Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

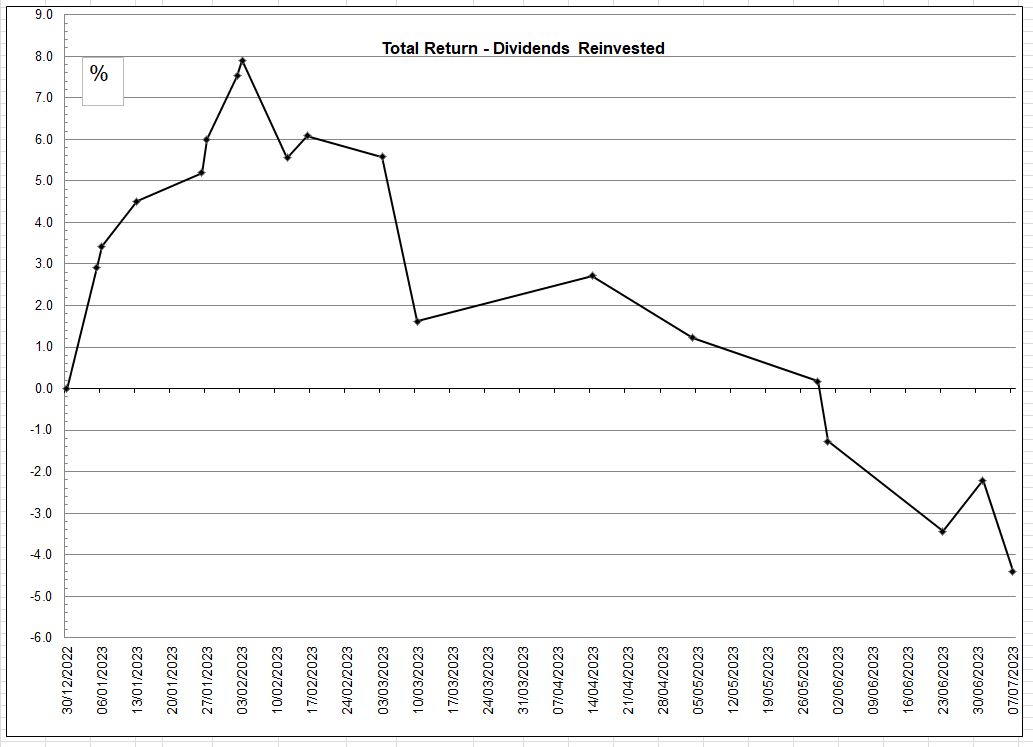

Mid-Year Blues (Total Returns drop off)

-

Steveam

- Lemon Slice

- Posts: 984

- Joined: March 18th, 2017, 10:22 pm

- Has thanked: 1798 times

- Been thanked: 538 times

Re: Mid-Year Blues (Total Returns drop off)

I’ve wondered off base in this thread as the OP talked about beginning of the year and I’ve been talking about from peak (16-Feb). Although my records are sketchy I think I’m down (in £) 2% from the beginning of the year.

If the exchange rate were unchanged I’d be plus a couple of %. All pretty much noise level stuff foe me.

Best wishes,

Steve

If the exchange rate were unchanged I’d be plus a couple of %. All pretty much noise level stuff foe me.

Best wishes,

Steve

-

Golam

- Lemon Pip

- Posts: 60

- Joined: August 11th, 2019, 9:35 pm

- Has thanked: 195 times

- Been thanked: 38 times

Re: Mid-Year Blues (Total Returns drop off)

Beginning of year to now, total return drop off for me is 7.6% ! Two thirds of portfolio is HYP style, one third Investment Trusts. I stress the HY element in both.

Should I be concerned ? Unsure at this stage. On the whole, am content.

Should I be concerned ? Unsure at this stage. On the whole, am content.

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: Mid-Year Blues (Total Returns drop off)

Just to point out...in the graph above, all dividends are reinvested. If I was drawing dividends then the TR figures would be ~3% lower thus a drop of ~7.5% since the start of the year.

HYP (income bias) 39%

UK Individual (Growth bias)7%

Growth ITs 10%

Income ITs 29%

US 7%

Prefs 6%

Cash 2%

There is a strong bias to UK although there is "some foreign" in there!

HYP (income bias) 39%

UK Individual (Growth bias)7%

Growth ITs 10%

Income ITs 29%

US 7%

Prefs 6%

Cash 2%

There is a strong bias to UK although there is "some foreign" in there!

