Got a credit card? use our Credit Card & Finance Calculators

Thanks to Rhyd6,eyeball08,Wondergirly,bofh,johnstevens77, for Donating to support the site

2008 again?

-

odysseus2000

- Lemon Half

- Posts: 6438

- Joined: November 8th, 2016, 11:33 pm

- Has thanked: 1562 times

- Been thanked: 975 times

2008 again?

Do not like this market at all, feels 2008-ish to me.

Fed clueless as usual just like 2008.

Moves of this magnitude require big money at a time when most desks normally have juniors on.

It all feels to me like some big bank with large counterparts risk is going down, first thought would be Goldman, but there is plenty of other weak stuff in Europe and after the Europeans raised rates into the Great Recession I don't have any confidence in them to have a clue or to have measures in place.

Hopefully I am all wrong and if someone else has another explanation I would like to have it.

Regards,

Fed clueless as usual just like 2008.

Moves of this magnitude require big money at a time when most desks normally have juniors on.

It all feels to me like some big bank with large counterparts risk is going down, first thought would be Goldman, but there is plenty of other weak stuff in Europe and after the Europeans raised rates into the Great Recession I don't have any confidence in them to have a clue or to have measures in place.

Hopefully I am all wrong and if someone else has another explanation I would like to have it.

Regards,

-

tikunetih

- Lemon Slice

- Posts: 429

- Joined: December 14th, 2018, 10:30 am

- Has thanked: 296 times

- Been thanked: 407 times

Re: 2008 again?

odysseus2000 wrote:Do not like this market at all, feels 2008-ish to me.

No.

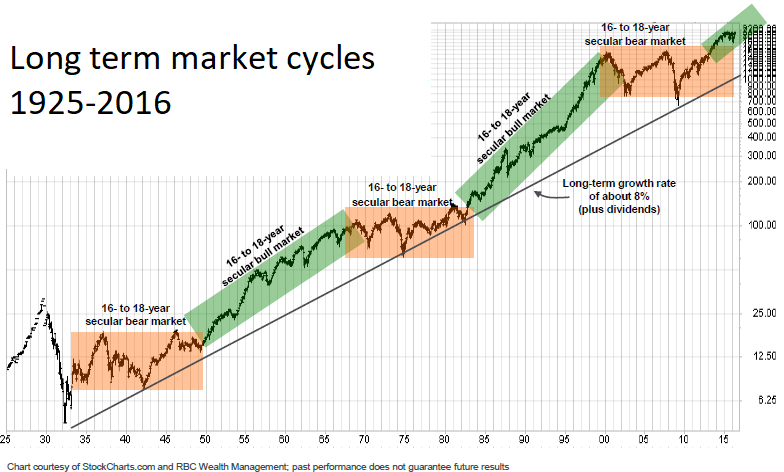

This is probably a cyclical bear market within the context of an overall secular bull market.

2007-09 was a cyclical bear within an overall secular bear.

This is relevant to quantum.

Those with well-constructed portfolios appropriate to their risk tolerance and goals should be at ease. If skilled or lucky they should benefit from the volatility.

Others, without enjoying such benefits, will suffer, some badly, particularly "more recent joiners" whose investment experience to date will have ill-prepared them for the full market cycle experience.

"Thus has it always been, thus shall it ever be"

-

TheMotorcycleBoy

- Lemon Quarter

- Posts: 3246

- Joined: March 7th, 2018, 8:14 pm

- Has thanked: 2226 times

- Been thanked: 588 times

Re: 2008 again?

A run on a bank, in the UK, will take a certain level of ingenuity, given that the next 2 days are actually, err... Bank Holidays.

-

odysseus2000

- Lemon Half

- Posts: 6438

- Joined: November 8th, 2016, 11:33 pm

- Has thanked: 1562 times

- Been thanked: 975 times

Re: 2008 again?

TheMotorcycleBoy wrote:A run on a bank, in the UK, will take a certain level of ingenuity, given that the next 2 days are actually, err... Bank Holidays.

A big bank going down with significant counterparts risk would be ingenious enough.

