Got a credit card? use our Credit Card & Finance Calculators

Thanks to Shelford,GrahamPlatt,gpadsa,Steffers0,lansdown, for Donating to support the site

New HYP

-

Adamski

- Lemon Quarter

- Posts: 1137

- Joined: July 13th, 2020, 1:39 pm

- Has thanked: 1513 times

- Been thanked: 582 times

New HYP

Hi All, myself and Mrs A. are looking at setting up two HYP's as we retire this year. Using our ISAs to pay out regular monthly amounts. This would be separate to our main non work investments in SIPPs.

I've started today with City of London as the core holding. And plan to add a few others.

Been thinking of MUT, HFEL, MRCH, Vanguard High Yield. Not sure what proportions or which ones.

I'm keen not to have too many, and avoid overlap, and not wanting too correlated with each other. Comments and advice welcome. Thanks

I've started today with City of London as the core holding. And plan to add a few others.

Been thinking of MUT, HFEL, MRCH, Vanguard High Yield. Not sure what proportions or which ones.

I'm keen not to have too many, and avoid overlap, and not wanting too correlated with each other. Comments and advice welcome. Thanks

-

Arborbridge

- The full Lemon

- Posts: 10489

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3667 times

- Been thanked: 5304 times

Re: New HYP

Adamski wrote:Hi All, myself and Mrs A. are looking at setting up two HYP's as we retire this year. Using our ISAs to pay out regular monthly amounts. This would be separate to our main non work investments in SIPPs.

I've started today with City of London as the core holding. And plan to add a few others.

Been thinking of MUT, HFEL, MRCH, Vanguard High Yield. Not sure what proportions or which ones.

I'm keen not to have too many, and avoid overlap, and not wanting too correlated with each other. Comments and advice welcome. Thanks

That doesn't sound like a HYP, but an IT basket, as you have no individual shares. Perhaps look at some of the baskets people are using on the IT board too?

Your choice so far is OK-ish, but I'd have doubts about HFEL in particular. SOI perhaps, or JAGI.

Arb.

-

tjh290633

- Lemon Half

- Posts: 8342

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 923 times

- Been thanked: 4179 times

Re: New HYP

I'm in the process of updating my data on a number of ITs, which I started a few years ago with a view to switching into them when I get further into my dotage.

I am looking at both yield and total return (via XIRR) by keeping records of dividends and the share price from my start date.

One problem is mergers and other corporate actions, especially when there is a choice between several investments.

If you have the time it might be instructive.

TJH

I am looking at both yield and total return (via XIRR) by keeping records of dividends and the share price from my start date.

One problem is mergers and other corporate actions, especially when there is a choice between several investments.

If you have the time it might be instructive.

TJH

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10032 times

Re: New HYP

Adamski wrote:

I've started today with City of London as the core holding. And plan to add a few others.

Just a few quick points -

- Don't chase outlier yields

- Look for a good spread of geographic and sector diversity

- Don't ignore long-term total return - it's possible to receive a useful natural yield without feeling like you're simply eating your own capital

- Watch out for IT's using high levels of gearing

Some info that can help with your investigations -

- Some instructions (under the first post...) for helping to find some suitable IT candidates using the AIC site - https://www.lemonfool.co.uk/viewtopic.php?f=31&t=36145

- Total-return comparison page on the Hargreaves Lansdown site, where up to 7 individual IT or other equity candidates can be investigated and compared over 1, 3, or 5-years - https://www.hl.co.uk/funds/fund-discounts,-prices--and--factsheets/search-results/f/fundsmith-equity-class-i-accumulation/charts

Good luck - it would be interesting to see where you land with this exercise once you're all done...

Cheers,

Itsallaguess

Re: New HYP

The quiet months will gnaw away at you until you buy some utter cr*p to balance out the income, mark my words.

W.

W.

-

88V8

- Lemon Half

- Posts: 5889

- Joined: November 4th, 2016, 11:22 am

- Has thanked: 4238 times

- Been thanked: 2619 times

Re: New HYP

Adamski wrote:Been thinking of MUT, HFEL, MRCH, Vanguard High Yield. Not sure what proportions or which ones.

I have an IT pot as part of our income investments. We're retired and our investments contribute around 80% of our income.

AEI

BIPS

CTY

HFEL (been a capital destroyer)

JCH

JEGI

LWDB

MCT

MRCH

MUT

NCYF

SHRS

SMIF

TFIF

VSL

Some to ponder.

They amount to about 30% of our pot. The rest of it is HYP shares and Fixed Interest... Prefs/Bonds.

I've never looked into Vanguard.