-

Newroad

- Lemon Quarter

- Posts: 1098

- Joined: November 23rd, 2019, 4:59 pm

- Has thanked: 17 times

- Been thanked: 344 times

Re: Mid-Year Blues (Total Returns drop off)

Hi Simoan.

YTD (more accurately 31/12/2022 to 30/06/2023 at last measure) I am up on average c3.3% for the other equity parts of the portfolio (the P-HYP represents about 3% of our net worth ex housing and DB pensions). As it happens, the SIPP's and JISA's have done slightly better than that, the ISA's slightly worse (but still up).

Not sure if that's good or bad, but it's better than the P-HYP performance noted earlier of c-14%!

Regards, Newroad

YTD (more accurately 31/12/2022 to 30/06/2023 at last measure) I am up on average c3.3% for the other equity parts of the portfolio (the P-HYP represents about 3% of our net worth ex housing and DB pensions). As it happens, the SIPP's and JISA's have done slightly better than that, the ISA's slightly worse (but still up).

Not sure if that's good or bad, but it's better than the P-HYP performance noted earlier of c-14%!

Regards, Newroad

-

simoan

- Lemon Quarter

- Posts: 2109

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1467 times

Re: Mid-Year Blues (Total Returns drop off)

Newroad wrote:Hi Simoan.

YTD (more accurately 31/12/2022 to 30/06/2023 at last measure) I am up on average c3.3% for the other equity parts of the portfolio (the P-HYP represents about 3% of our net worth ex housing and DB pensions). As it happens, the SIPP's and JISA's have done slightly better than that, the ISA's slightly worse (but still up).

Not sure if that's good or bad, but it's better than the P-HYP performance noted earlier of c-14%!

Regards, Newroad

Well done. You’ve at least beaten the return on cash. I haven’t managed to hit those giddy heights!

All the best, Si

-

simoan

- Lemon Quarter

- Posts: 2109

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1467 times

Re: Mid-Year Blues (Total Returns drop off)

I had a quick poke around to see what has worked and what hasn't YTD in my portfolio. Interesting that the best performing FTSE index is the Small Cap (excluding ITs). In the positive column Fundsmith is up 6% and Nick Train has outperformed with FGT up 3% and outperforming its benchmark (FTSE All Share) by 6% as I write. Obviously, large cap US technology has been strong. It seems quality shares with high margins have been winning against lower margin value shares. Perhaps that is what we should expect in an inflationary environment...

All the best, Si

All the best, Si

-

JohnW

- Lemon Slice

- Posts: 531

- Joined: June 1st, 2019, 7:00 am

- Has thanked: 5 times

- Been thanked: 185 times

Re: Mid-Year Blues (Total Returns drop off)

‘Nick Train has outperformed with FGT up 3% and outperforming its benchmark (FTSE All Share) by 6% as I write.

A quarter of its holdings are in US or EU stocks, unlike the FTSE All Share, I think.

-

simoan

- Lemon Quarter

- Posts: 2109

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1467 times

Re: Mid-Year Blues (Total Returns drop off)

JohnW wrote:‘Nick Train has outperformed with FGT up 3% and outperforming its benchmark (FTSE All Share) by 6% as I write.

A quarter of its holdings are in US or EU stocks, unlike the FTSE All Share, I think.

Yes, but the relative strength has come from UK stocks such as Sage and the two largest holdings RELX and LSEG. Other large UK holdings have not lost money e.g. Burberry and Experian. The UK holdings on their own have comfortably beaten the index, but as I mentioned before having overseas exposure has helped even if FGT does not hold any FAANGs.

FWLIW I looked at all the FTSE 100 risers YTD and the only HYP type risers were ABRDN and Sainsbury out of around 30 companies.

-

JohnW

- Lemon Slice

- Posts: 531

- Joined: June 1st, 2019, 7:00 am

- Has thanked: 5 times

- Been thanked: 185 times

Re: Mid-Year Blues (Total Returns drop off)

Yes, the fund’s UK stocks beat the UK index, but the investors also hold 25% as foreign stocks. Doesn’t it make sense to compare the fund’s performance with a partial holding of foreign stocks as well? That would be comparing like with something like it.