I have no idea if this is probable.

It may be just a cyclical bear market in a secular bull as mentioned all triggered by Powell raising Fed rates, but it feels different to me, especially happening now when normally most desks only have juniors on.

Regards,

-

Lootman

- The full Lemon

- Posts: 18927

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 636 times

- Been thanked: 6667 times

Re: 2008 again?

odysseus2000 wrote:It all feels to me like some big bank with large counterparts risk is going down, first thought would be Goldman, but there is plenty of other weak stuff in Europe and after the Europeans raised rates into the Great Recession I don't have any confidence in them to have a clue or to have measures in place.

Deutsche Bank has lost 60% of its market cap this year. Huge derivatives exposure. That would be my bet.

The worrying thing about today's market action was that it was the defensive areas that got hit the hardest - utilities, REITs and consumer staples.

And gold has really perked up these last two days.

Re: 2008 again?

Seems we have a confluence of events

1. Cutting rates to zero, combined with QE caused all assets to rally with high inter-asset correlations. Now, Fed rate hikes and balance sheet unwind (quantitative tightening) are causing the reverse. Market seems to be particularly sensitive to latter. Easy to show high correlation between central bank balance sheet size and risky asset prices.

2. The rest of the world is slowing. China and the EU. UK is mess with Brexit. US was the one "exceptional" developed economy but this was partially due to Trump's fiscal stimulus and tax that caused a one-off "sugar high" (the "Trump pump"). This will roll off by 2H19, so the market is now anticipating the "Trump dump" phase to US economy.

3. Downward revisions to earning estimates for many US stocks have occurred in recent months.

4. Trump: threatens Fed independence by saying he wants to fire Powell. US in shutdown due to impasse over funding of his Mexican Wall. Still have trade war with China that needs to be resolved within next 90 days.

No idea why anyone thinks derivative exposures are an issue. Derivatives were part of the problem in the last crisis but not so much now. First, nearly all IR and credit derivatives are cleared through LCH, DTCC and CME clearing houses. So there is far less bilateral exposure. These positions are hugely overcollateralized. Second, while the notional exposure seems high (many trillions), the actual cashflow transfers and net PVs are far far smaller and margined daily. DB stock has collapsed because it's a rubbish bank with a broken business model.

This has been a long bull market by historical standards. The anomaly is not the 20% fall in the S&P 500 since late Sep. The anomaly is the lack of equivalent falls over the past decade.

1. Cutting rates to zero, combined with QE caused all assets to rally with high inter-asset correlations. Now, Fed rate hikes and balance sheet unwind (quantitative tightening) are causing the reverse. Market seems to be particularly sensitive to latter. Easy to show high correlation between central bank balance sheet size and risky asset prices.

2. The rest of the world is slowing. China and the EU. UK is mess with Brexit. US was the one "exceptional" developed economy but this was partially due to Trump's fiscal stimulus and tax that caused a one-off "sugar high" (the "Trump pump"). This will roll off by 2H19, so the market is now anticipating the "Trump dump" phase to US economy.

3. Downward revisions to earning estimates for many US stocks have occurred in recent months.

4. Trump: threatens Fed independence by saying he wants to fire Powell. US in shutdown due to impasse over funding of his Mexican Wall. Still have trade war with China that needs to be resolved within next 90 days.

No idea why anyone thinks derivative exposures are an issue. Derivatives were part of the problem in the last crisis but not so much now. First, nearly all IR and credit derivatives are cleared through LCH, DTCC and CME clearing houses. So there is far less bilateral exposure. These positions are hugely overcollateralized. Second, while the notional exposure seems high (many trillions), the actual cashflow transfers and net PVs are far far smaller and margined daily. DB stock has collapsed because it's a rubbish bank with a broken business model.

This has been a long bull market by historical standards. The anomaly is not the 20% fall in the S&P 500 since late Sep. The anomaly is the lack of equivalent falls over the past decade.

-

odysseus2000

- Lemon Half

- Posts: 6438

- Joined: November 8th, 2016, 11:33 pm

- Has thanked: 1562 times

- Been thanked: 975 times

Re: 2008 again?

