Got a credit card? use our Credit Card & Finance Calculators

Thanks to Rhyd6,eyeball08,Wondergirly,bofh,johnstevens77, for Donating to support the site

VUSA or JAM for US exposure

-

richfool

- Lemon Quarter

- Posts: 3525

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1206 times

- Been thanked: 1289 times

VUSA or JAM for US exposure

I'm think of adding JAM or VUSA to my ISA to increase my US exposure. I'm conscious that both invest in the S&P500, and that JAM is an active IT, whereas VUSA is a low cost tracker (0.07%). VUSA also gives a slightly higher yield at around 1.23% against JAM's c 0.92%.

Currently I get my US exposure through BRSA, plus ATST and BUT

Does anyone have any other views or suggestions?

Currently I get my US exposure through BRSA, plus ATST and BUT

Does anyone have any other views or suggestions?

-

Lootman

- The full Lemon

- Posts: 18907

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 636 times

- Been thanked: 6665 times

Re: VUSA or JAM for US exposure

If you look at the top ten holdings for JAM you will notice that six of them pay no dividend, and the others only pay a small dividend. Since you mention dividend yield you might see that as a disadvantage but of course what it really means is that it is making a bigger bet on growth, with names like Nvidia and Tesla.

So I would regard JAM as a S&P 500 play with a growth tilt.

That said I have large positions in both and have done for years, as they do different things. They are both up bigly. VUSA is in my ISA, so no pesky ERI issues. JAM is in a taxable account and so the "problem" there is having to pay capital gains tax on it, eventually.

So I would regard JAM as a S&P 500 play with a growth tilt.

That said I have large positions in both and have done for years, as they do different things. They are both up bigly. VUSA is in my ISA, so no pesky ERI issues. JAM is in a taxable account and so the "problem" there is having to pay capital gains tax on it, eventually.

-

richfool

- Lemon Quarter

- Posts: 3525

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1206 times

- Been thanked: 1289 times

Re: VUSA or JAM for US exposure

Lootman wrote:If you look at the top ten holdings for JAM you will notice that six of them pay no dividend, and the others only pay a small dividend. Since you mention dividend yield you might see that as a disadvantage but of course what it really means is that it is making a bigger bet on growth, with names like Nvidia and Tesla.

So I would regard JAM as a S&P 500 play with a growth tilt.

That said I have large positions in both and have done for years, as they do different things. They are both up bigly. VUSA is in my ISA, so no pesky ERI issues. JAM is in a taxable account and so the "problem" there is having to pay capital gains tax on it, eventually.

Thank you for your observations. I note that both have quite large positions in MS, Apple, Amazon and Nvidia. In the case of Apple, VUSA has the largest holding at 7.58%. Both seem to have much the same holdings within their top tens.

https://www.hl.co.uk/shares/shares-sear ... etf-usdgbp

https://www.fundslibrary.co.uk/FundsLib ... fwfRze&r=1

-

JonnyT

- Lemon Pip

- Posts: 83

- Joined: November 7th, 2016, 8:54 am

- Has thanked: 11 times

- Been thanked: 27 times

Re: VUSA or JAM for US exposure

Why not go all in and go for IITU an ETF with holdings as follows:

Apple Inc Technology 25.4%

Microsoft Corp 18.8%

NVIDIA Corp 11.9%

Broadcom Inc 3.8%

Adobe Inc 2.6%

Cisco Systems Inc 2.4%

Salesforce Inc 2.2%

Accenture PLC Class A 2.1%

Oracle Corp 1.8%

Advanced Micro Devices Inc 1.8%

Given they are all fuelled by the top few here anyway.

Apple Inc Technology 25.4%

Microsoft Corp 18.8%

NVIDIA Corp 11.9%

Broadcom Inc 3.8%

Adobe Inc 2.6%

Cisco Systems Inc 2.4%

Salesforce Inc 2.2%

Accenture PLC Class A 2.1%

Oracle Corp 1.8%

Advanced Micro Devices Inc 1.8%

Given they are all fuelled by the top few here anyway.

-

monabri

- Lemon Half

- Posts: 8424

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3443 times

Re: VUSA or JAM for US exposure

I had to look up IITU.

https://www.hl.co.uk/shares/shares-sear ... -ucits-etf

It's quite a heavy bet on Apple and Microsoft !! ( 26% & 18% respectively).

