Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

ADrunkenMarcus' 'Dividend Growth Portfolio'.

-

kempiejon

- Lemon Quarter

- Posts: 3586

- Joined: November 5th, 2016, 10:30 am

- Has thanked: 1 time

- Been thanked: 1196 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

I know we mustn't fall in love with a shares by my DPLM experience has been cracking. Dividends up 18%, 14% and 16% CAGR over 5, 10 and 15 years.

-

ADrunkenMarcus

- Lemon Quarter

- Posts: 1595

- Joined: November 5th, 2016, 11:16 am

- Has thanked: 675 times

- Been thanked: 483 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

Yes, very promising in terms of strong cashflow and financial performance, as you Si and kempiejon have noted.

I purchased initially on 22 November 2012. Since then, the share price is up 510% for a CAGR of 19.8% and it has paid dividends amounting to 60.5% of book cost (taken as cash). The dividend per share has compounded at over 14% on a nominal basis and even 11.7% on a real terms basis, adjusted for inflation. Given the strong dividend growth, I suspect that it'll have returned to me my book cost in dividends alone (on a nominal basis) in 3-4 years' time. The nominal dividend yield on book cost has reached 11.4%, which is comparable to what AstraZeneca and Diageo have taken 24 years to achieve for me. Diploma continued to raise its dividend through the pandemic, with the only 'blip' (if you can call it that) being the 2020 interim dividend's postponement (they paid a single, final to cover for the whole year which represented annual growth on 2019).

Comparing 2021 to 2012, the ROCE has declined somewhat but remains strong. I note their recent results had 'ROATCE 17.3%' (their preferred measure) and this is somewhat down on 2018-19, however still a good result. Management are incentivised by this metric, among others. They look to the quality of growth and not growth for its own sake. Debt has increased but is 1.4x EBITDA, perfectly healthy.

I acknowledge it has benefited from a tailwind of a re-rating between 2012 and 2021, however I believe Diploma can deliver strong returns in the 2020s and the fundamental business model is sound.

Diploma is really a case study of an ideal investment for me: one which exhibits strong dividend growth over a sustained period, leaving to a high absolute dividend income over time accompanied by strong capital gains and a high total return. (The current dividend yield is 1.9%.) Examples/suggestions of other such companies for my portfolio are always welcome!

Best wishes

Mark.

I purchased initially on 22 November 2012. Since then, the share price is up 510% for a CAGR of 19.8% and it has paid dividends amounting to 60.5% of book cost (taken as cash). The dividend per share has compounded at over 14% on a nominal basis and even 11.7% on a real terms basis, adjusted for inflation. Given the strong dividend growth, I suspect that it'll have returned to me my book cost in dividends alone (on a nominal basis) in 3-4 years' time. The nominal dividend yield on book cost has reached 11.4%, which is comparable to what AstraZeneca and Diageo have taken 24 years to achieve for me. Diploma continued to raise its dividend through the pandemic, with the only 'blip' (if you can call it that) being the 2020 interim dividend's postponement (they paid a single, final to cover for the whole year which represented annual growth on 2019).

Comparing 2021 to 2012, the ROCE has declined somewhat but remains strong. I note their recent results had 'ROATCE 17.3%' (their preferred measure) and this is somewhat down on 2018-19, however still a good result. Management are incentivised by this metric, among others. They look to the quality of growth and not growth for its own sake. Debt has increased but is 1.4x EBITDA, perfectly healthy.

I acknowledge it has benefited from a tailwind of a re-rating between 2012 and 2021, however I believe Diploma can deliver strong returns in the 2020s and the fundamental business model is sound.

Diploma is really a case study of an ideal investment for me: one which exhibits strong dividend growth over a sustained period, leaving to a high absolute dividend income over time accompanied by strong capital gains and a high total return. (The current dividend yield is 1.9%.) Examples/suggestions of other such companies for my portfolio are always welcome!

Best wishes

Mark.

