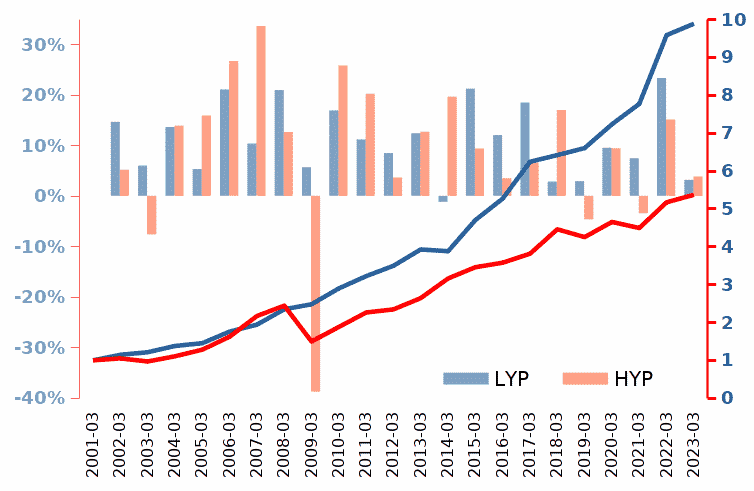

and there's no consistent indication that high dividend yields (HYP) to be exceptional.

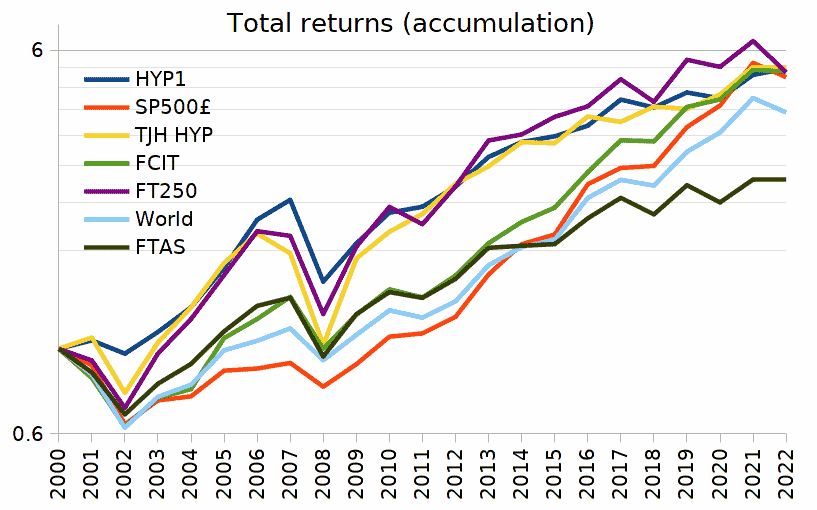

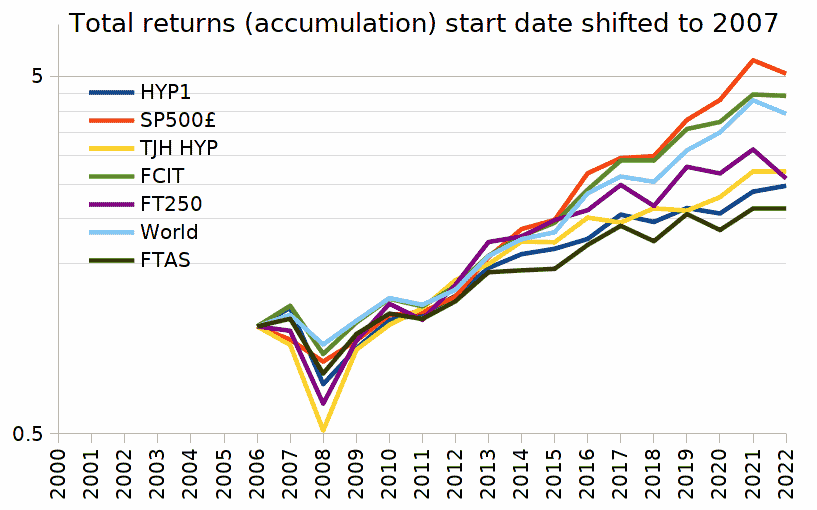

HYP1 was proposed as a annuity alternative, where you retained the capital value, however the income production has been volatile/inconsistent, unlike a annuity, or DIY dividend methods such as SWR (consistent inflation adjusted income/dividend to the amount/timing that better matches your particular circumstances).

investors are often attracted into choices that have performed relatively well, expect that relative outpacing to continue. Often however that flips around, past laggards can rise to be the ongoing winners, whilst past leaders may decline to relatively lag. A broader index such as world/FCIT ... is inclined to be more centralish, as it includes elements of other sub-set portfolios/asset-allocations.