-

Charlottesquare

- Lemon Quarter

- Posts: 1794

- Joined: November 4th, 2016, 3:22 pm

- Has thanked: 105 times

- Been thanked: 567 times

Re: Mid-Year Blues (Total Returns drop off)

simoan wrote:vand wrote:

Definitely some truth to that, and it's the reason why most "common sense" investing should start off at a globally diversified portfolio.

However, also worth bearing in mind that some of those figures are a bit inflated unless you are currency-hedged too. GBPJPY is up 15% YTD, as an example.

Yes, there's been no hiding place for a UK investor YTD, with the strong pound meaning most of the gains made overseas have been offset by currency movements. But still bad IMHO to be in the red YTD on a TR basis. I would be reviewing my portfolio and looking hard in the mirror. FWIW I include myself in that number even though I am up ~1% YTD (mainly thanks to a large holding in Fundsmith and US Large Cap tech). That's not good enough IMHO.

But why move/change investments, no guarantees a change will be any better and if you reallocate you may miss any recoveries that happen.

This thread made me compare my holdings today with my 4/1/23 figures, pretty sad reading, ignoring the holdings where I have changed number of shares (cannot be bothered working out) and ignoring divs received, every holding, no matter where in world it invests, excepting Berkshire & JPM IG, has bled

Aberdeen Asian 15,540, now 13,860

Bellway 4030 now 3918

Berkshire 13327 now 13497

B Rock Sus IT 13325 now 12383

B Rock World min 12441 now 9986

BAT 3160 now 2547

EU asset 14340 now 12945

HEFL 16950 now 14100

Hipgnosis 7057 now 5801

IMP 3052 now2579

JPM I & G 19183 now 19814

Legal and Gen 6494 now 5852

Middlefild Canadian 14026 now 12311

Murray int 18660 now 16200

Schroeder Int 15990 now 14660

Scot Mortg 9096 mow 7716

Shell 12037 now 11552

Smith DS 13696 now 11068

unilever 12661 now 11913

Vina Capital 4620 now 4310

Total was 289,168 4/1/23 today 265,111 (inc divs and extra £438 invested)

To me not sure any area/sector is safer than any other, accordingly I will hold on to what i have, use circa £13,500 divs pa to increase some holdings and wait. Past experience has shown me that changing direction after falls rarely improves my position in the long term.

-

simoan

- Lemon Quarter

- Posts: 2109

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1467 times

Re: Mid-Year Blues (Total Returns drop off)

Charlottesquare wrote:simoan wrote:Yes, there's been no hiding place for a UK investor YTD, with the strong pound meaning most of the gains made overseas have been offset by currency movements. But still bad IMHO to be in the red YTD on a TR basis. I would be reviewing my portfolio and looking hard in the mirror. FWIW I include myself in that number even though I am up ~1% YTD (mainly thanks to a large holding in Fundsmith and US Large Cap tech). That's not good enough IMHO.

But why move/change investments, no guarantees a change will be any better and if you reallocate you may miss any recoveries that happen.

Where did I say that you should take any action at all? I didn't even mean to imply that. I have no intention of changing anything but you constantly need to review what has worked and what hasn't, particularly where something external has changed for the worse - in this case stubborn inflation, increasing interest rates and a strengthening pound. It's a while since we've experienced any of those things, let alone all three in combination in the past 20 years. I think this situation was fairly foreseeable a few months ago, and so I am allowed to beat myself up if I want to!

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Mid-Year Blues (Total Returns drop off)

Charlottesquare wrote:To me not sure any area/sector is safer than any other, accordingly I will hold on to what i have, use circa £13,500 divs pa to increase some holdings and wait. Past experience has shown me that changing direction after falls rarely improves my position in the long term.

But UK:VWRL has a total return of about +4.5% YTD because it's included the handful of stocks that have ripped this year. That's the powerful argument behind indexing.

-

Charlottesquare

- Lemon Quarter

- Posts: 1794

- Joined: November 4th, 2016, 3:22 pm

- Has thanked: 105 times

- Been thanked: 567 times

Re: Mid-Year Blues (Total Returns drop off)

simoan wrote:Charlottesquare wrote:

But why move/change investments, no guarantees a change will be any better and if you reallocate you may miss any recoveries that happen.

