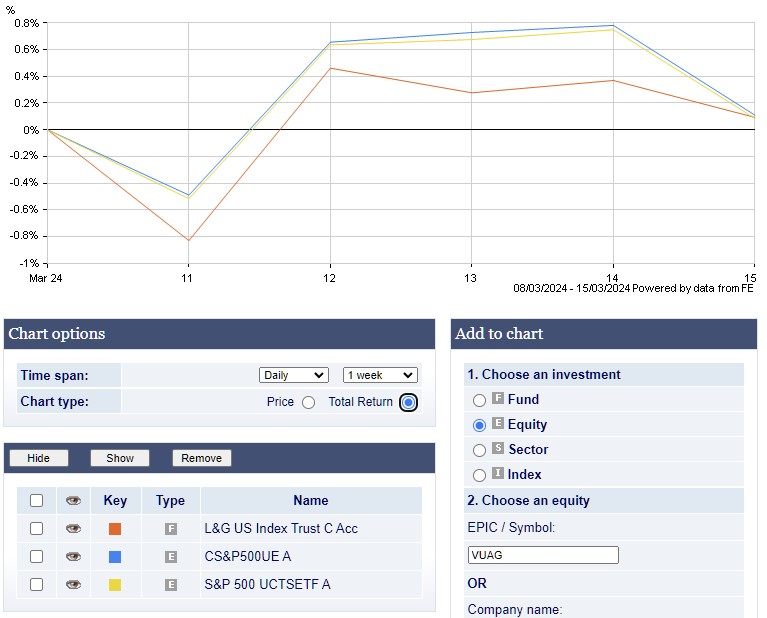

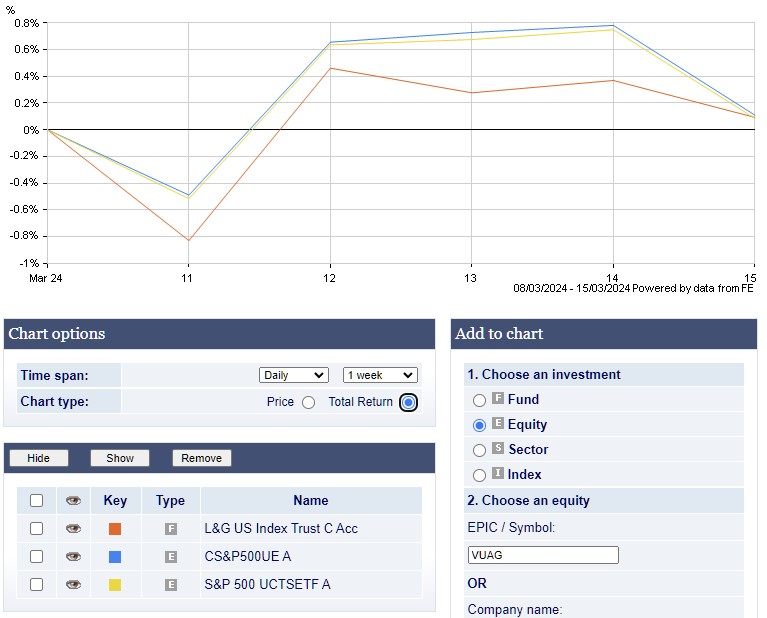

that seems to show the OEIC (orange) falling relative to the ETFs from the start of the period.

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

International wrote:I'd be converting >500K in the first go around so losing 1% would be 5 years of current platform fees! Not the planned saving.

So to mitigate I could:

1) Do things in stages, like dollar-cost-averaging

2) Sell the OEIC, taking note of when I did that. Don't buy the EFT until it has swung below (relatively) what I sold the OEIC for

Even if I stick with OEICs and move to another platform I am still going to do a tidy up so the need to avoid swings in the wrong direction still stands.

GeoffF100 wrote:If tidying up is costly, you meed to question whether it is worth it. Tidy portfolios are not necessarily any more profitable than untidy ones.

ukmtk wrote:My bad.

Indeed Vanguard invented the index tracker - it seems Mr Bogle was not initially a fan of ETFs (https://en.wikipedia.org/wiki/The_Vanguard_Group).