(Vanguard's S&P 500, VUSA, is c7% and 6% for AAPL and MSFT.)

https://www.hl.co.uk/shares/shares-sear ... -ucits-etf

It's quite a heavy bet on Apple and Microsoft !! ( 26% & 18% respectively).

(Vanguard's S&P 500, VUSA, is c7% and 6% for AAPL and MSFT.)

-

Dicky99

- Lemon Slice

- Posts: 634

- Joined: February 23rd, 2023, 7:42 am

- Has thanked: 173 times

- Been thanked: 288 times

Re: VUSA or JAM for US exposure

richfool wrote:I'm think of adding JAM or VUSA to my ISA to increase my US exposure. I'm conscious that both invest in the S&P500, and that JAM is an active IT, whereas VUSA is a low cost tracker (0.07%). VUSA also gives a slightly higher yield at around 1.23% against JAM's c 0.92%.

Currently I get my US exposure through BRSA, plus ATST and BUT

Does anyone have any other views or suggestions?

I'm thinking along the same lines but thought IGUS might be preferable because of the currency hedging.

-

hiriskpaul

- Lemon Quarter

- Posts: 3913

- Joined: November 4th, 2016, 1:04 pm

- Has thanked: 702 times

- Been thanked: 1552 times

Re: VUSA or JAM for US exposure

For a US growth fund, JAM has not done well compared to a US growth index (very few funds have), so if you think growth will continue to outperform I would go for a US growth ETF. iShares have recently launched a iShares Russell 1000 Growth ETF, listed on the LSE (R1GR). The US listed equivalents have trounced JAM over the last 10 years. There are probably other such ETFs available, but I tend to prefer iShares.

OTOH if you don't want to bet on growth continuing to outperform, go for a more market neutral ETF, such as VUSA.

OTOH if you don't want to bet on growth continuing to outperform, go for a more market neutral ETF, such as VUSA.

-

richfool

- Lemon Quarter

- Posts: 3525

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1206 times

- Been thanked: 1289 times

Re: VUSA or JAM for US exposure

Dicky99 wrote:richfool wrote:I'm think of adding JAM or VUSA to my ISA to increase my US exposure. I'm conscious that both invest in the S&P500, and that JAM is an active IT, whereas VUSA is a low cost tracker (0.07%). VUSA also gives a slightly higher yield at around 1.23% against JAM's c 0.92%.

Currently I get my US exposure through BRSA, plus ATST and BUT

Does anyone have any other views or suggestions?

I'm thinking along the same lines but thought IGUS might be preferable because of the currency hedging.

I wasn't familiar with IGUS until your post above, but note it is an i-Shares hedged, accumulating, version. The OCF/TER of IGUS is 0.20% as opposed to VUSA's O.07%

Thanks, Dicky99. I did in fact buy some JAM (JP Morgan American trust) yesterday (4th October), on a down day, whilst the SP was down at 483.5p. I decided/preferred to go for an active, where the manager can vary the investments/holdings according to his assessment of markets. I'll think about VUSA for my wife's ISA, noting is has the very low OCR/TER of 0.07% and a higher dividend yield than JAM. I'll also keep IGUS in mind.

-

DrFfybes

- Lemon Quarter

- Posts: 3777

- Joined: November 6th, 2016, 10:25 pm

- Has thanked: 1190 times

- Been thanked: 1980 times

Re: VUSA or JAM for US exposure

richfool wrote:I'm think of adding JAM or VUSA to my ISA to increase my US exposure.

Does anyone have any other views or suggestions?

BRKB?

-

Lootman

- The full Lemon

- Posts: 18907

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 636 times

- Been thanked: 6665 times

Re: VUSA or JAM for US exposure

DrFfybes wrote:richfool wrote:I'm think of adding JAM or VUSA to my ISA to increase my US exposure.

Does anyone have any other views or suggestions?

BRKB?

I like BRK not least because it does not pay out a dividend and so presents me with no unwelcome tax events or tax withholding.

But that said the OP appears to like dividends . .

-

richfool

- Lemon Quarter

- Posts: 3525

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1206 times

- Been thanked: 1289 times

Re: VUSA or JAM for US exposure

Lootman wrote:DrFfybes wrote:BRKB?