Where did I say that you should take any action at all? I didn't even mean to imply that. I have no intention of changing anything but you constantly need to review what has worked and what hasn't, particularly where something external has changed for the worse - in this case stubborn inflation, increasing interest rates and a strengthening pound. It's a while since we've experienced any of those things, let alone all three in combination in the past 20 years. I think this situation was fairly foreseeable a few months ago, and so I am allowed to beat myself up if I want to!

Maybe not say but there was a quasi implication- reviewing holdings would be a fairly futile exercise if no action was to be taken but personally I would likely not want to tempt myself towards tinkering so would cover my eyes and ignore the drops knowing that I was equally as likely to buy other holdings foolishly as I was to make good choices, after all if I could consistently beat the market I would have missed my obvious vocation as a fund manager.

-

simoan

- Lemon Quarter

- Posts: 2109

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1467 times

Re: Mid-Year Blues (Total Returns drop off)

Charlottesquare wrote:

Maybe not say but there was a quasi implication- reviewing holdings would be a fairly futile exercise if no action was to be taken but personally I would likely not want to tempt myself towards tinkering so would cover my eyes and ignore the drops knowing that I was equally as likely to buy other holdings foolishly as I was to make good choices, after all if I could consistently beat the market I would have missed my obvious vocation as a fund manager.

I’m talking about reviewing performance and asset allocation rather than individual holdings. For instance, I am overweight UK small caps, and whilst I don’t intend selling any, going forwards I am likely to allocate less new money to that sector of the market. And, of course, If you can’t even beat cash you should maybe think again about why you’re investing in individual shares at all rather than a global index tracker ETF. I suspect many UK equity investors will not beat the return on the risk free rate this year, and that’s not good. It’s about being honest with yourself as opposed to burying your head in the sand.

-

Charlottesquare

- Lemon Quarter

- Posts: 1794

- Joined: November 4th, 2016, 3:22 pm

- Has thanked: 105 times

- Been thanked: 567 times

Re: Mid-Year Blues (Total Returns drop off)

simoan wrote:Charlottesquare wrote:

Maybe not say but there was a quasi implication- reviewing holdings would be a fairly futile exercise if no action was to be taken but personally I would likely not want to tempt myself towards tinkering so would cover my eyes and ignore the drops knowing that I was equally as likely to buy other holdings foolishly as I was to make good choices, after all if I could consistently beat the market I would have missed my obvious vocation as a fund manager.

I’m talking about reviewing performance and asset allocation rather than individual holdings. For instance, I am overweight UK small caps, and whilst I don’t intend selling any, going forwards I am likely to allocate less new money to that sector of the market. And, of course, If you can’t even beat cash you should maybe think again about why you’re investing in individual shares at all rather than a global index tracker ETF. I suspect many UK equity investors will not beat the return on the risk free rate this year, and that’s not good. It’s about being honest with yourself as opposed to burying your head in the sand.[/quote]

Surely one bad year is to be expected now and then, is one year not far too short an investment period to really bother with? I look at equities on an at least 5 year outlook and with these ones my investment window runs to 2035 re their existing wrapper and within alternative wrappers possibly longer if I live that long. (some years I have done fine, since 2020 I am well up, since 2019 I am still ahead, just more recent period a tad sickly, but over a lifetime that is what happens. I am not at my age going back to trading in and out of holdings/areas, been there, done that, these days it is stay invested and let markets take care of themselves.

-

tjh290633

- Lemon Half

- Posts: 8290

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 919 times

- Been thanked: 4138 times

Re: Mid-Year Blues (Total Returns drop off)

simoan wrote:FWLIW I looked at all the FTSE 100 risers YTD and the only HYP type risers were ABRDN and Sainsbury out of around 30 companies.

You might be interested in the change in SP of the holdings in my HYP, which also shows the historic yield on each holding.

