Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

Gold in Sterling Within £10 of Record High

-

CommissarJones

- Lemon Slice

- Posts: 367

- Joined: November 10th, 2016, 9:15 pm

- Been thanked: 103 times

Gold in Sterling Within £10 of Record High

Gold priced in sterling rose as high as £1,186.57/ounce today, compared with the record high of £1,194.98 in September 2011, according to investing.com. The Brexit-related weakening of the pound has really given bullion a lift: sterling-priced gold climbed 18% in the three months through July, compared with respective gains of 11% and 10% in euros and dollars.

-

CommissarJones

- Lemon Slice

- Posts: 367

- Joined: November 10th, 2016, 9:15 pm

- Been thanked: 103 times

Re: Gold in Sterling Within £10 of Record High

Gold came within the proverbial hair's breadth of setting a new all-time high against the pound today - at the session peak of £1,194.51/ounce, it was within 50p of the September 2011 record (as shown by investing.com). But ultimately it fell short, and now prices are back down to around £1,185/oz. Nonetheless, I would not be the least bit surprised to see the record fall soon-ish, given all of the pressures on sterling.

-

richfool

- Lemon Quarter

- Posts: 3520

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1204 times

- Been thanked: 1288 times

Re: Gold in Sterling Within £10 of Record High

CommissarJones wrote:Gold came within the proverbial hair's breadth of setting a new all-time high against the pound today - at the session peak of £1,194.51/ounce, it was within 50p of the September 2011 record (as shown by investing.com). But ultimately it fell short, and now prices are back down to around £1,185/oz. Nonetheless, I would not be the least bit surprised to see the record fall soon-ish, given all of the pressures on sterling.

If or as gold is now at a long term high, the question will then arise for me, as to whether to take my profit, knowing that I will then no longer have a holding of gold, or whether to sit tight in the knowledge that future movement could well be down.

-

Laughton

- Lemon Slice

- Posts: 909

- Joined: November 6th, 2016, 2:15 pm

- Has thanked: 142 times

- Been thanked: 335 times

Re: Gold in Sterling Within £10 of Record High

"could well be down" - but, in my view, could more likely be up.

I'm certainly not selling yet.

I'm certainly not selling yet.

-

CommissarJones

- Lemon Slice

- Posts: 367

- Joined: November 10th, 2016, 9:15 pm

- Been thanked: 103 times

Re: Gold in Sterling Within £10 of Record High

richfool wrote:If or as gold is now at a long term high, the question will then arise for me, as to whether to take my profit, knowing that I will then no longer have a holding of gold, or whether to sit tight in the knowledge that future movement could well be down.

Bullion has made a strong upward move in recent weeks, so in the short term, I would not be surprised to see a pullback of some kind. On a medium-term to long-term view, ISTM that the bias for gold is very much to the upside. IMV there are good reasons to argue that currencies as a group will continue to depreciate against precious metals over the medium/long term. I have no plans to sell my holding.

Gold broker Sharps Pixley notes that sterling-priced bullion set a record high at the afternoon fixing on 2 August. Onward and (one hopes) upward.

-

CommissarJones

- Lemon Slice

- Posts: 367

- Joined: November 10th, 2016, 9:15 pm

- Been thanked: 103 times

Re: Gold in Sterling Within £10 of Record High

It looks as though sterling-priced gold has set a new all-time high in the market (as opposed to the daily fixing). Investing.com shows it currently at £1,202.84/ounce, which pretty conclusively busts the previous record of September 2011.

-

CommissarJones

- Lemon Slice

- Posts: 367

- Joined: November 10th, 2016, 9:15 pm

- Been thanked: 103 times

Re: Gold in Sterling Within £10 of Record High

And the move goes on: sterling-priced bullion has topped £1,235/ounce today, after breaking above £1,200/oz at the start of the week. Up 6% in August already. (All according to investing.com.)

