The question I find myself asking now is how will this downturn look compared to the slump of the late 80s/early90s in real terms? We have similar sort of drivers - an initial surge of inflation coupled with and soaring interest rates... back then it was followed by a recession in the early 90s and then generally tight monetary policy for a few years.

Back then, according to Nationwide index, prices slumped from £62,782 in Aug 89 to £50,128 by Feb 1993. There was no quick recovery and they bumbled along near this level for 2-3 years, hitting £51k in Dec 1995 which is probably where they made their inflation-adjusted lows.

62.7k to 50.9k over 7 years is a 19% nominal decline, but CPI inflation during those years was:

1990 - 8.06%

1991 - 7.46%

1992 - 4.59%

1993 - 2.56%

1994 - 2.22%

1995 - 2.70%

1996 - 2.85%

https://www.macrotrends.net/countries/G ... n-rate-cpiSo the peak to trough decline in real terms over this time was as much as 41%.

In comparison, current decline house prices have gone from a peakish price of about 273k to 261k in just over a year, which in nominal terms is a 4.5% decline, but if you factor in inflation that becomes more like a 14% decline.

There is clearly a long way to go before it looks anywhere near as bad as the early 90s, but this may be instructive for anyone who thinks the housing market is just going to bounce back next year.

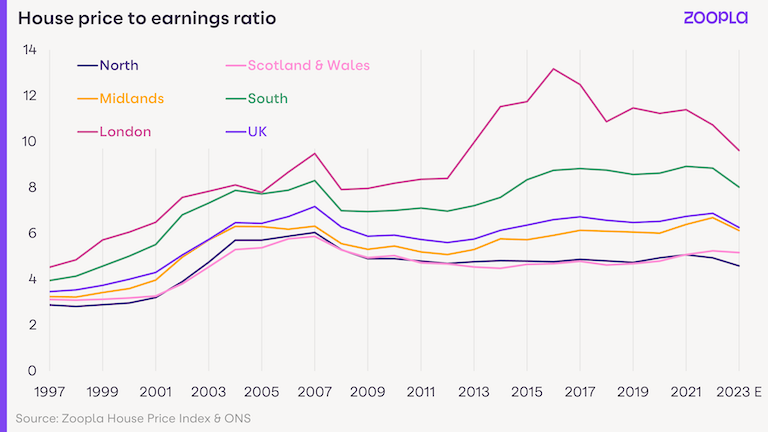

UK property has had such a good run over the last 30 years, there is bound to be a prolonged period where it returns closer to a sustainable trend.