That's a tiny increase of just 0.44% which is disappointing.

Got a credit card? use our Credit Card & Finance Calculators

Thanks to gpadsa,Steffers0,lansdown,Wasron,jfgw, for Donating to support the site

abrdn Equity Income Trust (AEI) disappointing final dividend

-

dundas666

- 2 Lemon pips

- Posts: 177

- Joined: December 27th, 2019, 2:53 pm

- Has thanked: 165 times

- Been thanked: 100 times

abrdn Equity Income Trust (AEI) disappointing final dividend

The final dividend for abrdn Equity Income Trust (AEI) was declared at 5.7p, taking the total annual dividend to 22.8p, compared to 22.7p last year.

That's a tiny increase of just 0.44% which is disappointing.

That's a tiny increase of just 0.44% which is disappointing.

-

scotia

- Lemon Quarter

- Posts: 3569

- Joined: November 4th, 2016, 8:43 pm

- Has thanked: 2377 times

- Been thanked: 1949 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

dundas666 wrote:The final dividend for abrdn Equity Income Trust (AEI) was declared at 5.7p, taking the total annual dividend to 22.8p, compared to 22.7p last year.

That's a tiny increase of just 0.44% which is disappointing.

I think I would be even more disappointed with its performance - its total return over 5 years is -2.25%, compared to the FTSE all share of +32.6%

(data from Hargreaves Lansdown)

-

funduffer

- Lemon Quarter

- Posts: 1339

- Joined: November 4th, 2016, 12:11 pm

- Has thanked: 123 times

- Been thanked: 848 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

I agree the increase is disappointing.

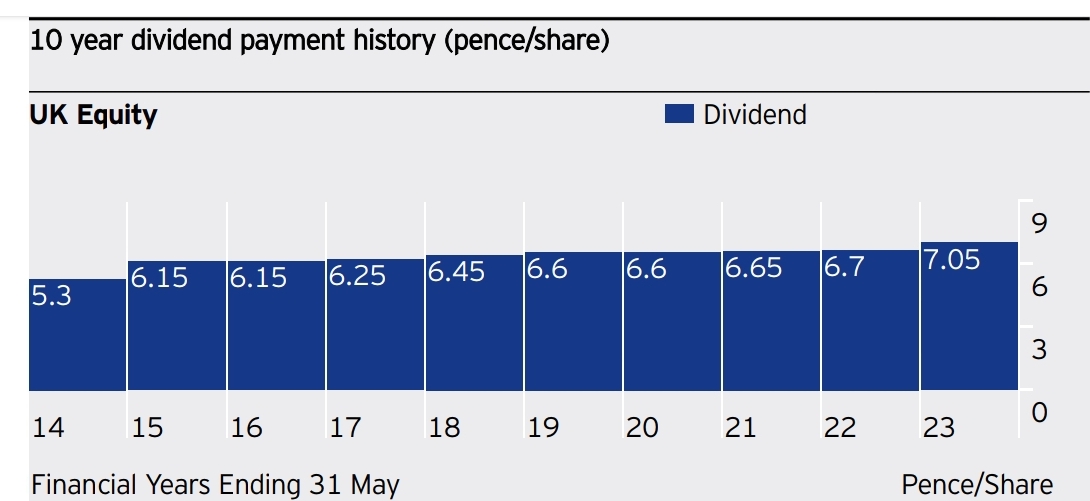

However, I have held AEI for nearly 10 years, and in that time the dividend has increased on average by more than 6% per year, outstripping inflation.

I am down on capital but up overall on total return, but since I need income, I am happy(ish) with this.

I haven't read the final report commentary, but I suspect this may have to do with re-building income reserves following the pandemic hiatus. Current reserves for dividend cover are at 0.94 years.

FD

However, I have held AEI for nearly 10 years, and in that time the dividend has increased on average by more than 6% per year, outstripping inflation.

I am down on capital but up overall on total return, but since I need income, I am happy(ish) with this.

I haven't read the final report commentary, but I suspect this may have to do with re-building income reserves following the pandemic hiatus. Current reserves for dividend cover are at 0.94 years.