-

GoSeigen

- Lemon Quarter

- Posts: 4407

- Joined: November 8th, 2016, 11:14 pm

- Has thanked: 1603 times

- Been thanked: 1593 times

Re: Gold in Sterling Within £10 of Record High

CommissarJones wrote:And the move goes on: sterling-priced bullion has topped £1,235/ounce today, after breaking above £1,200/oz at the start of the week. Up 6% in August already. (All according to investing.com.)

If you don't mind my saying so: there are plenty of web sites that publish gold spot prices. Posting just prices of investments is considered bad form on these forums. Very happy to see discussion about the merits of gold as an asset though...

GS

-

richfool

- Lemon Quarter

- Posts: 3520

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1204 times

- Been thanked: 1288 times

Re: Gold in Sterling Within £10 of Record High

I like the idea of periodic updates on the price of Gold being posted here. Such updates are usually accompanied by related comments and views from other posters, or indeed stimulate such comments. Personally, I see Gold more as an asset class than an individual stock. Also this thread is on a separate Mining & metals board, thus those not interested don't need to look.

This morning Gold has reached 1516, having recently topped 1500. There was discussion on Bloomberg TV this morning suggesting that Gold could reach 1600 before the upside abates. Though the person being interviewed did point out that dollar strength would limit further upside.

I see that Fresnillo (Mexican silver and gold miner, - up 2.2% this morning) has been recommended as a "conviction buy", by Goldman Sachs.

This morning Gold has reached 1516, having recently topped 1500. There was discussion on Bloomberg TV this morning suggesting that Gold could reach 1600 before the upside abates. Though the person being interviewed did point out that dollar strength would limit further upside.

I see that Fresnillo (Mexican silver and gold miner, - up 2.2% this morning) has been recommended as a "conviction buy", by Goldman Sachs.

-

GoSeigen

- Lemon Quarter

- Posts: 4407

- Joined: November 8th, 2016, 11:14 pm

- Has thanked: 1603 times

- Been thanked: 1593 times

Re: Gold in Sterling Within £10 of Record High

richfool wrote:I like the idea of periodic updates on the price of Gold being posted here.

Gold is now at $1529.

GS

-

richfool

- Lemon Quarter

- Posts: 3520

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1204 times

- Been thanked: 1288 times

Re: Gold in Sterling Within £10 of Record High

GoSeigen wrote:richfool wrote:I like the idea of periodic updates on the price of Gold being posted here.

Gold is now at $1529.

GS

Yes, it's going well. Whilst being tempted to take some profit off the table, I think I will stick with my holding (SGLN) until at least 31st October (Brexit day) and see what the situation is then.

-

GoSeigen

- Lemon Quarter

- Posts: 4407

- Joined: November 8th, 2016, 11:14 pm

- Has thanked: 1603 times

- Been thanked: 1593 times

Re: Gold in Sterling Within £10 of Record High

richfool wrote:GoSeigen wrote:richfool wrote:I like the idea of periodic updates on the price of Gold being posted here.

Gold is now at $1529.

GS

Yes, it's going well. Whilst being tempted to take some profit off the table, I think I will stick with my holding (SGLN) until at least 31st October (Brexit day) and see what the situation is then.

It just hit 1530. I've made another £15. That'll pay for a round of drinks.

GS

-

youfoolishboy

- 2 Lemon pips

- Posts: 233

- Joined: November 4th, 2016, 11:35 am

- Has thanked: 22 times

- Been thanked: 43 times

Re: Gold in Sterling Within £10 of Record High

I have been buying a gold proxy for some time, I don’t like buying physical gold no dividend only capital growth. I started buying last year as I began to believe the world economy was looking rather shaky. To me now we are heading into a worldwide recession Trump is not going to stop his America First policy even if the Chinese give in and sign a deal, which I believe is unlikely as they are now playing for time and a Democrat in the Whitehouse, as he will go about looking to change his stance with other trading nations, I suspect the EU are next in line. I don’t think Brexit is really the biggest issue out there just now driving the gold price. I have been selling down my portfolio, apart from fixed income, as well and I now have so much invested in gold that I have the price on my browser so I can follow it, https://goldprice.com/

My proxy is AAZ a gold miner in Azerbaijan. Very strong sensible management who are heavily invested in the company, loads of gold, just found a load more nearby and are proving it up they will need to upgrade production facilities to get it out mind you, production costs are low and the really good bit they pay a divi, not a recommendation DYOR.