-

kempiejon

- Lemon Quarter

- Posts: 3586

- Joined: November 5th, 2016, 10:30 am

- Has thanked: 1 time

- Been thanked: 1196 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

ADrunkenMarcus wrote:Diploma is really a case study of an ideal investment for me: one which exhibits strong dividend growth over a sustained period, leaving to a high absolute dividend income over time accompanied by strong capital gains and a high total return. (The current dividend yield is 1.9%.) Examples/suggestions of other such companies for my portfolio are always welcome!

Off the top of my head from my portfolio of strong growth for both metrics and having checked back to your first post to see what you've already got I would offer Linde PLC NYSE:LIN, Spectris PLC SXS and London Stock Exchange group LSEG.

LSEG shows Dividends up by 17%, 14% and 12% CAGR over 5, 10 and 15 years.

SXS only has single digit income CAGR, yields 2.26 on capital over 10 years looks ahead of a field of the 4.

Linde have increased their dividends over my 5 year holding period but I don't have similar income numbers for as I crib from Dividenddata who only do UK

https://www.dividenddata.co.uk/dividend ... ?epic=LSEG

I've just eyeballed data from DD and google finance and other 3rd party websites. I've held all of them for quite few years and since purchase, as capital and income growth has been good, I've had no cause to have more than a perfunctory check of their current state.

-

simoan

- Lemon Quarter

- Posts: 2109

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1467 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

ADrunkenMarcus wrote:Diploma is really a case study of an ideal investment for me: one which exhibits strong dividend growth over a sustained period, leaving to a high absolute dividend income over time accompanied by strong capital gains and a high total return. (The current dividend yield is 1.9%.) Examples/suggestions of other such companies for my portfolio are always welcome!

From my own holdings, maybe Spirent (SPT) and Gamma Communications (GAMA) are worth looking at. If you're not fussed about a dividend, SDI (SDI) is a similar proposition to Diploma (i.e. a profitable buy and build approach to growth) in the field of scientific equipment.

All the best, Si

-

ADrunkenMarcus

- Lemon Quarter

- Posts: 1595

- Joined: November 5th, 2016, 11:16 am

- Has thanked: 675 times

- Been thanked: 483 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

kempiejon wrote:Off the top of my head from my portfolio of strong growth for both metrics and having checked back to your first post to see what you've already got I would offer Linde PLC NYSE:LIN, Spectris PLC SXS and London Stock Exchange group LSEG.

LSEG shows Dividends up by 17%, 14% and 12% CAGR over 5, 10 and 15 years.

SXS only has single digit income CAGR, yields 2.26 on capital over 10 years looks ahead of a field of the 4.

Linde have increased their dividends over my 5 year holding period but I don't have similar income numbers for as I crib from Dividenddata who only do UK

https://www.dividenddata.co.uk/dividend ... ?epic=LSEG

I've just eyeballed data from DD and google finance and other 3rd party websites. I've held all of them for quite few years and since purchase, as capital and income growth has been good, I've had no cause to have more than a perfunctory check of their current state.

Thanks, some good pointers there and I noted Nick Train holds LSE. Spectris has been on my radar before. I know it has changed somewhat in recent years .

simoan wrote:ADrunkenMarcus wrote:Diploma is really a case study of an ideal investment for me: one which exhibits strong dividend growth over a sustained period, leaving to a high absolute dividend income over time accompanied by strong capital gains and a high total return. (The current dividend yield is 1.9%.) Examples/suggestions of other such companies for my portfolio are always welcome!

From my own holdings, maybe Spirent (SPT) and Gamma Communications (GAMA) are worth looking at. If you're not fussed about a dividend, SDI (SDI) is a similar proposition to Diploma (i.e. a profitable buy and build approach to growth) in the field of scientific equipment.

SDI has performed very strongly recently! I note a recent uptick in CROIC, even at the same time as turnover and EBIT has surged.

I don't know if either of you have Kainos on your radars. They're not in my dividend growth portfolio but I've held in my SIPP since 2017 and they had risen nine-fold or more at their recent peak. The current dividend yield is about 1.5% but it has been growing very strongly and their business model seems very scalable. Worth a look.

Best wishes

Mark.