FD

-

monabri

- Lemon Half

- Posts: 8441

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1551 times

- Been thanked: 3449 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

The miniscule increase was to

1. Maintain AIC divi hero status ( my thought on this )

2.The board mandated that the (fund) Manager ensures that the dividend is covered by

earnings in the current year, with an expectation of sustainable growth, and the portfolio is positioned

accordingly - see the interim report .

https://www.abrdnequityincome.com/en-gb ... ture?tab=2

(Interim report to March 23)

So..the bare minimum to maintain AIC rating and not to hamstring the manager.

Page 10 of the Q3 interim

"Our focus remains on achieving the priorities set out by the Board at the time of Covid crisis. The Board emphasised

that our first priority should be to build a portfolio that could deliver sufficient income to cover the dividend. This

was achieved last September for the first time for two years. We continue to position the portfolio with the

intention of achieving the Board’s objectives of covering the dividend, delivering dividend growth in excess of

inflation over the cycle and rebuilding reserves. We see the focus on portfolio income as consistent with our

investment process which favours companies whose cash flow and dividend potential are not priced in by

the market."

(My bold)

I hold AEI and will give it time to deliver.

1. Maintain AIC divi hero status ( my thought on this )

2.The board mandated that the (fund) Manager ensures that the dividend is covered by

earnings in the current year, with an expectation of sustainable growth, and the portfolio is positioned

accordingly - see the interim report .

https://www.abrdnequityincome.com/en-gb ... ture?tab=2

(Interim report to March 23)

So..the bare minimum to maintain AIC rating and not to hamstring the manager.

Page 10 of the Q3 interim

"Our focus remains on achieving the priorities set out by the Board at the time of Covid crisis. The Board emphasised

that our first priority should be to build a portfolio that could deliver sufficient income to cover the dividend. This

was achieved last September for the first time for two years. We continue to position the portfolio with the

intention of achieving the Board’s objectives of covering the dividend, delivering dividend growth in excess of

inflation over the cycle and rebuilding reserves. We see the focus on portfolio income as consistent with our

investment process which favours companies whose cash flow and dividend potential are not priced in by

the market."

(My bold)

I hold AEI and will give it time to deliver.

-

everhopeful

- 2 Lemon pips

- Posts: 213

- Joined: November 9th, 2016, 12:18 pm

- Has thanked: 9 times

- Been thanked: 87 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

I hold these but have been underwhelmed by the total return. Despite the poor performance they trade at only a very small discount to NAV less than 1%.

Invesco Select Trust which is also in the UK Equity Income universe has a much better capital performance at all time frames and is trading at a 14% discount to NAV. The yield is 4.38% compared with 7.56% for AEI but if income is not a primary concern I am thinking it might be wise to sell AEI and buy the Invesco trust. Any re-rating of the large discount would be a bonus.

Invesco Select Trust which is also in the UK Equity Income universe has a much better capital performance at all time frames and is trading at a 14% discount to NAV. The yield is 4.38% compared with 7.56% for AEI but if income is not a primary concern I am thinking it might be wise to sell AEI and buy the Invesco trust. Any re-rating of the large discount would be a bonus.

-

monabri

- Lemon Half

- Posts: 8441

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1551 times

- Been thanked: 3449 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

everhopeful wrote:I hold these but have been underwhelmed by the total return. Despite the poor performance they trade at only a very small discount to NAV less than 1%.

Invesco Select Trust which is also in the UK Equity Income universe has a much better capital performance at all time frames and is trading at a 14% discount to NAV. The yield is 4.38% compared with 7.56% for AEI but if income is not a primary concern I am thinking it might be wise to sell AEI and buy the Invesco trust. Any re-rating of the large discount would be a bonus.

The rate of increase in dividends from the Invesco fund is disappointing. Years when the dividend has been static followed by small step increases.

https://www.invesco.com/uk/en/investmen ... folio.html

-

everhopeful

- 2 Lemon pips

- Posts: 213

- Joined: November 9th, 2016, 12:18 pm

- Has thanked: 9 times

- Been thanked: 87 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

Well that was why I made the point about income not being the primary concern. The attraction is in the large discount and capital performance.

AEI seems rather like HFEL. One is being paid income at the expense of capital return.

