Page 1 of 3

Which index is the best to follow?

Posted: September 27th, 2021, 5:02 pm

by Jon277

Many years ago now there was an article on the Motely Fool which looked at the historical yield of different indices in the UK and as a result I invested in the FTSE250 for quite a while as opposed to the FTSE 100.

There are many more indices available now does anyone know where they could be compared or has seen any articles that have looked at this lately?

I'd be interested to see which indices have done well over the last decade for example.

Thanks

Jon

Re: Which index is the best to follow?

Posted: September 27th, 2021, 5:11 pm

by JohnB

When comparing indexes always look for total return, ignoring dividends is unwise, but sadly that's what many sites do.

Be aware that the fall of the pound has distorted the numbers, the ftse 100 has 80% of its income from abroad, so had benefitted more than the 350, who of course have a big brexit problem now.

S&P 500 has done very well numerically, but its companies have been doing capital growth rather than dividends,so it appears very over valued by some measures

Going forward, just go for a global inde

Re: Which index is the best to follow?

Posted: September 27th, 2021, 5:54 pm

by Jon277

I found this tool which is quite good

https://www2.trustnet.com/Tools/Charting.aspxI have created one but can't work out how to insert the iamges

Re: Which index is the best to follow?

Posted: September 27th, 2021, 6:42 pm

by dealtn

Jon277 wrote:Many years ago now there was an article on the Motely Fool which looked at the historical yield of different indices in the UK and as a result I invested in the FTSE250 for quite a while as opposed to the FTSE 100.

There are many more indices available now does anyone know where they could be compared or has seen any articles that have looked at this lately?

I'd be interested to see which indices have done well over the last decade for example.

Thanks

Jon

What are you trying to compare (presumably as a guide to what might occur in the future)?

Historical Yield strikes me as an unusual variable to use, and invest as a result of such analysis. (Total) Return would make more sense surely?

Re: Which index is the best to follow?

Posted: September 27th, 2021, 6:47 pm

by monabri

(1)If you use windows you can create a JPG file using the "snipping tool". This can be a snapshot of whatever is displayed on screen.

(2)Then upload the JPG image using POSTIMAGE

https://postimages.org/(note: you do not need to create an account - just hit the "Upload" button)

(3)Then click on the icon at the end of the "hotlink for forums"

(4) Then paste the link in (edit paste or CTL-V).

Check to see if it is displaying correctly (use the preview button on the TLF site) before pressing the "Submit" button.

Re: Which index is the best to follow?

Posted: September 27th, 2021, 8:45 pm

by GeoffF100

If you want just one index to follow, choose the global index. Vanguard includes FTSE 100 and FTSE All Share trackers in their packaged funds. They market a FTSE 250 tracker, but they do not use it themselves. By implication the Vanguad committee thinks that the FTSE 100 has better prospects than the smaller UK stocks. One problem with the FTSE 250 is that it includes a lot of Investment Trusts, which perennially underperform the remainder of the FTSE 250.

Re: Which index is the best to follow?

Posted: September 28th, 2021, 1:43 am

by Shaker

For a global index, use MSCI World

Re: Which index is the best to follow?

Posted: September 28th, 2021, 7:19 am

by GeoffF100

Shaker wrote:For a global index, use MSCI World

FTSE world is better than MSCI world because it contains many more stocks and has a much higher level of diversification. VWRL does the job. VWRL = 0.89 * VEVE + 0.11 * VFEM does the same job and is cheaper. You can calculate the exact weights from the percentages in the US for VWRL and VEVE.

Re: Which index is the best to follow?

Posted: September 28th, 2021, 7:32 pm

by Jon277

Thanks for the tip on images -

To another poster yield may have been used wrongly I think they meant total returns or total net returns more likely

Re: Which index is the best to follow?

Posted: September 29th, 2021, 3:17 am

by JohnW

Jon277 wrote:Many years ago now there was an article on the Motely Fool which looked at the historical yield of different indices in the UK and as a result I invested in the FTSE250 for quite a while as opposed to the FTSE 100.

There are many more indices available now does anyone know where they could be compared or has seen any articles that have looked at this lately?

I'd be interested to see which indices have done well over the last decade for example.

