That is one reason why I have been moving more to a Low Yield Portfolio (LYP

Got a credit card? use our Credit Card & Finance Calculators

Thanks to bruncher,niord,gvonge,Shelford,GrahamPlatt, for Donating to support the site

Low Yield Portfolio

-

scrumpyjack

- Lemon Quarter

- Posts: 4891

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 620 times

- Been thanked: 2725 times

Low Yield Portfolio

I agree a Labour government is likely to raise the tax on dividends but the main target would be to stop tax avoidance by the use by tradesmen of companies to switch earned income into dividend income. They won’t raise much from individuals dividends from quoted companies. Most of that will be in ISAs and Sips which are not subject to dividend taxes. Obviously there will be some increased revenue from shareholdings in taxable accounts.

That is one reason why I have been moving more to a Low Yield Portfolio (LYP ) approach, to reduce the impact of dividend taxes. I avoid companies which pay too high a dividend. I think that is sensible anyway.

) approach, to reduce the impact of dividend taxes. I avoid companies which pay too high a dividend. I think that is sensible anyway.

That is one reason why I have been moving more to a Low Yield Portfolio (LYP

-

monabri

- Lemon Half

- Posts: 8475

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1555 times

- Been thanked: 3452 times

Re: Low Yield Portfolio

Where would one invest...in the stagnant UK market or elsewhere? There might be a flow of money out of UK companies and into other markets.

-

scrumpyjack

- Lemon Quarter

- Posts: 4891

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 620 times

- Been thanked: 2725 times

Re: Low Yield Portfolio

monabri wrote:Where would one invest...in the stagnant UK market or elsewhere? There might be a flow of money out of UK companies and into other markets.

Increasingly into global investment trusts in my case, but also companies who operate globally but are UK or UK listed. Obviously you can easily buy US or other overseas shares directly. Companies can move domicile if they don't like the way they are treated (as Shell and Unilever have shown). Companies like Shell and BP, IMO, would be better off changing domicile to the USA. Oilies are better treated and rated over there. (I have a small legacy holding of Shell).

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Low Yield Portfolio

As always it depends what the objective of the portfolio is. Tax wagging the dog's tail and all that. I live off my dividend income and currently generate rather more than I need to. I could look at transferring some holdings, not so much into a low income portfolio, but hopefully into a growth portfolio, rather harder to do in my experience. In any case at least with a relatively high income share, you have a good chance of getting a return even if it is taxed, with a possible bonus of a growth in the share price. The same can hardly be said for a low income share as you are already precluded from one source of return.

Dod

Dod

-

DrFfybes

- Lemon Quarter

- Posts: 3855

- Joined: November 6th, 2016, 10:25 pm

- Has thanked: 1223 times

- Been thanked: 2017 times

Re: Low Yield Portfolio

I made a deliberate step in this direction when I stopped work, mainly to avoid tax, although I was also moving to a more passive portfolio

My unsheltered assets have been moved largely to HSBC FTSE All World, VEVE and BRKB. The VEVE dollar divi is a bit of a pain, and if/when I ever cash in the BRKB I'll have some amusing CGT calcs to figure out since II now list my average purchase price in dollars (they were bought at different excgange rates) so I might have to cash them in in tranches.

Some ITs are worth a look, FCIT pays a pretty low dividend, as does ATST. The issue with that approach is the low divi investments tend to grow so you end up shuffling for CGT.

If you like trackers, HSBC FTSE All World Index Class C is pretty interchangable with VEVE and has an annual divi a month before the VEVE date, so you can switch back and forth and avoid the divi issue alltogether with them. Obviously there are transactional fees and Stamp Duty on the VEVE purchase.

Or you could always just buy a bunch of shares yeilding over 8% and wait for them to cut/cancel the divi, but that tends to hit your capital as well

Paul

My unsheltered assets have been moved largely to HSBC FTSE All World, VEVE and BRKB. The VEVE dollar divi is a bit of a pain, and if/when I ever cash in the BRKB I'll have some amusing CGT calcs to figure out since II now list my average purchase price in dollars (they were bought at different excgange rates) so I might have to cash them in in tranches.