You won't go wrong with MRCH, CTY, MUT as a foundation. However, dividend increases are likely to be limited while they rebuild their reserves.

I agree one need not start with a large selection. Small purchases are not economic and one can always expand the selection.

V8

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10032 times

Re: New HYP

Wuffle wrote:

The quiet months will gnaw away at you until you buy some utter cr*p to balance out the income, mark my words.

Surely any actual dividend-payment dates are utterly meaningless in all of this though?

I always assume that a portfolio of dividend-paying investments will be paying into some sort of holding account that's likely to then be allowed to build up some level of 'income reserve', and once that has been achieved, it can then be drawn off to deliver regular and balanced income from that 'income-reserve ballast', whilst incoming dividends from the portfolio continue to top it up at whatever frequency and in whatever months the underlying investments choose to do so...

I'd never in a million years expect to build up an income-delivering portfolio around actual dividend payment dates - there are much, much more important drivers to choosing our investments than something like that...

A holding account with a suitable level of reserve inside it can act as a useful emergency fund, as well as completely do away with any payment-schedule influence on choosing income-investments, and I can't think of a worse driver than 'having to look for something that pays out in July', or similar....

Cheers,

Itsallaguess

-

Adamski

- Lemon Quarter

- Posts: 1137

- Joined: July 13th, 2020, 1:39 pm

- Has thanked: 1513 times

- Been thanked: 582 times

Re: New HYP

Thanks all for your replies and advice.

@arborbridge - yes I should have called something else like high yield IT basket. I like the look of Schroder Oriental Income, looks less volatile than the other FE alternatives I've looked at.

@itsallaguess - I'm looking at those other factors in my analysis (returns, geographic and sector spread, etc). Thanks for the links.

@88V8 - thanks for sharing your pf. Point taken on HFEL

I like look of Vanguard High Yield etf and may include it for extra global exposure.

@itsallaguess - that's what I'll be doing, building up a cash reserve, and myself and Mrs A drawing on fixed monthly amounts. (For the early retirement gap, until work pensions can be drawn on).

@arborbridge - yes I should have called something else like high yield IT basket. I like the look of Schroder Oriental Income, looks less volatile than the other FE alternatives I've looked at.

@itsallaguess - I'm looking at those other factors in my analysis (returns, geographic and sector spread, etc). Thanks for the links.

@88V8 - thanks for sharing your pf. Point taken on HFEL

I like look of Vanguard High Yield etf and may include it for extra global exposure.

@itsallaguess - that's what I'll be doing, building up a cash reserve, and myself and Mrs A drawing on fixed monthly amounts. (For the early retirement gap, until work pensions can be drawn on).

-

1nvest

- Lemon Quarter

- Posts: 4542

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 722 times

- Been thanked: 1423 times

Re: New HYP

Adamski wrote:Hi All, myself and Mrs A. are looking at setting up two HYP's as we retire this year. Using our ISAs to pay out regular monthly amounts. This would be separate to our main non work investments in SIPPs.

I've started today with City of London as the core holding. And plan to add a few others.

Been thinking of MUT, HFEL, MRCH, Vanguard High Yield. Not sure what proportions or which ones.

I'm keen not to have too many, and avoid overlap, and not wanting too correlated with each other. Comments and advice welcome. Thanks

Single click, VMIG a FTSE250 total return/accumulation fund provided by Vanguard, inside a SIPP and/or ISA. In a general (taxable) account VMID, that distributes the dividends, so makes any self assessment reporting easier.

The FTSE250 includes a broad bunch of Investment Trusts and runs along somewhat similar lines to Terry's TJH HYP i.e. tweaked HYP. Winners are top sliced out of the Index, into the FTSE100, and are replaced with 'value', stocks that haven't totally failed and that fall out of the FTSE100 into the FTSE250. At the bottom end stocks fall out of the bottom to be replaced with alternative rising stocks. Some of the stocks will also be natural high yield type stocks, that pay above average dividend yields.

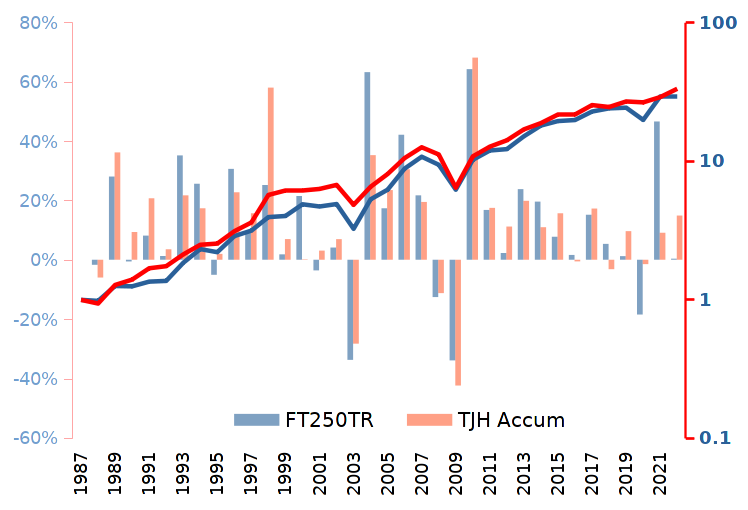

Stats ...