-

ADrunkenMarcus

- Lemon Quarter

- Posts: 1595

- Joined: November 5th, 2016, 11:16 am

- Has thanked: 675 times

- Been thanked: 483 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

I made a single trade this (calendar) year and (probably) the only trade this portfolio year (1 May through 30 April). As I Tweeted on 28 December 2022:

I am pleased my portfolio has now edged ahead of the FTSE All World TR Index ($) again, as well as the various UK benchmark indexes. I did not monitor the calendar year but, compared to 10 January 2022, my acc units are up about 3 percent. I have a core holding in Murray International (MYI) which has proven a little more resilient in tough times this year.

The current dividend yield for the portfolio is running at about 2.4 percent and I expect it now to edge up slightly in nominal terms when I report for 2022-23.

Best wishes

Mark.

Sold a small position in the American $PYPL to top up the Swedish $EVO, taking it to a 3.1% position. My only trade this year for my dividend growth portfolio. Possibly a rookie error selling low, but $EVO is decent value and great margins / CROIC!

I am pleased my portfolio has now edged ahead of the FTSE All World TR Index ($) again, as well as the various UK benchmark indexes. I did not monitor the calendar year but, compared to 10 January 2022, my acc units are up about 3 percent. I have a core holding in Murray International (MYI) which has proven a little more resilient in tough times this year.

The current dividend yield for the portfolio is running at about 2.4 percent and I expect it now to edge up slightly in nominal terms when I report for 2022-23.

Best wishes

Mark.

-

ADrunkenMarcus

- Lemon Quarter

- Posts: 1595

- Joined: November 5th, 2016, 11:16 am

- Has thanked: 675 times

- Been thanked: 483 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

I note Fundsmith have revealed they have now sold out of PYPL entirely. If I have made a rookie mistake, it feels somewhat comforting I'm not the only one!

Best wishes

Mark.

Best wishes

Mark.

-

ADrunkenMarcus

- Lemon Quarter

- Posts: 1595

- Joined: November 5th, 2016, 11:16 am

- Has thanked: 675 times

- Been thanked: 483 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

Victrex and Kone both held their ordinary dividends for 2022 and did not repeat the specials they paid for 2021. It will be interesting to watch these two in the future. They have had a challenging year and Kone's margin dropped into single digits (their aspiration is 16%) but ROCE remained very strong (it's averaged over 30 percent over recent years).

Victrex has had its issues recently with a lack of growth. Without double checking, the ordinary dividend has been flat since around 2018 and, although they have paid some very healthy specials, they did skip the interim dividend during COVID-19 and only paid a final for the year at the usual level (thereby representing an ordinary dividend cut). The issue with that company is really that their six mega programmes and future pipeline really need to start paying off in the coming years. The share price today is just above my first purchase back in October 2015, although it had practically doubled during a period of excess in 2018 (an example, in hindsight, of why a bias towards long term holding can sometimes be detrimental).

More pleasingly, Evolution (which pays a single dividend each year) has increased its annual dividend by about 41 percent to 2 Euro per share. In Sterling terms, this represents a 1.8 percent gross dividend yield (reduced to 1.1 percent net, after Swedish dividend tax is taken off).

This morning, Renishaw also raised its interim dividend by 5 percent.

Best wishes

Mark.

Victrex has had its issues recently with a lack of growth. Without double checking, the ordinary dividend has been flat since around 2018 and, although they have paid some very healthy specials, they did skip the interim dividend during COVID-19 and only paid a final for the year at the usual level (thereby representing an ordinary dividend cut). The issue with that company is really that their six mega programmes and future pipeline really need to start paying off in the coming years. The share price today is just above my first purchase back in October 2015, although it had practically doubled during a period of excess in 2018 (an example, in hindsight, of why a bias towards long term holding can sometimes be detrimental).

More pleasingly, Evolution (which pays a single dividend each year) has increased its annual dividend by about 41 percent to 2 Euro per share. In Sterling terms, this represents a 1.8 percent gross dividend yield (reduced to 1.1 percent net, after Swedish dividend tax is taken off).

This morning, Renishaw also raised its interim dividend by 5 percent.