Some ITs are worth a look, FCIT pays a pretty low dividend, as does ATST. The issue with that approach is the low divi investments tend to grow so you end up shuffling for CGT.

If you like trackers, HSBC FTSE All World Index Class C is pretty interchangable with VEVE and has an annual divi a month before the VEVE date, so you can switch back and forth and avoid the divi issue alltogether with them. Obviously there are transactional fees and Stamp Duty on the VEVE purchase.

Or you could always just buy a bunch of shares yeilding over 8% and wait for them to cut/cancel the divi, but that tends to hit your capital as well

Paul

-

scrumpyjack

- Lemon Quarter

- Posts: 4891

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 620 times

- Been thanked: 2725 times

Re: Low Yield Portfolio

DrFfybes wrote: The issue with that approach is the low divi investments tend to grow so you end up shuffling for CGT.

That is the expectation and I would rather pay 20% CGT than 60% income tax.

I have been increasing my holding of Monks as I like their portfolio, they are on a large discount (probably because BG is out of favour) and the yield is a juicy 0.3%

-

Lootman

- The full Lemon

- Posts: 19133

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 646 times

- Been thanked: 6793 times

Re: Low Yield Portfolio

scrumpyjack wrote:DrFfybes wrote: The issue with that approach is the low divi investments tend to grow so you end up shuffling for CGT.

That is the expectation and I would rather pay 20% CGT than 60% income tax.

I have been increasing my holding of Monks as I like their portfolio, they are on a large discount (probably because BG is out of favour) and the yield is a juicy 0.3%

I have migrated to a LYP portfolio for a few years now. Monks is a good one. Various ITs pay no dividend, and there is always Berkshire Hathaway.

-

simoan

- Lemon Quarter

- Posts: 2139

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 478 times

- Been thanked: 1481 times

Re: Low Yield Portfolio

Perhaps I’m talking out of turn here, but buying shares just because they have a low dividend yield is every bit as stupid as buying shares just because they have a high dividend yield. Buy good companies with strong balance sheets, avoid bad companies with weak balance sheets would be my advice. The dividend yield shouldn’t really matter as a justification for holding in itself. Generally, good companies can re-invest cashflow at good internal rates of return (high ROCE/ROE) to grow future profits and do not pay out a large amount as dividends. As others have said, making investment decisions with tax at the forefront of your mind is a strange way to go. If I was worried about possible future government intervention, I’d personally be much more concerned about holding shares in regulated industries which covers just about any UK listed High Yielding share you care to mention.

All the best, Si

All the best, Si

-

dealtn

- Lemon Half

- Posts: 6106

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 445 times

- Been thanked: 2344 times

Re: Low Yield Portfolio

simoan wrote:Perhaps I’m talking out of turn here, but buying shares just because they have a low dividend yield is every bit as stupid as buying shares just because they have a high dividend yield. Buy good companies with strong balance sheets, avoid bad companies with weak balance sheets would be my advice. The dividend yield shouldn’t really matter as a justification for holding in itself. Generally, good companies can re-invest cashflow at good internal rates of return (high ROCE/ROE) to grow future profits and do not pay out a large amount as dividends. As others have said, making investment decisions with tax at the forefront of your mind is a strange way to go. If I was worried about possible future government intervention, I’d personally be much more concerned about holding shares in regulated industries which covers just about any UK listed High Yielding share you care to mention.

All the best, Si

Exactly. This isn't an investment strategy decision (and arguably doesn't belong here as a result). This is a (potential) tax strategy, and wouldn't feature near the top of a list of rational reasons to be deciding which company to invest in.

-

scrumpyjack

- Lemon Quarter

- Posts: 4891

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 620 times

- Been thanked: 2725 times

Re: Low Yield Portfolio

Well tax is certainly a factor to take into account and it is as stupid to ignore it as it is to make the only selection factor. As in all things, a balanced judgement is needed.

-

77ss

- Lemon Quarter

- Posts: 1279

- Joined: November 4th, 2016, 10:42 am

- Has thanked: 236 times

- Been thanked: 417 times

Re: Low Yield Portfolio

scrumpyjack wrote:I agree a Labour government is likely to raise the tax on dividends..........

What do you think has been happening over the past 10 years? Under Conservative governments.