FTSE250 and TJH respective figures for total returns spanning fiscal years April 1987 - April 2023

Log linear regression 10% 9.9%

Average 12.3% 12.4%

Stdev 22.2% 20.2%

Min -33.9% -42.4%

Max 64.2% 68.1%

R-squared 0.973 0.961

The log linear regression (trend line of the exponential plot slope) is a better broader measure than CAGR that is more reflective of individual start and end date specific levels. R-Squared indicates how volatile the actual progression moved around that trend line (variance). Whilst the FTSE250 had a higher (worse) standard deviation in yearly changes, it had the higher (better) r-squared, so IMO essentially the same/very-similar overall.

For income in the case of VMIG just sell some shares as/when required. For VMID its a combination of selling some shares and taking/leaving the dividends as cash. Conceptually, not suggesting you do so in practice, but you could take the exact same amount of income as provided by TJH HYP. There are a variety of means to address how much income might be drawn each year, such as SWR, where for instance a 4% SWR has you take 4% of the initial portfolio value as income at the start, and then uplift that £££ amount each year by inflation as the amount of income drawn in subsequent years.

Don't expect close alignment, each waxes and wanes

More suited to the disinterested. Some/many around here enjoy doing the manual management of maintaining their own set of 15 or 30 (whatever) stocks and all of the recording/reporting (such as dividends) that entails. But that could become difficult in later years should your mind/ability start to decline/fail.

-

1nvest

- Lemon Quarter

- Posts: 4542

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 722 times

- Been thanked: 1423 times

Re: New HYP

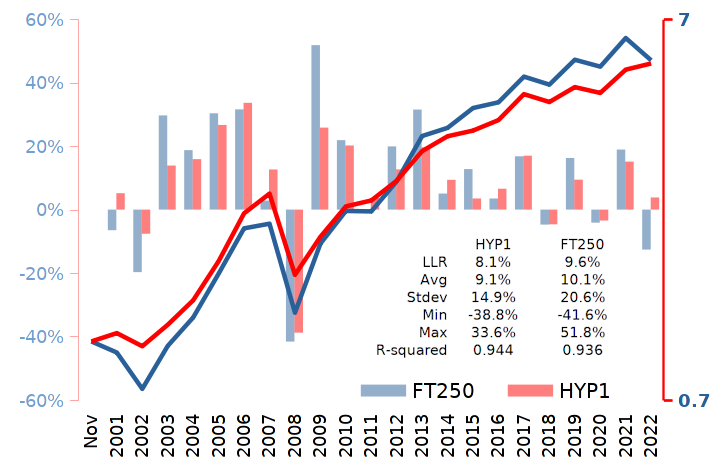

As another FTSE250 total return versus HYP1 total return example

For total return calculations I just assumed reinvestment of dividends at the ongoing rate of return, so with each years current HYP1 value (started at £75,000) and each years subsequent value thereafter, along with each years total dividend value ...

year total return = ( current-value + dividends - previous-year-value ) / previous-year-value

Again broadly comparable

For total return calculations I just assumed reinvestment of dividends at the ongoing rate of return, so with each years current HYP1 value (started at £75,000) and each years subsequent value thereafter, along with each years total dividend value ...

year total return = ( current-value + dividends - previous-year-value ) / previous-year-value

Again broadly comparable

-

1nvest

- Lemon Quarter

- Posts: 4542

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 722 times

- Been thanked: 1423 times

Re: New HYP

When you put aside individual stock selection and dividend/income management/focus, reducing such to a single click factor (FTSE250 index fund), perhaps drawing income using SWR that yields a regular inflation adjusted income (yearly, monthly, whatever you prefer), then that can lead to better secondary level analysis/management. For instance you can reliably short that portfolio via single clicks, either selling, or by adding a short FTSE250 if otherwise selling might induce a taxable capital gain event. And/or you might combine both long, short and leverage alternatives in weightings that for instance open up generally migrating funds from one account to another, such as from SIPP to ISA. With SIPP's you don't pay any tax on the way in, pay tax on the way out, with ISA you pay in out of taxed money, but are tax free on the way out. Pay in via SIPP, withdraw via ISA and you side step tax altogether. SIPP capital migrated into ISA also becomes accessible (spendable) where otherwise that might not be a option (can't draw/spend from SIPP until a certain age).