My proxy is AAZ a gold miner in Azerbaijan. Very strong sensible management who are heavily invested in the company, loads of gold, just found a load more nearby and are proving it up they will need to upgrade production facilities to get it out mind you, production costs are low and the really good bit they pay a divi, not a recommendation DYOR.

-

GoSeigen

- Lemon Quarter

- Posts: 4407

- Joined: November 8th, 2016, 11:14 pm

- Has thanked: 1603 times

- Been thanked: 1593 times

Re: Gold in Sterling Within £10 of Record High

richfool wrote:GoSeigen wrote:richfool wrote:I like the idea of periodic updates on the price of Gold being posted here.

Gold is now at $1529.

GS

Yes, it's going well. Whilst being tempted to take some profit off the table, I think I will stick with my holding (SGLN) until at least 31st October (Brexit day) and see what the situation is then.

Back to $1529. I think someone is manipulating the price.

GS

-

Tzvikmister

- Posts: 25

- Joined: April 28th, 2019, 8:42 am

- Been thanked: 3 times

-

richfool

- Lemon Quarter

- Posts: 3520

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1204 times

- Been thanked: 1288 times

Re: Gold in Sterling Within £10 of Record High

youfoolishboy wrote:I have been buying a gold proxy for some time, I don’t like buying physical gold no dividend only capital growth. I started buying last year as I began to believe the world economy was looking rather shaky. To me now we are heading into a worldwide recession Trump is not going to stop his America First policy even if the Chinese give in and sign a deal, which I believe is unlikely as they are now playing for time and a Democrat in the Whitehouse, as he will go about looking to change his stance with other trading nations, I suspect the EU are next in line. I don’t think Brexit is really the biggest issue out there just now driving the gold price. I have been selling down my portfolio, apart from fixed income, as well and I now have so much invested in gold that I have the price on my browser so I can follow it, https://goldprice.com/

My proxy is AAZ a gold miner in Azerbaijan. Very strong sensible management who are heavily invested in the company, loads of gold, just found a load more nearby and are proving it up they will need to upgrade production facilities to get it out mind you, production costs are low and the really good bit they pay a divi, not a recommendation DYOR.

Youfoolishboy, I have been following your AAZ and note it has popped up some 9% today. I'm not sure what caused it, as gold itself is little changed.

-

youfoolishboy

- 2 Lemon pips

- Posts: 233

- Joined: November 4th, 2016, 11:35 am

- Has thanked: 22 times

- Been thanked: 43 times

Re: Gold in Sterling Within £10 of Record High

Youfoolishboy, I have been following your AAZ and note it has popped up some 9% today. I'm not sure what caused it, as gold itself is little changed.

Last night a report from Bloomberg claimed the Azeri government were looking to buy the 49% of the JV they own with AAZ for the mines. Thy Azeri government had hired some consultants to get a price and investigate the purchase. The translation was a bit ropey. An RNS came out this morning confirming there had been chats with the Azeri government and others about various things. So bid speculation is rife and probably accurate.

Anglo Asian Mining PLC, the AIM listed gold, copper and silver producer focused in Azerbaijan, notes the recent press report regarding the Ministry of Economy of Azerbaijan engaging a consultant to advise on a possible transaction with R.V. Investment Group Services, LLC, a subsidiary of Anglo Asian whose principal asset is the Group's production sharing agreement with the Government of Azerbaijan dated 20 August 1997.

The Company notes that, while it has been in recent discussions with the Government of Azerbaijan and other parties in relation to potential transactions, such discussions are preliminary and no terms have been discussed or agreed. There can be no certainty that these discussions will result in any transactions. The Company further notes that it regularly has discussions with other parties regarding the development of the Group.

-

richfool

- Lemon Quarter

- Posts: 3520

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1204 times

- Been thanked: 1288 times

Re: Gold in Sterling Within £10 of Record High

youfoolishboy wrote:Youfoolishboy, I have been following your AAZ and note it has popped up some 9% today. I'm not sure what caused it, as gold itself is little changed.