To keep it simple, I confine my figures to basic rate taxpayers - but higher rate payers have seen a similar trend.

Prior to April 2016 the tax payable on dividends was 0%

Then the rate went to 7.5% - with the first £5,000 being exempt

The rate is now 8.75% and the exempt amount has been reduced to £1,000 - and will be further reduced to £500 next year

As another poster has observed, a Low Yield Portfolio might give you capital gains to worry about, and here again the exempt amount has been reduced from £12,000 in 2019-2020 to £6,000 this year - going to £3,000 next year.

I have long wondered how long the ISA break can remain untouched.

-

scrumpyjack

- Lemon Quarter

- Posts: 4891

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 620 times

- Been thanked: 2725 times

Re: Low Yield Portfolio

8.75%! You ain't seen nothing yet. Under Healey it got to 98% and over 100% in one year due to a retrospective surcharge

-

1nvest

- Lemon Quarter

- Posts: 4565

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 727 times

- Been thanked: 1445 times

Re: Low Yield Portfolio

Dod101 wrote:As always it depends what the objective of the portfolio is. Tax wagging the dog's tail and all that. I live off my dividend income and currently generate rather more than I need to. I could look at transferring some holdings, not so much into a low income portfolio, but hopefully into a growth portfolio, rather harder to do in my experience. In any case at least with a relatively high income share, you have a good chance of getting a return even if it is taxed, with a possible bonus of a growth in the share price. The same can hardly be said for a low income share as you are already precluded from one source of return.

Dod

Total return is total return. Dividends can be as directed by the stock/fund, or DIY taken out of total return (at times and to the amounts of your own choosing).

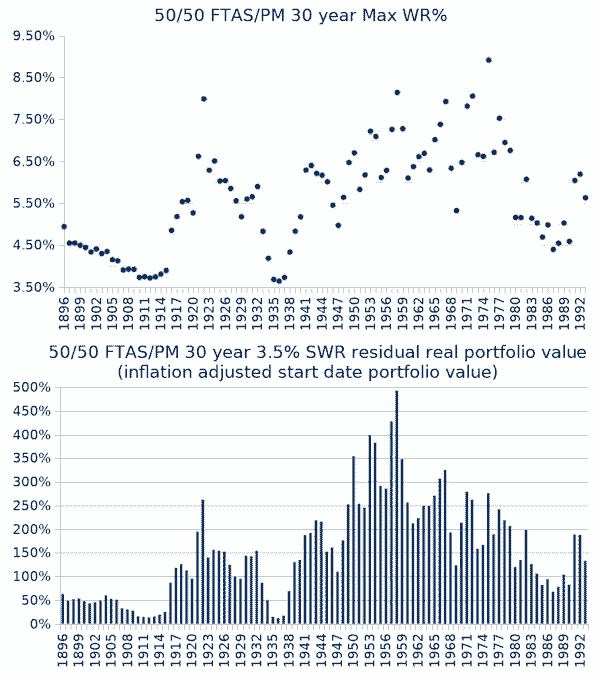

50/50 FT All Share/PM (precious metals), and historically a 30 year 3.66% SWR was supported. 3.66% of the start date portfolio value drawn as income for the first year, where that £££ amount is uplifted by inflation as the amount drawn as income in subsequent years, so a consistent/reliable (known) income each and every year. Dividends in contrast are more variable

US example, BRK/Gold 50/50 3.5% SWR started in 1986, $500,000 initial portfolio value, $17,500 initial SWR value, and after income the portfolio value more recently stands at $17.4 million (grew at near 7% annualised real, 9.9% nominal). The continuation of the inflation adjusted $17,500 withdrawals (near $50,000 more recently) being less than 0.3% of the ongoing portfolio value. Yet over all of those years not a penny received in interest or dividends.

Inadvisable as even though BRK is a conglomerate, that is still a single stock risk factor, but you could split that with MKL (often referred to as being baby BRK, that also doesn't pay dividends) and/or other low/no dividend yield choices (FCIT that pays a relatively low dividend yield, as a world stock type proxy ...etc.).

