Re: Latest Inflation figures released.

Posted: March 23rd, 2017, 4:17 pm

odysseus2000 wrote:Look at e.g. the US treasury payments as rates rise and you will find it goes up.

Only for new issues. The rest stay the same.

TJH

Shares, Investment and Personal Finance Discussion Forums

https://www.lemonfool.co.uk/

odysseus2000 wrote:Look at e.g. the US treasury payments as rates rise and you will find it goes up.

tjh290633

Only for new issues. The rest stay the same.

odysseus2000 wrote:The effect of interest rate rises is significant just by the weight of money in bonds. If it wasn't so central banks would not use interest rates as a weapon.

The effect of ultra low and negative interest rates was not inflation as many suggested, but deflation: Too little money chasing too many goods.

Similarly the effect of interest rates rising will not be deflation but inflation.

One should also see currencies weaken as rates rise, not strengthen as the effect of more money going into the system is to lower its value as prices rise.

Regards,

Flint

Are you saying that if interest rates rise in the US, then the $ will weaken ?

If interest rates rise in the UK and the US will the £ and the $ both weaken - say against the Euro. ?

odysseus2000 wrote:... but we are currently no where near the end of a business cycle, much nearer the beginning

Steadyaim

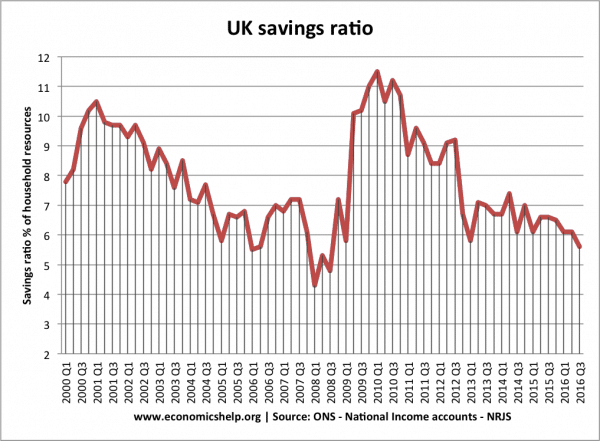

I disagree. The vast majority of the economy is driven by consumers, they spend less in recession and then spend more when the economy recovers. This chart available at http://www.economicshelp.org/blog/848/e ... -ratio-uk/ suggests to me that we are nearer the next recession than the last one:

If, as your chart suggests, consumer spending is falling off and continues then I will be wrong. If we are heading into a down turn I would expect this to show in other measures like pmi too.

argoal

I believe that you have misread the chart Ody, it shows a decrease in the saving rate rather than consumer spending.

All things being equal - that would suggest an increase in consumer spending rather than a decrease.