ETFs appear to date from 1989 (according to wikipedia https://en.wikipedia.org/wiki/Exchange-traded_fund).

ukmtk wrote:Vanguard invented the index tracker - it seems Mr Bogle was not initially a fan of ETFs (https://en.wikipedia.org/wiki/The_Vanguard_Group).

ETFs appear to date from 1989 (according to wikipedia https://en.wikipedia.org/wiki/Exchange-traded_fund).

International wrote:GeoffF100 wrote:If tidying up is costly, you meed to question whether it is worth it. Tidy portfolios are not necessarily any more profitable than untidy ones.

Yes, I agree that. The context is here: viewtopic.php?t=42245 . I'm looking to reposition myself to be retired (or FI at least) and this whole platform/OEIC/ETF decision is driven by my realisation that I am haemorrhaging platform fees which are dragging me by ~0.2% in my ISA and arguably ~0.17% in my pension.

When we get to retirement withdrawal rates where I think about numbers like growth of 5% less inflation of 3%, leaving 2% then 0.2% drag seems a lot!

I appreciate your help with thinking through the potential switch costs.

EthicsGradient wrote:The L&G OEIC tracks the FTSE USA index, not the S&P 500. It's similar (587 constituents), but not identical, so you expect variations, and not because of the OEIC v. ETF comparison.

International wrote:that seems to show the OEIC (orange) falling relative to the ETFs from the start of the period.

1nvest wrote:International wrote:Hello,

I'm with HL who charge percentage platform fees for "funds" but a flat fee for ETFs. I have been pondering either:

- Moving to iWeb and staying with "Funds", which are OEICs in my case.

- Staying with HL and moving to ETFs.

I have noticed that in the UK we seem to have a good choice of OEICs, which is not the case elsewhere.

I think I have got my head around the differences between the two from reading this forum and other resources. I think I prefer "funds"/OEICs to ETFs, but it is more a case of familiarity.

My question is this: given that ETFs are newer and more fashionable, do you think OEICs/funds will gradually die out in favour of ETFs?

Thanks for any thoughts.

Predominately ETF's are held via a broker, who takes your money and buys the shares (funds) you like ... in their name. Requires a linked bank account, where transfers can be blocked. Somewhat similar to depositing money into a bank savings account, where the money becomes the banks, and where they pay you (often relatively small amounts) of interest for that 'loan', and increasingly nowadays object/delay/block your loan being repaid.

Some funds such as FCIT have savings plan options (https://www.columbiathreadneedle.co.uk/ ... ained/gia/ £40+VAT/year fee), where you send them a cheque and buy shares in the fund more directly with the fund managers. Sell shares and they'll post you a cheque for the proceeds. Direct bank transfers are also supported however a cheque is more flexible - even if there maybe a higher cost to cash a cheque if you don't have a account at the place that cashes the cheque for you. Largely cuts out the broker, market maker and bank risk factors.

I'm not fan of lending to others, such as banks (cash deposits/savings accounts) or the state (Gilts), especially when they get to set the terms and conditions (tax rates etc.). Nor come to that even Pounds, would rather hold/use US dollar bills. Gold combined with stocks can serve well, and if stocks are held directly with a fund, cheques based, you could be in a situation where you're carrying physical gold and cheque(s) around ... outside of the fiat/virtual banking system. Assuming a bad case situation cashing a cheque might incur a 5% of value cost, as might cashing in gold be at 5% below spot price. Better that than having "your" money locked by others, and more generally the costs are minimal, maybe even zero (or in the case of gold, you might buy a coin at 2% above spot, sell at 1% above spot to a retailer, or privately both buy and sell at 1% above spot).

For such diversity reasons, I opine that ETF's will not totally eliminate funds, nor will paper money totally eliminate gold/silver. They may (have) a smaller market share, but remain active/available. If anything there's a possible situation where ETF's have already peaked in market share/alternatives bottomed, where in percentage terms ETF's start losing a proportion of market share.

Users browsing this forum: No registered users and 37 guests