I like BRK not least because it does not pay out a dividend and so presents me with no unwelcome tax events or tax withholding.

But that said the OP appears to like dividends . .

It's more the exposure to that sector (the US and the S&P500) that I am after, appreciated there isn't much income to be had there.

I don't usually hold individual shares directly, particularly not US ones. My holdings are almost all IT's. Note that JAM, VUSA and IUGS all hold Berkshire.

-

hiriskpaul

- Lemon Quarter

- Posts: 3913

- Joined: November 4th, 2016, 1:04 pm

- Has thanked: 702 times

- Been thanked: 1552 times

Re: VUSA or JAM for US exposure

richfool wrote:Dicky99 wrote:

I'm thinking along the same lines but thought IGUS might be preferable because of the currency hedging.

I decided/preferred to go for an active, where the manager can vary the investments/holdings according to his assessment of markets.

This is precisely why I dislike active. Active fund managers are mostly really crap at assessing markets!

To see just how bad they are, take a look at this https://www.spglobal.com/spdji/en/docum ... d-2022.pdf

If you don't want to read it all focus on reports 1a and 1b. Well over 90% of funds failing to beat their benchmarks over 20 years. To think about it another way, if you want to ensure you invest in a top decile fund, buy an index fund.

-

richfool

- Lemon Quarter

- Posts: 3525

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1206 times

- Been thanked: 1289 times

Re: VUSA or JAM for US exposure

hiriskpaul wrote:richfool wrote: I decided/preferred to go for an active, where the manager can vary the investments/holdings according to his assessment of markets.

This is precisely why I dislike active. Active fund managers are mostly really crap at assessing markets!

To see just how bad they are, take a look at this https://www.spglobal.com/spdji/en/docum ... d-2022.pdf

If you don't want to read it all focus on reports 1a and 1b. Well over 90% of funds failing to beat their benchmarks over 20 years. To think about it another way, if you want to ensure you invest in a top decile fund, buy an index fund.

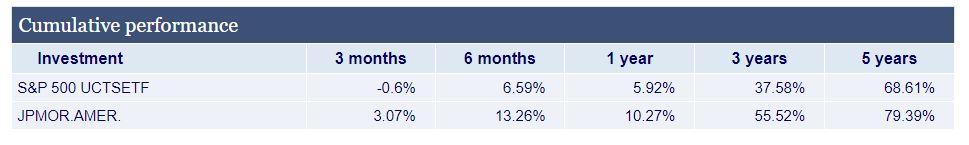

I chose JAM because of its performance, not an average trust. What matters here is a comparison between JAM and VUSA to be fair.

-

DrFfybes

- Lemon Quarter

- Posts: 3777

- Joined: November 6th, 2016, 10:25 pm

- Has thanked: 1190 times

- Been thanked: 1980 times

Re: VUSA or JAM for US exposure

richfool wrote:I don't usually hold individual shares directly, particularly not US ones. My holdings are almost all IT's. Note that JAM, VUSA and IUGS all hold Berkshire.

With over 60 holdings, BRK has more than a lot of ITs

If you do go directly into US stocks, beware of the $60k Estate tax limit which AIUI also applies to one of the Vanguard S&P ETFs (VOO) but not VUSA/VUSD.

Paul

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: VUSA or JAM for US exposure

richfool wrote:Lootman wrote:If you look at the top ten holdings for JAM you will notice that six of them pay no dividend, and the others only pay a small dividend. Since you mention dividend yield you might see that as a disadvantage but of course what it really means is that it is making a bigger bet on growth, with names like Nvidia and Tesla.

So I would regard JAM as a S&P 500 play with a growth tilt.

That said I have large positions in both and have done for years, as they do different things. They are both up bigly. VUSA is in my ISA, so no pesky ERI issues. JAM is in a taxable account and so the "problem" there is having to pay capital gains tax on it, eventually.

Thank you for your observations. I note that both have quite large positions in MS, Apple, Amazon and Nvidia. In the case of Apple, VUSA has the largest holding at 7.58%. Both seem to have much the same holdings within their top tens.

https://www.hl.co.uk/shares/shares-sear ... etf-usdgbp

https://www.fundslibrary.co.uk/FundsLib ... fwfRze&r=1

Thanks for the elucidation about JPMorgan American IT. It is clearly a growth trust. I do not mind that and it looks an interesting one to me. Will take a closer look.