Epic Change Yield

IMI 22.13% 1.63%

TSCO 9.46% 4.44%

BT.A 9.10% 6.30%

BA. 5.30% 3.00%

TATE 2.08% 2.55%

SSE 1.84% 5.55%

TW. 0.34% 9.22%

SHEL -0.26% 3.85%

RKT -0.31% 3.19%

NG. -0.92% 5.61%

BP. -3.08% 4.56%

KGF -3.90% 5.46%

ADM -4.35% 7.68%

LLOY -4.71% 5.55%

ULVR -5.15% 3.77%

UU. -5.67% 4.87%

HLN -5.74% 1.17%

SGRO -5.91% 3.66%

GSK -8.32% 4.19%

LGEN -9.26% 8.26%

WDS -9.55% 11.98%

DGE -9.89% 2.36%

AZN -10.13% 2.37%

BHP -12.26% 10.01%

AV. -12.76% 8.02%

PSON -12.80% 2.63%

SMDS -13.81% 6.50%

RIO -14.68% 8.23%

S32 -14.97% 9.78%

VOD -15.67% 11.13%

IMB -16.49% 8.20%

PHP -16.52% 7.19%

IGG -17.65% 6.91%

BLND -20.32% 7.19%

BATS -22.28% 9.05%

Av.Chg -6.14% 5.57%

Mostly from the FTSE100. Before you ask, IMI was originally bought in 2009 at 265p, with a yield of 7.82%.

TJH

-

OhNoNotimAgain

- Lemon Slice

- Posts: 767

- Joined: November 4th, 2016, 11:51 am

- Has thanked: 71 times

- Been thanked: 147 times

Re: Mid-Year Blues (Total Returns drop off)

monabri wrote:The year started off well and my portfolio actually started to show some reasonable gains....and then.... The overall drop in total return since the peak is ~12.5%...maybe if I rephrase it as a drop of 4.5% from the start of the year it might sound better or rename the portfolio as "monabri's HYP * "?

It's a bit discouraging but the income is holding up (Direct Line Group excepted). I wonder if we are to see further drops until interest rates are under control?

(* not even close to a HYP, not even if I squint!).

Yes, it's the exchange rate of sterling versus the dollar.

If the pound goes up companies that earn most of their money overseas, normally in dollars, decline relative to companies that make all their money in sterling.

Measured in dollars of course everyone's a winner.

-

1nvest

- Lemon Quarter

- Posts: 4458

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 701 times

- Been thanked: 1374 times

Re: Mid-Year Blues (Total Returns drop off)

tjh290633 wrote:simoan wrote:FWLIW I looked at all the FTSE 100 risers YTD and the only HYP type risers were ABRDN and Sainsbury out of around 30 companies.

You might be interested in the change in SP of the holdings in my HYP, which also shows the historic yield on each holding.Epic Change Yield

IMI 22.13% 1.63%

TSCO 9.46% 4.44%

BT.A 9.10% 6.30%

BA. 5.30% 3.00%

TATE 2.08% 2.55%

SSE 1.84% 5.55%

TW. 0.34% 9.22%

SHEL -0.26% 3.85%

RKT -0.31% 3.19%

NG. -0.92% 5.61%

BP. -3.08% 4.56%

KGF -3.90% 5.46%

ADM -4.35% 7.68%

LLOY -4.71% 5.55%

ULVR -5.15% 3.77%

UU. -5.67% 4.87%

HLN -5.74% 1.17%

SGRO -5.91% 3.66%

GSK -8.32% 4.19%

LGEN -9.26% 8.26%

WDS -9.55% 11.98%

DGE -9.89% 2.36%

AZN -10.13% 2.37%

BHP -12.26% 10.01%

AV. -12.76% 8.02%

PSON -12.80% 2.63%

SMDS -13.81% 6.50%

RIO -14.68% 8.23%

S32 -14.97% 9.78%

VOD -15.67% 11.13%

IMB -16.49% 8.20%

PHP -16.52% 7.19%

IGG -17.65% 6.91%

BLND -20.32% 7.19%

BATS -22.28% 9.05%

Av.Chg -6.14% 5.57%

Mostly from the FTSE100. Before you ask, IMI was originally bought in 2009 at 265p, with a yield of 7.82%.

TJH

-

1nvest

- Lemon Quarter

- Posts: 4458

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 701 times

- Been thanked: 1374 times

Re: Mid-Year Blues (Total Returns drop off)

1nvest wrote:tjh290633 wrote:You might be interested in the change in SP of the holdings in my HYP, which also shows the historic yield on each holding.Epic Change Yield

