AEW UK REIT (AEWU) - A covered 8.9% yield...

Posted: March 10th, 2020, 9:07 pm

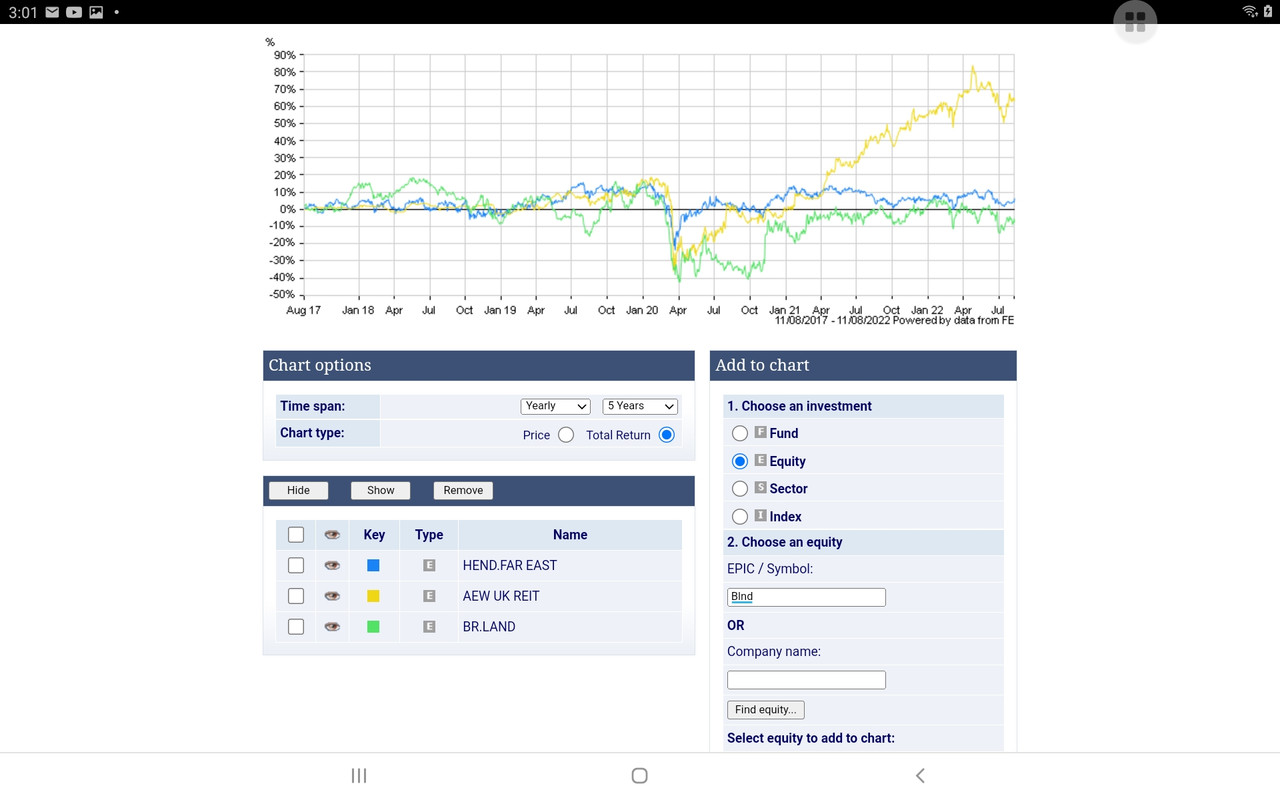

AEW UK REIT launched in May’15 amidst a flurry of listings by other small REITs, mostly concentrating on the undervalued regions.

AEWU is managed by AEW UK Investment Management which employs a team of 26. It is part of AEW Group, one of the world's largest real estate managers with EUR70.2bn of assets under management as at Sep’19.

https://www.aewukreit.com

The most recent trading Update on 16th January revealed these stats as at 31 Dec’19:

# Port = 35 regional properties

# Port Value = £195.8m

# Port split: IND – 48.5%; OFF – 23.1%; RET – 13.3%; Other 15.1%

# NAV = 97.24p/share

# Occupancy = 96.14%

# EPS for Q4’19 = 2.18p

# Q4’19 dividend = 2p/share (Targeted annual dividend = 8p/share)

# LTV = 26.3%

# Significant lettings ahead of estimated rental values

# Shares in Issue = 151.56m

# Borrowings: £51.5m to Oct’23 @ Libor + 1.4%. 90% hedged to max. Libor + 2%

https://uk.advfn.com/stock-market/londo ... i/81538274

So, in Feb’20, with everything in the garden looking rosy, the Company decided to launch a £20m equity raise at 97p/share. The endeavour was of course unfortunately timed, as the emerging Coronavirus scared off potential buyers, though they still managed to place 7.2m new shares.

On Black Monday (9th Mar’20) the shares dropped momentarily from 90p to a low of 83p, before recovering through that momentous day to close at 88p. Further progress today to 90p where the shares stand at an 8.2% discount and provide a covered yield of 8.9% - the highest in the sector.

AEWU is managed by AEW UK Investment Management which employs a team of 26. It is part of AEW Group, one of the world's largest real estate managers with EUR70.2bn of assets under management as at Sep’19.

https://www.aewukreit.com

The most recent trading Update on 16th January revealed these stats as at 31 Dec’19:

# Port = 35 regional properties

# Port Value = £195.8m

# Port split: IND – 48.5%; OFF – 23.1%; RET – 13.3%; Other 15.1%

# NAV = 97.24p/share

# Occupancy = 96.14%

# EPS for Q4’19 = 2.18p

# Q4’19 dividend = 2p/share (Targeted annual dividend = 8p/share)

# LTV = 26.3%

# Significant lettings ahead of estimated rental values

# Shares in Issue = 151.56m

# Borrowings: £51.5m to Oct’23 @ Libor + 1.4%. 90% hedged to max. Libor + 2%

https://uk.advfn.com/stock-market/londo ... i/81538274

So, in Feb’20, with everything in the garden looking rosy, the Company decided to launch a £20m equity raise at 97p/share. The endeavour was of course unfortunately timed, as the emerging Coronavirus scared off potential buyers, though they still managed to place 7.2m new shares.

On Black Monday (9th Mar’20) the shares dropped momentarily from 90p to a low of 83p, before recovering through that momentous day to close at 88p. Further progress today to 90p where the shares stand at an 8.2% discount and provide a covered yield of 8.9% - the highest in the sector.