Dod

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: VUSA or JAM for US exposure

DrFfybes wrote:richfool wrote:I don't usually hold individual shares directly, particularly not US ones. My holdings are almost all IT's. Note that JAM, VUSA and IUGS all hold Berkshire.

With over 60 holdings, BRK has more than a lot of ITs

If you do go directly into US stocks, beware of the $60k Estate tax limit which AIUI also applies to one of the Vanguard S&P ETFs (VOO) but not VUSA/VUSD.

Paul

That is one reason to favour JAM. I like the fact that it is a UK based IT and JPM are in my opinion a good manager. JAM has low costs and is a sizeable fund.

Dod

-

monabri

- Lemon Half

- Posts: 8424

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3443 times

Re: VUSA or JAM for US exposure

These suggestions might not be entirely appropriate, but other ways of gaining US exposure include:

- Pershing Square Holdings (PSH), the recent interim report is worth reading:

https://assets.pershingsquareholdings.com/2023/08/18112040/Pershing-Square-Holdings-Ltd.-June-2023-Interim.pdf

The wide discount, Bill Ackman's interest rate hedging and SPARC dabbling may be enticements or obstacles to investing depending on your views. I have exposure indirectly via a holding in AVI Global.

- For US small cap value (which I don't think is served by the US small cap ITs) in the OEIC sphere VT De Lisle America and Franklin Templeton Royce US Small Cap Opportunity might be of interest.

- Pershing Square Holdings (PSH), the recent interim report is worth reading:

https://assets.pershingsquareholdings.com/2023/08/18112040/Pershing-Square-Holdings-Ltd.-June-2023-Interim.pdf

The wide discount, Bill Ackman's interest rate hedging and SPARC dabbling may be enticements or obstacles to investing depending on your views. I have exposure indirectly via a holding in AVI Global.

- For US small cap value (which I don't think is served by the US small cap ITs) in the OEIC sphere VT De Lisle America and Franklin Templeton Royce US Small Cap Opportunity might be of interest.

-

77ss

- Lemon Quarter

- Posts: 1276

- Joined: November 4th, 2016, 10:42 am

- Has thanked: 233 times

- Been thanked: 416 times

Re: VUSA or JAM for US exposure

richfool wrote:I'm think of adding JAM or VUSA to my ISA to increase my US exposure. I'm conscious that both invest in the S&P500, and that JAM is an active IT, whereas VUSA is a low cost tracker (0.07%). VUSA also gives a slightly higher yield at around 1.23% against JAM's c 0.92%.

Currently I get my US exposure through BRSA, plus ATST and BUT

Does anyone have any other views or suggestions?

No need to go all out for a completeiy US holding. Have you looked at JGGI - 62.5% US.

In terms of 5 year TR, both JAM and JGGI have outperformed BRSA, ATST and BUT - and have done a bit better even than VUSA.

I hold both JAM and JGGI - so far, so good.

-

richfool

- Lemon Quarter

- Posts: 3525

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1206 times

- Been thanked: 1289 times

Re: VUSA or JAM for US exposure

77ss wrote:richfool wrote:I'm think of adding JAM or VUSA to my ISA to increase my US exposure. I'm conscious that both invest in the S&P500, and that JAM is an active IT, whereas VUSA is a low cost tracker (0.07%). VUSA also gives a slightly higher yield at around 1.23% against JAM's c 0.92%.

Currently I get my US exposure through BRSA, plus ATST and BUT

Does anyone have any other views or suggestions?

No need to go all out for a completeiy US holding. Have you looked at JGGI - 62.5% US.

In terms of 5 year TR, both JAM and JGGI have outperformed BRSA, ATST and BUT - and have done a bit better even than VUSA.

I hold both JAM and JGGI - so far, so good.

I do hold JGGI. Sorry, I didn't think to mention it, as it is in the Global Growth & Income sector. Indeed I should have said, it is my largest holding.

I also hold SAIN and MYI in the GG&I sector, which have lower exposure to the US.

In the event, I added JAM to the "trolley".

Return to “Investment Strategies”

Who is online

Users browsing this forum: No registered users and 17 guests