IMI 22.13% 1.63%

TSCO 9.46% 4.44%

BT.A 9.10% 6.30%

BA. 5.30% 3.00%

TATE 2.08% 2.55%

SSE 1.84% 5.55%

TW. 0.34% 9.22%

SHEL -0.26% 3.85%

RKT -0.31% 3.19%

NG. -0.92% 5.61%

BP. -3.08% 4.56%

KGF -3.90% 5.46%

ADM -4.35% 7.68%

LLOY -4.71% 5.55%

ULVR -5.15% 3.77%

UU. -5.67% 4.87%

HLN -5.74% 1.17%

SGRO -5.91% 3.66%

GSK -8.32% 4.19%

LGEN -9.26% 8.26%

WDS -9.55% 11.98%

DGE -9.89% 2.36%

AZN -10.13% 2.37%

BHP -12.26% 10.01%

AV. -12.76% 8.02%

PSON -12.80% 2.63%

SMDS -13.81% 6.50%

RIO -14.68% 8.23%

S32 -14.97% 9.78%

VOD -15.67% 11.13%

IMB -16.49% 8.20%

PHP -16.52% 7.19%

IGG -17.65% 6.91%

BLND -20.32% 7.19%

BATS -22.28% 9.05%

Av.Chg -6.14% 5.57%

Mostly from the FTSE100. Before you ask, IMI was originally bought in 2009 at 265p, with a yield of 7.82%.

TJH

Wondering about Robert Lichello's AIM https://www.gummystuff.org/AIM.htm and how that might pan out if applied to each HYP stock. Tells you when to add or reduce. For example for one started against VOD in January 2023

Generally tends to yield quite good XIRR whilst also tending to top-slice winners, top-up laggards.

Maintaining 30+ AIM's (stocks) may sound daunting, but in practice its pretty light weight management, and I see there's even a app for it https://play.google.com/store/apps/deta ... crypto_aim (targeted at use with crypto's, but I suspect it may also work with regular stocks).

-

Gerry557

- Lemon Quarter

- Posts: 2057

- Joined: September 2nd, 2019, 10:23 am

- Has thanked: 173 times

- Been thanked: 569 times

Re: Mid-Year Blues (Total Returns drop off)

Sat in front of my spreadsheet and looking at weekly data. So this will miss the exact daily high and low.

My PF rose to a peak 11 Feb 23 up just over 6%. It then dropped 8.77% from the peak, hitting a weekly low on 8 Jul 23.

The last fortnight has seen an uptick with both weeks showing gains.

I have a basket of funds where there have been no additional buys or dividend reinvestment. Even after the last two good weeks they are down 0.81% on the year to date. Obviously the dividends would make this positive number.

The income holding shares are doing what was planned as the first six months show income was higher in every month compared to the previous years similar months. This was as expected as more shares have been acquired with reinvestment of dividends.

Although I think July's income might fall slightly short of last year due to a payment that will be made in early August this year instead. This will bump August income so more swings and roundabouts really in the scheme of things. I'm expecting the annual figure to be higher than last year's.

The overall income has risen every year except 2020 due to covid effects. That years income fell 18.5% compared to 2019. I suspect buying back then has helped this year's figures somewhat.

So I suppose its what is ahead now for the rest of the year. After x2 relatively good weeks will we get a down week next. Maybe not as we are still off the peak but it won't take too much to get back there either plus as more dividends arrive there is scope that adding these back into the mix the peak figure could be surpassed again this year. It might be Xmas time.

Still let's not count chickens just yet as they might be swans of the dark variety.

My PF rose to a peak 11 Feb 23 up just over 6%. It then dropped 8.77% from the peak, hitting a weekly low on 8 Jul 23.

The last fortnight has seen an uptick with both weeks showing gains.

I have a basket of funds where there have been no additional buys or dividend reinvestment. Even after the last two good weeks they are down 0.81% on the year to date. Obviously the dividends would make this positive number.

The income holding shares are doing what was planned as the first six months show income was higher in every month compared to the previous years similar months. This was as expected as more shares have been acquired with reinvestment of dividends.

Although I think July's income might fall slightly short of last year due to a payment that will be made in early August this year instead. This will bump August income so more swings and roundabouts really in the scheme of things. I'm expecting the annual figure to be higher than last year's.

The overall income has risen every year except 2020 due to covid effects. That years income fell 18.5% compared to 2019. I suspect buying back then has helped this year's figures somewhat.

So I suppose its what is ahead now for the rest of the year. After x2 relatively good weeks will we get a down week next. Maybe not as we are still off the peak but it won't take too much to get back there either plus as more dividends arrive there is scope that adding these back into the mix the peak figure could be surpassed again this year. It might be Xmas time.

Still let's not count chickens just yet as they might be swans of the dark variety.

Return to “Portfolio Management & Review”

Who is online

Users browsing this forum: No registered users and 53 guests