Or other such considerations, for instance I'm not a all-stock investor, instead I combine stock with gold - as a portfolio hedge. If you own your own home, have a decent pension income, then for some they might opine they need no bonds and go all-in on a stock. I'm somewhat in that category however I prefer the comfort of a portfolio hedge. Along the lines of a assumption that during a 30 year/whatever investment horizon period at times stocks might dive, whilst gold might do well at such time. If 66.6 initial stock value halves to 33.3, whilst 33.3 gold value doubles to 66.6, then rebalancing back to 67/33 stock/gold weightings has exposure back to as before, but where the number of shares held have been doubled-up. Which is a Martingale betting method, after each losing play (stocks halving/gold doubling), double-up on your stake (number of shares). All very conceptual, but where 67/33 stock/gold in effect runs along those lines. This US PV example indicates how 67/33 stock/gold broadly compared in reward to all-stock, but did so with lower risk (higher Sharpe Ratio) across 1972 to recent.

Looking at Monte Carlo simulations, again US based data, and 100% stock with a 30 year 4% SWR had a 86% success probability, whereas for 67/33 stock/gold that increased to a 96% probability PV MC. Many a 65 year old retiree will have a lower probability of actually living another 30 years.

This is another example (again US data), where instead of 67/33 stock/gold the position is held as thirds each in 2x stock/bonds/gold PV, which might be preferred/useful in some cases such as with migration of capital between accounts or tax efficiencies in mind.

Much of the above might be irrelevant to the unconcerned, who prefer to just set and pretty much forget their investment portfolio. Whilst HYP might be appropriate for those who instead prefer to dabble, as a hobby, then there are alternatives such stock/dividends dabbling as the above (capital migration dabbling ...etc.).

Or other such considerations, for instance I'm not a all-stock investor, instead I combine stock with gold - as a portfolio hedge. If you own your own home, have a decent pension income, then for some they might opine they need no bonds and go all-in on a stock. I'm somewhat in that category however I prefer the comfort of a portfolio hedge. Along the lines of a assumption that during a 30 year/whatever investment horizon period at times stocks might dive, whilst gold might do well at such time. If 66.6 initial stock value halves to 33.3, whilst 33.3 gold value doubles to 66.6, then rebalancing back to 67/33 stock/gold weightings has exposure back to as before, but where the number of shares held have been doubled-up. Which is a Martingale betting method, after each losing play (stocks halving/gold doubling), double-up on your stake (number of shares). All very conceptual, but where 67/33 stock/gold in effect runs along those lines. This US PV example indicates how 67/33 stock/gold broadly compared in reward to all-stock, but did so with lower risk (higher Sharpe Ratio) across 1972 to recent.

Looking at Monte Carlo simulations, again US based data, and 100% stock with a 30 year 4% SWR had a 86% success probability, whereas for 67/33 stock/gold that increased to a 96% probability PV MC. Many a 65 year old retiree will have a lower probability of actually living another 30 years.

This is another example (again US data), where instead of 67/33 stock/gold the position is held as thirds each in 2x stock/bonds/gold PV, which might be preferred/useful in some cases such as with migration of capital between accounts or tax efficiencies in mind.

Much of the above might be irrelevant to the unconcerned, who prefer to just set and pretty much forget their investment portfolio. Whilst HYP might be appropriate for those who instead prefer to dabble, as a hobby, then there are alternatives such stock/dividends dabbling as the above (capital migration dabbling ...etc.).

-

1nvest

- Lemon Quarter

- Posts: 4542

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 722 times

- Been thanked: 1423 times

Re: New HYP

The government, for whatever its reasons better known to them than me, are pretty generous.

Consider a 20's something individual who is working and earning £40K/year. Approaching April they drop £20K into a ISA in the current fiscal year, and another £20K in the new financial year. And also load £80K into a SIPP (two years of allowance, as a £64K payment in, that's topped up to by £16K tax relief to £80K total). Loading up a portfolio similar in total returns to a HYP (FT250) they structure the holdings in order to be inclined to migrate SIPP value over to ISA value.

Out of their £40K gross wage they take home £31K after having paid tax and National Insurance, but in effect received back £8K in SIPP credits, and where once migrated over to ISA that capital is entirely accessible, free to be drawn/spent. And under recent changes the life time allowance has been made unlimited.