Hi Workshy,

Yes, this analysis is consistent with what we are seeing, but whether it is the whole picture I am not sure.

One can argue, as you do, that this is just the natural course of events and that the last ten year are the anomaly and that now we are simply having a recession that counters the previous ten years of anti-depression medicine. That the Fed are simply setting things back to what they class as normal, normal being some ill defined concept that can be set to what ever they want depending on how they want to measure it.

I find it hard to see how Fed rate rises now are consistent with their dual mandate to maximise employment and stabilise prices. Given all the things you mention (Slowing US company profits, China slowing, Brexit, etc) it seems strange for the Fed to have now chosen to raise rates and increase QT. If they were to keep to their dual mandate these factors would suggest now is a time to keep rates steady or lower them, not raise them.

The consequence of small rises like 1/4% don’t seem significant but for US real estate where prices in the major centres are millions for modest places in e.g. New York these add to significant rises at a time when US profits are slowing and one expects lay offs in the new year. Are the banks immune to a fall in US real estate prices? Dunno, I doubt it and meanwhile the troubles surrounding Goldman become more opaque at least to me. What lurks around in Italian and other European banks is also unclear to me. But if there are bad things hidden away this type of interest rate rises, equity falls and general economic weakness are likely to bring them out.

For now the falls have taken the spx back to where it was in the first quarter of 2017. The rate of fall is similar to what we saw in 2008 as shown on this log plot:

https://twitter.com/0_ody/status/1077377676275576832

If things are normal we can expect a rally from these very oversold levels and then more declines.

Trump and his administration will likely continue to try and talk the market up, but it seems to me that the Fed is key here. If Trump fires Powell many say it will undermine Fed independence and make things worse, but I would expect the markets to rally strongly, especially if rates were cut. Even without a Powell firing the declines are sufficiently large that one can expect other Fed governors to come out wanting interest rate rises on hold or reversed. Powell though has made this his policy and he may refuse to do anything and argue that the markets are not his job. If he says anything like this it will likely cause a very negative market reaction and a big drop in support for Trump.

If there is more structural underlying weakness that suddenly comes to the markets attention I imagine that the pace of decline will be enough that the circuit breakers will get activated. The level 1, 2 and 3 halts are 7%, 13% and 20% and there is also the new limit up limit down that applies to certain individual stocks:

https://personal.vanguard.com/us/conten ... ersJSP.jsp

One can argue that after these declines that the biggest threat is to shorts who have made out like bandits in December. The oversold oscillators are at extreme levels now.

As I said I have no clue about what is going on. I can easily believe that this is normal or that it is indicative of bigger underlying trouble. It always feels bad when markets correct so that may be influencing me as might be the ugly selling on Christmas eve. It will be interesting to see what comes.

Regards,

Yes, this analysis is consistent with what we are seeing, but whether it is the whole picture I am not sure.

One can argue, as you do, that this is just the natural course of events and that the last ten year are the anomaly and that now we are simply having a recession that counters the previous ten years of anti-depression medicine. That the Fed are simply setting things back to what they class as normal, normal being some ill defined concept that can be set to what ever they want depending on how they want to measure it.

I find it hard to see how Fed rate rises now are consistent with their dual mandate to maximise employment and stabilise prices. Given all the things you mention (Slowing US company profits, China slowing, Brexit, etc) it seems strange for the Fed to have now chosen to raise rates and increase QT. If they were to keep to their dual mandate these factors would suggest now is a time to keep rates steady or lower them, not raise them.

The consequence of small rises like 1/4% don’t seem significant but for US real estate where prices in the major centres are millions for modest places in e.g. New York these add to significant rises at a time when US profits are slowing and one expects lay offs in the new year. Are the banks immune to a fall in US real estate prices? Dunno, I doubt it and meanwhile the troubles surrounding Goldman become more opaque at least to me. What lurks around in Italian and other European banks is also unclear to me. But if there are bad things hidden away this type of interest rate rises, equity falls and general economic weakness are likely to bring them out.

