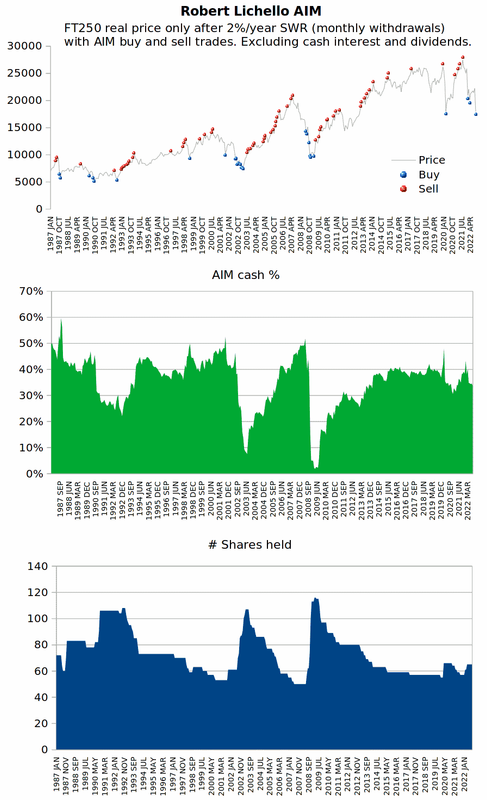

Can be used when transitioning from accumulation (saving) into retirement (drawdown)

In younger years 100% stock accumulation can be fine/good, averaging in money over many years. 100% stock can even be fine in retirement. Often once stocks have been held for a while corrections/declines can be more a case of just giving back some/all of 'other peoples money', might not be a concerning risk, but for new retirees that is subject to early years sequence of returns risk, if you endure large declines soon after starting retirement/drawdown then that can become critical.

Buy and hold is the same as cost-less lumping in each and every day. A reasonable way to manage things is to buy and hold right up to retirement, then take some off the table when you transition into retirement, and then average that money back into stocks again over a period of time during retirement.

But how much to take off the table, and when to cost average that money back in again? Well that's where AIM can help. If you run a paper/backtest AIM, pretend money, that will provide a indicator of the current %CASH that would currently hold that can be used as a indicator of how-much cash. If you run a actual AIM where you ignore any sale trades, just increase Portfolio Control by half the indicated value of shares to be sold, without actually selling any shares, then that will average-in the cash over time. We no longer have to concern ourselves with answering when and how much.

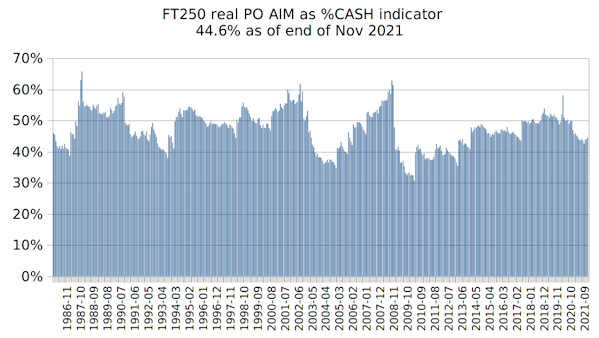

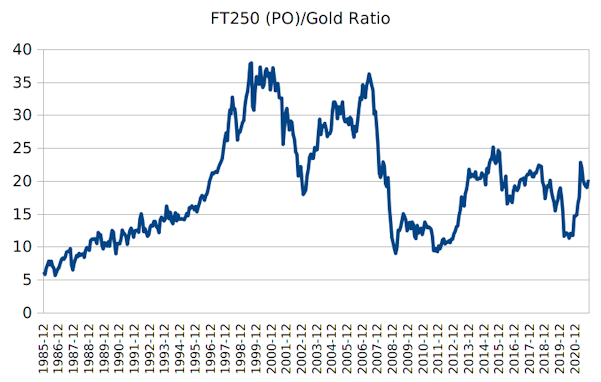

Recently, applied to the FT250 stock index, I'm seeing a appropriate amount of %CASH figure of 44.5%. The FT250/Gold ratio is also somewhat central at around a 20 figure/value. Pretty much indicating that FT250 is fair value, neither expensive nor cheap.

If stock prices do dive soon after retirement then the cash reserves will buy more shares, average down the average cost of stock, reduce early years sequence of returns risk. Likely do much better mid to longer term than having lumped-in. If stock prices do well then AIM buys the dips and whilst likely not as great gains as had you lumped all in from day 1 the rewards will still be good, lag only marginally.

For the paper/backtest AIM I suggest tracking the FT250 (or whatever index) real price (adjusted for inflation), ignoring dividends and assuming cash paces inflation. 20% BUY SAFE, 10% SELL SAFE, 10% of number of shares minimum trade size AIM settings, along with increasing Portfolio Control by 1.5%/year monthly pro-rata rate when reviewing AIM monthly. For the cost averaging in AIM settings of 0% SAFE and minimum trade size, monthly reviews, but only actually buying shares when AIM indicates if a reasonable amount is suggested, say £1000 or more, otherwise just ignore that months advice.

Historically that did OK if started from where a Bull run subsequently occurred after starting retirement, did pretty well in cases where large declines occurred relatively soon after starting retirement - much better than had you been all-in. And did OK when started prior to a Bunny market, again better than having lumped in.

This is a chart showing a paper AIM of FT250 real price indicated %CASH over time and up to recent, where if you were retiring recently it is suggesting 44.6% cash to be appropriate.

I also keep a record of FT250 nominal price only divided by Gold price over time as another indicator of when stocks might be relatively cheap or expensive compared to the price of gold, which can serve as a secondary/confirmation type indicator.

Note how both did a reasonable job for retirees in late 1990's/early 2000's pre dot-com bubble bursting and again prior to the 2008/9 financial crisis. Where in both cases AIM and stock/gold ratio were pretty much shouting out warnings. The subsequent declines with AIM buying into/across those dips would have left a retiree far better placed than had they been all-in, seen large price declines compounded with income withdrawals.