Best wishes

Mark.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

ADrunkenMarcus wrote:Victrex and Kone both held their ordinary dividends for 2022 and did not repeat the specials they paid for 2021. It will be interesting to watch these two in the future. They have had a challenging year and Kone's margin dropped into single digits (their aspiration is 16%) but ROCE remained very strong (it's averaged over 30 percent over recent years).

Victrex has had its issues recently with a lack of growth. Without double checking, the ordinary dividend has been flat since around 2018 and, although they have paid some very healthy specials, they did skip the interim dividend during COVID-19 and only paid a final for the year at the usual level (thereby representing an ordinary dividend cut). The issue with that company is really that their six mega programmes and future pipeline really need to start paying off in the coming years. The share price today is just above my first purchase back in October 2015, although it had practically doubled during a period of excess in 2018 (an example, in hindsight, of why a bias towards long term holding can sometimes be detrimental).

More pleasingly, Evolution (which pays a single dividend each year) has increased its annual dividend by about 41 percent to 2 Euro per share. In Sterling terms, this represents a 1.8 percent gross dividend yield (reduced to 1.1 percent net, after Swedish dividend tax is taken off).

This morning, Renishaw also raised its interim dividend by 5 percent.

Best wishes

Mark.

None of that sounds very encouraging in a dividend growth portfolio.

Trust you hold Shell.

Dod

-

ADrunkenMarcus

- Lemon Quarter

- Posts: 1595

- Joined: November 5th, 2016, 11:16 am

- Has thanked: 675 times

- Been thanked: 483 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

Dod101 wrote:None of that sounds very encouraging in a dividend growth portfolio.

Trust you hold Shell.

None?

Evolution raised its annual dividend 41%. And Renishaw raised the interim 5% in a sign of medium term confidence despite a challenging year.

I tend to agree with you as regards Victrex not growing its ordinary dividend for some time. (I have to admit I had been considering a switch into Bioventix which has a similar yield and better growth forecast, plus a record of specials.)

I don't hold Shell. It had held its dividend for some years then slashed it, though, so I can see it will now be growing the dividend from a lower base.

Best wishes

Mark.

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

ADrunkenMarcus wrote:Dod101 wrote:None of that sounds very encouraging in a dividend growth portfolio.

Trust you hold Shell.

None?

Evolution raised its annual dividend 41%. And Renishaw raised the interim 5% in a sign of medium term confidence despite a challenging year.

I tend to agree with you as regards Victrex not growing its ordinary dividend for some time. (I have to admit I had been considering a switch into Bioventix which has a similar yield and better growth forecast, plus a record of specials.)

I don't hold Shell. It had held its dividend for some years then slashed it, though, so I can see it will now be growing the dividend from a lower base.

Best wishes

Mark.

Tabulate dividend CAGR over 5,10,15 years. Shell's growth rates are negative. Facts v sentiment.

https://www.dividenddata.co.uk/dividend ... ?epic=SHEL

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

OK. I plead guilty as charged but I think given the current situation, Shell ought to be in an income portfolio.

Dod

Dod

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

Victrex....of all the places to set up business...Cleveleys! Reason, ex ICI staff looking for a job to tide them over to retirement? I know Cleveleys very well ( my parents retired to Fleetwood).

Edit....there I go....sentiment!

Edit....there I go....sentiment!

-

ADrunkenMarcus

- Lemon Quarter

- Posts: 1595

- Joined: November 5th, 2016, 11:16 am

- Has thanked: 675 times

- Been thanked: 483 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

Dod101 wrote:OK. I plead guilty as charged but I think given the current situation, Shell ought to be in an income portfolio.

Perfectly fair point and you could even justify a dividend growth portfolio from today (as opposed to income portfolio), because it's now growing the dividend from a low base, but it's not really a long term compounder given the decade + record.

How they manage the 'green transition' is a key point for me.

Best wishes

Mark.

Last edited by ADrunkenMarcus on February 2nd, 2023, 10:15 am, edited 1 time in total.

-

ADrunkenMarcus

- Lemon Quarter

- Posts: 1595

- Joined: November 5th, 2016, 11:16 am

- Has thanked: 675 times

- Been thanked: 483 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

monabri wrote:Victrex....of all the places to set up business...Cleveleys! Reason, ex ICI staff looking for a job to tide them over to retirement? I know Cleveleys very well ( my parents retired to Fleetwood).