Thanks

Jon

I'm not sure that a decade's returns are a good basis on which to choose an index. Asset classes, and sub-classes like regional equities, go through higher and lower performance cycles compared with sensible comparators, cycles which can last at least a decade, so it's not a reliable guide to future performance. Which is why every investment document includes 'past performance is no guarantee....'. Because that has become mundane advice, don't mistakenly pay it too little attention.

If the last decade's performance did perfectly predict the next decade's, it wouldn't help you much if you were investing for four decades.

Indexes don't incur trading costs, so fund managers might choose an index because they can track it more cheaply than another. Keep that in mind if you think performance is crucial.

Re: Which index is the best to follow?

Posted: September 29th, 2021, 9:33 am

by GoSeigen

Don't bother index picking -- just invest in a passive tracker with low fees.

LOL

GS

Re: Which index is the best to follow?

Posted: September 29th, 2021, 10:19 am

by murraypaul

GoSeigen wrote:Don't bother index picking -- just invest in a passive tracker with low fees.

Tracking what?

That is what the original poster is asking, which index should they track?

Re: Which index is the best to follow?

Posted: September 29th, 2021, 11:23 am

by AleisterCrowley

World tracker with low fees

Check Monevator for recommendations

I use VWRL, which as noted is not the cheapest but it's pretty good

Re: Which index is the best to follow?

Posted: September 29th, 2021, 2:07 pm

by Jon277

JohnW wrote:I'm not sure that a decade's returns are a good basis on which to choose an index. Asset classes, and sub-classes like regional equities, go through higher and lower performance cycles compared with sensible comparators, cycles which can last at least a decade, so it's not a reliable guide to future performance. Which is why every investment document includes 'past performance is no guarantee....'. Because that has become mundane advice, don't mistakenly pay it too little attention.

If the last decade's performance did perfectly predict the next decade's, it wouldn't help you much if you were investing for four decades.

Indexes don't incur trading costs, so fund managers might choose an index because they can track it more cheaply than another. Keep that in mind if you think performance is crucial.

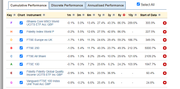

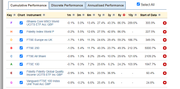

I think a decade is a good starting point - looking at the table in the image I proivde above you can see very large differences between indices - essentially showing that you would have been better off investing in a world index over a 10 year period and seeing that all of the UK indices underperformed against it. This I think links to a point you made about REGIONAL EQUITIES or even national equities. We now have a far greater choice and it is a fact that different regions are performing differently and whilst past performance is no guarantee neither can it be completely dismissed. The chart and the table above provide plenty of evidence showing large differences in different indices.

Re: Which index is the best to follow?

Posted: September 29th, 2021, 2:18 pm

by GeoffF100

Jon277 wrote:I think a decade is a good starting point - looking at the table in the image I proivde above you can see very large differences between indices - essentially showing that you would have been better off investing in a world index over a 10 year period and seeing that all of the UK indices underperformed against it.

The world index is a sensible choice, but not because it has done well in the last 10 years. It is sensible because it provides more diversification than the other market weighted indexes. If all investors had the same investment objective, same risk tolerance taxes etc, and there is one optimal equity portfolio for all of them, that portfolio must be the world index, because that is the only one that they can all hold. The UK market has been rubbish for the last ten years, and is now on a low valuation relative to other markets, particularly the US. Perhaps it will prove to be good value starting from that low price.

Re: Which index is the best to follow?

Posted: September 29th, 2021, 5:42 pm

by GoSeigen

murraypaul wrote:GoSeigen wrote:Don't bother index picking -- just invest in a passive tracker with low fees.

Tracking what?

That is what the original poster is asking, which index should they track?

You misquoted me. Next time try to include the "LOL" [it doesn't mean "lots of love"].

GS

Re: Which index is the best to follow?

Posted: September 29th, 2021, 9:56 pm

by JohnW

Jon277 wrote:I think a decade is a good starting point - looking at the table in the image I proivde above you can see very large differences between indices - essentially showing that you would have been better off investing in a world index over a 10 year period and seeing that all of the UK indices underperformed against it.

I think all your observations are valid, but past performance would not be the best reason to choose an index I'd suggest. In this case where a world index outperforms many others, you wouldn't finish up with a poor choice. But if you were looking at charts where Korean stocks outperformed, it would be a poor choice theoretically to buy only Korean stocks, despite that they might turn out to be winners for another century.