In effect a high yield portfolio of another kind (HYPOAK), of value of around £8K saving on stoppages out of a £40K gross wage benefit (£1K in effect stoppages rather than £9K), and where their £120K of combined initial SIPP and ISA might also have a conservative 3% SWR drawn (£3.6K), that is inclined to be a PWR (perpetual withdrawal rate). £11.6K combined (£8K tax credit, £3.6K SWR income), relative to £120K value (SIPP/ISA) = 9.7% yield.

Consider a 20's something individual who is working and earning £40K/year. Approaching April they drop £20K into a ISA in the current fiscal year, and another £20K in the new financial year. And also load £80K into a SIPP (two years of allowance, as a £64K payment in, that's topped up to by £16K tax relief to £80K total). Loading up a portfolio similar in total returns to a HYP (FT250) they structure the holdings in order to be inclined to migrate SIPP value over to ISA value.

Out of their £40K gross wage they take home £31K after having paid tax and National Insurance, but in effect received back £8K in SIPP credits, and where once migrated over to ISA that capital is entirely accessible, free to be drawn/spent. And under recent changes the life time allowance has been made unlimited.

In effect a high yield portfolio of another kind (HYPOAK), of value of around £8K saving on stoppages out of a £40K gross wage benefit (£1K in effect stoppages rather than £9K), and where their £120K of combined initial SIPP and ISA might also have a conservative 3% SWR drawn (£3.6K), that is inclined to be a PWR (perpetual withdrawal rate). £11.6K combined (£8K tax credit, £3.6K SWR income), relative to £120K value (SIPP/ISA) = 9.7% yield.

-

funduffer

- Lemon Quarter

- Posts: 1340

- Joined: November 4th, 2016, 12:11 pm

- Has thanked: 123 times

- Been thanked: 848 times

Re: New HYP

1nvest wrote:As another FTSE250 total return versus HYP1 total return example

For total return calculations I just assumed reinvestment of dividends at the ongoing rate of return, so with each years current HYP1 value (started at £75,000) and each years subsequent value thereafter, along with each years total dividend value ...

year total return = ( current-value + dividends - previous-year-value ) / previous-year-value

Again broadly comparable

TR is not particularly relevant, as the OP intends to withdraw the income from the portfolio, to live on / supplement their income.

Progression of income per unit is more relevant, I feel.

FD

-

Newroad

- Lemon Quarter

- Posts: 1112

- Joined: November 23rd, 2019, 4:59 pm

- Has thanked: 17 times

- Been thanked: 348 times

Re: New HYP

Hi Adamski.

I would start at the other end, given your apparent preferences. Use a straw-man of 100% VHYL and ask what that doesn't give you, then do the minimum adjustment (which may be nothing) from there.

There are potentially valid reasons for adjustment of that straw-man, but only you know whether they are relevant to you. If they aren't, then maybe it's fire and forget?

Regards, Newroad

I would start at the other end, given your apparent preferences. Use a straw-man of 100% VHYL and ask what that doesn't give you, then do the minimum adjustment (which may be nothing) from there.

There are potentially valid reasons for adjustment of that straw-man, but only you know whether they are relevant to you. If they aren't, then maybe it's fire and forget?

Regards, Newroad

-

1nvest

- Lemon Quarter

- Posts: 4542

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 722 times

- Been thanked: 1423 times

Re: New HYP

funduffer wrote:TR is not particularly relevant, as the OP intends to withdraw the income from the portfolio, to live on / supplement their income.

Progression of income per unit is more relevant, I feel.

FD

Taking your own dividends out of total return is little different to firms paying out a dividend at the times and amounts of their choosing. You could replicate their collective choice precisely out of total returns if you so preferred. The main difference is dividends paid out come out of the firms bottom lines, whilst DIY dividends might in some cases such as BRK (Berkshire Hathaway pays no dividends) be purely paid by other investors rather than the firms. Living off dividends involves a potentially too variable cash (income) flow [Deletion].

The OP's heading towards Investment Trusts is more inclined to have a more stable income flow, but they come at a cost. Whilst the highlighted costs are typically low in appearance there are other more opaque costs where in some, even many cases the total costs can amount to 1%/year or more.

Moderator Message:

If you can't summon a calibre of argument that doesn't involve hurling gratuitous abuse at your fellow people then please find another site to do it on. Thanks - Chris

If you can't summon a calibre of argument that doesn't involve hurling gratuitous abuse at your fellow people then please find another site to do it on. Thanks - Chris

Return to “Portfolio Management & Review”

Who is online

Users browsing this forum: No registered users and 1 guest