For now the falls have taken the spx back to where it was in the first quarter of 2017. The rate of fall is similar to what we saw in 2008 as shown on this log plot:

https://twitter.com/0_ody/status/1077377676275576832

If things are normal we can expect a rally from these very oversold levels and then more declines.

Trump and his administration will likely continue to try and talk the market up, but it seems to me that the Fed is key here. If Trump fires Powell many say it will undermine Fed independence and make things worse, but I would expect the markets to rally strongly, especially if rates were cut. Even without a Powell firing the declines are sufficiently large that one can expect other Fed governors to come out wanting interest rate rises on hold or reversed. Powell though has made this his policy and he may refuse to do anything and argue that the markets are not his job. If he says anything like this it will likely cause a very negative market reaction and a big drop in support for Trump.

If there is more structural underlying weakness that suddenly comes to the markets attention I imagine that the pace of decline will be enough that the circuit breakers will get activated. The level 1, 2 and 3 halts are 7%, 13% and 20% and there is also the new limit up limit down that applies to certain individual stocks:

https://personal.vanguard.com/us/conten ... ersJSP.jsp

One can argue that after these declines that the biggest threat is to shorts who have made out like bandits in December. The oversold oscillators are at extreme levels now.

As I said I have no clue about what is going on. I can easily believe that this is normal or that it is indicative of bigger underlying trouble. It always feels bad when markets correct so that may be influencing me as might be the ugly selling on Christmas eve. It will be interesting to see what comes.

Regards,

-

jackdaww

- Lemon Quarter

- Posts: 2081

- Joined: November 4th, 2016, 11:53 am

- Has thanked: 3203 times

- Been thanked: 417 times

Re: 2008 again?

around 2008 there were several blue chips available at half todays prices .

i bought in then , and am doing the same now.

i bought in then , and am doing the same now.

-

tikunetih

- Lemon Slice

- Posts: 429

- Joined: December 14th, 2018, 10:30 am

- Has thanked: 296 times

- Been thanked: 407 times

Re: 2008 again?

odysseus2000 wrote:It always feels bad when markets correct

I enjoy the man-made phenomena of rapidly falling markets and this US market decline is no different.

"Third waves are wonders to behold", and that's especially the case with nested 3rd waves as we have here: relentless with virtually no pullbacks allowing people to re-position.

During these moves the rate at which price changes doesn't allow people to gather their thoughts, to deliberate or to reason and their responses become dominated by the amygdala and the autonomic nervous system.

Many of the best laid plans go out of the window as people are swept up by and succumb to the emotions of the crowd.

Mele Kalikimaka

-

TahiPanasDua

- Lemon Slice

- Posts: 322

- Joined: June 4th, 2017, 6:51 pm

- Has thanked: 402 times

- Been thanked: 233 times

Re: 2008 again?

ap8889 wrote:2008 Crisis was a great time to buy equities, in the rear view mirror.

As I am accumulating ie a net buyer of shares, lower prices at this time are helpful. I am buying the index now but hopeful we may see FTSE 6000 again at some point, at which level I will be gearing up and going all in.

The FTSE at 6000 is a reasonable and sensibly modest target.

An article in Seeking Alpha by John Kingham suggests that, based on Shiller's CAPE ratio, the FTSE is slightly cheap at 5,600 to 6,500. Your 6,000 fits in there nicely. He suggests 4,600 to 5,600 is cheap. I am targeting under 5,600 and will have no regrets if I don't make it.

If you decided to cost average in, 6,000 seems a good starting point.

I followed Shiller closely in both the dotcom and financial crises busts and with leverage made impressive gains. I have little confidence I can repeat the feat and certainly now lack the motivation or guts to leverage.

The CAPE ratio is of limited help except at market extremes. This raises the question of what constitutes an extreme. Individual views will vary enormously and few of us are dispassionate at such times.

TP2.

-

Ashfordian

- Lemon Slice

- Posts: 996

- Joined: November 4th, 2016, 5:47 pm

- Has thanked: 168 times

- Been thanked: 161 times

Re: 2008 again?

odysseus2000 wrote:Do not like this market at all, feels 2008-ish to me.