Dividends come out of each firms bottom line. DIY dividends are sourced by other investors buying the shares that you sell, have no effect on the firm itself (other than a change of shareholder name entry on their register of shareholders). £100 of dividend paid out is £100 less the firm has, all else being equal the share price declines in reflection of that. In contrast £100 of stock value sold and the purchaser might be paying twice book-value (whatever) for those shares.

DIY dividends levelled to the amount and times of your own choosing are also more tax and cost efficient. It's nice to have some dividends however, perhaps up to your tax exempt/efficient allowances.

It's a lot easier to plan with a known figure. £10,000 of occupational pension, £10,000 of state pension, £20,000 of DIY dividends, all inflation adjusted, when your spending is £40,000/year. In contrast if stock dividends are £20,000 one year, but halve the next, £30,000 of income/£40,000 of spending and you have to sell £10,000 value of shares possibly at a time when share prices are down. DIY dividends sells share consistently, but that averages out, sometimes shares are sold at relatively higher prices, sometimes relatively lower prices, broadly washes.

Note that the 3.66% SWR figure is often rounded up to 4%, a low probability (relatively few historic cases) of that failing before 30 years, maybe only supporting 27 years. For a 65 year old retiree living to 92 is also a relatively low probability. There was also a relatively good probability of ending 30 years with the same or more in inflation adjusted terms as the start date portfolio value.

Gold (and/or art) is a asset for those who 'have enough' and are more interested in wealth preservation. Physical in-hand assets with no counter-party risk, that can be moved to less punitive regimes if/when the domestic regimes policies become more confiscatory. Proposals of wealth taxes more often ignore that will drive assets/wealth overseas - moved as soon as there is even a hint of such policies potentially rising, that includes stock value (T+2 time to liquidate and electronic transfer the sale proceeds). Which intends to burden the rest more. Better to have 1% paying a third of the total tax take, than see that flight and the rest having to fill that hole (having to pay 50% more in taxes). Even better still, US style, is to look to attract/develop wealth - ideally to 3% levels. But as LT/KK demonstrated, the UK prefers to totally stamp out such policies (with that can totally now flattened, not even kicked into the long grass, UK taxes have been doomed to rise to punitive levels - as favoured by Remainers - who opine if the UK suffers enough then it will rejoin the EU).

-

1nvest

- Lemon Quarter

- Posts: 4565

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 727 times

- Been thanked: 1445 times

Re: Low Yield Portfolio

scrumpyjack wrote:8.75%! You ain't seen nothing yet. Under Healey it got to 98% and over 100% in one year due to a retrospective surcharge

130% tax in 1968 IIRC driving the subsequent out-flight ...

Rolling Stones moved to France

David Bowie, Marc Bowlan both moved to Switzerland

Cat Stevens went to Brazil

Rod Stewart and Bad Company moved to California.

Ringo Starr moved to Monte Carlo

Just the tip of the iceberg

By the mid 1970's the UK was on the borderline of not having enough to cover its spending, had to secure a IMF cover-note. Wasn't actually used, but had to be put in place - just in case, requiring IMF terms/conditions to be adopted. As part of that lights were going out (power cuts) and there were three-day week type policies, and many strikes, piles of uncollected litter/rubbish, the dead remaining unburied etc.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Low Yield Portfolio

Before 1nvest gets too carried away, we were not talking about all of that. Apart from anything else, in the times he writes about there were no ISAs for instance and currently at least, Starmer and co, assuming that they get a mandate, show no signs of reverting to those politics of envy. Meanwhile it is of course sensible for everyone to take what defensive measures they feel are necessary.

Dod

Dod

-

vand

- Lemon Slice

- Posts: 815

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 187 times

- Been thanked: 379 times

Re: Low Yield Portfolio

I'm sure "low yield portfolio" is overthinking it.

A HYP is by definition an active stratetgy; if you don't trust it, either because you are trying to position yourself for a tax policy that may or may not happen, or because you view it as a better overall strategy regardless, then just flip back to the default passive strategy, which is a global index tracker.

Anyway, believe it or not, companies aren't stupid 'y'know, and generally have a good idea of the tax code in which they operate. If dividend payments become more disadvantageous they will allocate their capital differently, pay out less dividend and do more buybacks and reinvestment.

