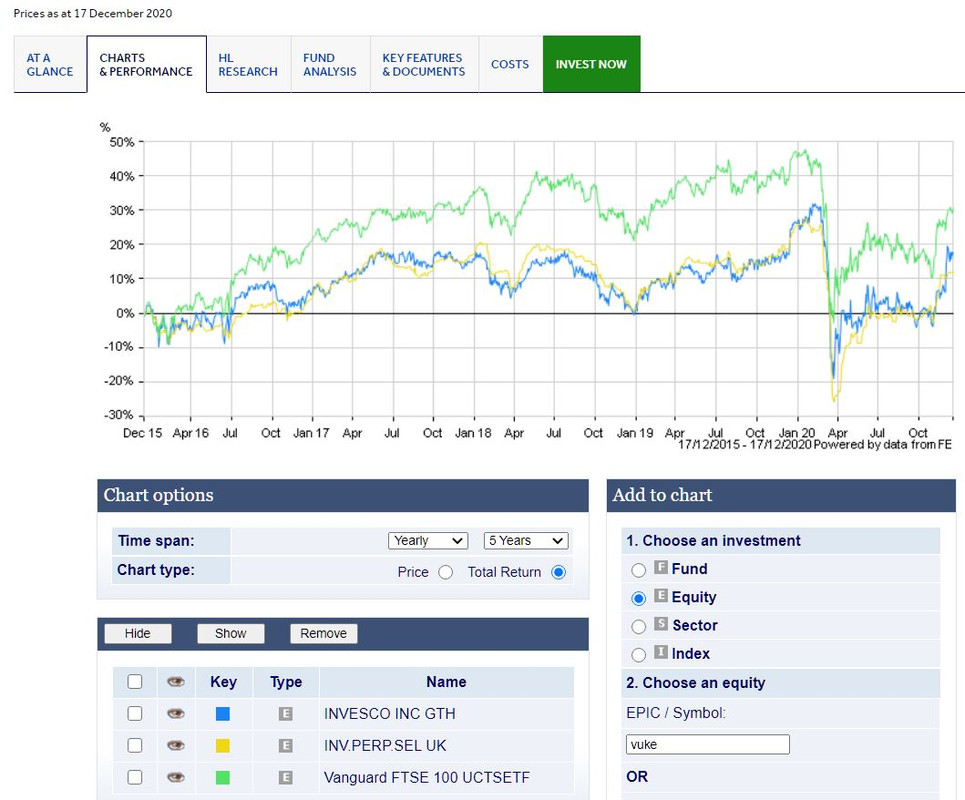

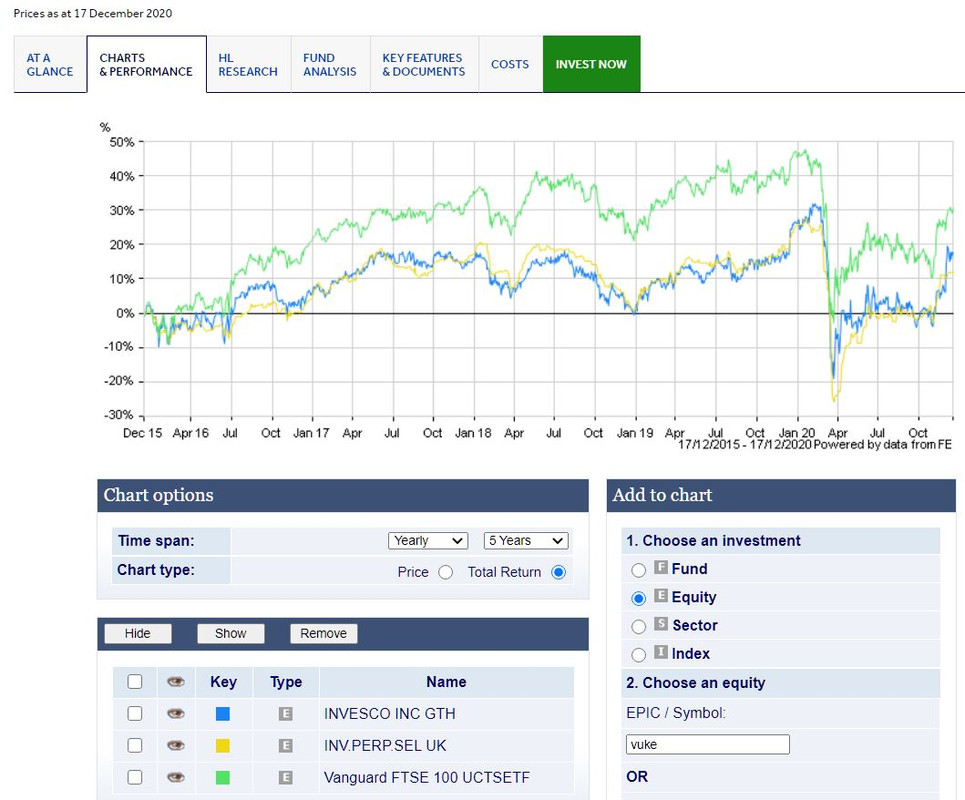

IVPU is "something different" to what you first bought with IVI! The yields are broadly similar but surely the added complexity of IVPU is costly (Ongoing charges 0.9% according to the AIC with 19% gearing, which I feel is a bit racy!). I can forsee much "pickering" ahead (4 pickerings a year

)when deciding whether to jump from one class to another.

Then again, let's have a look at the much cheaper VUKE for comparison...

Graph produced using HL's comparator tools:-

https://www.hl.co.uk/funds/fund-discoun ... ion/charts

Re: IVI disappearing soon

Posted: December 19th, 2020, 5:45 pm

by Arborbridge

monabri wrote:IVPU is "something different" to what you first bought with IVI! The yields are broadly similar but surely the added complexity of IVPU is costly (Ongoing charges 0.9% according to the AIC with 19% gearing, which I feel is a bit racy!). I can forsee much "pickering" ahead (4 pickerings a year

)when deciding whether to jump from one class to another.

Then again, let's have a look at the much cheaper VUKE for comparison...

Graph produced using HL's comparator tools:-

https://www.hl.co.uk/funds/fund-discoun ... ion/charts

Interesting that you chose VUKE - I bought some to see if it was worth it as a one stop shop. Unfortunately, it promptly dropped in price which makes the XIRR look a bit sick. Before I bought, I did a backcheck which seemed to suggest that I would have been better off just buying VUKE than other things I have (probably including HYP) . Backtesting is one thing, but naturally after one buys the object of your desire crumbles! Reality is always different which is why I always advise people to have skin in the game to see how things

really work out.

After a walk today, I did feel more inclined to just sell up my IVI and look elsewhere - or absorb the proceeds into my existing ArbIT. What I'm not clear about is whether I would be better off taking their alternative 30% in cash offer, or just having done with it now. That latter scheme seems just messy.

Arb.

Re: IVI disappearing soon

Posted: December 21st, 2020, 4:49 pm

by TahiPanasDua

Arborbridge wrote:

After a walk today, I did feel more inclined to just sell up my IVI and look elsewhere - or absorb the proceeds into my existing ArbIT. What I'm not clear about is whether I would be better off taking their alternative 30% in cash offer, or just having done with it now. That latter scheme seems just messy.

Arb.

[/quote]

Arb,

I feel similarly. I only have about 10k in IVI and will probably sell the lot as I don't fancy the new IT. I will wait and see what happens as the markets are tumbling around our ears today.

TP2.

Re: IVI disappearing soon

Posted: December 21st, 2020, 6:37 pm

by Arborbridge

TahiPanasDua wrote:Arborbridge wrote:

After a walk today, I did feel more inclined to just sell up my IVI and look elsewhere - or absorb the proceeds into my existing ArbIT. What I'm not clear about is whether I would be better off taking their alternative 30% in cash offer, or just having done with it now. That latter scheme seems just messy.

Arb.

Arb,

I feel similarly. I only have about 10k in IVI and will probably sell the lot as I don't fancy the new IT. I will wait and see what happens as the markets are tumbling around our ears today.

TP2.

Why

is it that whenever we decide to sell something, markets tumble?!

Re: IVI disappearing soon

Posted: April 6th, 2021, 1:41 pm

by Alaric

Snorvey wrote:.....and to answer my own question, yes there is excess income to report - 0.0116 according to the 2019/20 reporting status.

Its all very confusing.

HMRC appear to have concluded that "excess income" is taxable in a similar way to dividends in accumulation OEICs. Unlike OEICs there isn't a mechanism in place to ensure personalised reporting of the amounts.

Re: IVI disappearing soon

Posted: April 6th, 2021, 5:13 pm

by Hariseldon58

Excess Reportable Income on distributing ETFs is more of a paperwork nuisance than a financial one, the amounts are small, but its a bit of a bind to track the figures down, the deemed payment date is six months after it is declared, base don your holding that date, easy with Vanguard as they declare at the end of June and the payment is deemed to be at the end of December in the same tax year.

Using EUDV as an example, the amount is deemed to be payable on 30th September 2020 on the number of shares you held on 31st March 2020. IE payable in one tax year on a holding in the prior tax year. Ditto some of the iShares ETFs, ERI effects both distributing and Accumulating ETFs, easier to hold in a tax sheltered account.