Fed clueless as usual just like 2008.

Moves of this magnitude require big money at a time when most desks normally have juniors on.

It all feels to me like some big bank with large counterparts risk is going down, first thought would be Goldman, but there is plenty of other weak stuff in Europe and after the Europeans raised rates into the Great Recession I don't have any confidence in them to have a clue or to have measures in place.

Hopefully I am all wrong and if someone else has another explanation I would like to have it.

Regards,

I'm not sure the Fed is being clueless. If there is something going on behind the scenes, would it have spooked the markets more if they had not followed their previously direction of raising rates in December?

The bigger question is why did the S Treasury Secretary release a statement saying that the 6 largest banks have confirmed they have "ample liquidity"? Is there a gremlin running around the system? The BoE have pretty much confirmed that if there was another run on British bank that the general public would not be informed and you have to think this policy would be the replicated by other major central banks due to the damage this being in public would cause.

The bigger part of the statement that raises concern for me is "The key regulators will discuss coordination efforts to assure normal market operations". Is this just a badly worded sentence in relation to the US government shutdown?

To me, before this statement, these were normal market operations where the excess froth was being removed from a very high priced market. Considering this is computers doing most of these trading moves, with juniors to oversee it (although in constant contact with the decision makers) I didn't see a problem with these moves. Computers just align to the group-think faster than their human counterparts hence the moves up and down are larger.

The only think we can be sure about is that if there is something going on we will be the last to know about it.

-

odysseus2000

- Lemon Half

- Posts: 6438

- Joined: November 8th, 2016, 11:33 pm

- Has thanked: 1562 times

- Been thanked: 975 times

Re: 2008 again?

The statement by the Fed on the 19th of this month, is cited by some as the reason we had the big sell off on Christmas Eve:

https://www.federalreserve.gov/newseven ... 81219a.htm

The opening paragraph:

Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has remained low. Household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier in the year. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

This seems strange to me because it does not mention any of the weakness reported by US corporations. It does not consider the tariff dispute with China which is of it self is causing a rise in the price of US imports and rises in the price of US exports to China. Nor does it consider the Federal Government shutdown. How these factors can not negatively impact US employment is difficult to understand. Can the Fed see things that I can not or is their information as faulty as it was in 2008? If I was in their position with their dual mandate I would be thinking of keeping rates constant or reducing them, anticipating future weakness.

The Fed, instead said:

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 2-1/4 to 2‑1/2 percent.

This was a unanimous decision which still looks clueless to me given the backdrop. One of the oft cited policy goals of this Fed has been to restore interest rates to normal levels, without defining what normal is. This policy looks to be doing this without consideration of the current situation or likely near term future pressure on the US economy.

Meanwhile we have another theme, US treasury secretary Mnuchin calling all the major banks:

https://www.forbes.com/sites/antoinegar ... 54c852ff51

If everything is fine why make such calls?

The strength in the market today was not unexpected given the size of the Christmas Eve move as most shorts made out like bandits then and would have covered to lock in gains. If things progress as normal it would not surprise me to see some more strength followed by weakness on Friday or Monday as shorts re-load into higher prices.

Dunno, it still feels a bit 2008-ish to me.

Regards,

https://www.federalreserve.gov/newseven ... 81219a.htm

The opening paragraph:

Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has remained low. Household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier in the year. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

This seems strange to me because it does not mention any of the weakness reported by US corporations. It does not consider the tariff dispute with China which is of it self is causing a rise in the price of US imports and rises in the price of US exports to China. Nor does it consider the Federal Government shutdown. How these factors can not negatively impact US employment is difficult to understand. Can the Fed see things that I can not or is their information as faulty as it was in 2008? If I was in their position with their dual mandate I would be thinking of keeping rates constant or reducing them, anticipating future weakness.

The Fed, instead said:

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 2-1/4 to 2‑1/2 percent.