Last night a report from Bloomberg claimed the Azeri government were looking to buy the 49% of the JV they own with AAZ for the mines. Thy Azeri government had hired some consultants to get a price and investigate the purchase. The translation was a bit ropey. An RNS came out this morning confirming there had been chats with the Azeri government and others about various things. So bid speculation is rife and probably accurate.

Anglo Asian Mining PLC, the AIM listed gold, copper and silver producer focused in Azerbaijan, notes the recent press report regarding the Ministry of Economy of Azerbaijan engaging a consultant to advise on a possible transaction with R.V. Investment Group Services, LLC, a subsidiary of Anglo Asian whose principal asset is the Group's production sharing agreement with the Government of Azerbaijan dated 20 August 1997.

The Company notes that, while it has been in recent discussions with the Government of Azerbaijan and other parties in relation to potential transactions, such discussions are preliminary and no terms have been discussed or agreed. There can be no certainty that these discussions will result in any transactions. The Company further notes that it regularly has discussions with other parties regarding the development of the Group.

That's certainly put a fire under its tail. (AAZ) Up another 7% today.

My small holding, bought on 15th August is up 23% so far, - that's in 12 days.

-

1nvest

- Lemon Quarter

- Posts: 4414

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 691 times

- Been thanked: 1346 times

Re: Gold in Sterling Within £10 of Record High

GoSeigen wrote:CommissarJones wrote:And the move goes on: sterling-priced bullion has topped £1,235/ounce today, after breaking above £1,200/oz at the start of the week. Up 6% in August already. (All according to investing.com.)

If you don't mind my saying so: there are plenty of web sites that publish gold spot prices. Posting just prices of investments is considered bad form on these forums. Very happy to see discussion about the merits of gold as an asset though...

GS

OK GS, I'll bite. Simply because of lockdown boredom.

Harry Markowitz (Nobel prize winner) said, "I visualised my grief if the stock market went way up and I wasn't in it – or it went way down and I was completely in it. So I split my contributions 50/50 between stocks and bonds."

US data, for the Dow/gold ratio, how many ounces of gold to buy the Dow

If instead of stock and bonds, you 50/50 stock and gold, that's a form of neutral stock position, neutral currency position (gold is a form of global currency).

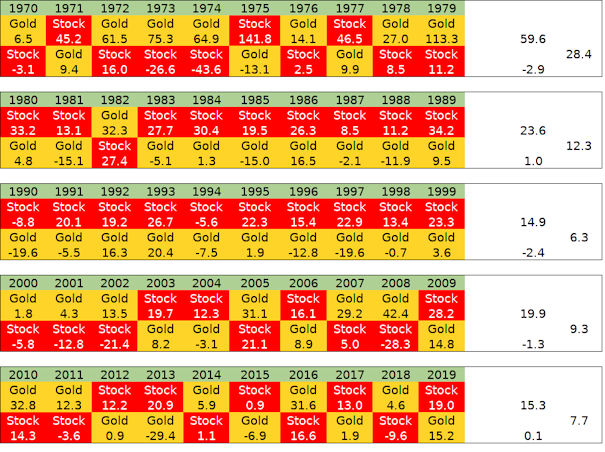

Callan Periodic Table for UK FT All Share total return, gold (£ percentage gains/losses).

To the right I've averaged each decades yearly best and worst assets, and then averaged those two values. Which is indicative that on average the years best asset often spikes up a reasonable amount, whilst the years worst asset doesn't lose much, if at all.

Note also the 1990's where stocks were repeatedly the best asset and gold was the yearly bad asset. Gold ended the 1980’s with a last business day 10am price fix on 29th December 1989 of £249.84 per ounce, and ended the 1990’s at a 30th December 1999 10am price fix of £171.26. Over that decade the nominal price of gold declined -31.5% however the yearly rebalanced accumulation portfolio ended the decade with 2.54 times more ounces of gold in your safe.