AEI seems rather like HFEL. One is being paid income at the expense of capital return.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

everhopeful wrote:Well that was why I made the point about income not being the primary concern. The attraction is in the large discount and capital performance.

AEI seems rather like HFEL. One is being paid income at the expense of capital return.

And the other is achieving a capital return possibly at the expense of income. What I look for is a decent increase in the dividend year on year with at least a modest increase in the capital. Don’t we all?

AEI is in danger of being another HFEL and then one day having to face reality just as HFEL appears to be doing.

Dod

-

88V8

- Lemon Half

- Posts: 5875

- Joined: November 4th, 2016, 11:22 am

- Has thanked: 4230 times

- Been thanked: 2613 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

monabri wrote:The miniscule increase was to

1. Maintain AIC divi hero status ( my thought on this )...

I am sure we will see a lot of this for a while.

Piddling increases from high-yielding ITs.

It's the price we pay for smooth dividend continuity.

V8 (holder)

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

88V8 wrote:monabri wrote:The miniscule increase was to

1. Maintain AIC divi hero status ( my thought on this )...

I am sure we will see a lot of this for a while.

Piddling increases from high-yielding ITs.

It's the price we pay for smooth dividend continuity.

V8 (holder)

It is also a nonsense as everyone must know.

Dod

-

88V8

- Lemon Half

- Posts: 5875

- Joined: November 4th, 2016, 11:22 am

- Has thanked: 4230 times

- Been thanked: 2613 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

Dod101 wrote:88V8 wrote:I am sure we will see a lot of this for a while.

Piddling increases from high-yielding ITs.

It's the price we pay for smooth dividend continuity.

It is also a nonsense as everyone must know.

If it continued, yes.

But they have done OK, 3.5% avge divi growth five years and a 7.5% yield.

Compare that with the more pedestrian MUT Murray Income for example at 2.5% avge five years and 4.5% yield.

Although MUT have grown the SP c25% in that time vs ??? for AEI who have done that thing of renaming the trust, formerly ASEI, so their past performance is lost in the mists of time.

Anyway, I hold both, swings & roundabouts.

V8

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

88V8 wrote:Dod101 wrote:It is also a nonsense as everyone must know.

If it continued, yes.

But they have done OK, 3.5% avge divi growth five years and a 7.5% yield.

Compare that with the more pedestrian MUT Murray Income for example at 2.5% avge five years and 4.5% yield.

Although MUT have grown the SP c25% in that time vs ??? for AEI who have done that thing of renaming the trust, formerly ASEI, so their past performance is lost in the mists of time.

Anyway, I hold both, swings & roundabouts.

V8

I am in a position these days that I do not have to seek out the really high yields but would prefer to sacrifice some yield for a share that has a good prospect of at least a modest increase in the share price. Hence I like the two Murray Trusts and would never buy HFEL or I think AEI. But you are of course right. We only know if we are right well after the event and a decent spread of ITs seems to me to be sensible way to proceed.