Edit....there I go....sentiment!

I'm hoping the ex ICI staff who wanted to retire have now gone!

Best wishes

Mark.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

ADrunkenMarcus wrote:Dod101 wrote:OK. I plead guilty as charged but I think given the current situation, Shell ought to be in an income portfolio.

Perfectly fair point and you could even justify a dividend growth portfolio from today (as opposed to income portfolio), because it's now growing the dividend from a low base, but it's not really a long term compounder given the decade + record.

How they manage the 'green transition' is a key point for me.

Best wishes

Mark.

The trouble is that by the time you know how they are managing the 'green transition' it will probably be too late.

Dod

-

ADrunkenMarcus

- Lemon Quarter

- Posts: 1595

- Joined: November 5th, 2016, 11:16 am

- Has thanked: 675 times

- Been thanked: 483 times

-

ADrunkenMarcus

- Lemon Quarter

- Posts: 1595

- Joined: November 5th, 2016, 11:16 am

- Has thanked: 675 times

- Been thanked: 483 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

monabri wrote:Tabulate dividend CAGR over 5,10,15 years. Shell's growth rates are negative. Facts v sentiment.

https://www.dividenddata.co.uk/dividend ... ?epic=SHEL

You know, eyeballing that chart, the current dividend per share for Shell is probably basically the same in real terms as c. 2000-01.

By contrast, from 2000 to 2022:

Diploma's dividend is up 22.5 fold;

Victrex's dividend is up 9.8 fold;

Spirax Sarco's dividend is up 7.6 fold;

Renishaw's dividend is up 5.3 fold;

Rotork's dividend is up 5.2 fold.

All are up by multiples in real terms, also.

I believe all have paid specials as well in that period, except maybe Renishaw and/or Diploma (would need to check). I've held Diploma from 2012; Victrex from 2015; Spirax from 2015; Renishaw from 2011 and Rotork from 2015.

With the usual caveats about past performance not being necessarily repeated in future, my experience with this portfolio has been that I have had better results from moderate or lower current dividend yielders, growing their dividends at a higher rate over a sustained period of time.

Best wishes

Mark.

