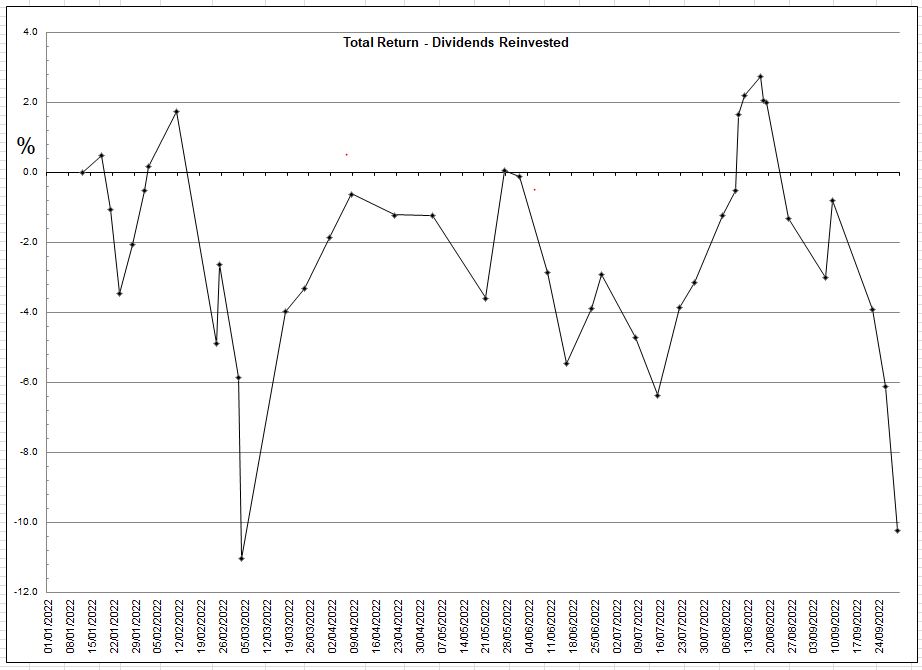

1nvest wrote:FT250 stocks are ranging from 1 year down more than -80% to up near +60%. Index -29%, median stock -25%, average -24%

a.k.a. UK smaller caps are getting killed by high energy costs and rising cost of debt, which may leave little left for LT/KK's desired growth ambitions, where the main work for millions newly unemployed might be jogging up and down the stairs at home trying to keep warm.

Within that FTSE250 population we have Monks IT, Fidelity China Special Situations, Edinburgh Wordwide, EBOX, Smithson, Schroder Oriental....all showing shareprice drops. It's not just UK small caps suffering. I could also mention China funds in general and Bailie Gifford's Shin Nippon (BGS).

Global smaller companies are showing "drops" over 1 year, eg The Global Smaller Companies IT ( GSCT, formerly "BGSC" BMO Global Smaller).

https://www.hl.co.uk/shares/shares-sear ... -trust-plc

However, Is there not a scenario where the war in Ukraine miraculously ends and energy prices drop allowing small companies to recover?

( I won't make a political comment on this board as it is not appropriate).