Dod

-

stacker512

- 2 Lemon pips

- Posts: 173

- Joined: July 16th, 2020, 1:34 pm

- Has thanked: 181 times

- Been thanked: 51 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

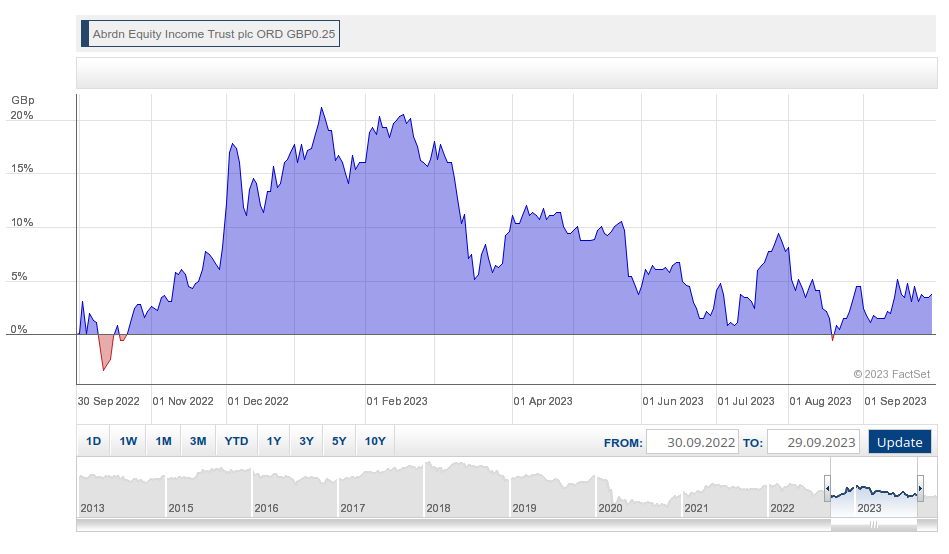

Annual report for 2023 just came out (yesterday?), been surprised by the quoted "Share price total return per ordinary share" of +11.4%

Is that inclusive of dividends, because if not, it seems to contradict my own holding.

Is that inclusive of dividends, because if not, it seems to contradict my own holding.

-

DavidM13

- Lemon Slice

- Posts: 425

- Joined: October 12th, 2018, 5:01 pm

- Has thanked: 46 times

- Been thanked: 407 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

stacker512 wrote:Annual report for 2023 just came out (yesterday?), been surprised by the quoted "Share price total return per ordinary share" of +11.4%

Is that inclusive of dividends, because if not, it seems to contradict my own holding.

I agree with the figures and yes they include dividends. You are checking 30th September 2022 to 30th September 2023 arent you?

-

monabri

- Lemon Half

- Posts: 8441

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1551 times

- Been thanked: 3449 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

DavidM13 wrote:stacker512 wrote:Annual report for 2023 just came out (yesterday?), been surprised by the quoted "Share price total return per ordinary share" of +11.4%

Is that inclusive of dividends, because if not, it seems to contradict my own holding.

I agree with the figures and yes they include dividends. You are checking 30th September 2022 to 30th September 2023 arent you?

As Frank Carson said. "It's the way I tell 'em" (ie the start point was pretty low!)

(

-

stacker512

- 2 Lemon pips

- Posts: 173

- Joined: July 16th, 2020, 1:34 pm

- Has thanked: 181 times

- Been thanked: 51 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

DavidM13 wrote:stacker512 wrote:Annual report for 2023 just came out (yesterday?), been surprised by the quoted "Share price total return per ordinary share" of +11.4%

Is that inclusive of dividends, because if not, it seems to contradict my own holding.

I agree with the figures and yes they include dividends. You are checking 30th September 2022 to 30th September 2023 arent you?

I was looking at 1Y graphs, so my bad.

However, when looking at the dates, it still seems somehow wrong. This is all likely due to my lack of understanding, rather than anything abrdn might be doing wrong.

-

DavidM13

- Lemon Slice

- Posts: 425

- Joined: October 12th, 2018, 5:01 pm

- Has thanked: 46 times

- Been thanked: 407 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

stacker512 wrote:DavidM13 wrote:

I agree with the figures and yes they include dividends. You are checking 30th September 2022 to 30th September 2023 arent you?

I was looking at 1Y graphs, so my bad.

However, when looking at the dates, it still seems somehow wrong. This is all likely due to my lack of understanding, rather than anything abrdn might be doing wrong.

Probably that chart is just the raw price return rather than a total return. If you step into my humble abode and use the performance chart here https://www.theaic.co.uk/companydata/ab ... erformance I can guarantee it is price total return.

-

monabri

- Lemon Half

- Posts: 8441

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1551 times

- Been thanked: 3449 times

-

monabri

- Lemon Half

- Posts: 8441

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1551 times

- Been thanked: 3449 times

Re: abrdn Equity Income Trust (AEI) disappointing final dividend

Thanks David, that's a useful tool that the AIC have provided. I hadn't used it before. The AIC tool offers the ability to set the required range of dates rather than units such as "1 year/3 year/5 year" which is useful (as per my earlier attempt above using the Hargreaves Lansdown tool **).

Monabri

** Post #635230 to which I should have attributed a link

https://www.hl.co.uk/funds/fund-discoun ... ion/charts

Return to “Investment Trusts and Unit Trusts”

Who is online

Users browsing this forum: No registered users and 17 guests