ADrunkenMarcus wrote:monabri wrote:Source. https://www.hl.co.uk/funds/fund-discoun ... ion/charts

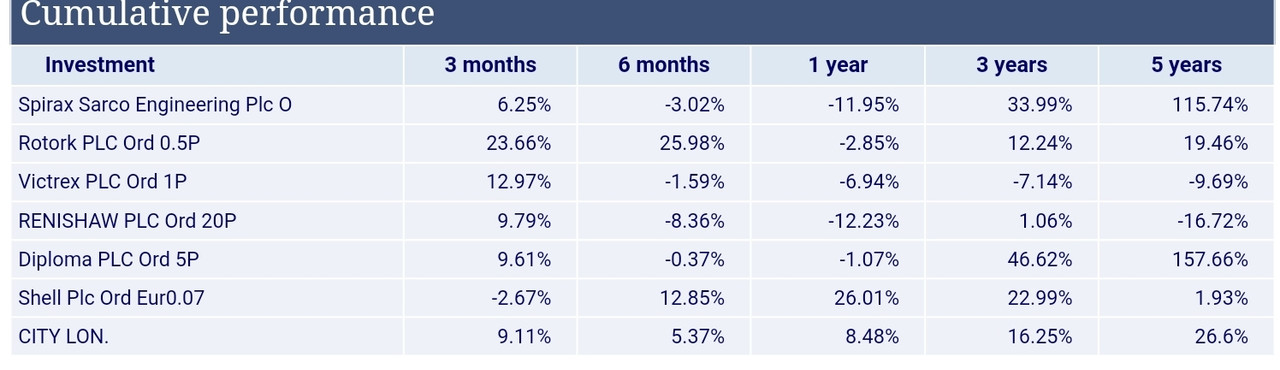

Total Return over the last 5 years.

What were you thinking about Victrex? I was surprised to see RSW poor 5 year returns, but where do the founders go?

5 years is a reasonable timeframe to see which way the wind is blowing.

Over the last 5 years, even CTY has trumped SHEL. ( of course, if you bought during max Covid it would have been a different story).

You know, with the benefit of hindsight, I thought to myself that I should have focused more on Spirax and Diploma. Then I realised it was not solely hindsight, because I topped up BOTH in 2018!

Note how strong Spirax's return is despite the share price dropping about 31% from the late 2021 'bubble'-style peak to today's 11900p. (In late 2021, the share price was up 421% on my 2015 purchase and the CAGR stood in the thirties.) It has always looked overvalued in the last decade or so.

Rotork has underperformed my portfolio and has been going through a 'recovery' type situation IMHO, but strengthening recently. It was much weaker in 2016 than 2018, and that was when I bought much of my holding (2015-16).

Victrex's five year return is pretty poor but does reflect it was flying rather high in 2018. My dilemma is whether to stick with it until when (or if) the mega programmes start paying off, or switch into Bioventix.

Renishaw's performance will look shocking in a few years' time. It surged a while back on talk the founders were selling their controlling interest. Then it fell sharply when they made the correct long term decision for the business!

As an aside, the portfolio is up 3% as I write. Diploma up over 6% today, Spirax over 5%, Renishaw over 5% and Victrex over 3% and Rotork over 3%. My best performer today is Evolution, up 9.5%. Mid caps seem to be doing well (although Spirax outgrew the FTSE 250!)

Best wishes

Mark.

I thought this was a Dividend Growth portfolio? You seem to be concentrating on the share prices. If it is a dividend growth portfolio it would seem reasonable to produce numbers for dividend growth over the last five years or so and possibly the yields in each of these five years as well.

Just as a matter of interest, my almost entirely domestic, mostly income, portfolio is up over 10% in the month of January.

Dod