A HYP is by definition an active stratetgy; if you don't trust it, either because you are trying to position yourself for a tax policy that may or may not happen, or because you view it as a better overall strategy regardless, then just flip back to the default passive strategy, which is a global index tracker.

Anyway, believe it or not, companies aren't stupid 'y'know, and generally have a good idea of the tax code in which they operate. If dividend payments become more disadvantageous they will allocate their capital differently, pay out less dividend and do more buybacks and reinvestment.

-

simoan

- Lemon Quarter

- Posts: 2139

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 478 times

- Been thanked: 1481 times

Re: Low Yield Portfolio

Dod101 wrote:Before 1nvest gets too carried away, we were not talking about all of that. Apart from anything else, in the times he writes about there were no ISAs for instance and currently at least, Starmer and co, assuming that they get a mandate, show no signs of reverting to those politics of envy. Meanwhile it is of course sensible for everyone to take what defensive measures they feel are necessary.

Dod

It's just common sense though isn't it? Unless the OP does not have access to tax free accounts for some reason, then it's just common sense to hold any shares which are subject to higher taxation (be that income or capital gains) within those wrappers, and the one's that don't in taxable accounts. That's not an investment strategy though, and doesn't necessarily mean you end up with a Low Yield Portfolio (across all accounts) either depending on your financial circumstances.

All the best, Si

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Low Yield Portfolio

simoan wrote:Dod101 wrote:Before 1nvest gets too carried away, we were not talking about all of that. Apart from anything else, in the times he writes about there were no ISAs for instance and currently at least, Starmer and co, assuming that they get a mandate, show no signs of reverting to those politics of envy. Meanwhile it is of course sensible for everyone to take what defensive measures they feel are necessary.

Dod

It's just common sense though isn't it? Unless the OP does not have access to tax free accounts for some reason, then it's just common sense to hold any shares which are subject to higher taxation (be that income or capital gains) within those wrappers, and the one's that don't in taxable accounts. That's not an investment strategy though, and doesn't necessarily mean you end up with a Low Yield Portfolio (across all accounts) either depending on your financial circumstances.

All the best, Si

Absolutely and I have most of my equities sheltered in ISAs and most of the others in a SIPP. No one wants to pay more tax than necessary but fundamentally if I need to pay tax on however the 'cooky crumbles' with unsheltered holdings (not many these days) then that is just too bad. At least if I am required to pay tax it means I have made some investment profits.

Dod

-

scrumpyjack

- Lemon Quarter

- Posts: 4891

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 620 times

- Been thanked: 2725 times

Re: Low Yield Portfolio

vand wrote:I'm sure "low yield portfolio" is overthinking it.

A HYP is by definition an active stratetgy; if you don't trust it, either because you are trying to position yourself for a tax policy that may or may not happen, or because you view it as a better overall strategy regardless, then just flip back to the default passive strategy, which is a global index tracker.

Anyway, believe it or not, companies aren't stupid 'y'know, and generally have a good idea of the tax code in which they operate. If dividend payments become more disadvantageous they will allocate their capital differently, pay out less dividend and do more buybacks and reinvestment.

Unfortunately I don't think companies consider the private investor at all. They only consider institutional investors. For example Tesco sold their far east business and returned over £5 billion to shareholders. They did this by paying a dividend subject to the highest rates of income tax for private investors, when the amount was clearly a capital item. Crazy. It forced me to sell my Tesco shares before they went xd.

-

DrFfybes

- Lemon Quarter

- Posts: 3855

- Joined: November 6th, 2016, 10:25 pm

- Has thanked: 1223 times

- Been thanked: 2017 times

Re: Low Yield Portfolio

simoan wrote:Perhaps I’m talking out of turn here, but buying shares just because they have a low dividend yield is every bit as stupid as buying shares just because they have a high dividend yield. Buy good companies with strong balance sheets, avoid bad companies with weak balance sheets would be my advice.

All the best, Si

If I was buying shares in individual companies then that would be sound advice.

But as I lack the ability/inclination to do that sort of research and long ago learnt I'm not very good at it, then Trackers, ITs, and OEICs are my investment route.

And once you make that leap, yield is a pretty good filter for your chosen approach.

Paul

Return to “Investment Strategies”

Who is online

Users browsing this forum: No registered users and 2 guests