This was a unanimous decision which still looks clueless to me given the backdrop. One of the oft cited policy goals of this Fed has been to restore interest rates to normal levels, without defining what normal is. This policy looks to be doing this without consideration of the current situation or likely near term future pressure on the US economy.

Meanwhile we have another theme, US treasury secretary Mnuchin calling all the major banks:

https://www.forbes.com/sites/antoinegar ... 54c852ff51

If everything is fine why make such calls?

The strength in the market today was not unexpected given the size of the Christmas Eve move as most shorts made out like bandits then and would have covered to lock in gains. If things progress as normal it would not surprise me to see some more strength followed by weakness on Friday or Monday as shorts re-load into higher prices.

Dunno, it still feels a bit 2008-ish to me.

Regards,

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: 2008 again?

So what are you going to do about it? I reckon you worry too much. It is only necessary to be concerned about the day to day movements in the markets if you are going to do something or other. Otherwise be like me and a few others and just relax.

Dod

Dod

-

Lootman

- The full Lemon

- Posts: 18927

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 636 times

- Been thanked: 6667 times

Re: 2008 again?

Dod101 wrote:So what are you going to do about it? I reckon you worry too much. It is only necessary to be concerned about the day to day movements in the markets if you are going to do something or other. Otherwise be like me and a few others and just relax.

Yes and, besides, the Dow was up 1,080 points today. When I started investing the Dow was under 1,000 points.

Maybe we should read this board as a reliable contrarian indicator

-

odysseus2000

- Lemon Half

- Posts: 6438

- Joined: November 8th, 2016, 11:33 pm

- Has thanked: 1562 times

- Been thanked: 975 times

Re: 2008 again?

Dod101 wrote:So what are you going to do about it? I reckon you worry too much. It is only necessary to be concerned about the day to day movements in the markets if you are going to do something or other. Otherwise be like me and a few others and just relax.

Dod

What am I going to do?

Trade it!

2008 was a fabulous year for shorting the market as was the crash 8 years before.

We are currently seeing moves in a day that earlier this year took over a month.

Volatility is the traders friend: Beginning in October traders have made out like bandits.

It is nice to have both a macro view of things and an ability to profit from volatility.

There are very many ways to make money in equity markets. Many people here seem to like the traditional methods of buy and hold which is fine and has worked well over long periods and so will likely work again. The availability of low dealing costs and real time prices has made trading on much shorter terms also an option. Much of that is done purely on technicals but I do like to have some macro background as well.

Yesterdays rally was very predictable and I noted in earlier posts on this thread that I expected a rally after such strong selling unless some bad news about e.g. a bank failure came out. If you know how to trade then it becomes possible to make more than the move in the equity by trading short down and long back up.

Regards,

-

OhNoNotimAgain

- Lemon Slice

- Posts: 767

- Joined: November 4th, 2016, 11:51 am

- Has thanked: 71 times

- Been thanked: 147 times

Re: 2008 again?

odysseus2000 wrote:

What am I going to do?

Trade it!

2008 was a fabulous year for shorting the market as was the crash 8 years before.

We are currently seeing moves in a day that earlier this year took over a month.

Volatility is the traders friend: Beginning in October traders have made out like bandits.

It is nice to have both a macro view of things and an ability to profit from volatility.

There are very many ways to make money in equity markets. Many people here seem to like the traditional methods of buy and hold which is fine and has worked well over long periods and so will likely work again. The availability of low dealing costs and real time prices has made trading on much shorter terms also an option. Much of that is done purely on technicals but I do like to have some macro background as well.

Yesterdays rally was very predictable and I noted in earlier posts on this thread that I expected a rally after such strong selling unless some bad news about e.g. a bank failure came out. If you know how to trade then it becomes possible to make more than the move in the equity by trading short down and long back up.

Regards,

Great, we need people like this to supply liquidity to the market. He should be applauded for risking his capital for the benefit of long term investors like Dodi.

-

TheMotorcycleBoy

- Lemon Quarter

- Posts: 3246

- Joined: March 7th, 2018, 8:14 pm

- Has thanked: 2226 times

- Been thanked: 588 times

Re: 2008 again?

tikunetih wrote:This is probably a cyclical bear market within the context of an overall secular bull market.