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

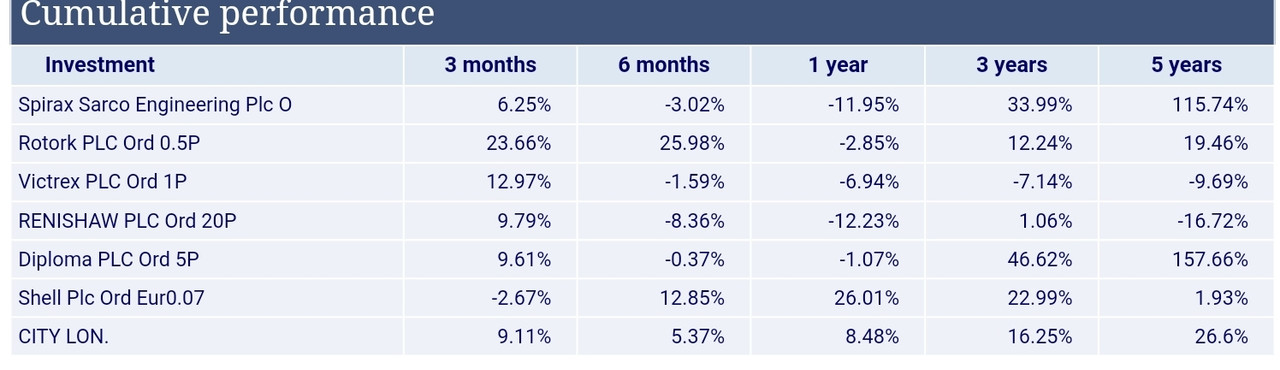

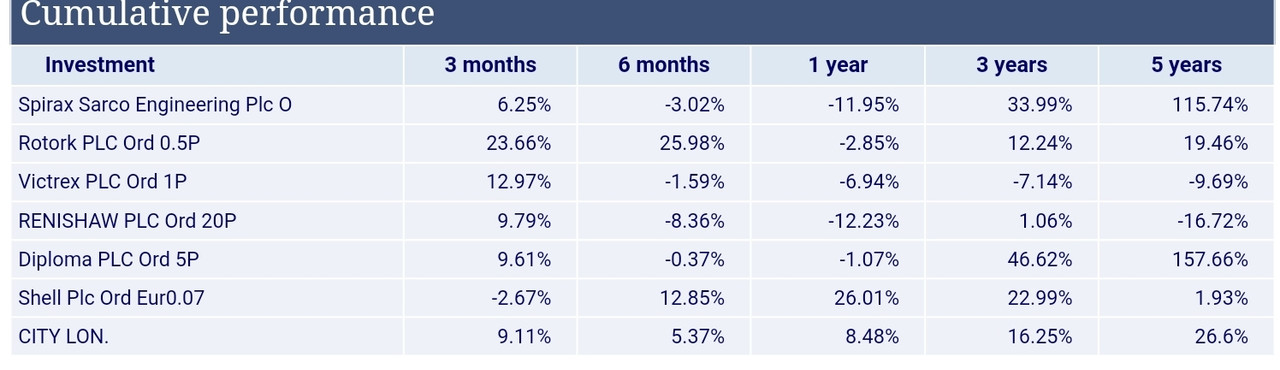

Source. https://www.hl.co.uk/funds/fund-discoun ... ion/charts

Total Return over the last 5 years.

What were you thinking about Victrex? I was surprised to see RSW poor 5 year returns, but where do the founders go?

5 years is a reasonable timeframe to see which way the wind is blowing.

Over the last 5 years, even CTY has trumped SHEL. ( of course, if you bought during max Covid it would have been a different story).

Total Return over the last 5 years.

What were you thinking about Victrex? I was surprised to see RSW poor 5 year returns, but where do the founders go?

5 years is a reasonable timeframe to see which way the wind is blowing.

Over the last 5 years, even CTY has trumped SHEL. ( of course, if you bought during max Covid it would have been a different story).

-

ADrunkenMarcus

- Lemon Quarter

- Posts: 1595

- Joined: November 5th, 2016, 11:16 am

- Has thanked: 675 times

- Been thanked: 483 times

Re: ADrunkenMarcus' 'Dividend Growth Portfolio'.

monabri wrote:Source. https://www.hl.co.uk/funds/fund-discoun ... ion/charts

Total Return over the last 5 years.

What were you thinking about Victrex? I was surprised to see RSW poor 5 year returns, but where do the founders go?

5 years is a reasonable timeframe to see which way the wind is blowing.

Over the last 5 years, even CTY has trumped SHEL. ( of course, if you bought during max Covid it would have been a different story).

You know, with the benefit of hindsight, I thought to myself that I should have focused more on Spirax and Diploma. Then I realised it was not solely hindsight, because I topped up BOTH in 2018!

Note how strong Spirax's return is despite the share price dropping about 31% from the late 2021 'bubble'-style peak to today's 11900p. (In late 2021, the share price was up 421% on my 2015 purchase and the CAGR stood in the thirties.) It has always looked overvalued in the last decade or so.

Rotork has underperformed my portfolio and has been going through a 'recovery' type situation IMHO, but strengthening recently. It was much weaker in 2016 than 2018, and that was when I bought much of my holding (2015-16).

Victrex's five year return is pretty poor but does reflect it was flying rather high in 2018. My dilemma is whether to stick with it until when (or if) the mega programmes start paying off, or switch into Bioventix.

Renishaw's performance will look shocking in a few years' time. It surged a while back on talk the founders were selling their controlling interest. Then it fell sharply when they made the correct long term decision for the business!

As an aside, the portfolio is up 3% as I write. Diploma up over 6% today, Spirax over 5%, Renishaw over 5% and Victrex over 3% and Rotork over 3%. My best performer today is Evolution, up 9.5%. Mid caps seem to be doing well (although Spirax outgrew the FTSE 250!)

Best wishes

Mark.

Return to “Portfolio Management & Review”

Who is online

Users browsing this forum: No registered users and 27 guests