Re: IVI disappearing soon

Posted: April 8th, 2021, 9:28 am

by Arborbridge

Arborbridge wrote:After a walk today, I did feel more inclined to just sell up my IVI and look elsewhere - or absorb the proceeds into my existing ArbIT. What I'm not clear about is whether I would be better off taking their alternative 30% in cash offer, or just having done with it now. That latter scheme seems just messy.

Arb.

So what happened to that idea, I ask myself. I did nothing and forgot all about it!

Arb.

Re: IVI disappearing soon

Posted: April 8th, 2021, 5:56 pm

by indicator

So what happened to that idea, I ask myself. I did nothing and forgot all about it!

That was clumsy of you!

I have just received notification of this action from HL with just a few days to go before having to decide.

Not good Mr Hargreaves.

I don't understand what's going to happen to the remaining 70% if I opt for the 30% cash.They say there's no guarantee on what is going to happen!

Has any one got an answer to the puzzle?

Re: IVI disappearing soon

Posted: April 8th, 2021, 6:32 pm

by Myfyr

I sold my holding for a minuscule profit. Not bad considering it was well under water a few months ago.

As part of my diversification strategy I bought Scottish Investment Trust (SCIN) with the proceeds.

I have enough in my ISA to buy another holding. I tried to buy JPEI but there were none available to buy!

Maybe I will wait until the end of the month and see if any bargains appear - to decide what will be the 38th IT in my ISA!

Re: IVI disappearing soon

Posted: April 10th, 2021, 11:31 am

by Arborbridge

indicator wrote:So what happened to that idea, I ask myself. I did nothing and forgot all about it!

That was clumsy of you!

I have just received notification of this action from HL with just a few days to go before having to decide.

Not good Mr Hargreaves.

I don't understand what's going to happen to the remaining 70% if I opt for the 30% cash.They say there's no guarantee on what is going to happen!

Has any one got an answer to the puzzle?

Presumably, you will receive the balance of 70% as units in the default version of the IT.

Re: IVI disappearing soon

Posted: April 13th, 2021, 10:22 am

by Rooky102

It is understandable that INVESCO want to keep the capital invested and the accompanying fees.

But to lock in 70% is not the fair way to do it.

When winding up an IT, the offer should be 100% cash at (NAV-costs) to all those who want it.

Those with capital gains liabilities are the only ones to benefit from a carry over to another INVESCO trust (I'm assuming that's what can be achieved)

And the lack of publicity (I also only found out at the last minute) may not be deliberate, but it certainly is wrong.

The boards of IT's that merge in future should insist on a fairer deal for all shareholders, not just the managers.

Re: IVI disappearing soon

Posted: April 13th, 2021, 11:15 am

by Dod101

Rooky102 wrote:It is understandable that INVESCO want to keep the capital invested and the accompanying fees.

But to lock in 70% is not the fair way to do it.

When winding up an IT, the offer should be 100% cash at (NAV-costs) to all those who want it.

Those with capital gains liabilities are the only ones to benefit from a carry over to another INVESCO trust (I'm assuming that's what can be achieved)

And the lack of publicity (I also only found out at the last minute) may not be deliberate, but it certainly is wrong.

The boards of IT's that merge in future should insist on a fairer deal for all shareholders, not just the managers.

Many of these reconstructions are often I think for the benefit of the manager rather than the ongoing shareholders but that is what the Directors are supposed to be doing, looking after the interests of shareholders that is. But this is not a winding up; if it were shareholders would be entitled to get the net assets as cash. This is a merger and as such it is normal that existing shareholders are offered the opportunity to take a percentage (in this case up to 30%) as cash usually at or around the NAV.

For the lack of publicity you need to blame the ISA manager, or the platform, not the Directors. The details have been on the IT's website for the last three months at least.

Dod

Re: IVI disappearing soon

Posted: April 13th, 2021, 12:22 pm

by Dod101

I don't think it does but does the original paperwork not give you any guidance?

Dod

Re: IVI disappearing soon

Posted: April 13th, 2021, 1:21 pm

by Arborbridge

Snorvey wrote:Dod101 wrote:I don't think it does but does the original paperwork not give you any guidance?

Dod

Far easier to ask on here

When you've checked the paperwork, you can let me know the answer too?

I did nothing in the end, in true HYPer-style. Just couldn't be bothered and I'm sure whatever happens it'll sort itself out. If I don't like this new possession when I have it, it will go to join my other "Dead Souls". I'll give it a year to get the feel of it.

Arb.