Over some prolonged periods you might be cost averaging up the ounces of gold being held, over other periods you might be reducing gold to cost average up the number of stock shares you hold. With often one asset (yearly best) popping to the upside by a 15%, 20% .. or more on a yearly average amount whilst the other (yearly worst) asset around breaks even, which in combination yields a reasonable overall positively biased reward.

Gold's 'dividend' comes out of trading it, leave it as a door stop lump of metal and its a questionable 'investment'. Having some gains arise out of price appreciation, dividends and volatility capture, across asset diversification and currency diversification is a reasonable overall portfolio. Wouldn't want to be all-in gold nor all-in stock, 50/50 middle road is fine. https://tinyurl.com/y7cm5b7t

50/50 stock/gold might be considered as a form of barbell of two extremes, with a central bullet type combined point. I box it into a 'unhedged global bond' type category https://tinyurl.com/y77we59j More volatile than a bond bullet, but where the volatility in part enables 'trading' (rebalancing) benefits.

Harry Browne took that a stage further and he blended that unhedged global bond bullet with a domestic short dated/long dated treasury barbell (25% in each of stocks, gold, short dated treasury, long dated treasury) that for a US investor from 1972 to the end of March 2020 has yielded nearly a 5% annualised real reward https://tinyurl.com/y9vy83nz (I used a 10 year bullet in that as it has longer history). Hover your mouse over the (i) symbol next to the CAGR figure in the Portfolio Returns section to see the inflation adjusted value pop-up.

History is weird however. I have data back from 1896 and up to 1931 when the BoE broke away form the gold standard it was more sensible to hold US stock and UK T-Bills/bonds as gold and money were the same (convertible) so it made more sense to have 'gold' earning interest (UK T-Bills) and to hold US stock for £/$ combined 50/50 exposure. After the break off the gold standard it was also more appropriate to hold UK stock and free-floating silver rather than US$ pegged gold. Only after President Nixon broke the US$ away from gold in 1968 as a means to help pay down the cost of the Vietnam war was is appropriate to hold UK stocks and gold. Keeping things at 50% stock, along with 50/50 domestic £ and foreign currency (of which gold is a global currency) kept things neutral. Plug that all into 1896 onwards data and for every 50 year period the worst case PWR (perpetual withdrawal rate) was 4% and the average case was 7% i.e. real gain/withdrawal amounts that left the original inflation adjusted start date value still intact at the end of 50 years. And where that worst case 50 year period was within a total period containing some pretty wild political/social/global extremes. That's just for just the 50/50 portfolio, not the Harry Browne version i.e. as of more recent (since 1968) FT All Share/gold 50/50 yearly rebalanced.

The primary risks are regret - seeing other stock heavy portfolios relatively pull ahead at times inducing you to switch your asset allocation, likely at a bad time. Over other periods you'll be pleased, such as 2008 and recent were pretty much non-events. The above Callan for instance indicates that both 2008 and 2009 were up years. The gold gains in 2008 more than offset the stock declines in 2008. Similarly year to date 2020 and gold is up over +40%, more than offsetting any declines in year to date share price declines.

-

GoSeigen

- Lemon Quarter

- Posts: 4407

- Joined: November 8th, 2016, 11:14 pm

- Has thanked: 1603 times

- Been thanked: 1593 times

Re: Gold in Sterling Within £10 of Record High

1nvest wrote:GoSeigen wrote:CommissarJones wrote:And the move goes on: sterling-priced bullion has topped £1,235/ounce today, after breaking above £1,200/oz at the start of the week. Up 6% in August already. (All according to investing.com.)

If you don't mind my saying so: there are plenty of web sites that publish gold spot prices. Posting just prices of investments is considered bad form on these forums. Very happy to see discussion about the merits of gold as an asset though...

GS

OK GS, I'll bite. Simply because of lockdown boredom.

Briefly (!) what do you think of Platinum? For my sins, I've been running down gold positions and switching to platinum but so far it's looking like a poor exchange.

GS

Who is online

Users browsing this forum: Kantwebefriends and 20 guests