2007-09 was a cyclical bear within an overall secular bear.

OOI What do you mean by secular bear or secular bull?

Do you mean the undercurrent was/is basically bearish/bullish?

(With a bearish fluctuation superimposed onto the main trend?)

Just trying to figure the terms out here.

thanks Matt

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: 2008 again?

TheMotorcycleBoy wrote:OOI What do you mean by secular bear or secular bull?

I have always understood that a secular bear market or secular bull market is describing the underlying trend, within which you can have the opposite trend from time to time. So I think you are pretty well correct.

Dod

Last edited by tjh290633 on December 28th, 2018, 2:49 pm, edited 1 time in total.

Reason: Tags corrected - TJH

Reason: Tags corrected - TJH

-

TheMotorcycleBoy

- Lemon Quarter

- Posts: 3246

- Joined: March 7th, 2018, 8:14 pm

- Has thanked: 2226 times

- Been thanked: 588 times

Re: 2008 again?

As a newbie, i.e. I have not been involved in private investing long enough to experience full bull/bear cycles etc.

But, hopefully, I ain't stupid so I want to run a theory past you lot.

so I want to run a theory past you lot.

Surely, if there is an equity sell out, and I mean a big sell out, don't the sellers of the equity need some where vaguely tempting to place their money instead?

Do we actually have such places today in the UK?

Apparently (and I'm just stating what I've recently read etc.) "the smart money flees to quality", and often this is UK gilts. But yields on them are pathetically low (1.3% ish?), as are any kind of saving account rates. O.k. perhaps the clever money buggers off abroad.....what now? The £ is very weak and so presumably buying US/European assets in pricey, and so surely the people potentially selling up their UK equity, have precious few options.

So how can today's scenario possibly map to previous ones, where presumably more attractive alternatives existed.

Just my newbie take on things - opinions, comment welcome!!

Matt

But, hopefully, I ain't stupid

Surely, if there is an equity sell out, and I mean a big sell out, don't the sellers of the equity need some where vaguely tempting to place their money instead?

Do we actually have such places today in the UK?

Apparently (and I'm just stating what I've recently read etc.) "the smart money flees to quality", and often this is UK gilts. But yields on them are pathetically low (1.3% ish?), as are any kind of saving account rates. O.k. perhaps the clever money buggers off abroad.....what now? The £ is very weak and so presumably buying US/European assets in pricey, and so surely the people potentially selling up their UK equity, have precious few options.

So how can today's scenario possibly map to previous ones, where presumably more attractive alternatives existed.

Just my newbie take on things - opinions, comment welcome!!

Matt

-

tikunetih

- Lemon Slice

- Posts: 429

- Joined: December 14th, 2018, 10:30 am

- Has thanked: 296 times

- Been thanked: 407 times

Re: 2008 again?

TheMotorcycleBoy wrote:What do you mean by secular bear or secular bull?

Essentially, what this chart is illustrating:

Secular bulls are strong uptrends persisting for up to a couple of decades, where the cyclical bull phases comprising them have much greater magnitude than the occasional cyclical bears. Hence the 'quantum' comment.

Whereas, secular bear markets are periods of sideways ranging price action where the cyclical bull and bear markets of which they comprise are of comparable magnitude to each other (because of the depth of the cyclical bears), hence the lack of overall progression, ie. the broad ranging.

NB note that this current (US S&P500) secular bull market only commenced in H1 2013, ie. ~5 1/2 years ago, when the previous secular bear's range was decisively exceeded, so my 'guess' would be that it has a dozen or so years to go yet; the cyclical bear market now underway appears comparable to the 1987 "crash" that temporarily interrupted the 1982-1999 secular bull market: somewhat 'scary' at the time, but in relatively short time it was just a blip in the historic charts.

Of course, this chart stuff is all bo!!ox, and any insight that charts provide into the psychology of market participants is merely coincidental, so pay no attention.

Return to “Macro and Global Topics”

Who is online

Users browsing this forum: No registered users and 12 guests