Where are we now ?

Posted: October 13th, 2022, 9:04 pm

Lots going on in the economy and markets.

I have kind of lost the place with LDI and it's real impact on my DB pension, not sure what happens next.

Not sure where UK and USA equities and earnings are about to go.

The energy market is battling between HC and Green Energy policy and I'm not too sure where this is going to end up.

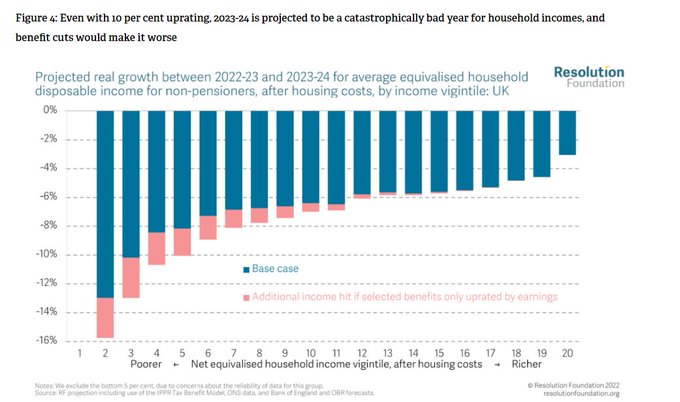

I think that UK society is going to have a very, very severe time financially in the next two or three years. Particularly pensioners and those dependent on crumbling State support.

Lots of calm, clever and methodical folkies here on TLF. Whither goeth the UK ?

I would really like to get your informed and measured views.

On the plus side, it was a beautiful day today and I hit some great golf shots.......Ah, life is good !!

Many thanks.

I have kind of lost the place with LDI and it's real impact on my DB pension, not sure what happens next.

Not sure where UK and USA equities and earnings are about to go.

The energy market is battling between HC and Green Energy policy and I'm not too sure where this is going to end up.

I think that UK society is going to have a very, very severe time financially in the next two or three years. Particularly pensioners and those dependent on crumbling State support.

Lots of calm, clever and methodical folkies here on TLF. Whither goeth the UK ?

I would really like to get your informed and measured views.

On the plus side, it was a beautiful day today and I hit some great golf shots.......Ah, life is good !!

Many thanks.