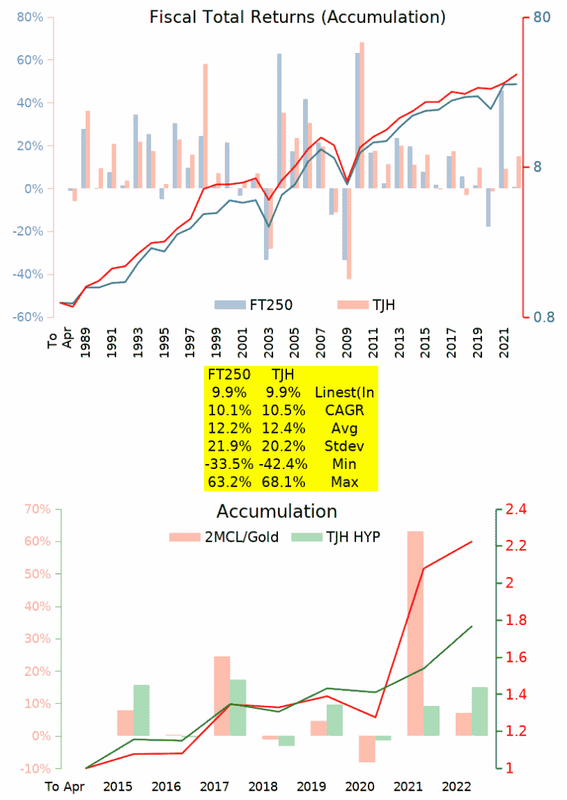

The charts show yearly total returns (left hand scale), and accumulation total returns (log scaled right hand scale), compared to Terry's (TJH) Accumulation HYP as a benchmark/reference.

Leveraged ETF's typically scale up exposure to a index, the LETF fund managers tend to rebalance daily, and in effect borrow to fund increasing stock exposure. Often snubbed as the tendency is to look at how the LETF worked alone. When however looked at as a means to scale down exposure, such as half as much in a 2x FTSE250 LETF (such as 2MCL) as would have been invested in a standard FTSE250 tracker, then the rewards tend to broadly align/compare. For the other half my personal preference is to hold gold, as I'm not a fan of Gilts/bonds. The last chart in the above image shows the result of 50/50 yearly rebalanced 2MCL/Gold since April 2014 (2MCL inception date was July 2013)

With half as much in a 2x LETF you can generally get away with rebalancing just once yearly. For higher levels of leverage such a as a third in 3x you probably need to rebalance every six months. At more extremes, such how Zvi Bodie holds 10% in 10x (using Traded Options), 90% in 'safe' assets, you'll probably need to rebalance at least monthly. So with a 2x, once yearly rebalanced, then that fits in well with being reviewed/rebalanced at around the end/start of each fiscal year (where that choice of review date enables you to opt to either trade in the old or new financial year (or a combination of both) according to whatever might be the more appropriate at the time - such as for tax efficiencies). With fiscal year end April 2023 rapidly approaching, its looking like 50/50 2MCL/gold is going to end the year around -8% down if things (prices) stay as they recently are.

Just thought I'd post this as there's little in the way of LETF discussions around TLF sections, and as I'm in the process of year end rebalancing/review ahead of the end of 2022/23 fiscal year I had the data/charts to hand.