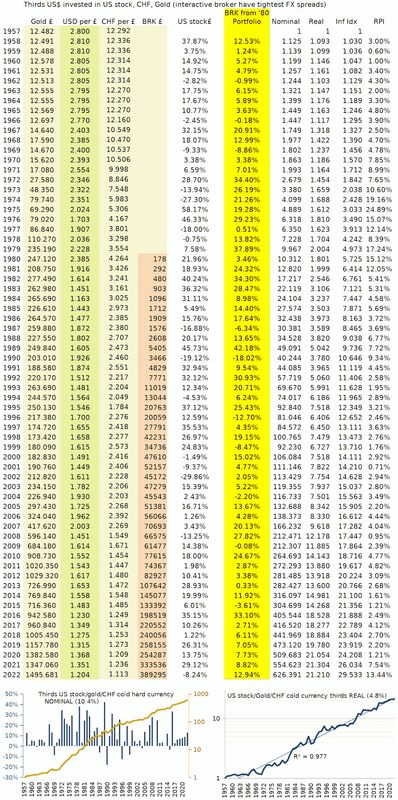

Average tends to be good-enough. Average-in, average-out, average holdings. Beyond that the only other aspect investors have some degree of control over are costs and taxes. If BRK avoids 15% US dividend withholding taxes that otherwise might have incurred a 2% dividend, 0.3% withholding tax, then that's more in your pocket. As might a lower yield portfolio be more tax efficient for some than a higher yielding portfolio.

High yield is a additional risk factor. Prior budgets have mentioned 'ISA dividends continue to remain tax free' ... that reading between the lines might have been taken as there was a background thought that ISA's might be revised to exclude dividends being tax exempt. As with bonds interest, dividends are regular/ongoing taxable events, in contrast capital gains can be deferred or selectively adjusted (portfolio reviews are best made around the end/start of old/new tax years, as capital gains might be taken in the old, new or a combination of both ... whichever might be the more tax efficient). Foregoing such advantages ... is a potential cost (risk).

Fair enough, for those that own their own home, have pensions that provide income comparable to a sizeable bond portfolio value, and can hold all of their stock in ISA/SIPP, then that can be tax/cost efficient (subject to changes in the likes of ISA dividends rules).

Liquidity is another factor to consider, the costs if you did have to sell-up and move perhaps your entire portfolio value.

The EU pretty much drove in a situation where UK investors into US funds saw that transitioned over to where both price appreciation and dividends became taxable as income (non-reporting funds, to HMRC, where KID's became mandatory but have near zero value). With capital gains tax exemptions in decline, for some having gains all as income taxable might be preferable, if for instance they had no other income other than their portfolio income (£12,500 personal allowance). Again however and the EU makes that difficult, most brokers will refuse to sell you a product/fund unless it has a KID.

Another risk factor often ignored is how the state has progressively introduce high degrees of monitoring/tracking. In 2017 a list of something like 120 countries was released, agreed sharing of data, and where another sizeable tranche were on the books to be added to that list. Banks have been driven to where they're starting to pretty much report all transactions to the state, as otherwise they risk losing their licence if anti-laundering cases are identified where the transactions weren't flagged. The CONNECT database is exploding in what data it captures, facial recognition, number plate tracking, geolocation recording, internet activities, financial transactions etc. etc. And a rule book where ... everyone is guilty one way or another. The state is progressing on the basis that the UK is a open prison, and where it can lock up or confiscate from whoever, whenever they like. Your money that you worked/gave up some of your life time is deemed by the state as to be its money. Increasingly made more difficult for individuals not to be a slave. We've transitioned to that progressively via stealth. Most don't care, or at least didn't until it was too late. Treat everyone as criminals and people will act criminally. Ending paper money is the next step the state is making on that front - to make it more difficult for instance for individuals to claim they sold something for cash incurring a capital loss that offset their stock capital gains for instance.

It's not that long ago when there was no income taxes, as people considered such taxes to be a invasion of their privacy. Was their money, none of the states business. Taxes were instead collected via spending, purchase taxes, the responsibility of shops/companies to collect/pay the taxes.