If you do choose to invest in the best performing index, would you then need to re-invest in the next decade's best performing index when your original choice became an under-performer? That's part of the problem.

But the theory now in vogue says the market distributes its investing money optimally, if it wasn't considered the optimal then investors would move their money elsewhere to make it optimal, so if you choose to invest any other way than capitalisation weighted and include stocks from every corner of the globe (in the proportions that the market as a whole does) then either you're not investing optimally or you think you know something the rest of the market doesn't know. I think it's based on the idea of diversification; the more you diversify, the less risk you take with each individual stocks, so you hold them all.

Well, you get a great benefit in moving from owning the five biggest stocks to owning the 1000 biggest, or 2000 biggest, but you don't get much more benefit from adding 2000 (now increasingly) small stocks to your first 2000. So I don't think you need the very broadest index available if there are other reasons not to (like cost, or your religion), but you want broad diversification regardless of last decade's star performer.

Re: Which index is the best to follow?

Posted: September 29th, 2021, 10:08 pm

by hiriskpaul

Jon277 wrote:JohnW wrote:I'm not sure that a decade's returns are a good basis on which to choose an index. Asset classes, and sub-classes like regional equities, go through higher and lower performance cycles compared with sensible comparators, cycles which can last at least a decade, so it's not a reliable guide to future performance. Which is why every investment document includes 'past performance is no guarantee....'. Because that has become mundane advice, don't mistakenly pay it too little attention.

If the last decade's performance did perfectly predict the next decade's, it wouldn't help you much if you were investing for four decades.

Indexes don't incur trading costs, so fund managers might choose an index because they can track it more cheaply than another. Keep that in mind if you think performance is crucial.

I think a decade is a good starting point - looking at the table in the image I proivde above you can see very large differences between indices - essentially showing that you would have been better off investing in a world index over a 10 year period and seeing that all of the UK indices underperformed against it. This I think links to a point you made about REGIONAL EQUITIES or even national equities. We now have a far greater choice and it is a fact that different regions are performing differently and whilst past performance is no guarantee neither can it be completely dismissed. The chart and the table above provide plenty of evidence showing large differences in different indices.

FTSE all-share index total return from end 1970 to end 2010 was 17.3% per year. MSCI World Index ex-UK was 14.9% per year (in pounds). So the FTSE all-share was the better index to plump for at the end of 2010, following 3 decades of clear outperformance. Remind me what happened next.

If it was possible to extrapolate future performance based on the last 10 years, a very profitable risk free trade would be to go long the "good" index, short the "bad". Easily achieved at low cost using equity index futures. As equity markets are highly correlated, you could safely gear that trade up by a factor of 3-4. Free money, no risk. An easy route to becoming a multi-millionaire.

Re: Which index is the best to follow?

Posted: September 30th, 2021, 10:35 am

by GoSeigen

JohnW wrote:But the theory now in vogue says the market distributes its investing money optimally, if it wasn't considered the optimal then investors would move their money elsewhere to make it optimal,

Yes, the arrogance and hubris of humanity... we are incapable of admitting to fallibility in our thinking...

GS

Re: Which index is the best to follow?

Posted: September 30th, 2021, 10:54 am

by GoSeigen

JohnW wrote:either you're not investing optimally or you think you know something the rest of the market doesn't know.

And a false dichotomy, and plain wrong in fact. The market does not price optimally, it prices based on the level the most stupid trader currently wishes to trade at. Why this is not blindingly obvious I have no idea. Very simple example: say I think a security is worth 104p. As a canny investor I am not going to go out there and pay 104p to buy it! There is someone willing to sell it to me at 16p. So I don't say to them, hey these are probably worth 104p, let's agree a price much closer to that because the market is efficient after all. I happily buy them at the offered 16p. Then the "market" says that I think they are worth 16p and the seller thinks they are worth 16p. NO! That is just the price we traded at. My real valuation of them was 104p but I bought them for 16p because someone was happy to sell at that price. The current trading price tells you nothing about the value of an investment and nothing about the market's valuation of an investment. It just tells you the price the dumbest person at the time is happy with.

I guarantee, the moment an investor figures this out properly for himself his investment performance will improve.

GS